-

QE is back Baby and the Mortgage Rates are loving it. Get your affairs in order and start that refinance now.

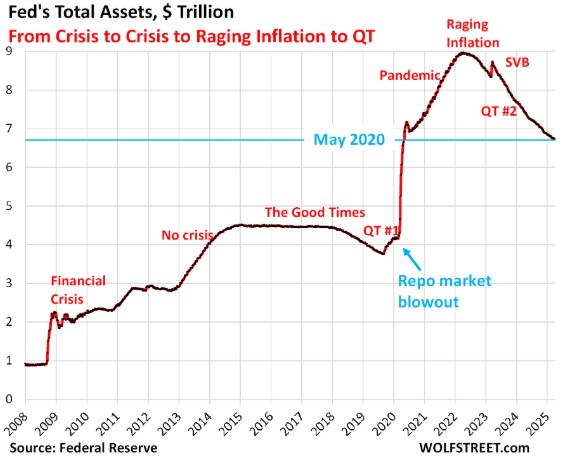

The President instructed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities. This is effectively Quantitative Easing (QE), the purchase of bonds to add liquidity and support lower interest rates.

For the past five years, we have been in Quantitative Tightening (QT), where the Fed has been reducing its balance sheet by selling Treasuries and MBS. That prolonged selling pressure has pushed bond yields higher and, as a result, negatively impacted mortgage rates.

A shift away from QT toward QE is meaningful for housing and could provide much-needed relief for rates.

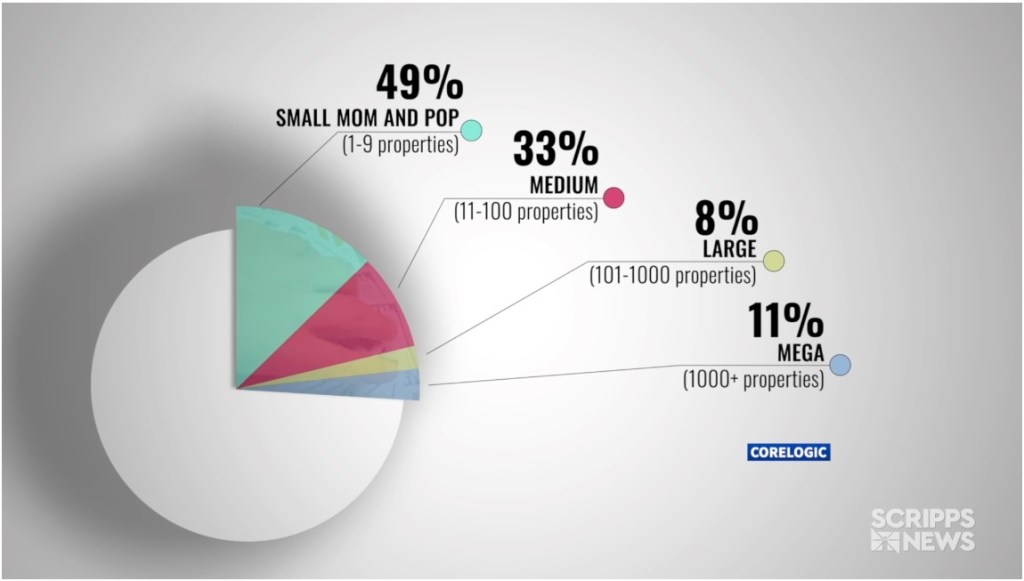

The President also strongly suggested curbing large institutional investors from purchasing single-family homes. The intent is to prevent big corporations from “gobbling up” housing inventory and instead prioritize owner-occupants and very small investors.

Limiting bulk purchases by large funds could help stabilize home prices, increase available inventory, and improve affordability for individual buyers, especially first-time and move-up homeowners.

This isn’t a new concept. Variations of this proposal have been discussed for years, including by lawmakers on the other side of the aisle, particularly as institutional ownership of single-family homes has grown.

Time to get pre-qualified for a purchase or refinance http://www.YourApplicationOnline.com

-

A single Tweet took the Bond market from Rate to not Rate friendly.

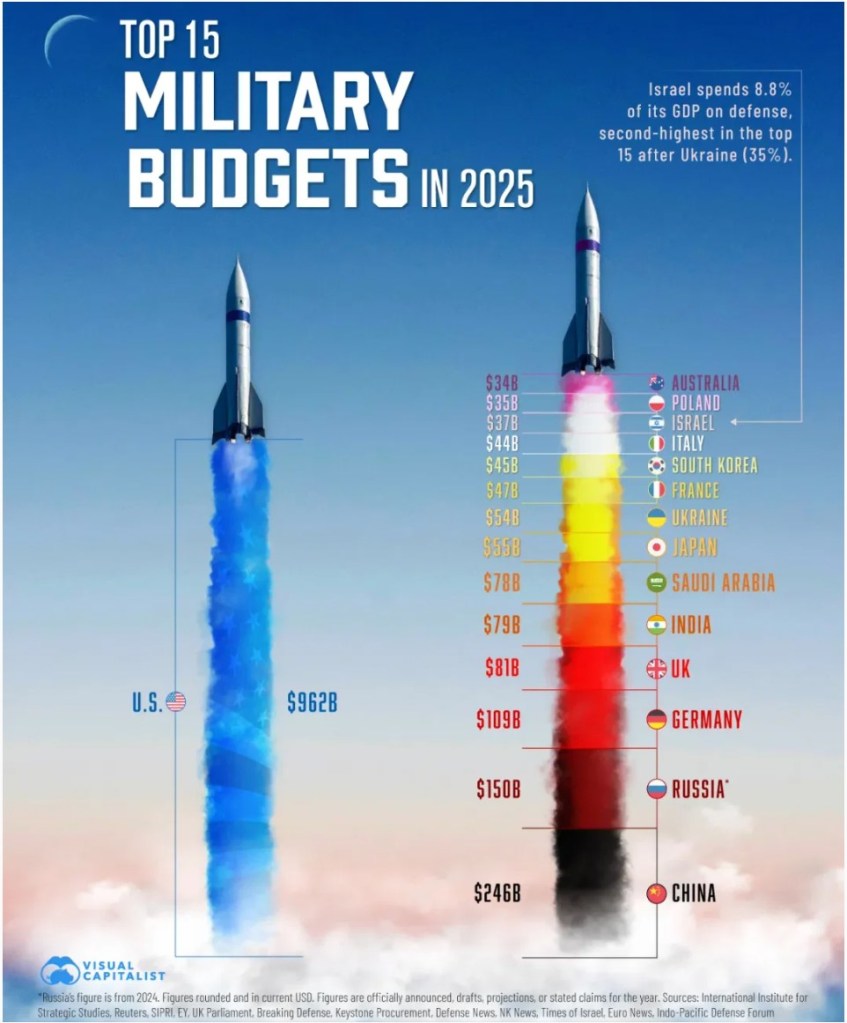

Increasing the defense budget to $1.5 trillion, yes, trillion, represents roughly a 50% increase. The obvious question is: where does that money come from? It gets printed, and that’s exactly what rattled the bond market.

The gains we were expecting from productivity and jobless claims were erased with a single tweet.

Tomorrow’s BLS Jobs Report is expected to show the unemployment rate edging down from 4.56% to 4.50%. On the surface, that seems insignificant, but these figures are rounded.

- 4.56% prints as 4.6%

- 4.50% prints as 4.5%

That rounding can change the narrative.

Bottom line: you can’t rely on the headline number alone. You have to look under the hood to see what’s really going on.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

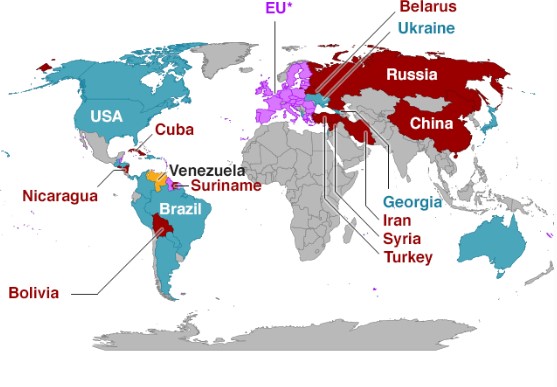

Russia, Venezuela, Greenland Oh My… Rates Improving

We received several bond-friendly economic reports, including ADP, JOLTS, Geo-Political tensions and overseas inflation data. Together, these developments are putting downward pressure on interest rates.

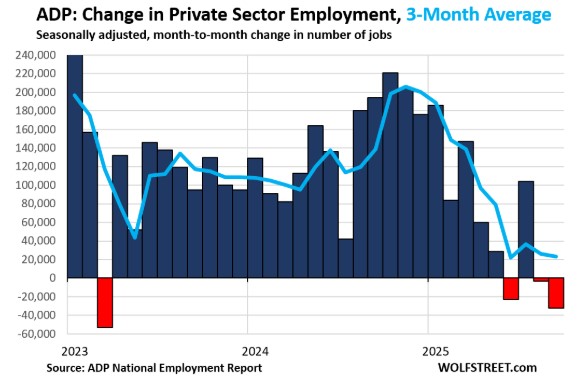

ADP Employment Report

ADP is considered the gold standard for real-time jobs data because it is based on actual payroll information rather than surveys.- December job growth: 41,000

- Market expectation: 50,000

This miss reinforces the narrative of a slowing labor market.

JOLTS (Job Openings and Labor Turnover Survey)

The JOLTS report also signaled labor market weakness. It tracks:- Job openings

- Hiring and quitting trends

- Wage growth for both job stayers and job changers

Results showed continued softening, particularly in wage momentum.

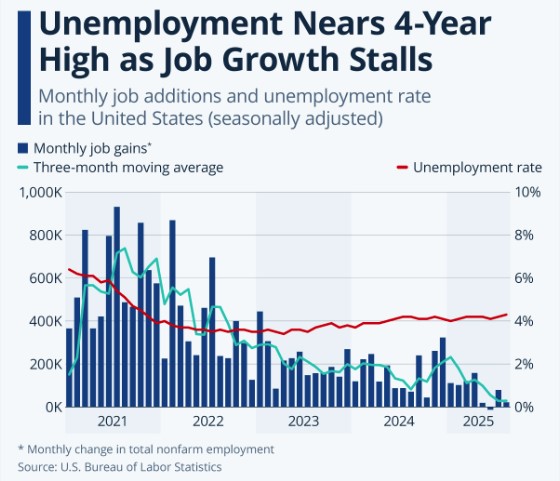

Job Growth Trend

The longer-term trend clearly shows deceleration:- 3-month average: 20,000

- 6-month average: 22,000

- 12-month average: 51,000

- 2024 average: 144,000

Bottom Line

The labor market continues to weaken. Mortgage bonds reacted favorably, pushing rates lower, as markets increasingly expect job growth to either continue slowing or stabilize at lower levels in the coming months.let’s get you pre-qualified http://www.YourApplicationOnline.com

-

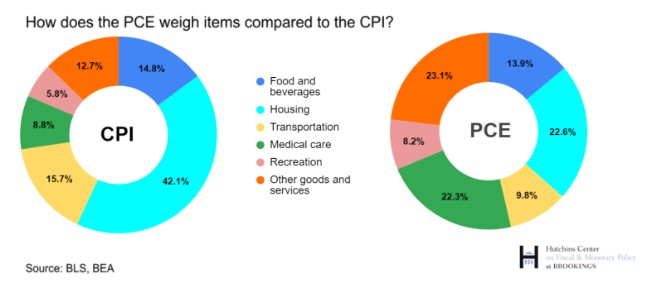

Rents Fall 0.8% 5th month in a row. Vacancy rate 7.3% highest ever tracked.

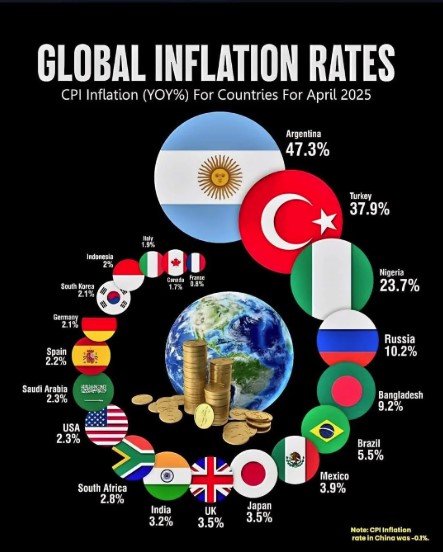

Rents make up the largest share of both the CPI and PCE inflation reports, followed by transportation/energy, with food and beverages coming in third.

While you might expect recent actions involving Venezuela to be destabilizing and push oil prices higher, the opposite has occurred. Concerns about a future oversupply of oil are driving prices lower, outweighing geopolitical risk.

Anecdotally, as consumers continue to tighten their belts, manufacturers and retailers are feeling the pressure and are responding by lowering prices to maintain demand.

All of this means lower Mortgage rates and more incentive for the FEDs to cut rates further. 2% inflation is on the horizon.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Market Update: Rates and Global Events

I wanted to share a quick market update. Interest rates remain sensitive to global events, and recent actions involving Venezuela have added some short-term volatility to the bond market.

When geopolitical uncertainty increases, investors tend to move toward safer assets, which can put downward pressure on rates, but these moves can be temporary and change quickly.

As always, I’m watching the market closely and will reach out if there’s an opportunity that makes sense for you. If you’re considering a purchase or refinance in the coming months, it’s a good time to stay informed and prepared.

Please feel free to reach out with any questions and forward this email to your friends or clients looking to refinance or purchase.

Video blog https://www.instagram.com/jack.kammermortgage/Online application http://www.YourApplicationOnline.com

-

Inflation still Rules the Roost. As it goes so do Rates.

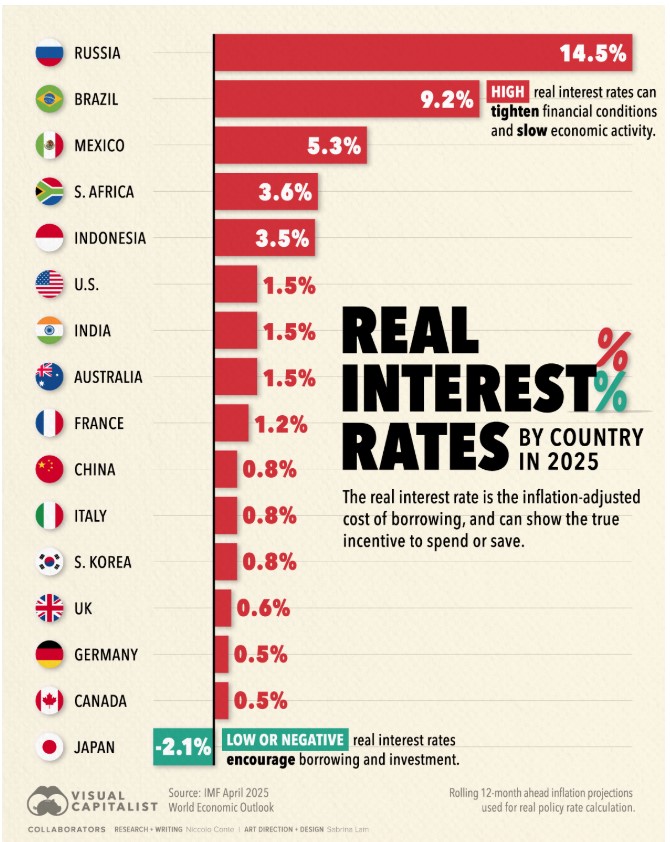

The Fed, most members, at least want to lower interest rates, but there is still some hesitation due to inflation concerns. Early indicators suggest inflation may have peaked and could move closer to the 2% target in the coming months.

The labor market has weakened, which is a growing concern. The Fed has acknowledged that the market has softened and is something they are watching closely.

Both these are strong indicators that the Fed rate and Mortgage rates will continue to drop in 2026.

Let’s get you pre-qualified. Our team is licensed in all 50 States. http://www.YourApplicationOnline.com

-

Thank you for Another Amazing year. Forecast for 2026 positive

Thank you for spending your time reading, engaging, and occasionally disagreeing with my posts this year. The conversations, feedback, and new subscribers made it an incredibly rewarding year.

As we peer into 2026, the outlook for home prices, market activity, and interest rates is pointing toward a banner year.

Having been in the business for over 21 years, I’ve seen my share of ups and downs. The last five years have marked one of the longer recoveries I’ve experienced but there is clearly light at the end of the tunnel.

Again, thank you for your time with me this year and onward to 2026.

http://www.YourApplicationOnline.com

-

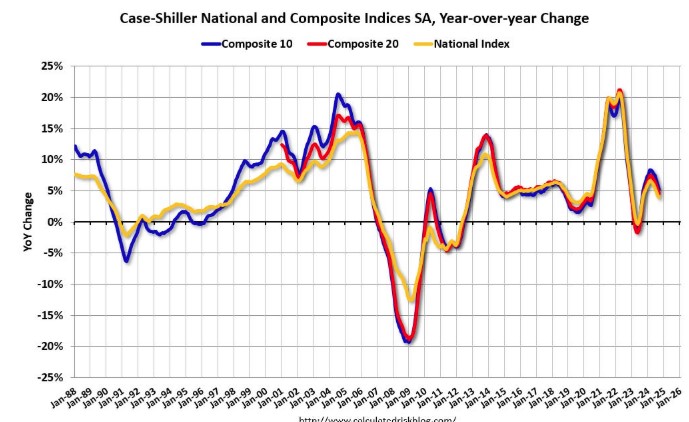

Rates Drop, Home Appreciation rises. Not a coincidence

As rates begin to fall, home values tend to rise. Over the last three months, we’ve seen home prices move higher, a clear shift after five consecutive months of declines.

So what does this mean for buyers, especially first-time buyers?

Waiting for the “perfect” moment, lower rates and lower prices can be costly. While you wait, the market keeps moving forward.

When rates drop, more buyers re-enter the market. More buyers mean more competition. More competition almost always means higher prices.

The result? Any benefit from a slightly lower rate is often offset by a higher purchase price and fewer options to choose from.

Timing the market is difficult. Positioning yourself correctly within it is far more important.

Start the new year with a fresh look, a mortgage financial checkup. Even if we uncover something unexpected on your credit report, there’s still time to address it, fix it, or remove it.

With spring just around the corner, now is the perfect time to get pre-qualified and be ready when the right home hits the market.http://www.YourApplicationOnline.com

-

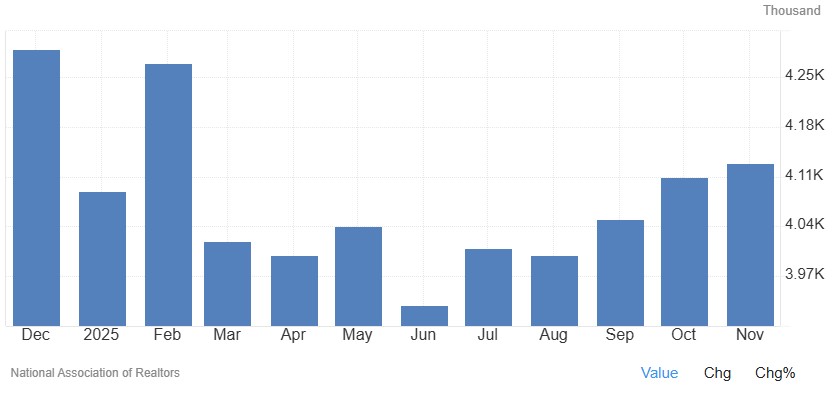

Home Sales Rising! Culprit, Rate drop and its going to continue.

We are seeing encouraging signs in the housing market. Home sales activity increased in November, reflecting renewed buyer confidence as mortgage rates have trended lower.This improvement supports the view that we may be entering a prolonged and more pervasive rate-decline environment, which we are hopeful will continue into 2026, benefiting both purchase and refinance activity.

Having spent over 20 years as a loan officer, I’ve only experienced a few true paradigm shifts in markets, rates, and expectations. This feels like one of them. While anecdotal, it’s worth noting.

let’s get you pre-qualified and ready to go in 2026.

http://www.YourApplicationOnline.com

-

Q3 GDP Much Stronger than expected, but… Shutdown muted actual numbers

Q3 GDP came in higher than expected at a 4.3% annualized pace, which simply extrapolates one quarter’s growth into a full-year number.

The challenge is that the normal sequence of Advanced, Second (Revised), and Final readings was skipped, leaving us with only a preliminary snapshot, not a fully vetted data set.

Digging deeper into the details:

- Consumer spending, the largest component of GDP, was boosted by a rush to purchase electric vehicles ahead of the EV tax credit expiration.

- Government spending, particularly defense, also saw a meaningful increase.

This matters because what we need and what markets need is clean, durable data, not numbers distorted by one-time events or shaped to fit a narrative or agenda.

The takeaway: headlines don’t tell the full story. We all need to challenge ourselves to look under the hood, understand the drivers, and separate sustainable growth from temporary distortions.

I’ve said this many times: don’t watch the tail, watch the dog to find out the direction.

Headlines are the tail. The underlying drivers, the quality, source, and sustainability of the data are the dog.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.