-

Shelter cool, Energy cooler Inflation not as hot.

September CPI Report Highlights:

- The Consumer Price Index (CPI) came in 0.1% cooler than expected, with year-over-year inflation moving from 3.0% to 2.9%.

- The Core CPI (which excludes food and energy) was also 0.1% below expectations.

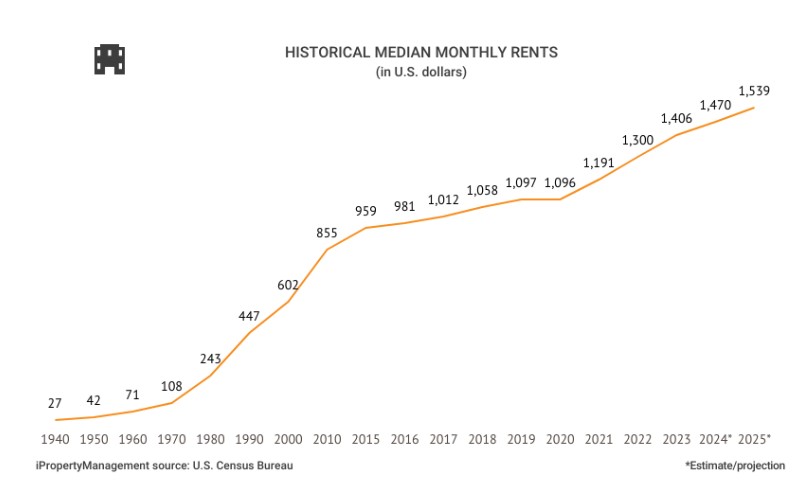

- Shelter costs, making up 44.4% of the Core Index, came in softer than expected.

- Owner’s Equivalent Rent (OER) roughly 33% of the Core Index rose only 0.1%, another encouraging sign of cooling inflation.

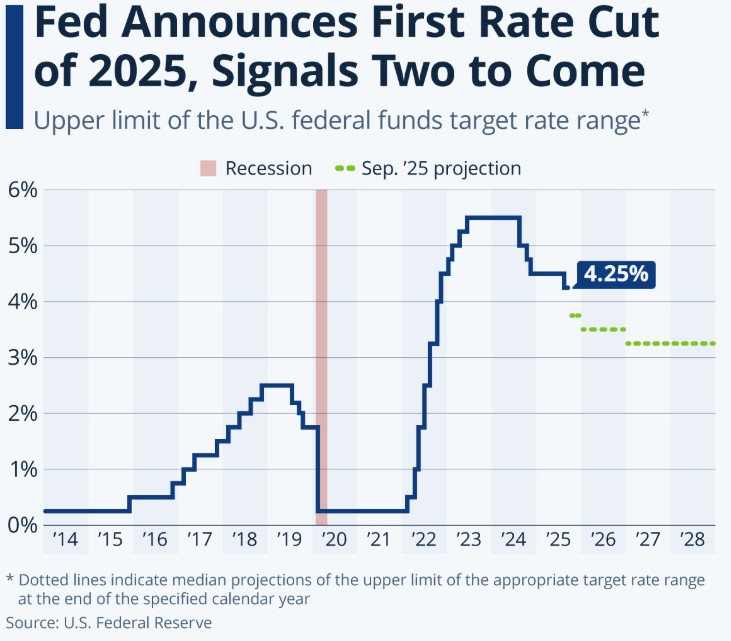

- Overall, this is good news for the Fed, supporting the case for continued rate cuts. The next Fed meeting is October 29th, where markets are pricing in a 0.25% to 0.50% cut.

Have a fantastic weekend, see you on the other side!

http://www.YourAppliciationOnline.com

-

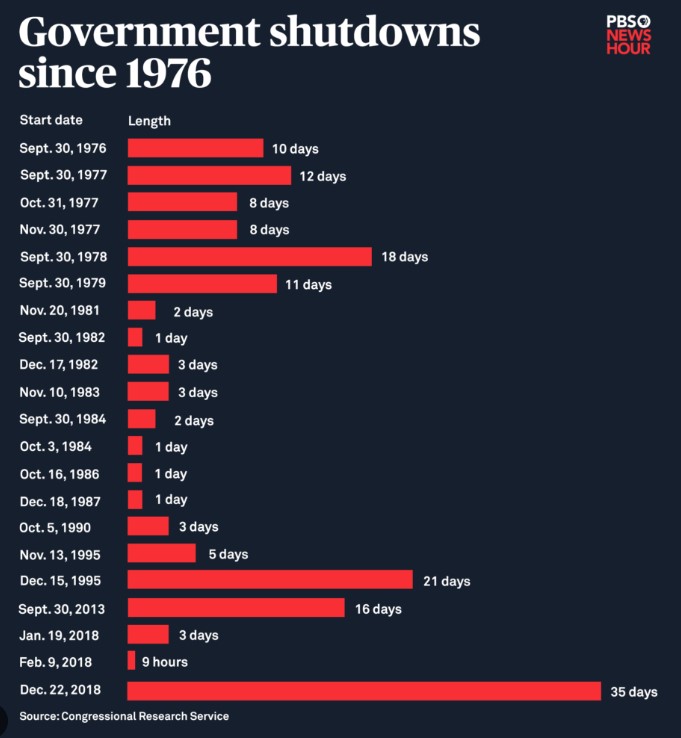

Shutdown Day 22: The Only Thing Still Working Is Market Anxiety.

The government shutdown continues to have a real impact on the market, creating uncertainty and limiting access to key economic data. Investors are watching closely as the 20-year bond auction takes place at 10 a.m. this morning. The level of demand in that auction will be a strong indicator of investor confidence and will directly influence rate movement.

If demand is strong, we could see yields (and therefore mortgage rates) improve slightly. However, if participation is weak, it may signal caution in the market and put upward pressure on rates.

Let’s not let the shutdown slow us down. the world keeps spinning and the rates are at their lowest point in two years.

Soft credit pull http://www.YourApplicaitonOnline.com

-

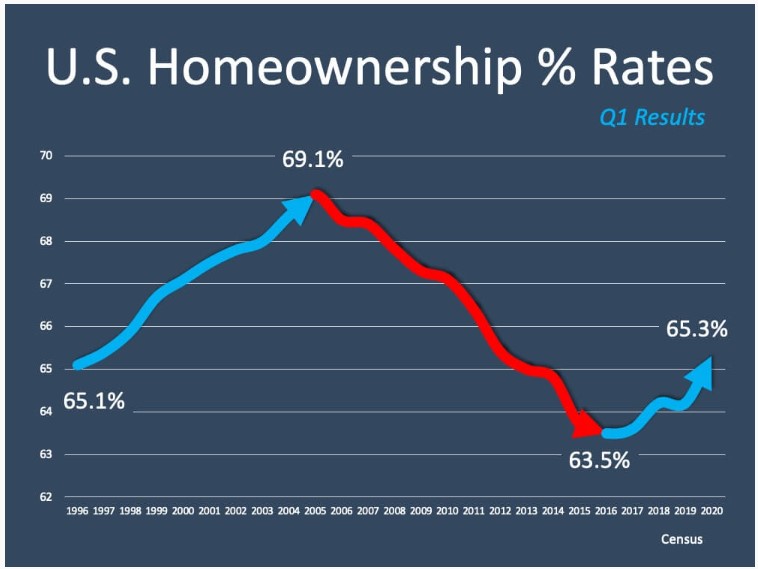

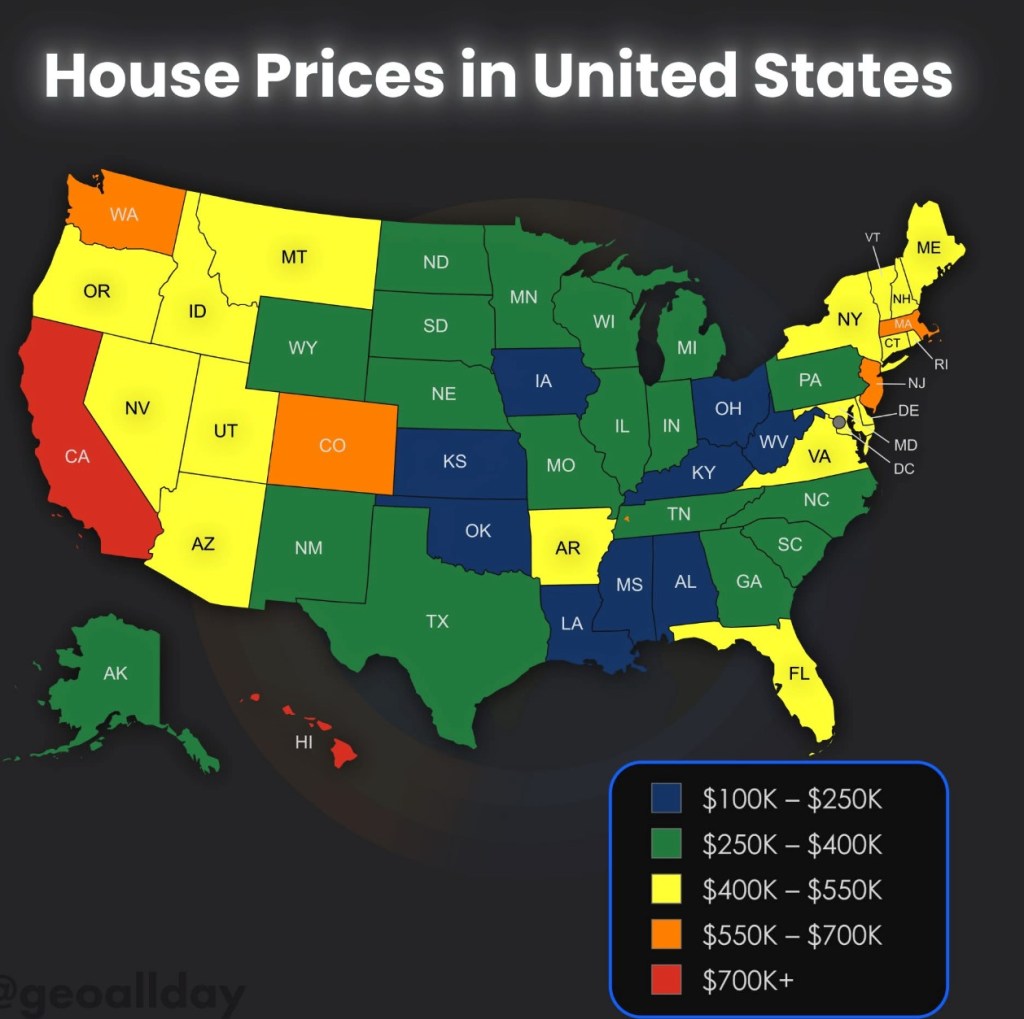

Two Thirds of Americans can afford a home. What about the other Third. Rates continue to move down.

Home affordability is a big deal. While roughly two-thirds of Americans can afford to buy a home, many choose not to, often because of lifestyle preferences, mobility, or uncertainty about the market. The remaining one-third, however, simply cannot afford homeownership and may never be in a financial position to do so.

This divide highlights one of the biggest challenges in today’s housing market: rising home prices and limited inventory continue to outpace wage growth, especially for first-time buyers. Even with rates moving lower, affordability remains a major barrier for millions of Americans hoping to enter the market.

There are options. Rural Housing is 100% financing as well as VA loans. FHA is 3.5% but many Down Payment Assistance Programs are available. Conventional has a 3% down payment options.

Let’s talk through your specific scenario and give you options. http://www.YourApplicaitonOnline.com

-

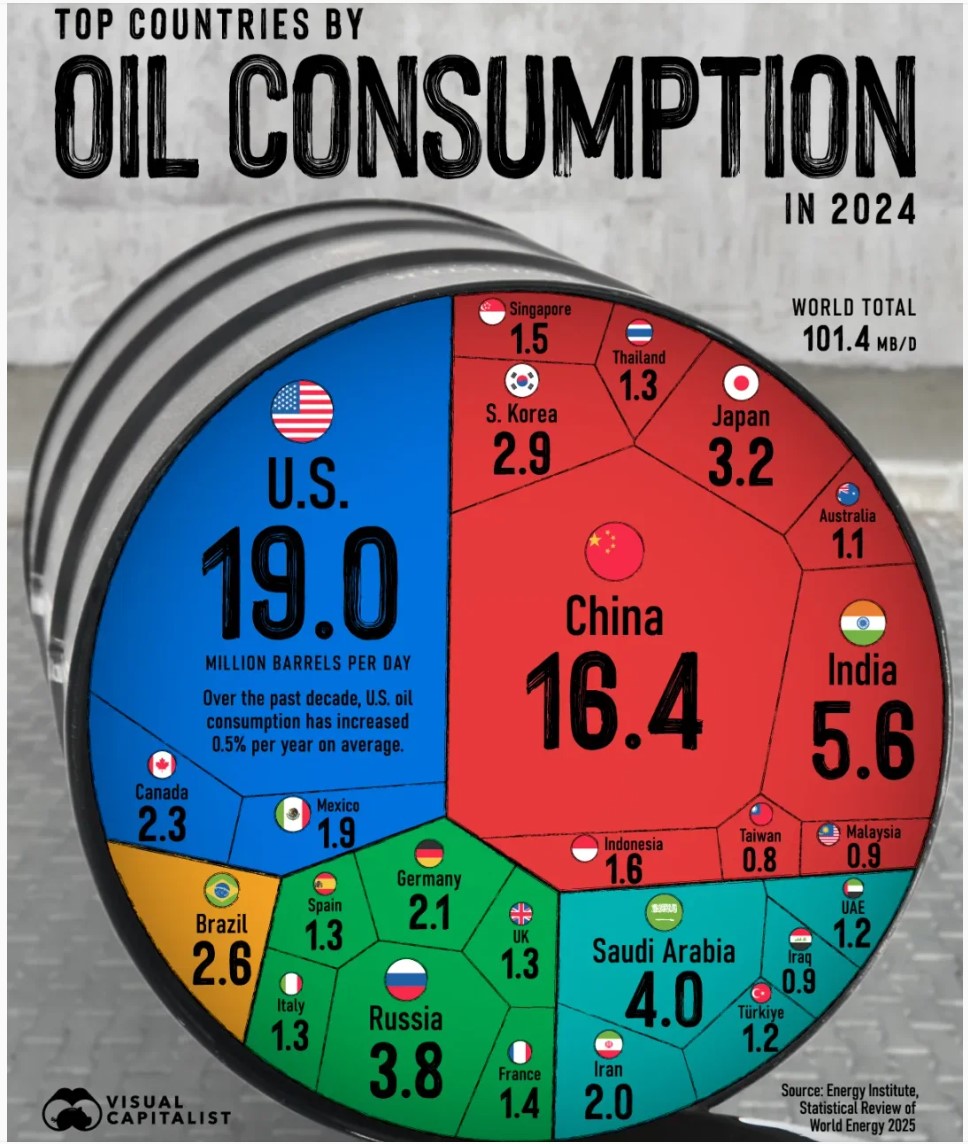

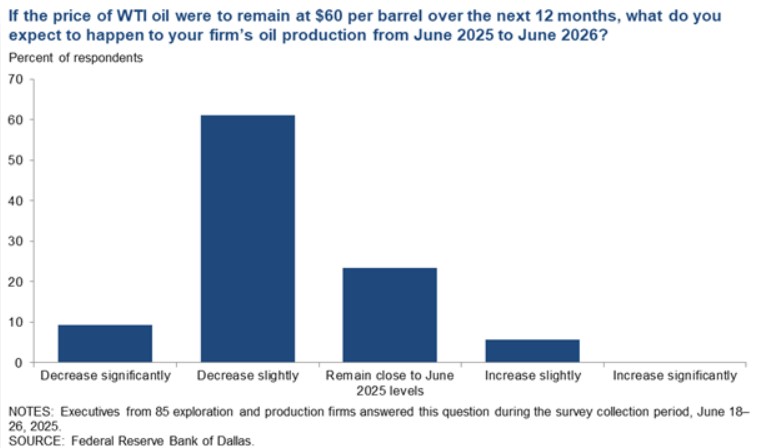

Oil Prices below $55 a barrel, slow downtrend and has staying power. Good news for inflation and rates.

That’s the short of it. Oil impacts everything from manufacturing to shipping and distribution and ultimately hits the consumer’s wallet when purchasing to filling up the tank.

If lower oil prices help keep inflation in check, the Fed will be that much more likely to continue lowering rates.

On the rental side, affordability is now the best it’s been in four years—another factor helping to bring overall inflation down.

Here’s an interesting side note: Americans are moving far less than they used to. Historically, about 15% of the population changed residences each year (and closer to 20% back in the 1960s). Over the past year, that number has dropped to just 11%.

It could be all those 3%’ers with their fantastic rate they don’t want to give up?

Rate are moving in the right direction and we see the activity growing. We expect that mobility % to increase substantially in the coming years.

Lets get you pre-approved today. http://www.YourApplicaitonOnline.com

-

Mortgage Spreads Are Narrowing And That’s Good News. Here’s Why.

The government shutdown may end by Friday, according to Kevin Hassett, Director of the National Economic Council. Uncertainty, however, is never good for business.

The mortgage spread the gap between mortgage rates and the 10-year Treasury yield serves as a confidence gauge for lenders. The tighter the spread, the more optimistic lenders are about borrowers not flipping the loans. It’s about stability.

My take: Rates continue to trend lower, and we expect to see them solidly in the 5’s by year-end. As rates fall, more buyers are jumping back into the market, creating renewed competition and even bidding wars for the most affordable homes.

Let’s get you pre-approved http://www.YourApplicationOnline.com

-

Builders Growing More Confident as Future Sales Expectations Move into Expansion Territory

Builders are skittish by nature, so when they start showing more confidence, it’s worth paying attention. They’re working with inventory that can take a year or more to bring to market, especially when new infrastructure is needed before construction even begins.

There’s now a 97% probability the Fed will lower rates by 0.25% at their October 29th meeting. The market has largely priced this in, but we’re hopeful it sets the stage for further mortgage rate improvements ahead.

My take: With the government shutdown, we’re flying blind on employment data. However, with Fed members acknowledging a weakening labor market, unemployment could rise quickly, which, fortunately or unfortunately, tends to help rates.

Lets get you pre-qualified today. http://www.YourApplicationOnline.com

-

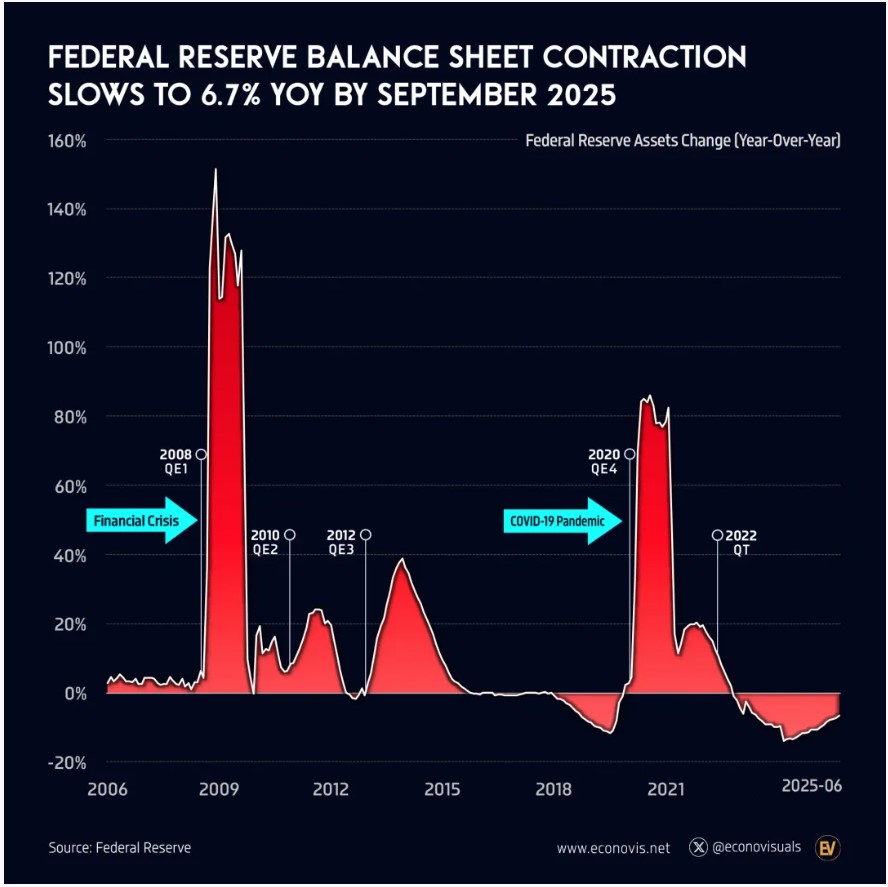

What is Liquidity Tightening? And the Feds decision to stop is positive news for Rates

Fed Chair Powell made an interesting comment yesterday about the Fed’s balance sheet. Over the past few years, the Fed has been reducing its holdings selling off assets instead of buying bonds, which has contributed to higher rates.

The Fed now appears to be signaling a shift, potentially resuming bond purchases to support liquidity, echoing the stimulus-driven strategies seen in 2020 and post-2008.

This shift should have a positive impact on rates, with the Fed potentially investing around $20 billion per month in Treasury purchases. Powell also signaled more confidence that the recent tariff-driven inflation is temporary.

My take: I’m already seeing more applications come across our desk, not just for refinances, but also for new purchases. Competition is heating up, so if you’re thinking about buying or refinancing, now’s the time to get started.

http://www.YourApplicationOnline.com

-

U.S. – China Trade Tensions Ripple Through Markets: Bonds Improve, Rates Drop

The back and forth and escalation is pressuring risk on assets driving money to the bond market helping rates. It’s a flight to safety.

Oil prices moved lower to $58.25 per barrel, the lowest level since May. Oil plays a critical role in the broader economic “food chain”, influencing manufacturing costs, transportation expenses, and ultimately how much extra cash consumers have to spend.

Day 14 of the Government Shutdown and Growing Uncertainty

As mentioned above, uncertainty is driving a flight to safety. We’re happy to see rates dropping, but it’s worth asking, at what price?

The September Consumer Price Index (CPI) report will be released on October 24th, just ahead of the Fed’s October 29th rate cut decision.

My take:

Uncertainty remains the dominant theme. Consumers are feeling uneasy, and that perception real or not impacts spending. When confidence drops, we see behavioral shifts: steak becomes chicken, new purchases turn into repairs.Get Pre-Approved http://www.YourApplicationOnline.com

-

Rates Improve as New Fed Chair Decision Looms; Two More Cuts Expected This Year

Mortgage rates are improving this week, with the market betting on two more rate cuts in October and December.

According to Fed Governor Waller, the Fed needs to take a cautious and gradual approach, keeping a close eye on the weakening labor market.

The famous or infamous BLS Jobs Report comes out later this month. Staff has been brought in to complete.

It’s a key data point used to calculate updates to Social Security, and it’s always a bond market–moving event.

My take: If you find a home you love, buy it. Don’t get hung up on rates they’re at their lowest point in nearly two years.

Yes, we expect rates to continue trending lower, but if you wait, you’ll be competing with everyone else who’s been sitting on the sidelines.

Pre-qualification starts here: http://www.YourApplicationOnline.com

-

What did the FED Minutes say? Hint Divided but want cuts.

The highly anticipated Fed Minutes did not disappoint.

They underscore a clear division within the Federal Reserve. Mortgage bonds remain flat, showing little favorable reaction.Fed members are split on the timing and extent of future rate cuts.

Fed Futures indicate a 95% chance of a cut October 29th.

Inflation and the labor market continue to weigh heavily on their decisions. This is a unique situation, normally, we see an inverse correlation between unemployment and inflation (low unemployment typically drives higher inflation and vice versa). But right now, we’re seeing the opposite: stubbornly high inflation and a weakening labor market.

That combination is the Fed’s biggest headache, and the risk of deflation now quietly lingers in the background.

We are on day 9 of the government shutdown with no clear finish line in sight. No one likes uncertainty and the market is reflecting its anxiety. Investors are hesitant to make bold moves until there’s clarity out of Washington.

While the shutdown itself has limited direct economic impact in the short term, prolonged uncertainty can weigh on consumer confidence and delay key data releases the Fed relies on. For now, the market is treading water, waiting for direction.

Lets get you pre-approved http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.