-

Fed Minutes and Bond Auction Today, Both Potential Market Movers. Buckle Up!

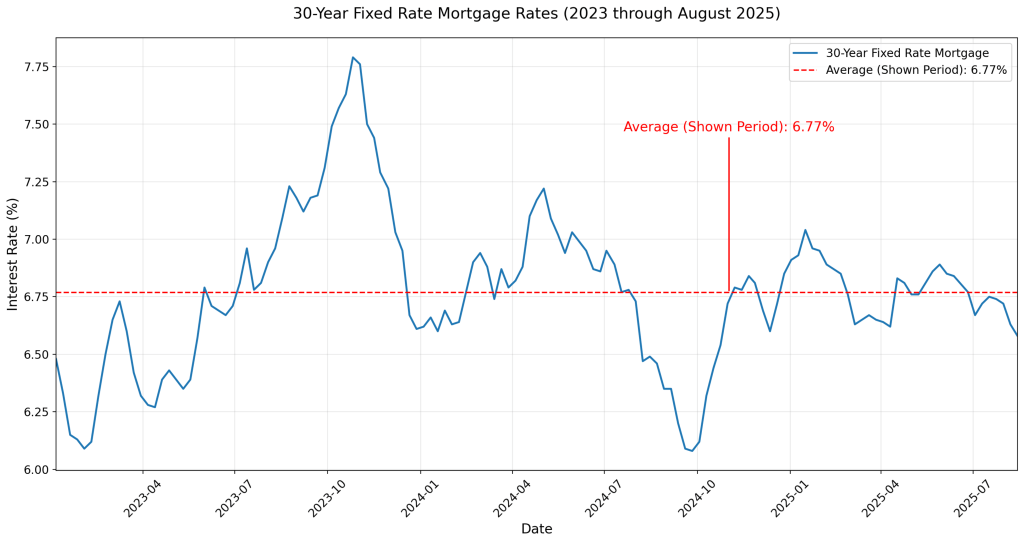

Rates Continue to Improve

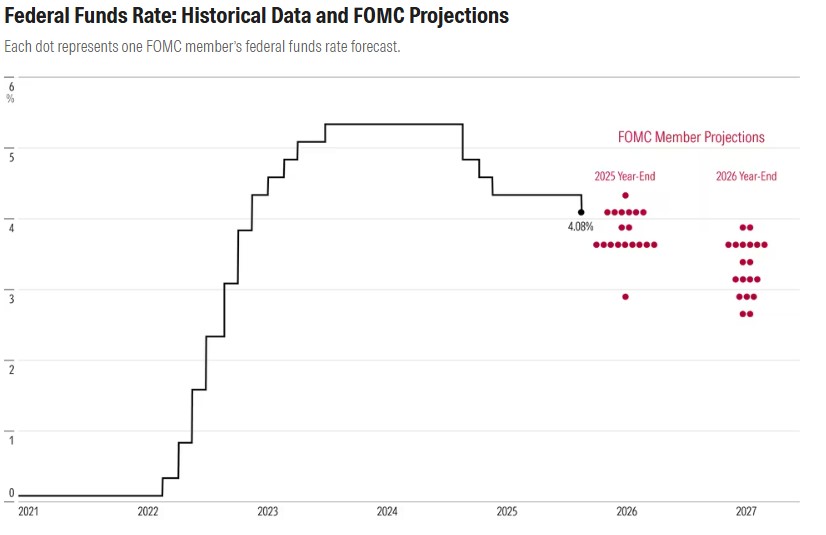

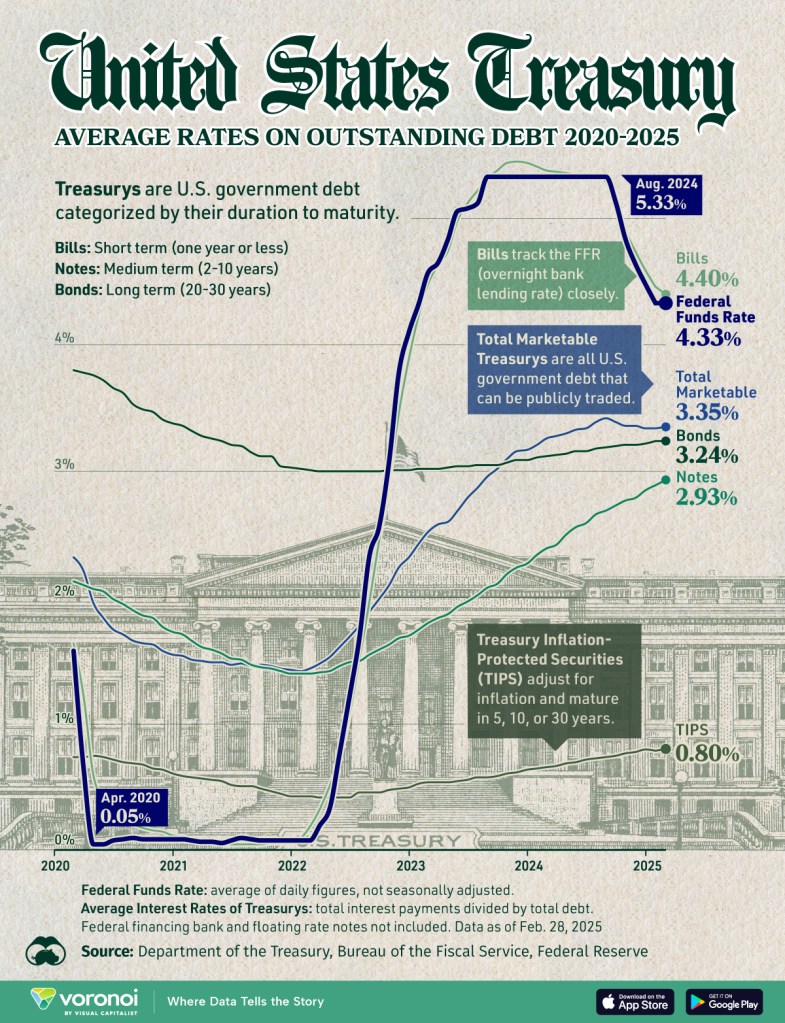

Rates are trending lower again, much like when Powell hinted on August 22nd about a potential September rate cut. We’re seeing a similar pattern now, with a high likelihood of another rate drop within the next two weeks.

The bond market, which primarily drives mortgage rates (via the 10-year Treasury), tends to “price in” expectations ahead of Fed action so the improvement we’re seeing today is the market’s way of preparing for what’s likely coming next.

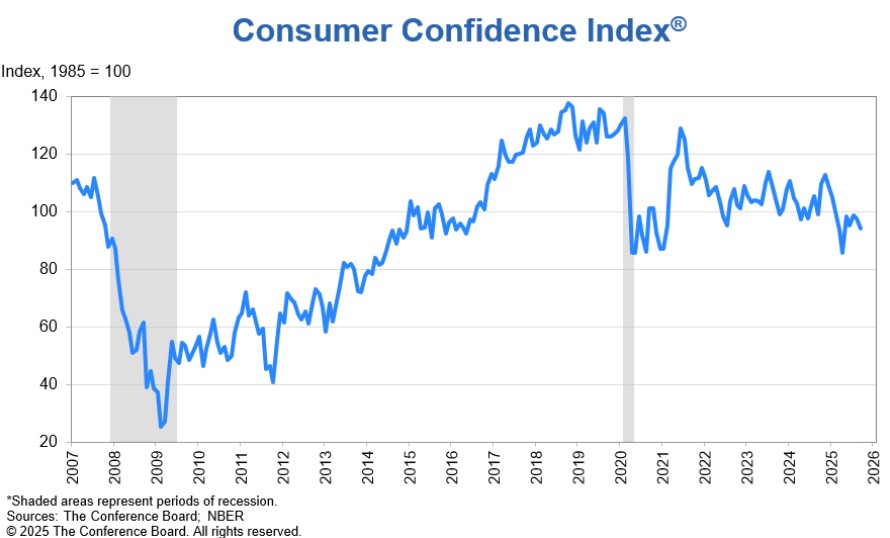

Consumer Expectations Show Rising Concern

The Consumer Expectations Survey for September indicates that consumers are growing more pessimistic about the labor market. This shift in sentiment is something the Federal Reserve watches closely, as weakening confidence often signals slowing economic momentum.

With the Fed increasingly focused on employment trends, this data adds further weight to the case for future rate cuts.

Know someone looking to refinance or purchase? happy to help and we are nationwide. http://www.YourApplicationOnline.com

-

Fed Minutes Tomorrow: Potential Game Changer. Here’s Why. Home Values holding on.

The Fed Minutes give markets a peek behind the curtain.

They’re essentially the detailed notes from the Federal Reserve’s last meeting, showing not just what decisions were made, but why, including the tone of the discussion, differing opinions among members, and what data they’re most concerned about.

Even though the Minutes are released after the decision, traders, economists, and lenders comb through every word looking for clues about what’s next.

If the tone sounds more cautious or focused on inflation, markets may scale back expectations for rate cuts. If it sounds more confident about easing or mentions risks to growth, it can boost bets on future cuts.

In short:

The Fed Minutes don’t change the past, they shape expectations for the future.Though August showed a decline in home values, the year over year values are up 1.3%.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

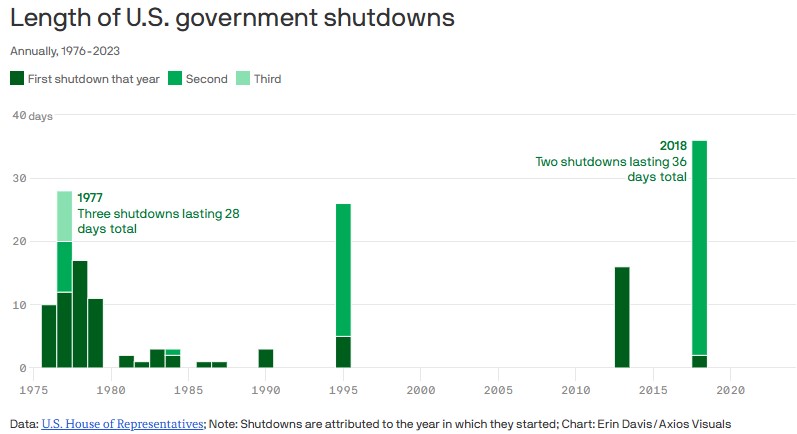

With Rate dropping Affordability is at the best level in 2.5 Years. The Shutdown is having an affect.

Market Update: Rolling With the Punches

We’ve lost a bit of ground on rates since the government shutdown, but for now, things are holding steady. The good news? Most loans are moving forward as usual, the only real slowdown is with USDA loans, which have temporarily hit pause.

If you’re in the middle of a transaction, it’s a good idea to check in with your lender and agent. Make sure the seller understands that any delays aren’t deal-breakers just a part of the process right now.

Here’s the silver lining

With recent rate drops, home affordability has improved and we’re now in the best position we’ve seen in over two and a half years. That means more buying power, better payment options, and renewed opportunities for those who were previously priced out.

Stay patient this too shall pass.

let’s get you qualified http://www.YourApplicationOnline.com

-

Don’t Over Index on Monthly Aggregates. Ok what now? English please.

My favorite Fed President is Austan Goolsbee from Chicago. He was on CNBC this morning talking about the stability of the labor market, then later in the same segment, he referenced its deterioration. A bit confusing, but he’s always fun to listen to.

One comment he made was “Don’t over index on monthly aggregates”. It’s Friday so let’s break that down into English.

Don’t place too much weight or make big conclusions based on a single month’s jobs data (like total payrolls or unemployment rate). Monthly jobs reports are noisy and can swing due to seasonal adjustments, temporary factors, or later revisions. Instead, it’s better to look at trends over several months and broader data points to get a truer picture of the labor market.

Watch the Dog not its Tail.

In other words: Don’t let one month’s headline number drive the whole narrative.

Have a fantastic weekend and if you or you know someone that is looking to refinance or purchase, we are happy to help.

http://www.YourApplicationOnline.com

-

Gov Shutdown will affect FHA, VA and USDA loans. In a Flood zone Hummm…

Overall, the mortgage industry is only minimally affected by the shutdown.

The main exception is for properties in flood zones that require FEMA’s National Flood Insurance Program, this is particularly relevant in states like Florida and Hawaii.

Additionally, USDA has paused operations as of yesterday, so any purchases in Rural Housing areas using USDA financing will be impacted until further notice.

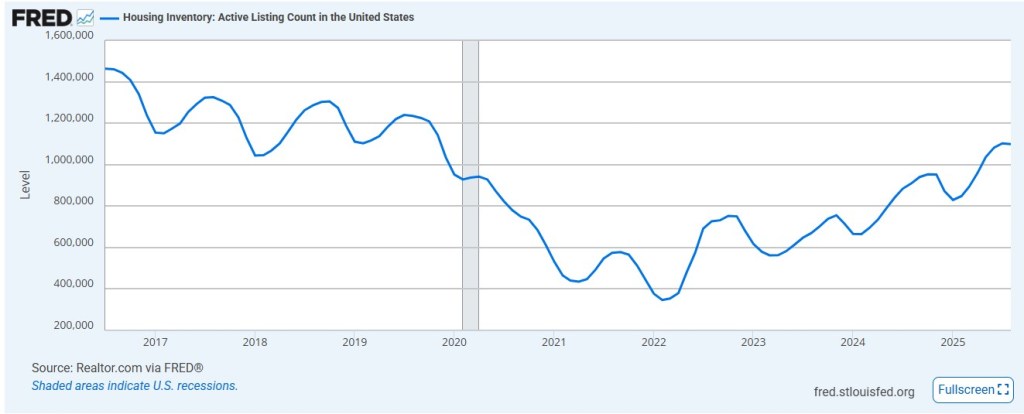

Nationally, home prices are trending higher, but locally the story can be very different, it all comes down to supply and demand.

Take New Mexico, for example, in some areas homes are averaging more than 100 days on the market. Florida, Texas, and properties in California fire zones are facing similar challenges.

Insurance costs are another major factor. What used to run $100–$150 a month in many areas is now closer to $500+ in high-risk fire or weather zones.

That added cost directly impacts a borrower’s qualification and, in turn, shrinks the pool of potential buyers, making it harder for sellers to achieve top dollar.

Rates are down and our team is ready to pre-qualify you or your clients.

http://www.YourApplicationOnline.com

-

Shutdown Looms Large, Rates Improve as ADP Misses Expectations

ADP data came in very weak at -32k versus expectations of +50k. To add to the concern, last month’s figure was revised down to -3k from the originally reported +54k.

This matters because ADP is based on actual payroll data, unlike the BLS report, which relies heavily on surveys.

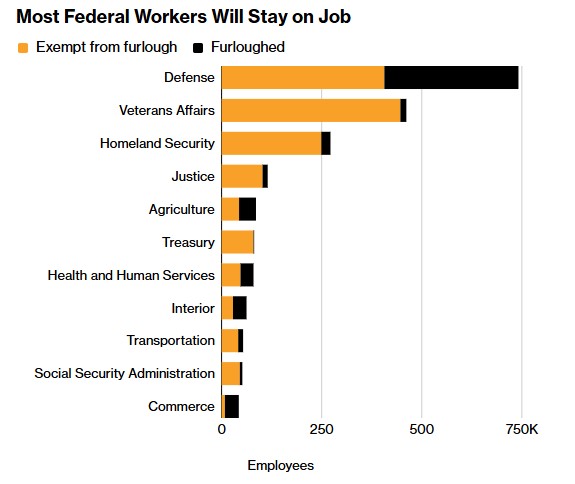

what will be impacted by the Government shutdown:

Most federal workers will remain on the job, but key processes will be impacted, such as Flood Insurance through NFIP, government payoffs and subordinations, VOEs for government employees, and ordering tax transcripts.

My take: Rates have dipped slightly as investors make a “flight to safety” into the bond market. More demand for bonds means lower yields, which in turn translates into lower mortgage rates.

let’s get you pre-approved http://www.YourApplicationOnline.com

-

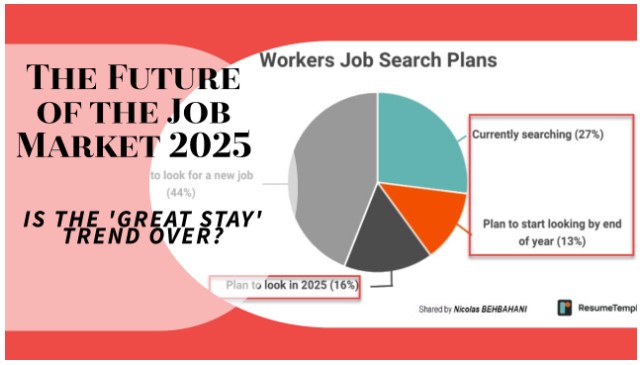

Fear in the Headlines, Optimism in the Numbers: Purchases Up, Rates Down

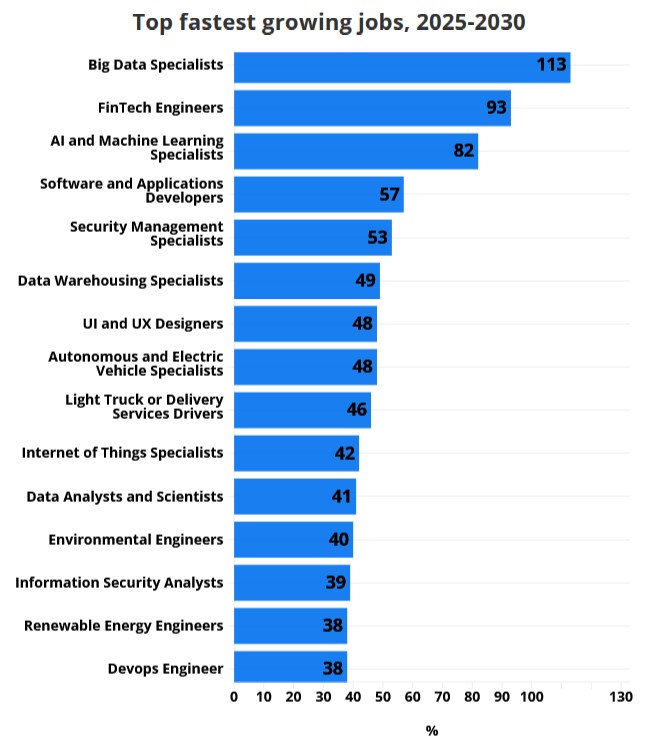

Job openings ticked slightly higher, but consumer confidence is slipping.

The labor market has cooled from an average of two jobs per seeker to nearly a one-to-one ratio.

With several key reports ahead, including the BLS data but if the Government shuts down that volatility and uncertainty continue to push money into the bond market, helping to keep rates moving lower.

Case Shiller Home Price Index showed home prices fell 0.1% in July, first decline in awhile. Y/Y home prices rose 1.7%.

All eyes are on tomorrow’s ADP report the real gold standard for jobs. Expect it to be a major market mover. Poor jobs report, lower rates.

let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Owning a home builds equity. Renting builds your landlords vacation fund.

We’ve got a busy week ahead. Bonds are holding their ground for now. Historically, during government shutdowns, bond yields tend to move lower which often translates into lower interest rates.

One idea floating is an interesting way to lower rates. It would be for the Federal Government to sell short-term bonds (6-month, 1-year, 2-year) and use those funds to purchase longer-term bonds particularly the 10-year, which mortgage rates are closely tied to.

My take:

Rates are holding steady for now, while housing inventory continues to rise. Could we see rates in the 5’s by year-end? Possibly. Some clients are already locking into the 5’s with rate buydowns. FHA and VA loans are often at or below 6%, depending on the client’s profile.

Let’s get you pre-approved http://www.YourApplicationOnline.com

-

Government shutdown potential impact buying a home.

A government shutdown doesn’t stop the mortgage industry, but it does slow things down. Here’s how:

- IRS Transcript Delays Lenders often require IRS tax transcripts (4506-C). If the IRS is closed, those transcripts can’t be processed, delaying loan approvals.

- Verification of Employment (VOE) For government employees, lenders may struggle to verify employment and income if HR departments are closed or minimally staffed.

- FHA, VA, USDA Loans These rely on federal agencies to issue commitments, guarantees, or insurance. During a shutdown, those pipelines slow dramatically, creating backlogs.

- Consumer Confidence & Markets Bond markets can become volatile during a shutdown, and since mortgage rates are tied to Treasuries, rates may swing unexpectedly.

- Closings Conventional loans with strong documentation often move forward, but anything dependent on government checks, transcripts, or approvals risks delays.

Bottom line: Loans will still close, but borrowers should expect extra time, especially with government-backed programs. Clear communication between lenders, agents, and clients becomes critical during these periods.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

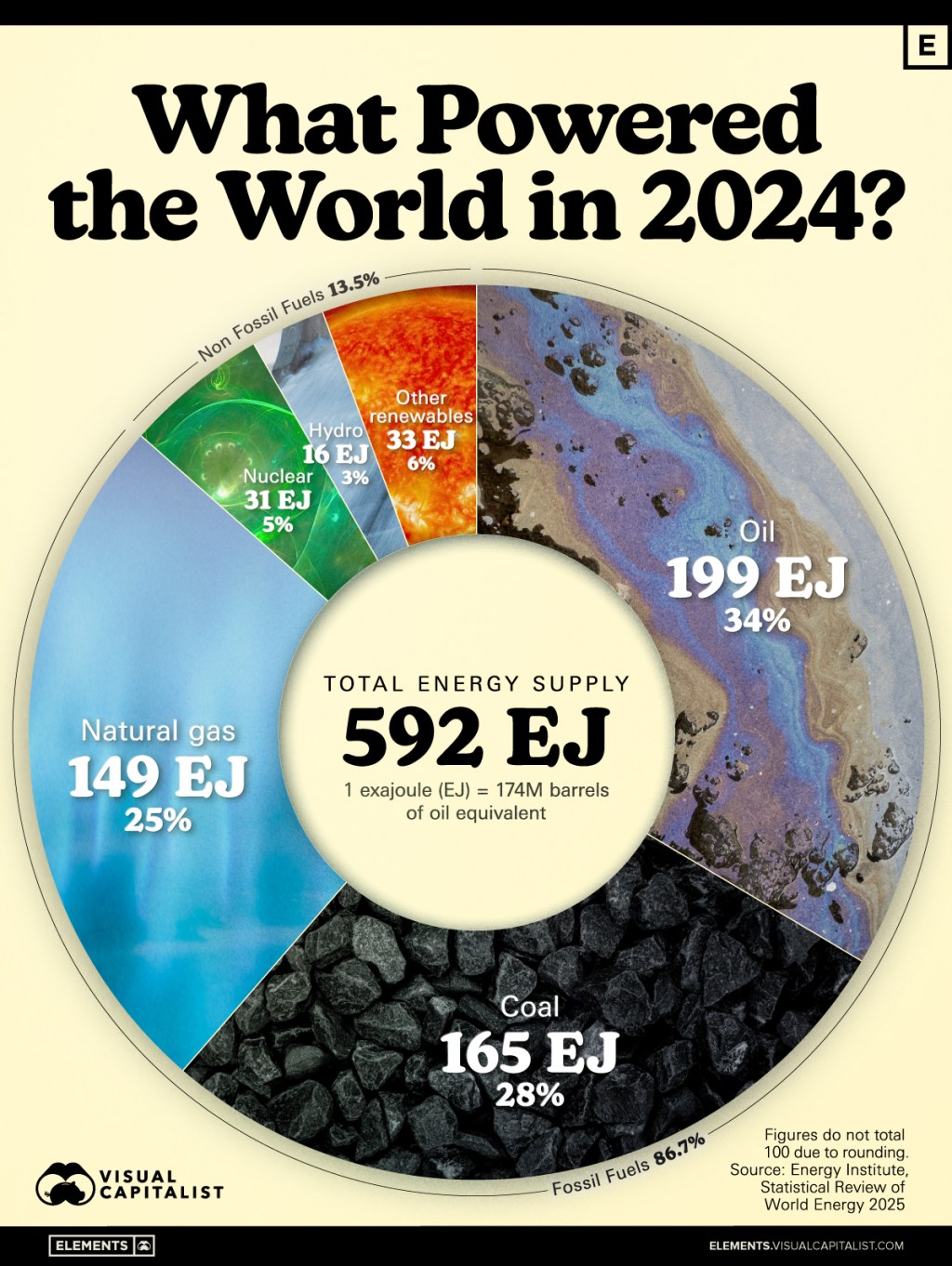

A.I. Sucks… Power that is. How is A.I. revolutionizing the Mortgage industry.

AI is transforming the mortgage industry by streamlining processes that once took days into tasks completed in minutes.

From automating income and asset verification to detecting fraud and reducing underwriting errors, AI helps lenders work faster, smarter, and with greater accuracy.

It also enhances borrower experiences by delivering quicker approvals, personalized loan options, and clearer communication.

The real power of AI in mortgages is its ability to combine efficiency with intelligence, freeing loan officers to focus more on relationships and strategy while technology handles the heavy lifting.

Highlights this morning

- Housing Inventory up 11% year over year

- GDP increased 2% slightly below expectations

- Initial Jobless Claims lower than expected, but revisions will follow.

Lets get you pre-qualified http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.