-

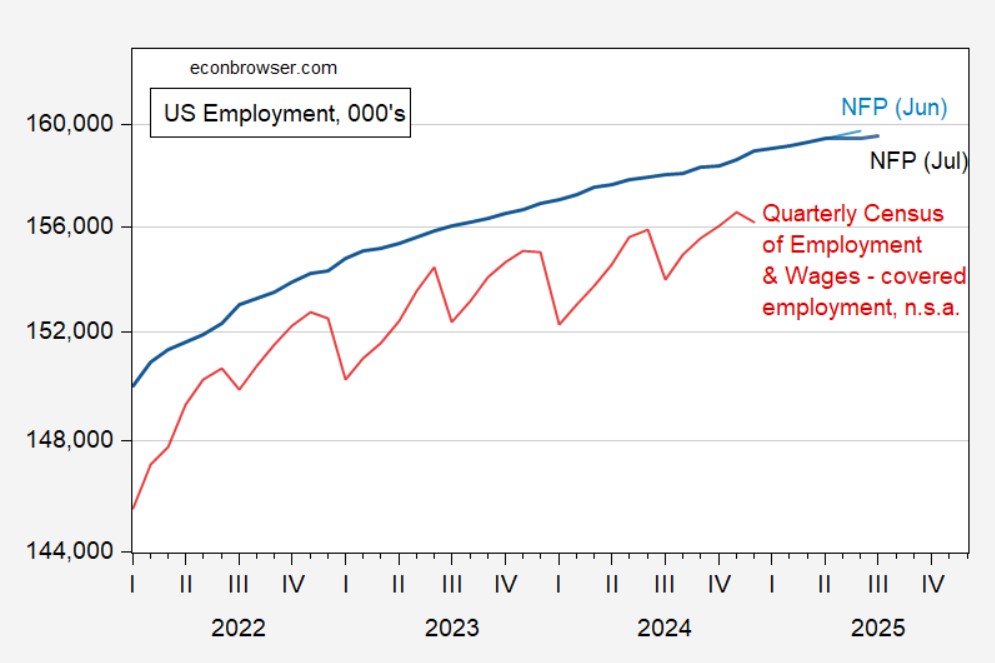

What is QCEW and it has Actual Labor numbers. Hint ouch…

Labor Market Reality Check (QCEW vs. BLS)

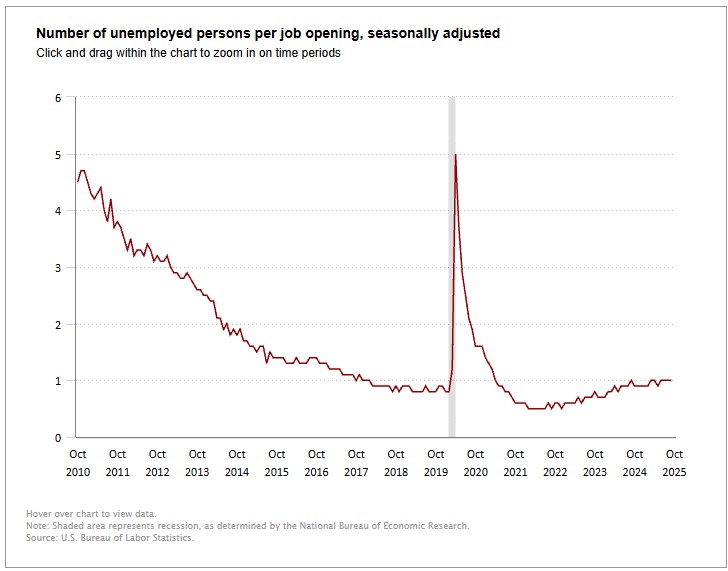

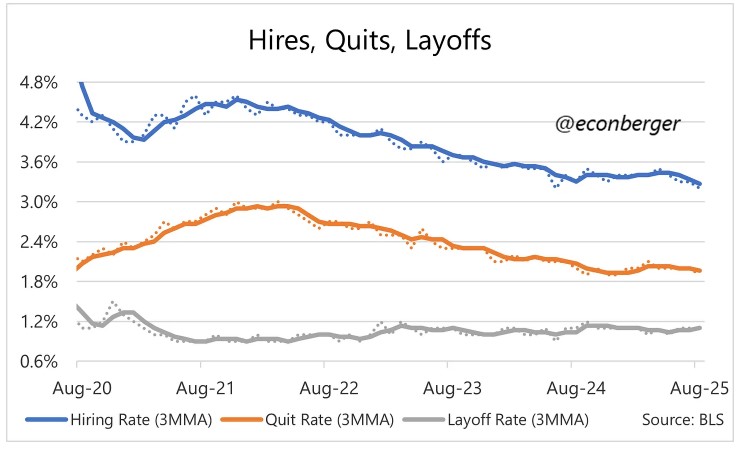

- Anecdotally and now with hard data we’ve known the labor market was weakening. The QCEW (Quarterly Census of Employment and Wages) data released Friday confirms it, using actual employment records, not estimates.

- Unemployment rate: 4.6%, the highest level in four years.

- April 2024 – March 2025:

- BLS overstated job growth by 52%.

- July 2024 – June 2025:

- BLS initially reported 1.923 million jobs created

- BLS later revised that down to 1.534 million

- QCEW shows actual job creation of just 420,000

- Result: BLS overstated job growth by 1.503 million, or 78%

- January 2025 – June 2025:

- Only 28,000 jobs created in total.

- Bottom line:

- The labor market has weakened substantially over this period.

What does this mean going forward?

- Despite the data, Fed members continue to lean on the narrative that the labor market is “solid,” “stable,” or “not that bad.”

The Feds will wake up and realize we are in far worse shape and again be late to the game.

Time to get pre-qualified for a mortgage. We see rates dropping and maybe sooner than later. http://www.YourApplicationOnline.com

-

Home Sales Steady, Plenty for the Fed to Chew On as Rate Cut Talk Continues

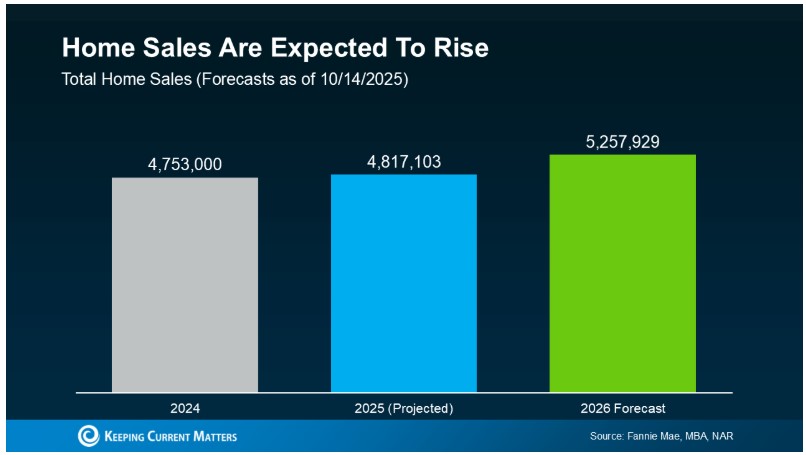

Existing home sales rose 0.5%, coming in close to expectations and roughly in line with this time last year. Activity is still working through a bit of a lag, largely due to government shutdown, related data delays, and the recent drop in interest rates hasn’t fully shown up in the numbers yet.

The New York Fed President, a current voting member, spoke this morning. The takeaway: while he stopped short of making any firm commitments, his comments suggest there is room for additional rate cuts down the road. One challenge right now is that inflation data is incomplete, with October and parts of November still missing, making it harder for policymakers to draw firm conclusions.

For now, rates are holding steady, and the bond market appears comfortable waiting for cleaner data. Looking ahead, if rates remain supportive and pent-up demand begins to surface, we expect a very active purchase and refinance environment in 2026.

let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Inflation is a Four letter word.

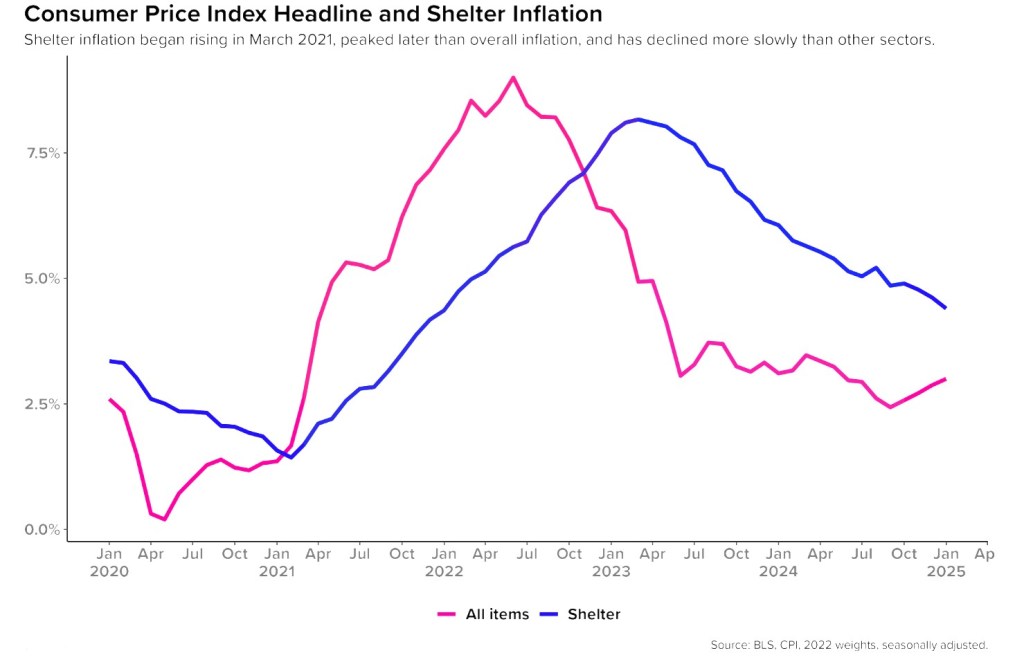

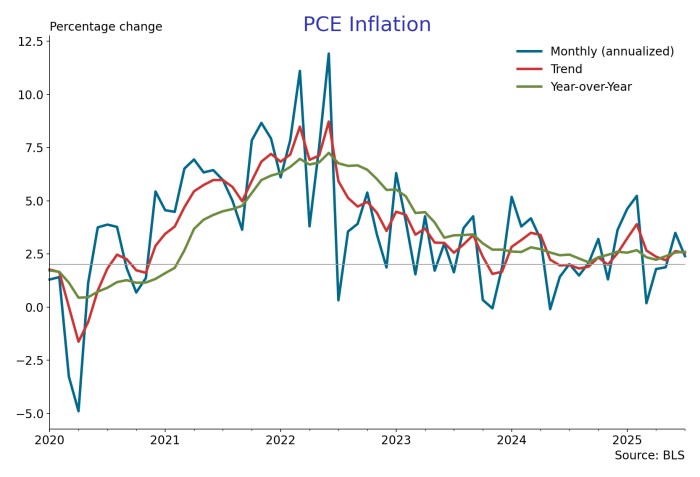

The Fed’s primary focus remains inflation.

Controlling inflation is central to the Fed’s mandate, and every major policy decision flows from that objective.The Consumer Price Index (CPI) will be released tomorrow morning.

Current expectations are for inflation to remain stable at 3.0%, which would reinforce the recent trend of cooling price pressures rather than renewed acceleration.Housing costs continue to do the heavy lifting.

A key reason inflation is holding steady is that rents are still trending lower. Shelter is one of the largest components of CPI, so even modest declines there have an outsized impact on the overall number.Why this matters for rates.

If CPI comes in as expected or softer it supports the bond market’s case that inflation is gradually easing, giving the Fed more room to consider rate cuts rather than hikes.In short: stable inflation, easing rents, and a patient Fed are the combination the bond market has been waiting for.

Lets get you ready for the new year. http://www.YourApplicationOnline.com

-

Job Data Is a Lot to Digest, Bond Market Hasn’t Finished Dinner Yet

The Bureau of Labor Statistics (BLS) served up some leftovers this week. October was revised down by 105,000 jobs, while November came in at a modest +64,000. August and September didn’t escape either, both were revised lower, confirming that the job market isn’t quite as hearty as the original menu suggested.

Translation: the Fed hawks are quietly eating crow, while the doves sit back, arms crossed, saying, “Let’s see how this digests.” Headline numbers once looked robust, but revisions are where the bond market really reads the fine print.

As a result, the odds of a January rate cut have ticked higher, not dramatically, but enough to move the needle. The bond market noticed, rates responded, and now we wait to see if this was a one-off indigestion… or the start of a lighter economic diet.

lets get you pre-qualified http://www.YourApplicationOnline.com

-

BLS Jobs Report Tomorrow. Thursday CPI busy week ahead.

The BLS Jobs Report comes out tomorrow, and if the “see-sawyers” are right, the numbers could come in light which would be rate-friendly for mortgages due to a classic flight-to-safety move in the bond market.

Right now, the market is expecting 40,000–50,000 jobs added in November, with the unemployment rate holding at 4.4% or ticking up to 4.5%.

And let’s not forget: Powell himself has acknowledged that BLS job reports may be overstating employment growth, which is why this release carries even more weight than usual.

So what does that mean for us?

Money managers crave stability. When the job market underperforms—even against already low expectations it scares them. When that happens, money tends to move out of the stock market and into the bond market.

That shift increases demand for bonds, pushes bond prices up, and drives yields (and mortgage rates) down. In short: weaker job data often translates into better news for rates.

-

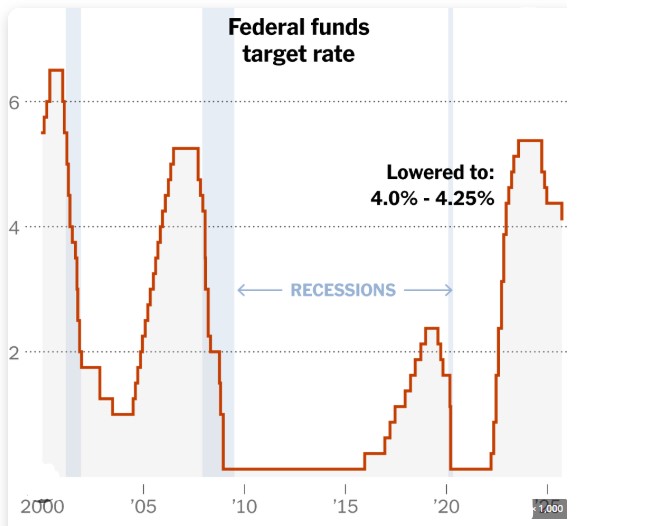

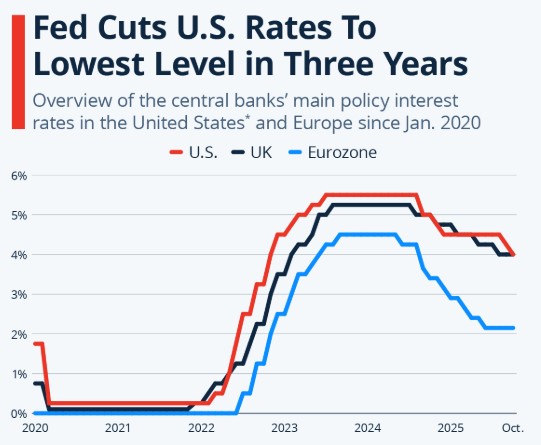

Breakdown of the Rate Cut and 2026 Expectations

The Feds cut rates this week, just as everyone expected but they did it in a noticeably more dovish tone.

In plain English, that means they’re more open to another rate cut, but they’ve set the bar higher. We’d need to see inflation continue to cool and the labor market weaken further before they pull that trigger again.

Powell also noted that the BLS jobs report may be overstating employment growth by roughly 60,000 jobs per month, suggesting the labor market is softer than the headline numbers imply. With next week’s BLS report on deck, we could be looking at a genuine market-mover.

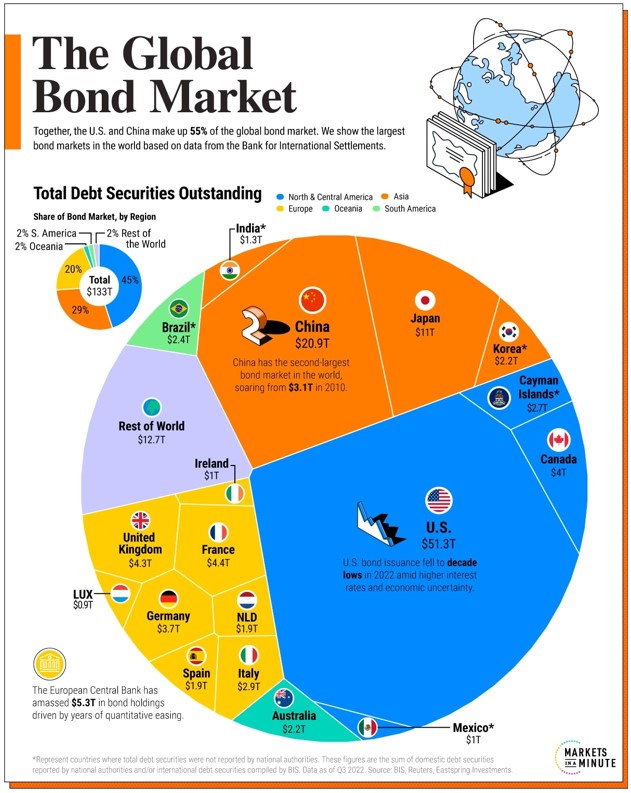

Another major development: the Fed has shifted back toward quantitative easing (QE), adding an estimated $40 billion in Treasury bills per month to its balance sheet.

The last time we saw this level of balance-sheet expansion was during the 2008 global financial crisis and again during the 2020 pandemic response both moments of significant economic recalibration.

2026 is shaping up to be a noticeably more dovish year as several of the Fed’s more hawkish voices rotate out. The current voting members, Powell, Goolsbee, Schmid, Musalem, and Collins will be replaced as part of the routine rotation of regional Fed Presidents.

With a new Fed Chair stepping in for Powell, the committee’s tone is expected to shift. A fresh leadership approach combined with a more dovish voting slate means the Fed may be more open to additional rate cuts in 2026, especially if inflation continues to cool and labor market data softens.

Time to take advantage of the lower rates http://www.YourApplicationOnline.com

-

Fed Spoke, Rates Cut, Mortgage Rates Follow… Let’s get to getting.

Powell swung his rate-cutting sword today and sliced 25bps off the Fed rate and for once, the mortgage market said, “You know what? Let’s match that.”

So yes… we actually saw a real 25bp improvement in rates this afternoon. Miracles do happen.Meanwhile, Truflation (the private company that measures inflation in real time, not once the government finishes entering numbers into a spreadsheet from 1997) reports inflation at 2.2% noticeably lower than the official PCE numbers.

In other words:

The trend is here. Momentum is building. Stuff is actually happening.So if you’ve been sitting on the couch watching holiday movies on repeat…

Get up. Kevin will still be left home alone when you get back.

And the Grinch isn’t stealing your interest rate — the market is actually giving you a gift for once.Time to get prepared before the crowd wakes up.

👉 Get pre-qualified: www.YourApplicationOnline.com

New YouTube Channel Series2a Rover Life and Lending

-

The Data Strikes Again: About as Useful as a Chocolate Teapot

The JOLTS (Job Openings and Labor Turnover Survey) for September and October showed an increase in job openings, with most of the gains coming from September. The biggest contributors were the Trade/Transportation/Utilities sector and Professional/Business Services.

The hiring rate held at 3.2%, the lowest level since 2011 (excluding the Covid period). At the same time, layoffs rose to their highest level since January 2023.

ADP data shows 20,000 jobs created over the last four weeks, but that follows 13,500 job losses in the previous four-week period.

What does this mean for the Fed?

This adds more justification for a rate cut tomorrow. The real question is how the market will react and at this point, it’s a toss-up.Lets get you pre-qualified today. http://www.YourApplicationOnline.com

-

This December Fed Cut is Different than Octobers. here’s why.

The October rate cut by the Feds was completely overshadowed by Powell’s follow-up comments. He essentially said, “Okay, okay here’s your rate cut… but don’t get used to it.”

Naturally, the market didn’t love that, and mortgage rates actually moved higher afterward.

This time around, the January rate cut is looking less likely, which means the market may take it more positively. When expectations drop, rates tend to behave better so we could see a more favorable reaction this round.

The JOLTS Job Openings and Labor Turnover Report, the ADP employment data, and tomorrow’s 10-year Treasury auction could all provide support for the bond market, especially as the employment landscape continues to show signs of weakening.

Rates are holding, just holding but tomorrow may show signs of improvement.

Time to get pre-approved http://www.YourApplicationOnline.com

-

The Snow is Plowed and ready for The Feds to cut rates. PCE came in light.

The Fed’s main mandate is inflation. Sure, they mention employment, but let’s be honest, inflation is their favorite child. The one whose report cards they hang on the fridge.

Today’s Personal Consumption Expenditures (PCE) came in up 0.3%, perfectly in line with estimates.

Year-over-year inflation nudged from 2.7% to 2.8%, just enough to remind the Fed that their “favorite child” still needs supervision.

My thoughts:

Wednesday’s ADP report showed 32,000 job losses in November, and paired with the lighter inflation numbers, it basically handed the Fed a golden ticket to lower rates.

let’s get you pre-qualified or look at that refinance http://www.YourApplicaitonOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.