-

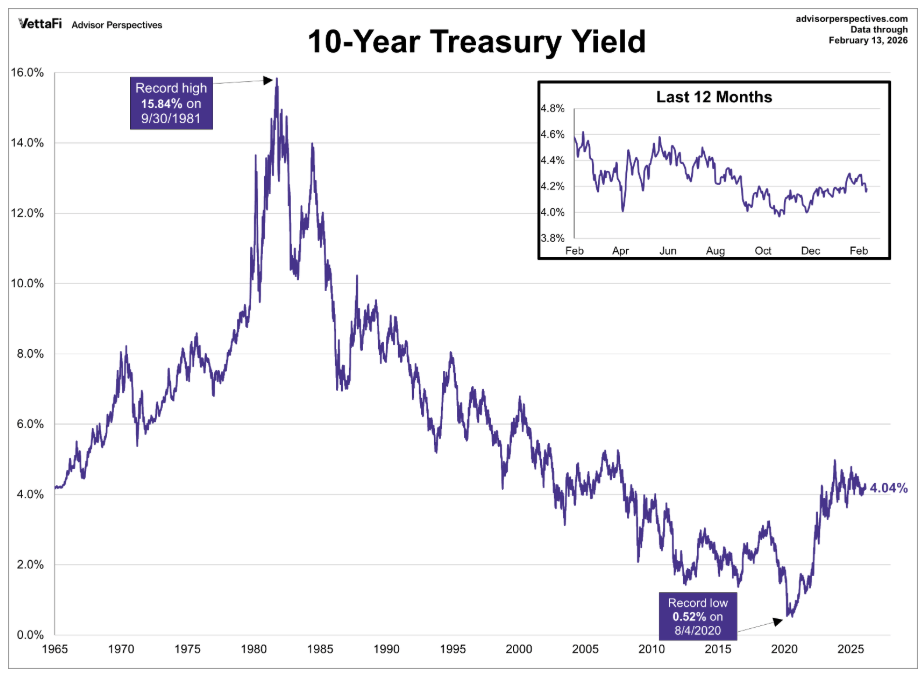

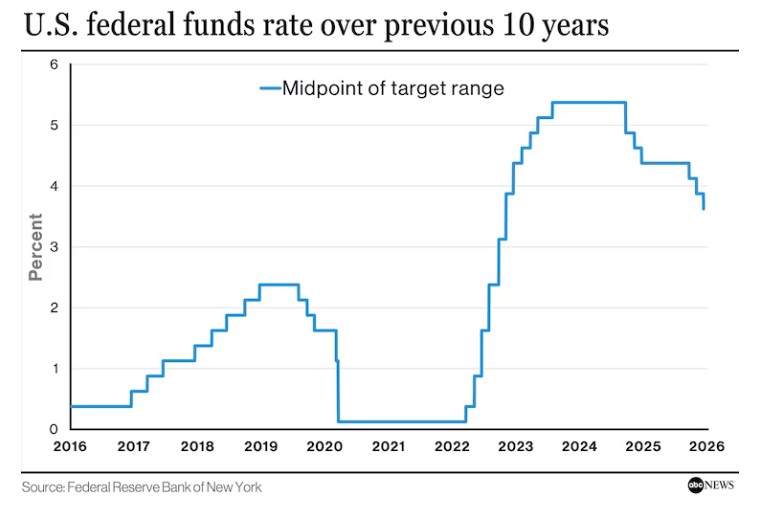

4% Bond Yield in Sight. Can it break through and What is a Floor, What is a celling?

If the 10y Bond drops below the 4% floor, look-out, rates are headed lower . We are almost there.

Think of the bond market like a house with very opinionated architecture.

The floor is that stubborn support level where yields drop(lower rates), knock politely, and the market says, “Nope. That’s cheap enough.” Buyers rush in Rates drop. The floor did its job.

The ceiling is the opposite. Yields climb higher (rates go up), peek their head up, and investors say, “Absolutely not. That’s too much.” Money pours into bonds, prices rise, yields fall, and rates back off. Ceiling holds.

Sometimes bonds pace between the floor and ceiling like a kid stuck inside on a rainy day, restless but contained. Other times they break through like the Kool-Aid Man yelling, “Oh yeah!” and suddenly we’re repricing before lunch.

We are dancing on the floor and it’s going to break through driving rates down.

http://www.YourApplicationOnline.com

-

Hum Not sure about that BLS Jobs report. Market thinks something fishy is going on and pulled back.

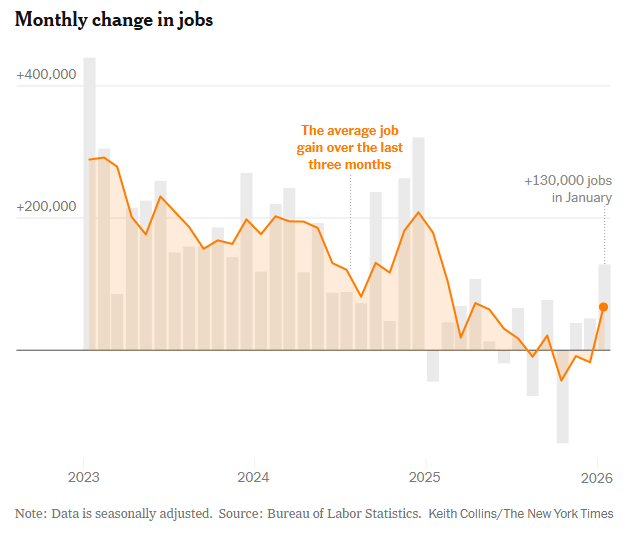

The Bureau of Labor Statistics (BLS) reported 130,000 jobs created in January.

But let’s pause for a moment.

The prior two months were both revised lower in November down to 41,000 and December down to 48,000. A combined 17,000 jobs quietly erased from the prior trend.

January is also a month that deserves context. Historically, it reflects post-holiday seasonal adjustments, retail layoffs, and annual benchmark revisions. The headline number rarely tells the full story without understanding how the seasonal factors are applied.

What stands out is the divergence between reports. ADP showed just 22,000 private-sector jobs added, while Revelio data reflected a decline of 13,300 jobs. That’s a meaningful gap compared to the BLS headline figure.

When alternative datasets are signaling softer private-sector momentum, and prior months are being revised lower, it suggests the labor market may be cooling more than the surface number implies.

The bigger question isn’t whether 130,000 is “good” or “bad.” It’s whether the underlying trend is slowing, and whether policymakers are looking at forward indicators or relying on backward revisions.

As always, the headline grabs attention. The revisions and cross-currents tell the real story.

Rates initially took a hit this morning but cooler heads prevailed and we are almost back to our improved pricing yesterday.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

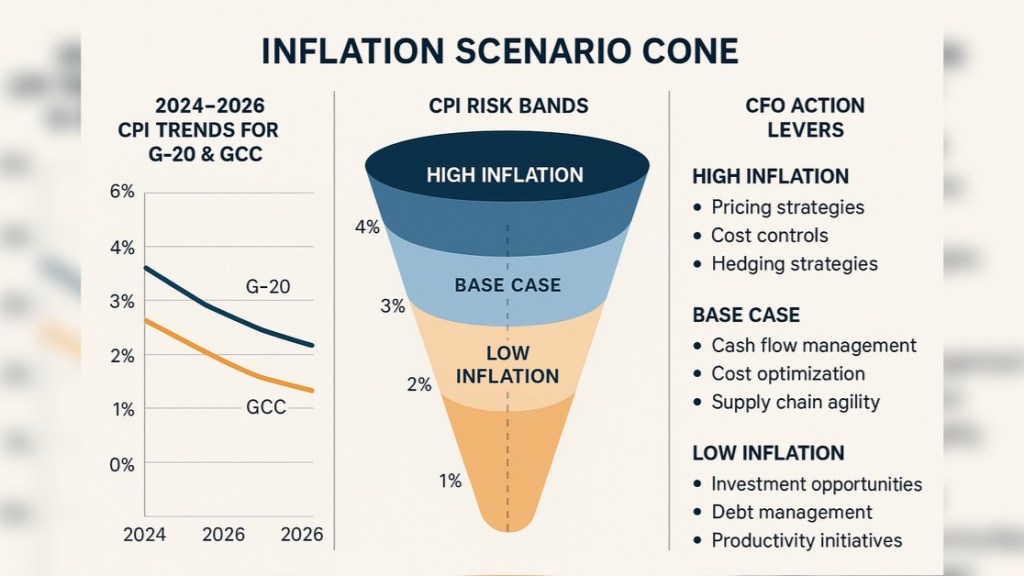

Critical week. Inflation forecast higher, Employment rate higher. Is A.I to blame?

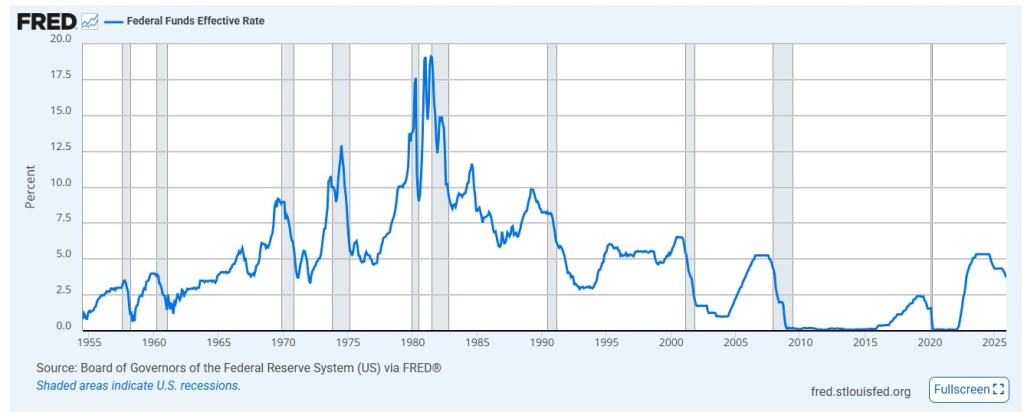

The Federal Reserve’s mandate is to maintain price stability, with a long-term inflation target of 2%, while also supporting maximum employment. To do this, the Fed adjusts monetary policy to either slow an overheating economy or stimulate one that’s losing momentum.

Today, the economy remains relatively robust by historical standards, but unemployment is beginning to move in the wrong direction. That puts the Fed in a difficult position: growth is holding up, yet cracks are forming beneath the surface of the labor market.

This is increasingly uncharted territory, and artificial intelligence may be playing a meaningful role. The productivity gains from AI are real, but they come with side effects. Efficiency improvements are already reducing the need for certain middle-management roles, administrative positions, ad agency functions, and segments of the labor force.

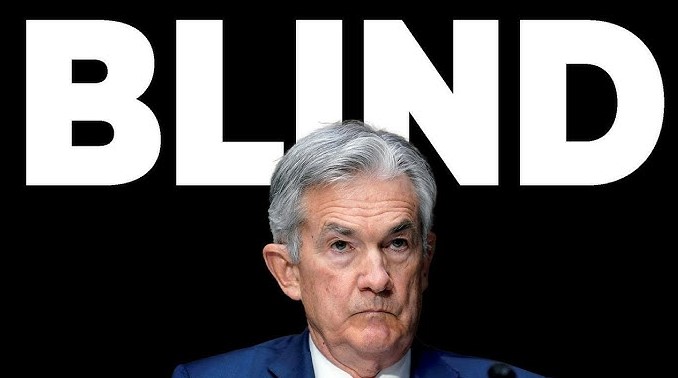

In the near term, that means higher productivity without higher wages—an environment that can cool inflation without traditional economic overheating. The challenge for policymakers is that these shifts don’t show up cleanly in backward-looking data. Job losses driven by efficiency look different than those caused by recessions.

In short, the Fed is navigating an economy that appears strong on the surface, while structural changes especially AI-driven efficiency, are quietly reshaping employment and inflation dynamics. This makes policy decisions more complex and increases the risk of reacting too late to trends that are already in motion.

Let’s get you Pre-Qualified http://www.YourApplicationOnline.com

-

Housing Wealth increase 78 of the last 83 years. Bitcoin effect Classic risk-off behavior

According to a recent National Association of Realtors article, the net worth of homeowners has increased by roughly $150,000 over the past five years, largely driven by price appreciation and principal paydown. That’s a meaningful wealth effect that continues to support housing demand.

On the supply side, Realtor.com reports listings were down 7% in January, yet still up 10% year over year. In other words, inventory is improving, but it remains tight enough to keep pricing supported hardly the setup for a housing collapse.

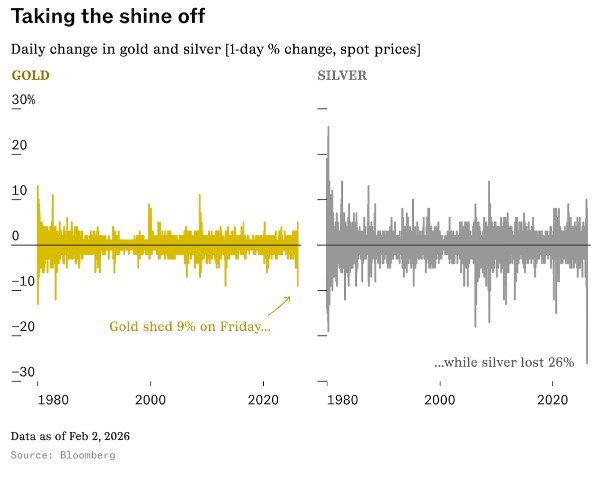

And then there’s crypto. Bitcoin fell nearly 50% from its October all-time high above $120,000, and a big driver has been a shift in liquidity toward precious metals. As tech particularly software has struggled, risk appetite has faded. Investors, especially retail money, did what it always does in moments of uncertainty: panic first, rotate later, moving capital into gold and silver as perceived safe havens.

Classic risk-off behavior. Different asset, same psychology.

Time to get pre-qualified soft credit pull http://www.YourApplicationOnline.com

-

JOLTS Job Report was a Jolt. seriously. Rates improve New Fed Chair wants to cut now.

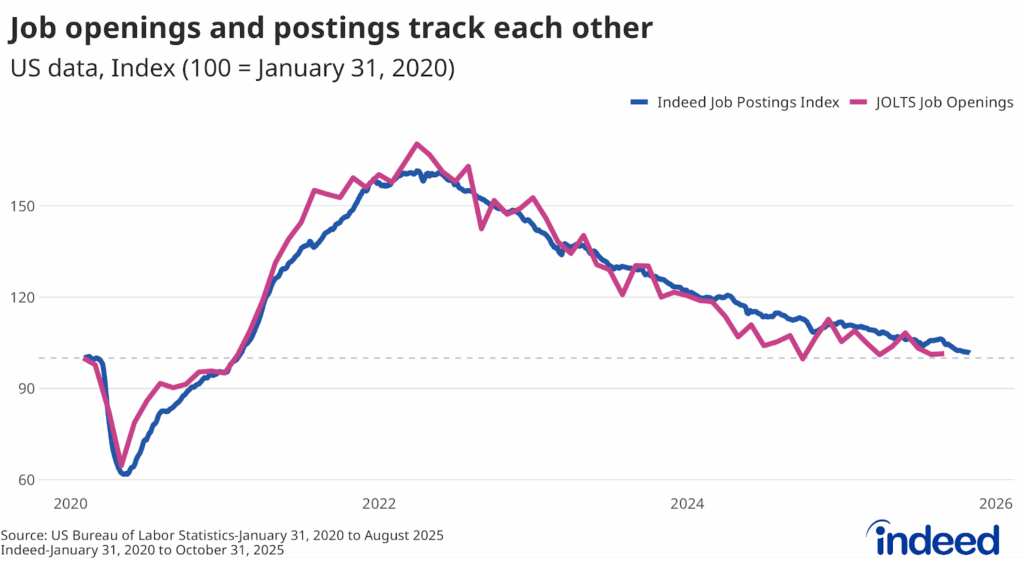

The JOLTS job report for December came in with 6.5 million job openings, well below the 7.2 million expected and officially the lowest level since 2020. Oof.

November didn’t escape either, getting revised down from 7.15M to 6.93M. So yes, the labor market is quietly taking its foot off the gas while pretending everything is fine.

Now layer in the AI boom. Counterintuitive take: AI won’t stoke inflation—it does the opposite.

Why? Productivity goes up, but jobs go down. Fewer jobs = less consumer spending. Less spending = retailers sharpening their pencils and cutting prices just to move inventory. Congrats, that’s disinflation with a Silicon Valley accent.And this is exactly why Kevin Warsh (or at least the future-looking Fed crowd) keeps nudging toward rate cuts. He’s not staring at last quarter’s data like it’s a backup camera, he’s looking through the front windshield at where the economy is actually headed.

Rear-view Fed vs. windshield Fed.

One taps the brakes late. The other sees the curve coming.Let’s get you pre-approved and ready to buy or refinance. http://www.YourApplicationOnline.com

-

Jobs Report: Not Great, Not Terrible (But Rate-Friendly)

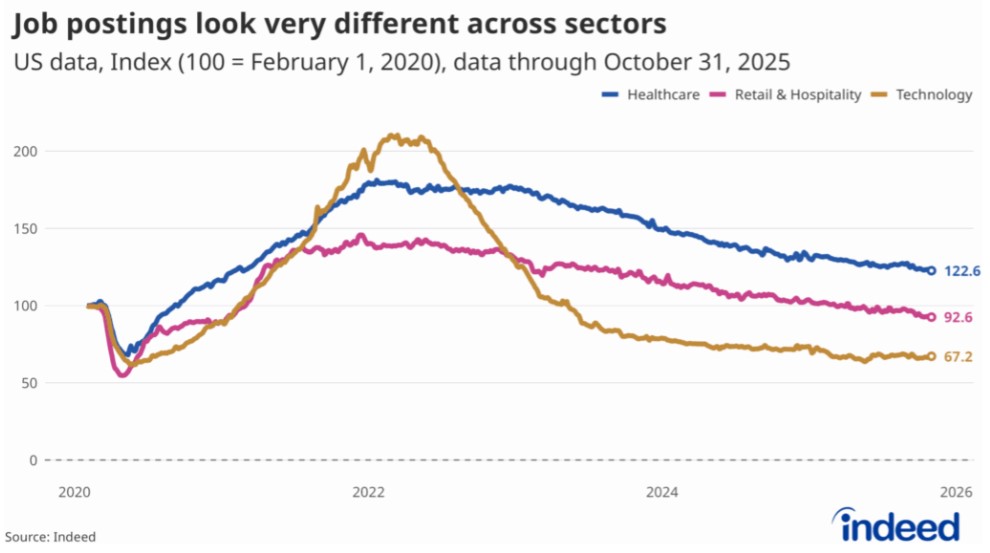

ADP released weaker-than-expected jobs data today, and for once, “bad news” was good news for bonds. Bonds caught a bid, which helped nudge mortgage rates slightly lower. No victory parade, but we’ll take the win.

Digging into the details (because the headline never tells the full story):

- Small businesses: created exactly zero jobs. Not negative… just aggressively neutral.

- Large businesses: shed about 18,000 jobs, which lines up with the layoffs we’ve been hearing about from companies like Amazon, UPS, and others.

- Medium-sized businesses: the overachievers of the group, adding roughly 41,000 jobs and doing all the heavy lifting.

So while the job market isn’t falling off a cliff, it’s clearly losing momentum. And that’s important.

A cooling economy and a softer labor market are exactly the signals the Fed watches for when deciding whether it’s time to lower rates, especially if inflation continues trending down as expected.

Bottom line:

Strong jobs push rates up.

Weak jobs pull rates down.

Today leaned more toward “rate-friendly slowdown” than “red-hot economy.”And once again, what looks like bad news at first glance ends up being pretty decent news if you’re watching mortgage rates.

Let’s get you pre-approved http://www.YourApplicationOnline.com

-

Job numbers Gold and Silver some shine is coming off.

The stock market is up, bonds are down… and mortgage rates are doing that thing where they look at good news and say, “Cool story, still not helping.” So yes, Wall Street is partying, but rates didn’t get the invite and actually lost a little ground today.

With Kevin Warsh stepping in as the new Fed Chair, the perceived separation between the Oval Office and the Federal Reserve suddenly feels very real. Markets liked that. Stocks reacted in a friendly, high-five-each-other kind of way. Bonds? Not so much. And when bonds sulk, rates follow.

Now let’s talk jobs, because this is where the magic trick happens.

Continuing unemployment claims are down, which sounds great… until you realize they stop counting you after roughly 21 to 26 weeks, depending on the state. Translation: the number can go down not because people found jobs, but because the clock ran out. That’s not job growth, that’s the data saying, “You’re no longer our problem.”

So if the job market feels strong on paper but weird in real life, that’s because both things can be true at the same time.

Bottom line:

What you think you’re seeing isn’t always what’s actually happening. Markets love headlines. Rates care about details. And right now, the details are doing all the talking.let’s get you pre-qualified http://www.YourApplicaitonOnline.com

-

New Fed Chair Kevin Warsh. Was a Dove now a bit of a Hawk. what that actually means.

In Federal Reserve policy, a hawk prioritizes fighting inflation, typically supporting higher interest rates and tighter monetary policy to keep prices stable.

A dove, on the other hand, focuses on economic growth and maximum employment, often favoring lower interest rates and a more accommodative, expansionary policy.

In short: hawks worry about inflation; doves worry about jobs.

I spent a good part of the morning watching coverage on Kevin Warsh, and the takeaway feels a bit mixed, though it’s clear he’s been openly critical of the current Fed and its approach to monetary policy.

Our view is that Warsh would be more forward-looking, with a greater willingness to look through the lagging inflation data and question potential overstatements in jobs numbers. That kind of perspective matters, especially when policy decisions are being made using data that often reflects where the economy was, not where it’s headed.

let’s get you pre-qualified http://www.YourApplicationOnline.com

-

Markets react to Potential Shut-Down. a bit of Deja Vu.

The stock and bond markets love stability. They like routine. Predictability. A nice, boring schedule.

Unfortunately, this year has been anything but boring.

Between budget drama and the very real possibility of a partial government shutdown, the markets are doing what they always do when uncertainty shows up—they get nervous. And nervous markets tend to overreact first and ask questions later.

When the markets start pacing the room and checking their phones every five minutes, we pay attention. Because jittery markets don’t just affect headlines they show up in rates, pricing, and timing.

For now, rates are flat, and the Fed’s decision not to cut rates did not negatively impact mortgage rates.

Whew.

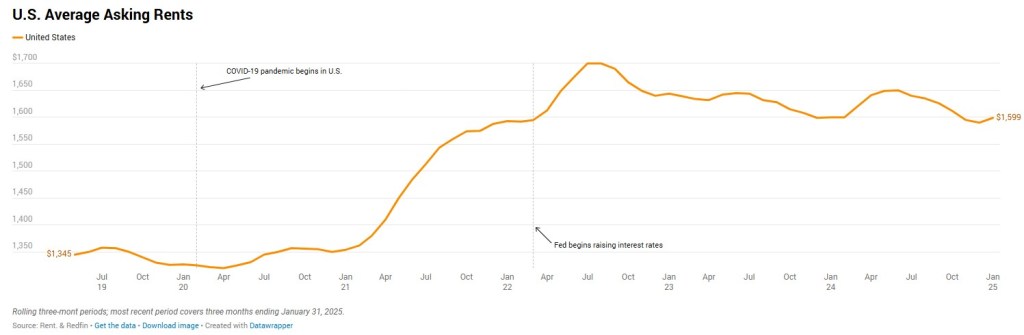

On the inflation front, there’s more good news: rents continue to decline on average, which is helping bring overall inflation numbers down. That trend matters, and it’s one of the quieter tailwinds working in favor of lower rates over time.

Time to get pre-qualified http://www.YourApplicationOnline.com

-

The Feds are Blind, Deliberately. Just need a bit more data…. UPS and Amazon cutting jobs.

There’s a better and more accurate inflation gauge from Truflation, which analyzes 10 million data points yes, 10 million, compared to roughly 80,000 used in CPI and PCE.

And the numbers don’t lie. PCE is at 1.39% and CPI at 1.16%.

The jobs data may appear stable, but that stability is misleading. Consumers certainly don’t feel it, and major employers like UPS and Amazon are signaling job cuts in the tens of thousands.

Jerome, take your hand away from your face and look at the real numbers. There is plenty of room to cut rates.

let’s get pre-qualified today http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.