-

ADP pulls off the Band-Aid. Don’t look if you’re squeamish.

The highly anticipated and somewhat feared ADP report tells it like it is. November numbers show 32,000 job losses, a sharp contrast to estimates calling for 10,000 to 40,000 job gains.

Looking deeper, small businesses lost 120,000 jobs, while medium and large companies posted some modest gains. Keep in mind: small businesses employ nearly 50% of the entire labor force. Let that sink in half of all workers are tied to small business.

If there’s a canary in the coal mine, this is it.

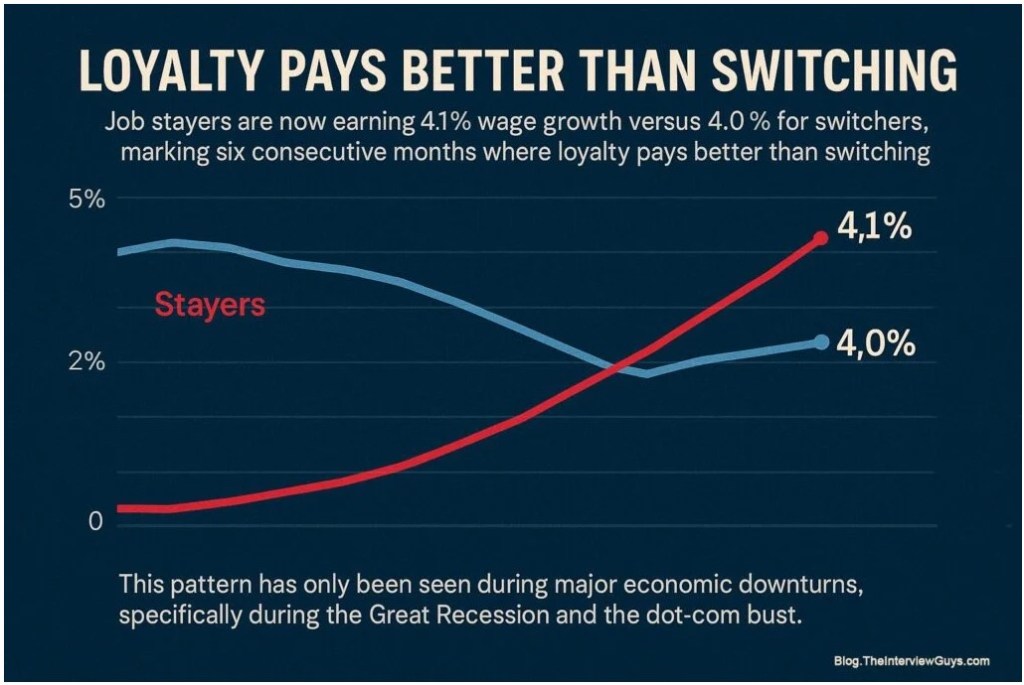

Another key detail: job stayers saw only modest pay increases, and job switchers saw even smaller gains.

The gap between the two has tightened to just 1.9%. In other words, fewer employees are switching jobs and when they do, the financial incentive is far less compelling than it used to be .

What does this all mean?

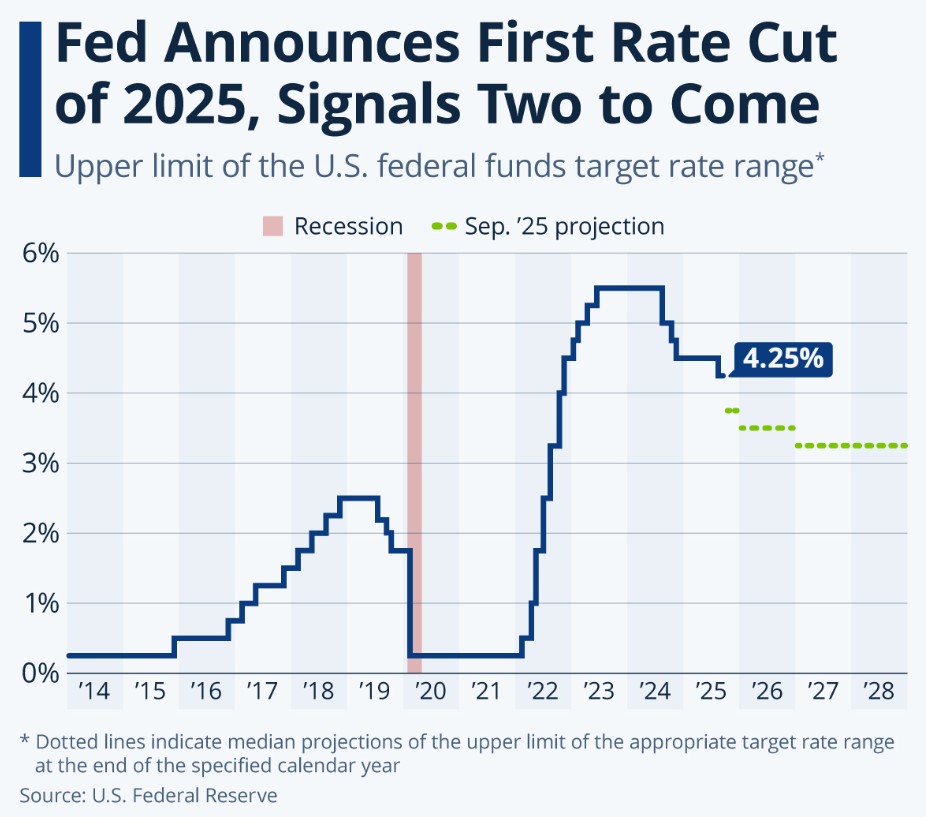

The odds of the Fed cutting rates on the 10th just increased. The bond market has already responded positively, and we expect this momentum to continue through the end of the year.Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Vacancies up, Renters rejoice, Big impact on Inflation huge.

Vacancy rates are increasing, and rental days-on-market are rising right along with them. For many landlords, the only lever left is lowering rents and that’s exactly what we’re now starting to see across the market.

Shelter makes up 35.5% of the Consumer Price Index (CPI). In trade terms, that’s a lot. When rents cool, inflation cools. Add in the recent drop in oil prices, and we should see some positive movement in the inflation data this month.

All of this gives the Fed even more reason to consider lowering their rate.

Tomorrow’s ADP Employment Report will be a key one to watch. Unlike survey-based reports, ADP is pulling directly from its actual payroll database no averaging, no guessing which makes it a much more accurate read on what’s really happening in the labor market.

lets get qualified http://www.YourApplicationOnline.com

-

What happens in Japan affects the World. Except their Fed rate is only 0.50. Black Friday surprise.

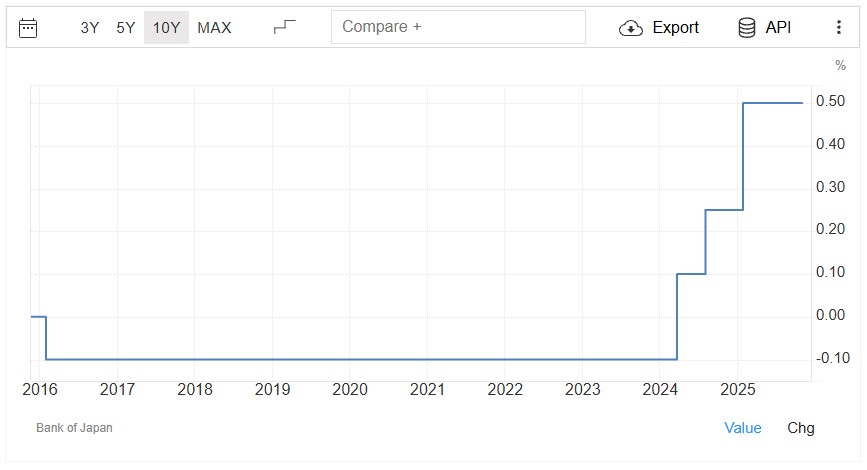

The bond market reacted sharply to comments from Japan’s BOJ Governor Ueda, hinting that a rate hike may be on the table later this month. But when you look at the chart below, it’s wild to see that Japan’s benchmark rate has been sitting at –0.10% since 2016, only nudging up into positive territory this year now sitting at just 0.50%. Even the suggestion of a move spooked global bond markets.

Meanwhile, the rumor mill is spinning at home: a new Fed Chair has reportedly been identified, but the name is still under wraps. Jerome Powell’s term officially runs through May 16, 2026, but expectations are growing that he may step down earlier.

On the consumer side, Black Friday smashed records $12B in spending, up 9% from last year. How much of that is inflation versus consumers simply shifting more purchases online is still unclear, but shoppers definitely showed up.

Let’s get you pre-qualified and ready for the new year. http://www.YourApplicationOnline.com

-

Inflation and Jobs data due after Feds meet Dec 10th.

What’s a Fed to Do?

The data pipeline is… not pipelining.

- BLS Jobs Report for October and November won’t hit until Dec 16 and it’s showing up without October’s unemployment rate, like it forgot part of its outfit.

- CPI (Inflation) for October? Canceled. Poof. Gone. We’ll go straight to the November CPI on Dec 18, as if October never happened.

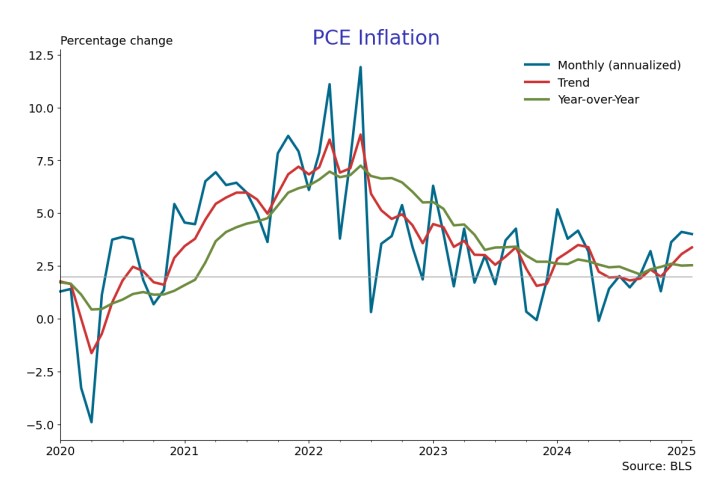

- PCE (the Fed’s favorite inflation gauge) for September and October is still MIA. No release date. No update. No “we’ll call you back.” Just radio silence.

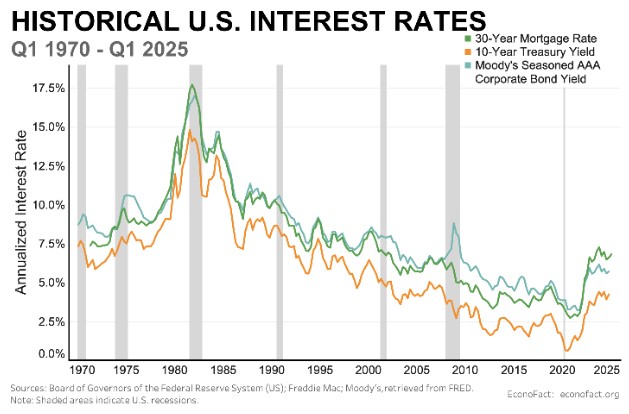

At this point, Powell’s probably refreshing his inbox like the rest of us. The likelihood of a Fed rate cut is fading fast, but the silver lining? Mortgage rates have actually rebounded, reminding everyone there’s often a hilarious (and frustrating) disconnect between the Fed rate and the mortgage rate.

It’s a short week, and our team is wishing you all a fantastic rest of the week — and a very Happy Thanksgiving! http://www.YourApplicationOnline.com

-

Mortgage Rates improving despite the Feds Hesitancy

Mortgage rates are dropping again and gaining back the ground they lost over the past couple of tough weeks. Even though the Fed has already hinted there will be no rate cut at their December 10th meeting, the Bond market clearly didn’t get the memo and reacted to other factors in our favor.

As we all gear up for one of the busiest travel weeks of the entire year, it’s a good reminder to take a deep breath, relax, and try not to honk at anyone who’s clearly forgotten how a turn signal works.

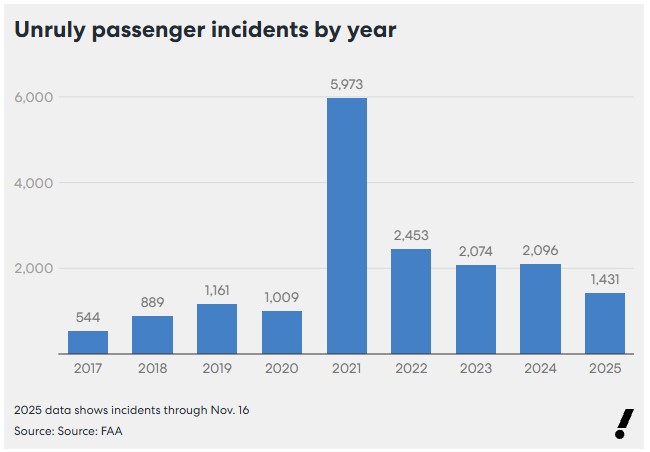

And in the middle of all the holiday chaos, I came across this graph this morning and thought it was worth sharing.

Have a fantastic weekend and next week. Our team will be available and happy to help.

http://www.YourApplicationOnline.com

-

Mixed Bag Jobs Report, and Now the Fed Says “No Rate Cut for You” in December

“A funny thing happened on the way to the forum… the Fed forgot to cut rates.

We all showed up expecting a grand performance, maybe a little drama, maybe a surprise plot twist but nope. Just Jerome Powell stepping out, clearing his throat, and saying, ‘Not today, folks.’

The audience groaned, the bond market spilled its popcorn, and mortgage rates quietly exited stage left.”This is a synopsis of the October 29th Fed minutes just released.

The Jobs Report came in as a mixed bag… more like the bargain bin, really. We added 119,000 jobs, but the unemployment rate still managed to climb from 4.3% to 4.4%. And because the universe loves consistency July and August were revised downward. Funny how revisions never seem to say, “Surprise! More jobs than we thought!”

So how did the Bond market react?

Surprisingly well. Rates actually improved.

Just because the Fed decided to take their ball and go home doesn’t mean mortgage rates have to follow them off the field.And here’s the real story: activity is picking up.

Not just calls, not just interest actual applications and, yes, real purchase contracts. The kind that have signatures, deadlines, and buyers who are actually doing something besides browsing Zillow at midnight.It’s been years since we’ve seen this kind of movement… and it’s a very welcome change.

Let’s get you qualified http://www.YourApplicationOnline.com

-

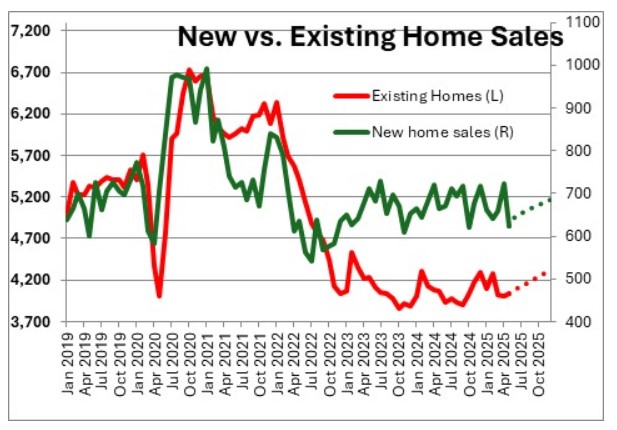

Home Sales Flat at 4M, NAR Projects 4.6M. Not Great, Not Terrible, But Definitely Improving

There are a number of reasons we project home sales to pick up.

Sure, lower interest rates help, but there’s something else happening too. Those ultra-low mortgages from years past are starting to lose their shine. You might love your rate, but let’s be honest… you might also hate your house.

Eventually something has to give. Maybe the family got bigger. Maybe the kids moved out and now you’re talking to empty bedrooms. Maybe the job changed.

Or maybe you’ve just decided you’re tired of sharing the kitchen with a dishwasher that sounds like a freight train. One way or another, life tends to nudge people forward.

2026 should be a banner year for the housing market and interest rates. Let’s get you pre-approved today for the tomorrow.

http://www.YourApplicationOnline.com Soft Credit pull.

-

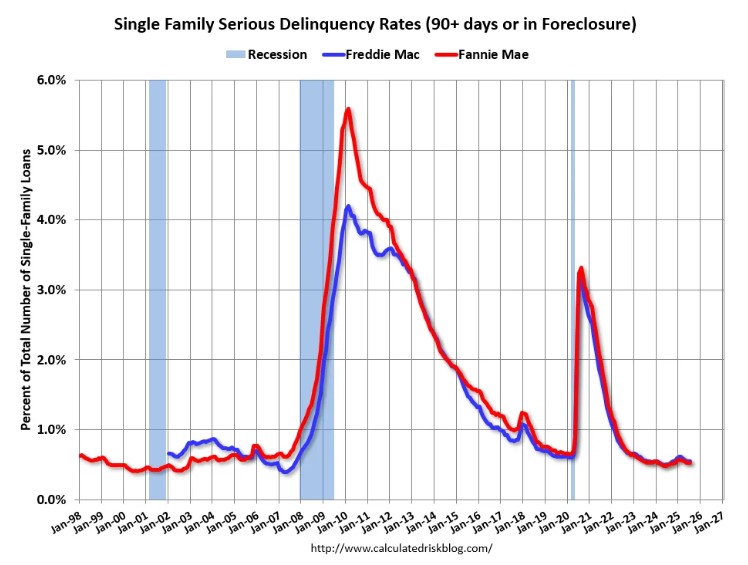

Foreclosures Up 20% in October But Don’t Panic: It’s Fuzzy Math

Diana Olick, a real estate analyst for CNBC, once again managed to scare the holy crap out of everyone until you actually look at what she was referring to.

Foreclosure rates are sitting at historic lows, so even a tiny uptick can look dramatic when expressed as a percentage. That’s why the headlines sound alarming, but the reality is anything but.

When you look at the graph below, you can clearly see the increase is minimal not a sign of any real distress in the housing market.

It’s a toss-up whether the Fed will cut rates in December. Powell’s comments after the October 29th cut poured cold water on expectations, dropping the odds from 95% to 49%.

Meanwhile, most of the voting and non-voting Fed members still have blinders on, staying laser-focused on inflation while largely overlooking the weakening job market.

Rates are already low, and forecasts show 2026 shaping up to be a banner year for both purchases and refinances, with rates expected to drop even more significantly than in 2025.

Get out there and take charge. http://www.YourApplicaitonOnline.com

-

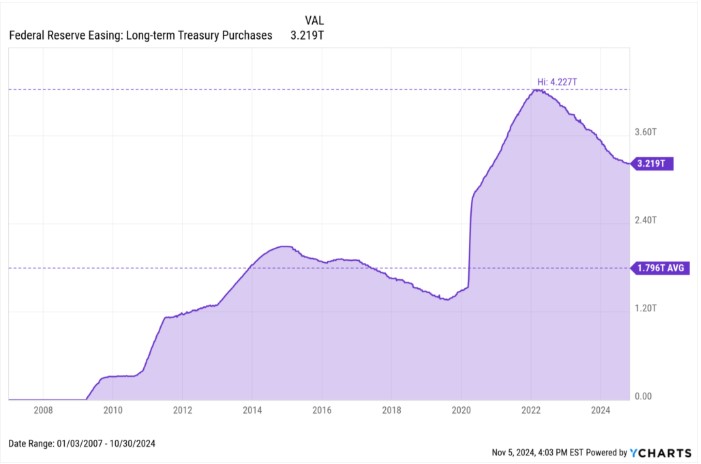

When Big Banks Start Buying Long-Term Treasuries, We Pay Attention, you should too

Despite comments from Fed members Susan Collins and Beth Hammack essentially saying, “Unemployment? What unemployment? Nothing to see here…”

There’s real data pointing to weakness in the labor market. Now that the government has reopened, the September and eventually October jobs reports will start to roll in. We expect they’ll confirm what alternative data has already shown: the labor market is getting tougher.

A bigger but quieter tell is that major banks and lenders are pouring money into long-term Treasuries and bonds, which has a direct, positive impact on rates.

They’re effectively hedging for lower long-term mortgage rates, knowing that as rates fall, their Treasury and bond holdings become more valuable over time.

When someone asks where I think interest rates are headed, it’s never a simple answer there are hundreds of data points to consider.

Bottom line: rates are going to drop.

When and by how much? No one can say for sure but the writing is definitely on the wall.http://www.YourApplicationOnline.com

-

So What does a 50y Mortgage actually look like. It’s striking and not in a good way

Let’s take a look:

- Loan amount: $400,000

- Down payment: 10%

Monthly principal & interest:

- 30-year mortgage → about $2,300

- 50-year mortgage → about $2,000

So yes, there’s a small monthly savings but wait for it…

- Total payments (30-year loan): $438,156

- Total payments (50-year loan): $816,396

That’s a big difference over time a reminder that a lower monthly payment doesn’t always mean a better deal.

Job Data Fuels Talk of December Rate Cut

ADP job numbers continue to point to labor market weakness, providing more ammunition for the Fed to cut rates in December.

In other news:

The House votes tonight on a measure to reopen the government.

The 10-Year Treasury Note Auction takes place today at 1 PM ET.

Let’s get you pre-qualified today http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.