-

Home Values Rise as Government Shutdown Nears an End, Refinances on the Upswing

Good news on several fronts this week!

It looks like the government shutdown will end by this Friday great news for everyone.

The ICE Mortgage Monitor reported home values rose 0.15% in October, the largest monthly gain since March. Year-over-year, prices are now up 0.9%.

There’s also talk that the Federal Government may increase Treasury purchases over the coming months and into next year a positive sign for interest rates.

Meanwhile, the NY Fed’s Consumer Expectations Survey showed inflation expectations declined 0.2% to 3.2%, adding another data point supporting further rate cuts.

Even with the shutdown, retail sales climbed 5% compared to last October showing consumers are still out there spending.

Time to move forward and get to getting!

👉 www.YourApplicationOnline.com

-

No BLS? No Problem, Alternative Data Confirms Job Market Weakness

Alternative Data Confirms Labor Market Weakness

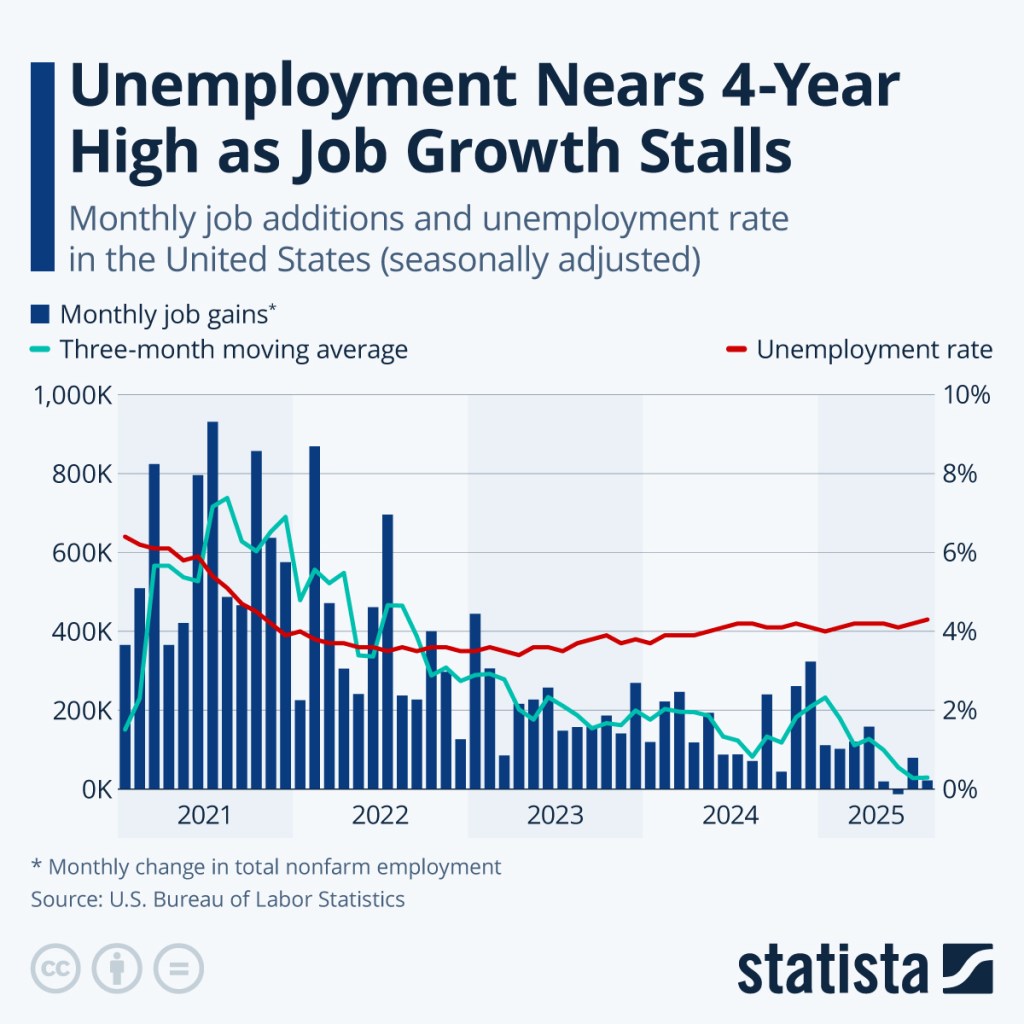

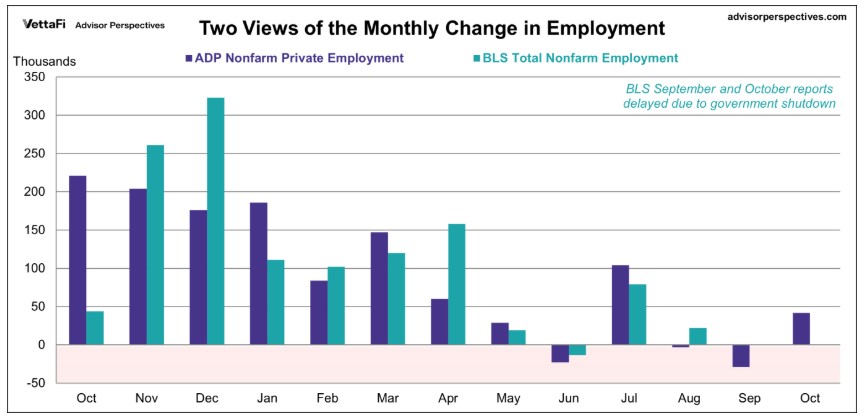

While the BLS Jobs Report wasn’t available, several private sector reports help reinforce the story of a weakening job market.

On Wednesday, ADP reported just 42,000 jobs created, far below the typical 200,000+ we’ve seen in stronger months.

Similarly, Revelio Labs, which analyzed data from over 100 million U.S. workforce profiles, also found evidence of a cooling labor market, echoing the same trend of slowing job growth.

Indeed also reported job openings are at their lowest level since February 2021.

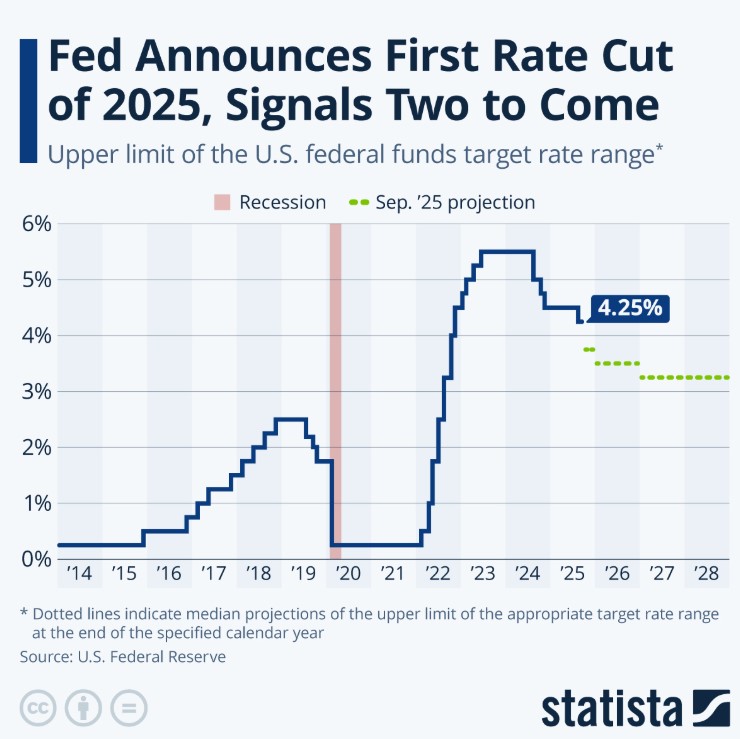

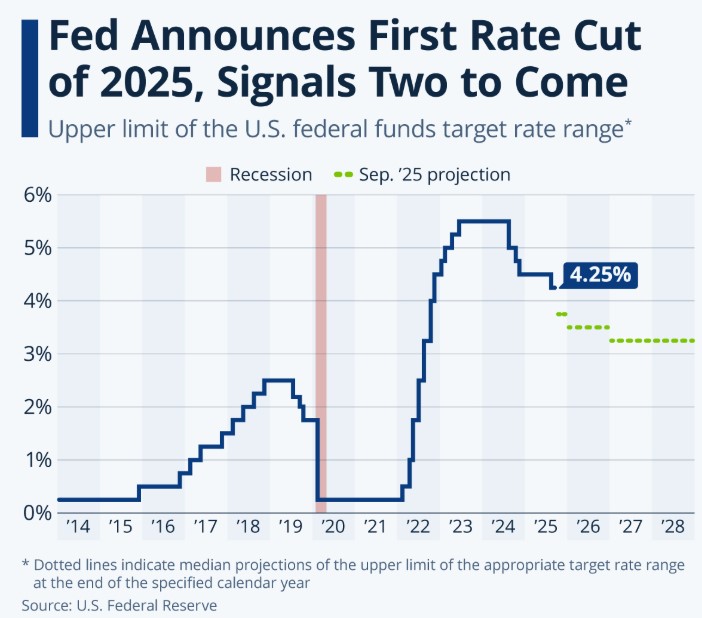

The Fed is beginning to acknowledge the growing weakness in the labor market, increasing the likelihood of a rate cut in December.

Meanwhile, mortgage rates have held onto their recent gains, and we anticipate further declines in the coming months as the data continues to soften.

Time to get you pre-qualified for a mortgage. http://www.YourApplicationOnline.com

-

Weak Jobs report “Challenger Report” give a more accurate view.

Challenger Jobs Report: Signs of Softening

The Challenger Jobs Report showed 153,000 job cut announcements in October the highest level for that month in 22 years.

Year-to-date, we’ve now seen over 1 million job cut announcements.

So why all the doom and gloom, Jack?

Because this is exactly the kind of data point that gives the Fed room to cut rates. Inflation may still be their official mandate, but it’s clear that jobs have taken the front seat in their decision-making.

Are the Fed Speakers Reading the Same Book?

Listening to the recent Fed speakers, you start to wonder if they’re reading from the same book as the rest of us.

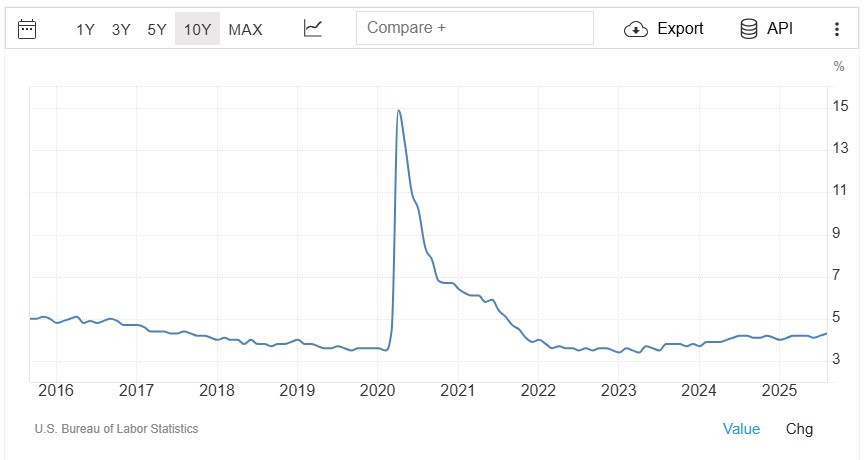

Yes, the unemployment rate sits at 4.4%, which on the surface means 95.6% of people are working. Sounds strong, right?

But dig a little deeper not long ago, we had a 2-to-1 ratio of job openings to available workers. Today, that’s down to 1-to-1, a clear sign that the job market is cooling faster than the headlines suggest.

Lets get you pre-qualified http://www.YourApplicationOnline.com

-

Funny thing, when the bar is set Low, so are the expectations

ADP Employment Report Reaction

The ADP Employment Report came in at 42,000 jobs for October, a very low number by historical standards, though still above expectations of just 24,000.

When you look at the bigger picture, the total jobs created over the last four months adds up to only about 10,000, which is meager at best. But that didn’t stop the bond market from reacting as if 200,000 jobs were created.

Even the Federal Reserve seemed to view this as a stronger-than-expected report, which could make them less inclined to cut rates further.

The BLS and PCE data will be available ahead of the December 10th Fed meeting and that will give us hard numbers for the Fed to chew on.

Lets get you qualified http://www.YourApplicationOnline.com

-

Home Values Poised to Rise as Labor Market Outweighs Inflation

Inflation may be the Federal Reserve’s primary mandate, but with the labor market struggling, jobs have become the dominant concern.

Markets are betting 65–70% on a December rate cut. When the government reopens and data starts rolling in again, signs of a softening job market could push the Fed toward a more decisive cut.

Cotality Home Price Insights show a 0.2% decline in September but still up 1.2% year over year. They forecast a 4.1% rise in the next 12 months.

If you or your client purchased a $500,000 home today, that could translate to a $20,000 increase in value over the next 12 months.

ADP, which operates independently of the government shutdown, will release its employment report tomorrow morning. Expectations are for a very weak 24,000 jobs added in October, typically, we see numbers closer to ten times that amount.

My take: Rates appear to be moving in the right direction. Out in the field, agents are reporting more activity, greater buyer interest, and a noticeable uptick in open houses.

Lets get you pre-qualified today. http://www.YourApplicationOnline.com

-

How Today’s Political Quagmire Is Driving Interest Rates Lower

Day 34 of the Government Shutdown

Tomorrow marks an unfortunate record. Beyond the layoffs and furloughs, there’s a growing concern around the Worker Adjustment and Retraining Notification Act (WARN)—a federal law that protects workers, families, and communities by requiring employers with 100 or more employees to provide at least 60 calendar days’ advance written notice of a plant closing or mass layoff affecting 50 or more employees.

We are now seeing layoff levels not experienced since 2009, underscoring the deepening economic strain caused by the prolonged shutdown.

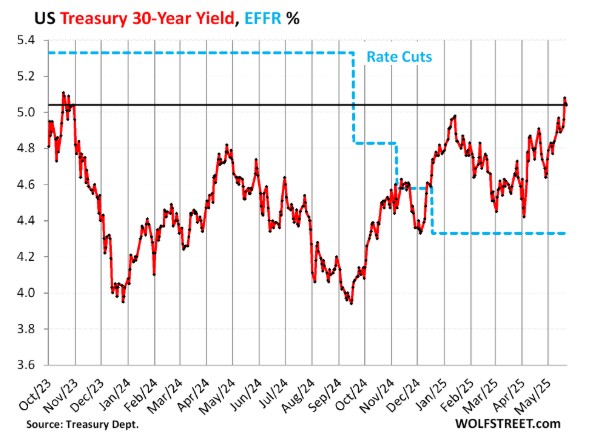

The side effect of a weakening job market is the flight to safety investors moving money out of riskier assets and into the bond and Treasury markets. As more money is “dumped” into these safe havens, demand rises, bond prices increase, and yields (interest rates) fall.

Class Dismissed and have a great rest of your week.

Let’s get you pre-approved and ready to purchase or refinance. Soft credit pull http://www.YourApplicationOnline.com

-

Don’t allow the Urgent to Drown-Out the Important. Fed Member inflation Ghosts

Halloween Edition: When Inflation Haunts the Fed

Kansas City Fed President Jeffrey Schmid appeared on CNBC this morning to explain why he dissented on the 25bp rate cut yesterday and hinted he’ll likely do the same in December.

Schmid sees ghosts in inflation phantoms from the past that keep him up at night. He’s one of the few Fed members still haunted by old inflation fears, refusing to see the other shadows creeping in… like rising unemployment.

My take: The cure has become worse than the disease. This obsession with fighting yesterday’s inflation ghosts is hurting today’s real people especially first-time homebuyers trying to step into the market before the door slams shut.

lets get you pre-qualified today, don’t be scared http://www.YourApplicationOnline.com

-

Powell, Your Killing me Smalls, Why you have to do us like that.

When asked about the December 10th rate cut, Powell said it was “not a foregone conclusion — far from it.” That single comment wiped out a month’s worth of progress, with the market losing 33 basis points yesterday.

In one sentence, Powell effectively took back all the mortgage rate gains we’ve seen recently.

Graph below shows what happens when the market is Spooked .

The other challenge is Treasury Secretary Bessent strategy of issuing more short-term debt and less long-term ie 10y. This could negatively affect the Mortgage rates.

My take: Though my frustration with Powell is obvious, the reality is that interest rates are still far lower today than at any point in the last few years. In this market, we think in inches, not feet, every small movement in rates sparks a reaction.

-

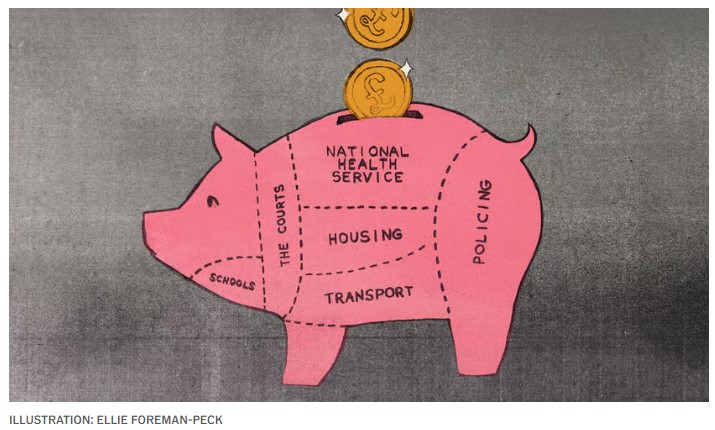

Fed Balance Sheet Runoff more impactful than Rate Cut Today

Fed Day: All Eyes on Powell

The Fed is expected to cut rates by 25 basis points this morning, but the real story will come after the 11 a.m. announcement when Chair Powell speaks. He’s been known to take a bit of a “Debbie Downer” tone, so we’re on edge and ready to lock in our clients as soon as he starts talking just in case.

The Fed also announced plans to end its runoff of Treasuries in the coming months and begin purchasing Treasuries again in 2026 very good news for long-term rates. For perspective, the Fed was buying tens of billions of dollars per month in Treasuries in 2020, totaling over $2 trillion that year. Those massive purchases were a big reason rates were so low at the time.

Mortgage applications are up, though not as much as expected. The market has largely priced in today’s rate cut and the one anticipated for December, so we don’t expect major rate drops for the remainder of the year but of course, that could change.

My take: If you’re thinking about refinancing, today’s rates are worth locking in.

http://www.YourApplicationOnline.com

-

How Does the Fed Decide When It’s Data-Dependent but Flying Blind. They are still going to Cut

There are still a few key data points guiding the Fed as it prepares for the October 29th rate cut decision.

The Chicago Fed’s Labor Market Indicators show the unemployment rate ticking up from 4.3% to 4.4%, signaling some softening in the job market. Auto delinquencies have also increased, while housing remains well below pre-pandemic levels, showing relative stability in that sector.

Rates are holding steady for now, but with the Fed’s decision and the 10-year Treasury hovering near 4%, it’s shaping up to be a busy week ahead. We’re all watching closely and hoping for lower yields.

Have a fantastic rest of your week!http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.