-

Significant Job Losses, While Oil Prices Weigh on Bonds! Shiny Ball syndrome

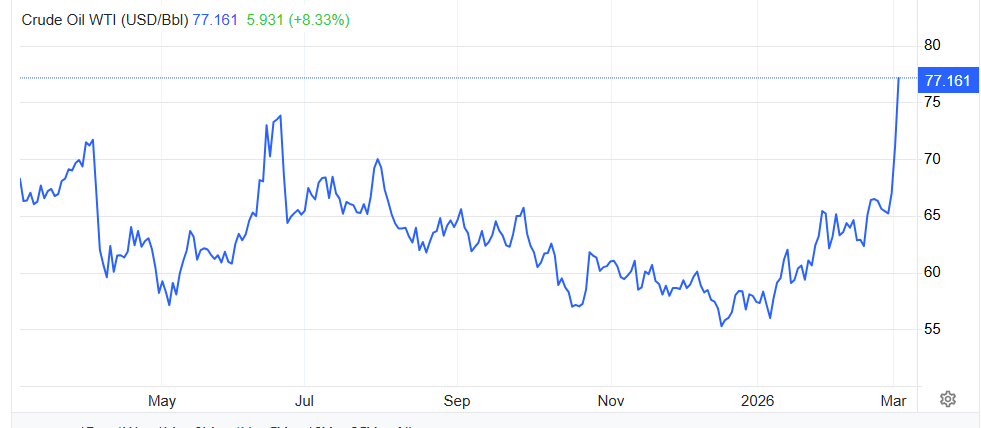

The market’s primary focus right now is the rise in oil prices, a bit of a “shiny ball syndrome”.

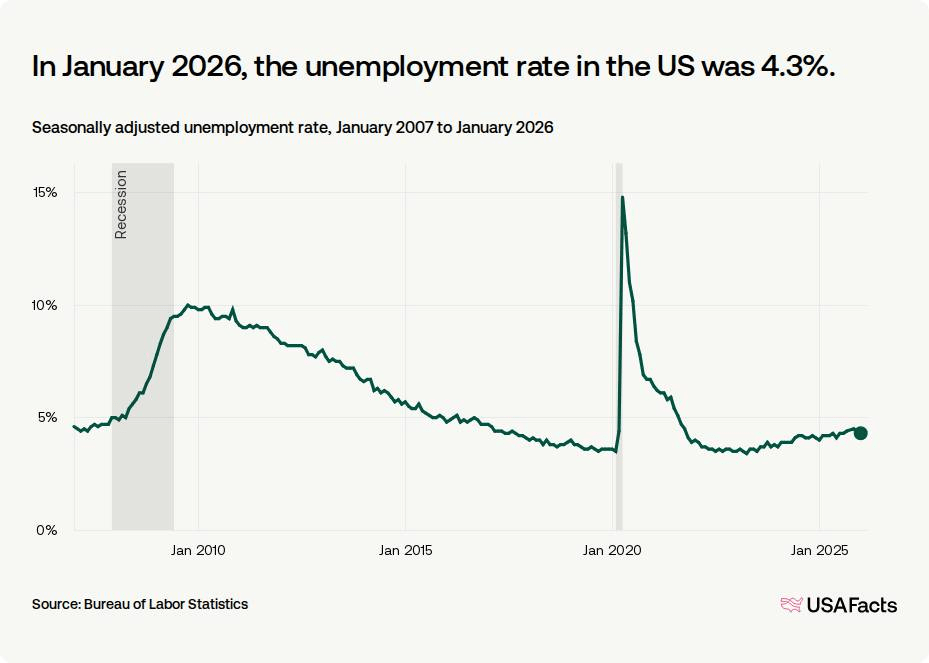

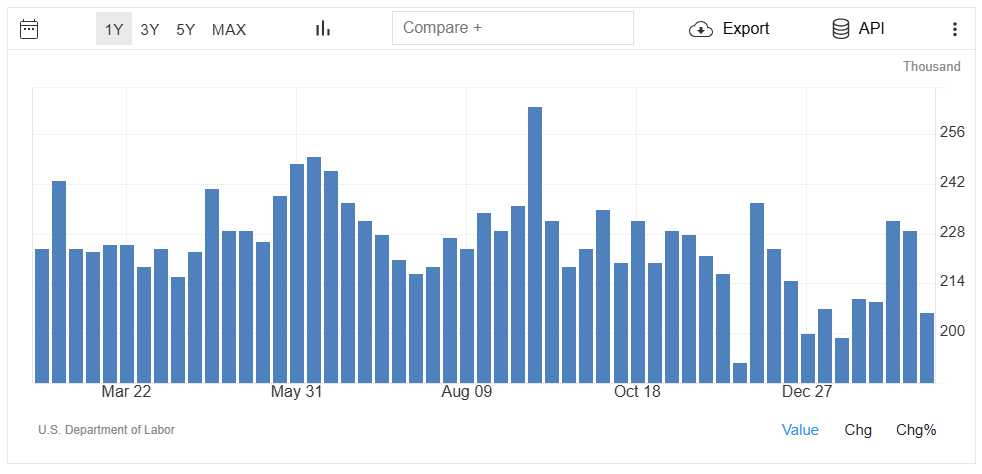

Meanwhile, the stock market is down again this morning, and the latest BLS jobs report showed a loss of 90,000 jobs, compared to expectations of 50,000 new jobs.

The war involving Iran is also pushing global tensions closer to a breaking point. This level of uncertainty creates a challenging environment for both professional and individual investors.

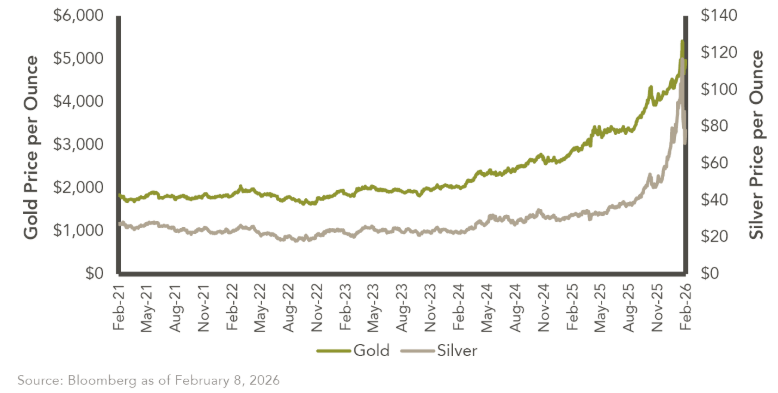

In times like these, many investors look for a “flight to safety,” often turning to precious metals such as gold, silver, and platinum as defensive assets. Historically, geopolitical instability tends to drive demand for these metals as investors seek to preserve value during volatile periods.

However, even safe-haven assets have limits. Markets can only absorb so much uncertainty before volatility spreads across all asset classes. Much like a pitcher that can only hold so much water, when the pressure builds too high, even traditionally stable investments can begin to show strain.

Mortgage rates are holding steady for now, though just barely. As market volatility begins to settle, rates should gradually follow and move lower. Position yourself for the potential rate improvements many expect as we move further into the spring.

http://www.YourApplicationOnline.com

-

Iran, Oil Prices, Bond market sell offs, Oh My…. Oh I forgot Inflation.

On a positive note, well, perhaps a realistic one, we continue to navigate a challenging financial and global market environment.

History consistently shows that these periods of volatility do pass.

As conditions stabilize, bond yields typically move lower, mortgage rates follow, and oil prices tend to settle back down.

Patience and perspective are important and needed.

Where do I see things going from here? Given that we’ve lost nearly 0.25% in interest rate improvement this week, my expectation is that it could take roughly another month for rates to work their way back to the levels we saw prior to the Iran conflict.

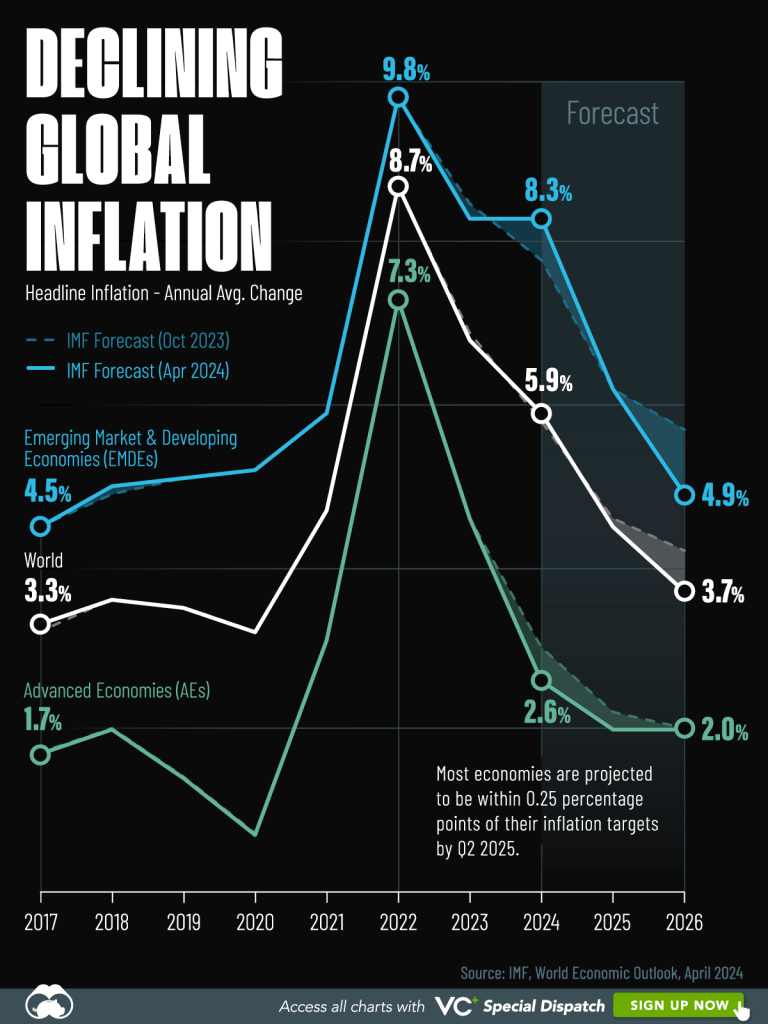

Higher oil prices tend to push inflation higher because energy is a core input in nearly everything, manufacturing goods, transporting products, and powering supply chains. When energy costs rise, it increases the cost of producing and moving goods throughout the economy.

As inflation expectations rise, bond investors demand higher yields, which in turn pushes mortgage rates higher in the short term. The good news is that historically these geopolitical shocks tend to be temporary, and as markets stabilize, oil prices and bond yields typically settle back down.

Our Team can get you ready for Spring and Summer http://www.YourApplicationOnline.com

-

Calm at least for the Oil and Bond market. Job Numbers better but not best.

As we discussed yesterday, markets often react in predictable patterns. The initial shock has begun to wear off, with both the oil and bond markets stabilizing. If this trend continues, it should support mortgage rates gradually moving back toward the lows we saw last Friday.

ADP Employment Report came in with 63,000 jobs created, a bit stronger than the 50,000 expected but still w weak number. Let’s break it down.

The lion share came from Education/Health Services. a whopping 58,000 jobs. These jobs are not economically sensitive meaning it’s a stable baseline of employment regardless of the economy.

Remember last week when the BLS reported 130,000 new jobs? ADP has now revised its January numbers down from 22,000 to 11,000.

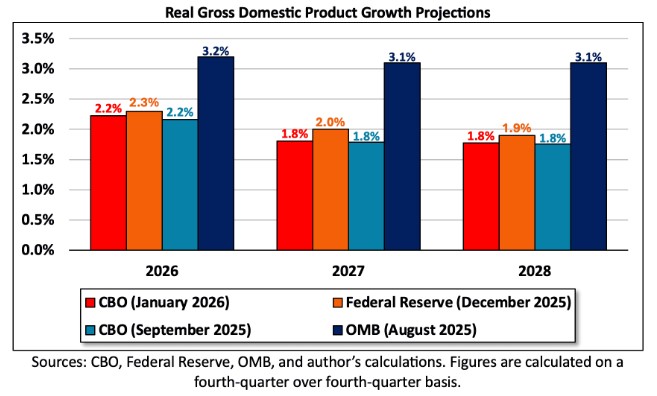

What does this tell us? It points to a softer labor market, with less aggressive hiring and reduced competition among companies for talent. Revisions like this are often early indicators of a slowing economy.

From a rate perspective, a cooling job market can ease inflationary pressure, which is generally supportive of lower interest rates.

Time to get pre-qualified http://www.YourApplicationOnline.com

-

Markets are reacting Emotionally but thinking Strategically. The argument for $120 a barrel.

Tensions between the United States and Iran have sharply escalated. What was geopolitical pressure is now open conflict, with the U.S. taking direct action and Iran responding in kind.

The situation has widened beyond these nations, pulling in and destabilizing the broader region.

Energy markets are reacting, global security feels more fragile, and the sense of uncertainty is real. Compared to last week, the stakes feel higher and the margin for error much smaller.

The argument for $120 a barrel is real. How is the supply replacement, including potential releases from strategic reserves and how quickly mobilized?

We’ll feel this at the gas pump sooner rather than later. Energy is a major component of inflation, and the Federal Reserve is watching closely.

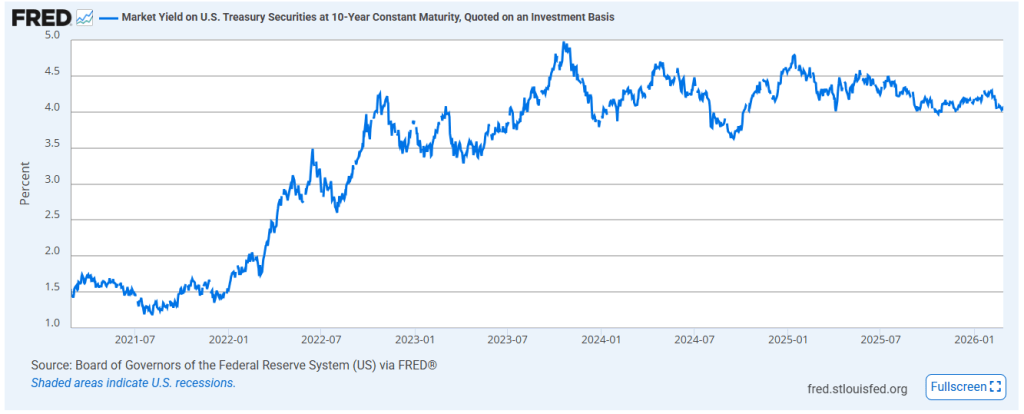

Bond yields have climbed, reversing most of the rate gains we’ve seen over the past two weeks. History suggests geopolitical spikes like this eventually cool off the bigger question isn’t if things settle down, but when.

http://www.YourApplicationOnline.com Mortgage Pre-Approval soft credit pull.

-

Where Oil Prices Go, So Do Interest Rates: Iran Tensions Add Fuel, No Flight to Safety

We may have expected a bond/securities flight to safety this morning, but history suggests otherwise.

If we look back:

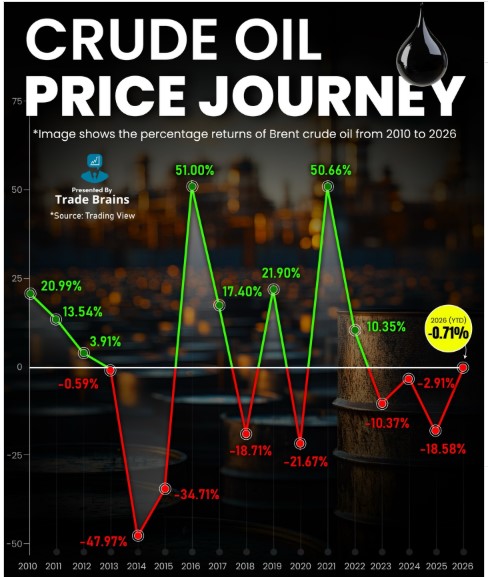

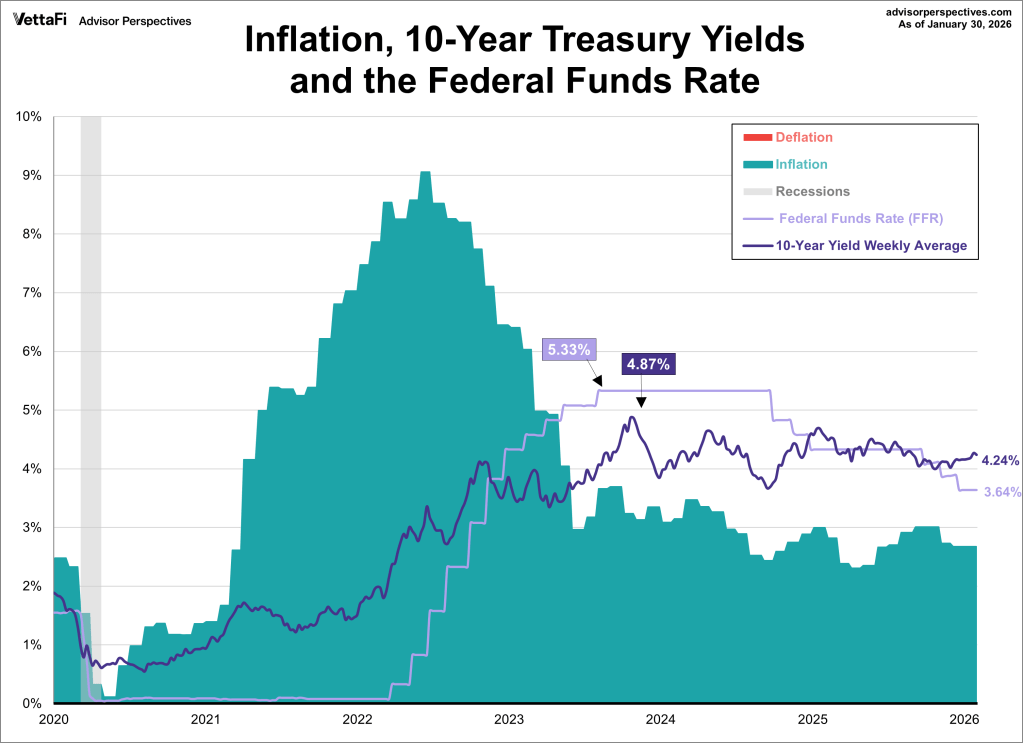

- Qasem Soleimani Assassination (2020): Oil jumped from $60 to $66 per barrel (+$6), while the 10-year Treasury increased 10 basis points.

- October 7 attacks (2023): Oil moved from $82 to $90 (+$8), and the 10-year rose 30 basis points.

- 12-Day War (June 16, 2025): Oil climbed from $74 to $83 (+$9), with the 10-year increasing 10 basis points.

The pattern: geopolitical shocks pushed oil higher, and instead of a sustained flight to safety into bonds, yields moved up alongside energy prices.

In all of these cases, oil prices and yields eventually settled back to prior or even lower levels once the initial shock faded.

We also have a busy week ahead for financial and labor market data. That reporting will likely have a far greater impact on rates than this morning’s oil-driven volatility.

Economic fundamentals especially inflation and jobs ultimately carry more weight than short-term geopolitical price spikes.

Let’s get you pre-qualified http://www.YourApplicationOnline.com

-

10y Bond Under 4%. Hold please.. Inflation numbers challenging

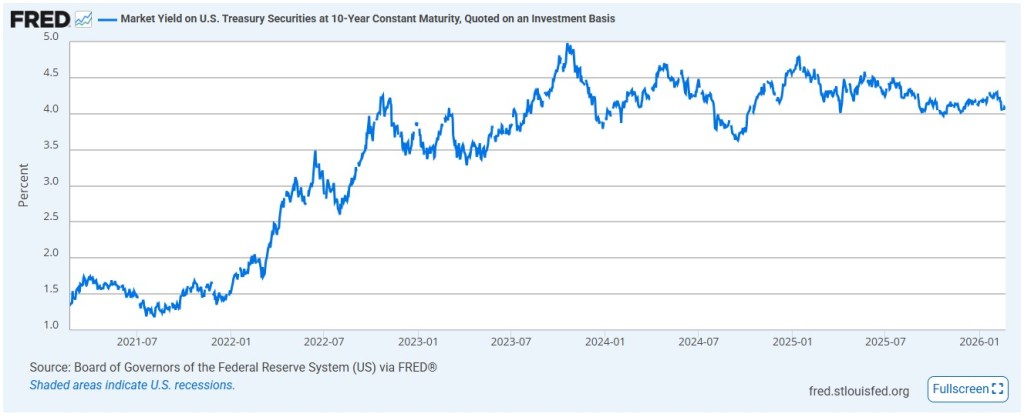

The stock market is down, and bond yields are following, which means mortgage rates continue to improve. We officially broke through the 4.00% yield floor, hitting 3.971% as of this morning.

That’s good news.

However, rates now need to hold these gains.

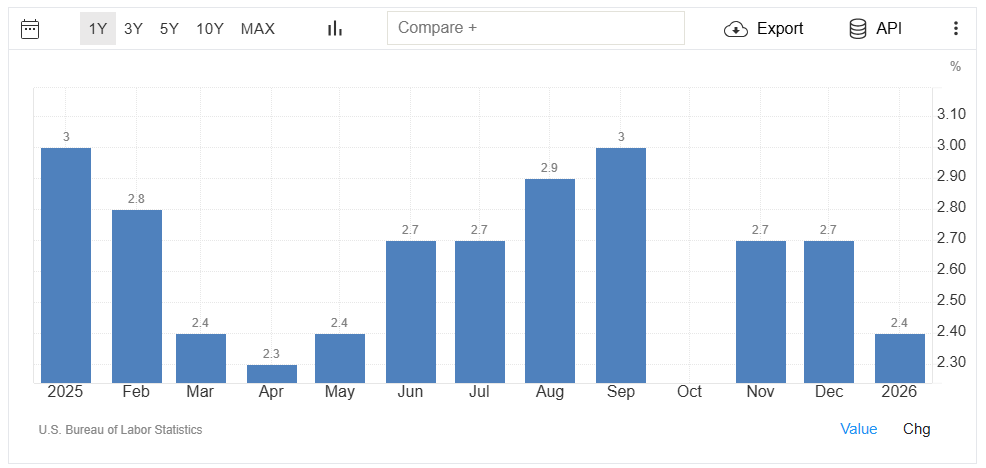

The biggest challenge? The latest Producer Price Index (PPI) report.

- Headline inflation rose 0.5% (we expected 0.3%).

- Year-over-year inflation declined to 2.9%, but expectations were 2.6%.

In short, inflation is cooling, just not as fast as projected.

What does that mean? Less motivation for the Fed to cut rates. They remain laser-focused on inflation.

Now this next part is important.

The Bureau of Labor Statistics (BLS) jobs report has a major influence on economic policy, but job growth has been overstated. The primary issue is something called the “Birth-Death Model.” This model estimates job creation from new businesses opening (births) and subtracts estimated losses from businesses closing (deaths).

Here’s where it gets interesting:

In April, May, and June of 2025, the Birth-Death model added 74,000 jobs to payroll estimates.

Today’s updated data shows the actual number was a negative -321,000 jobs.

That’s an overstatement of 395,000 jobs.

The sheer breadth of these downward revisions is staggering.

So what does this mean for interest rates?

Lower.

When economic data weakens and job growth is revised down significantly, investors move money into safer assets like bonds. That “flight to safety” pushes bond prices up and yields down, which ultimately helps mortgage rates improve.

We just need the bond market to keep believing the trend.

Time to get pre-qualified, soft credit pull. http://www.YourApplicationOnline.com

-

Lagging Data Overstates Inflation, Increasing Pressure on the Fed to Cut Rates 10-Year Yield at 4% Floor Nearing Breakthrough

Continuing the theme from earlier this week, the 10-year Treasury yield, which closely tracks mortgage rates, keeps pressing against a key support level. It’s tested that floor multiple times, and momentum suggests a potential break lower next week.

Geopolitical events, particularly involving Iran, could trigger a classic flight to safety into bonds, pushing yields down further. However, because Iran is part of OPEC, any escalation could also drive oil prices higher. That creates a competing pressure: rising energy costs can fuel inflation, especially since transportation and manufacturing remain heavily dependent on oil.

In short, bonds are leaning toward lower yields, but oil and inflation risks could complicate the move.

Time to get ready to refinance or purchase. Our team is nationwide and ready to go. http://www.YourApplicationOnline.com

-

SPF 100 Required: Lower Rates Ahead & Appreciation Heating up.

The market tried to stretch its legs today, small rebound, while bonds are down there tapping on the 4.00% yield floor like,

“Hello? Is this thing load-bearing or can we break through?”

If that floor cracks, rates could take an important step lower. And not a baby step. A real one.

Meanwhile, the appreciation reports came in and basically said,

“Yep… still going up.”Both S&P CoreLogic Case-Shiller Index and Federal Housing Finance Agency showed seasonally adjusted home prices rising 0.4%.

Translation:

Rates dipped → buyers woke up → demand showed up → prices said “thank you very much.”And now… let’s address the elephant.

Rates are the only thing that will eventually pry the 3% crowd out of their homes. You Know the Group. the 3-percenters.

They speak of their rate the way grandparents talk about buying gas for $0.89.

Some are frozen by fear.

Others wear it like a badge of honor.“Back in my day, we locked at 2.875%…”

But here’s the reality:

As rates ease, life events start outweighing nostalgia.Jobs change. Families grow. Downsizing happens. Opportunities knock.

And when that 4.00% yield floor finally gives way, the conversation shifts from: I’m never moving, to Okay…run the numbers.

Time to get pre-qualified http://www.YourApplicationOnline.com

-

The Phycological 4.0% Bond Yield Floor is going to break. Rates are starting to make their move.

The recent decision by the Supreme Court of the United States to halt tariffs could have meaningful long-term implications for inflation and rates.

Most financial analysts and economic data indicate that U.S. consumers have borne the majority of tariff costs through higher prices on imported goods. When tariffs are imposed, those added costs are often passed directly to businesses and ultimately to households.

If those tariffs are reduced or removed, it eases input costs across supply chains, from raw materials to finished goods. That creates downward pressure on prices, particularly in consumer goods categories that were heavily exposed to trade restrictions.

With inflation currently around 3%, the removal or softening of tariff-related price pressures gives inflation a clearer path toward the Federal Reserve’s target of 2%. While tariffs are not the sole driver of inflation, reducing structural cost burdens within the economy meaningfully improves the probability of achieving price stability without additional tightening.

In short: fewer tariffs = lower embedded costs = improved odds of returning to the “golden” 2% inflation target and Rates dropping.

Let’s get you pre-approved today. http://www.YourApplicationOnline.com

-

I say Potato you say Patato. Fed Meeting Notes show sharp division.

Yesterday afternoon we got the January 28th Fed meeting minutes, and the split could not be more obvious.

Some Fed members are basically saying, “Everything looks fine. Let’s pause. Maybe even hike again if inflation doesn’t cooperate.”

Fine? Based on what data? It feels disconnected from what’s actually happening on the ground.

Other Fed members see what the numbers are clearly showing:

- The labor market is weakening, especially once you factor in downward revisions.

- Deregulation is picking up momentum.

- Tariff pressures are easing.

- Housing is actively disinflating.

That’s two very different readings of the same economy.

One side sees lingering inflation risk.

The other sees slowing growth and cooling price pressures.This isn’t a minor difference in tone, it’s a fundamental disagreement about where the economy really stands.

And markets are paying attention.

My opinion? reality is going to hit and hit hard in the coming months. Rates will drop and we hope significantly by summer. The emperor is not wearing cloths.

Lets get you pre-qualified today http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.