-

It’s hard to make Predictions especially about the Future – Yogi Berra

Last week the market was feeling good and had already priced in the Fed’s 0.25% cut until Powell, in all his wisdom, reminded us that everything is still “data dependent.” Translation: don’t get too comfortable. Classic Debbie Downer move.

As a result, we gave back some ground over the past couple of days, though we’re still holding on to part of last month’s gains.

On the bright side, we’re now seeing the biggest spike in mortgage applications since 2022, with a big chunk of that being refinances.

My thoughts: no matter what data you read, it’s always a look in the rearview mirror. It’s the classic case of analysis paralysis. A slew of Fed members spoke yesterday and this morning, with the general consensus pointing toward continued rate cuts.

Powell, however, continues to play the cautious parent, reminding us that “you can’t have your pudding if you don’t eat your meat.”

Refinances and purchases are on the move.

http://www.YourApplicationOnline.com

-

“You’re not the Boss of me” I whispered to my Dog as I put his Blanket on the “Right Way”

So, who’s actually steering the Fed ship? Some days it feels like the Doves have the wheel, other days the Hawks swoop in, and Powell’s just trying not to hit the iceberg. No wonder the markets get seasick.

We have a full slate of Fed speakers this week, setting the stage for a volatile bond market. It’s Doves vs. Hawks and the Fed hasn’t been this divided in years.

Doves continue to push for rate cuts, while Hawks argue the tightening cycle should end here. Today, five Fed members speak three of them voting members, most leaning dovish.

Later this week brings five more, including Powell tomorrow. He remains the wild card: often so hesitant to commit that the lack of a clear decision creates its own uncertainty in the market.

We are carefully Floating our clients refinances and purchase locks today. The Rate is in the details.

Apply now http://www.YourApplicationOnline.com

-

Bond Markets are Forward looking. That’s why Rates went Up Yesterday. What?

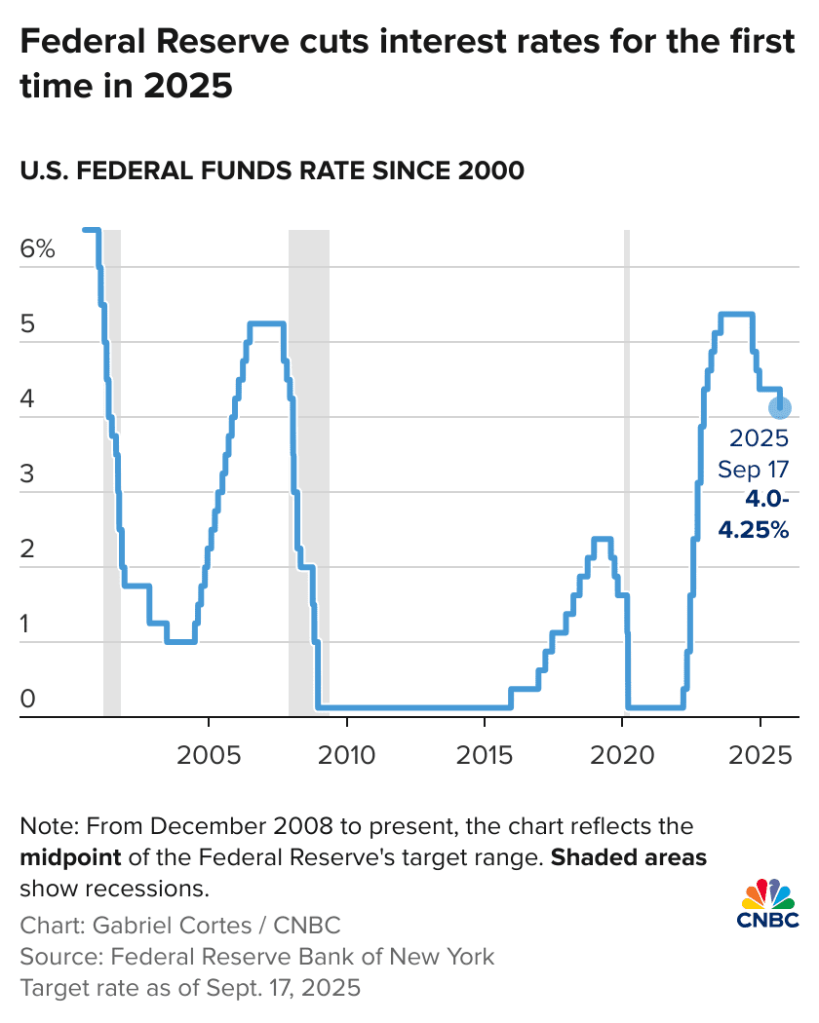

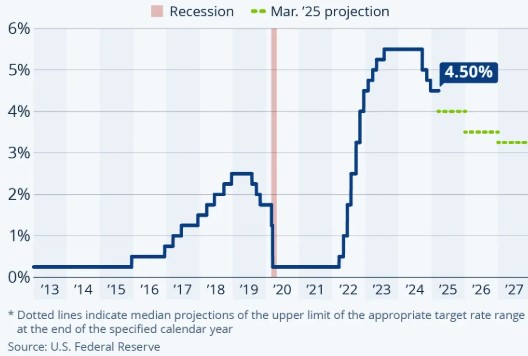

Since Powell’s speech on August 22nd, rates have improved by an average of 3/8%. The market had already priced in, and then received, the Fed’s 25bp cut.

Yesterday, Powell emphasized that policy remains clearly restrictive and signaled there’s still room for further cuts.

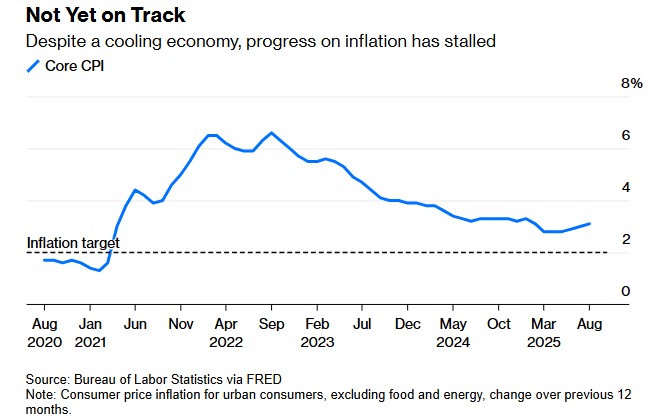

While inflation has been the Fed’s primary focus, the shift toward rising unemployment and growing downside risks to the labor market is now front and center.

So why did the rates go up when they are supposed to go down, right?

This morning’s Initial Jobless Claims came in lower than expected, which sparked a bond market sell-off. Money managers in this space react like a feral cat, jumping at their own shadow.

When we invest, we think in terms of dollars and long-term growth. Bond money managers, on the other hand, are often focused on pennies and the very short term.

These expectations are forward-looking, and if the bond market reacts the way it typically does, we should see movement ahead of the actual cuts, just like we saw back in August.

Hang in there… apply online http://www.YourApplicationOnline.com

-

Markets Hold Their Breath as Powell Prepares to Speak

The key this afternoon isn’t just if the Fed cuts, but how. A hawkish cut, done reluctantly, with little sign of more to come, could push bonds lower and rates higher. A dovish cut, signaling openness to further easing, could lift the bond market and drive mortgage rates down.

Let’s take a quick look at what lower rates mean for real borrowers. My client purchasing a $600,000 home with 15% down was at 6.875% back in August. Today, that same loan is at 6.125%, saving about $300 per month on their mortgage payment.

So when I hear critics argue “don’t cut rates, stay the course,” I have to wonder are they thinking about the average person just trying to buy a home?

http://www.YourApplicationOnline.com

-

The Closer It Gets, the Harder to See, Fed Day Arrives Tomorrow

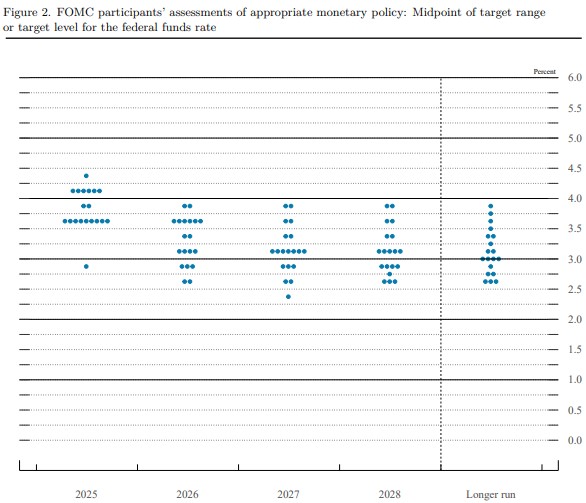

Time flies when you’re having fun, and tomorrow brings the long-awaited Fed announcement on rate cuts. The market has already priced in the expected 25bp cut, but the real story will be whether Powell signals the need for more cuts ahead.

There is a 75% chance of another 25pb cut in October with another 25bp cut in December.

The importers for now are absorbing the higher costs due to tariffs but the lingering fear is higher inflation down the road.

My Take: High interest rates hurt everyone. The job market has clearly cooled, yet inflation remains stubborn. Leaving the Fed rate unchanged only kicks the can further down a road we haven’t traveled in over 80 years.

Mortgage rates have been improving and should continue to trend lower for the foreseeable future, though they can always turn on a dime.

http://www.YourApplicationOnline.com

-

The Rate Cut That Already Happened ahead of the Fed, And Employment Absorption worries.

The market has already priced in the 25bp Fed cut, with the 10-year Treasury yield dropping about 30bp since Powell first hinted at a cut back on August 22.

Mortgage rates move closely with the 10-year Treasury yield because most borrowers keep their loans only 7–10 years, not the full 30. On average, mortgage rates run about 1.5%–2% higher than the 10-year. That extra gap, called the spread, reflects risk and investor demand.

In simple terms: if the 10-year yield rises, mortgage rates rise; if it falls, mortgage rates fall.

Example: A 10-year yield of 4% typically means mortgage rates around 6%.

Job Market overview:

At first glance, fewer hirings matched with fewer job seekers might look like a breakeven but that would not be correct. Without enough demand to absorb those who are laid off, the unemployment rate can climb quickly.

It’s Complicated but bottom line, mortgage rates should continue to decline.

http://www.YourApplicationOnline.com

-

Historically Dips in Rate are Transitory. Cut Wheat while its Sunny.

Over the past few years, we’ve seen rate drops come and go so quickly that it’s hard to convey just how urgent it is for refinance clients to act. The market is truly that volatile.

As the saying goes: watch the dog, not its tail, to see where it’s going. Rates are trending lower overall, but if you watch the “tail,” you can sometimes catch a dip in the movement. Just remember, like a tail, those drops swing back quickly.

My take: Inflation, while still elevated, appears to be stabilizing, and the labor market is clearly softening. These are exactly the signals the Fed watches, and strong indicators that the market is in need of rate relief.

Let’s get you pre-qualified before the mad rush later this fall.

http://www.YourApplicationOnline.com

Have a fantastic weekend and if you have an open house this weekend, let us know, our team can send you a financial open house flyer.

-

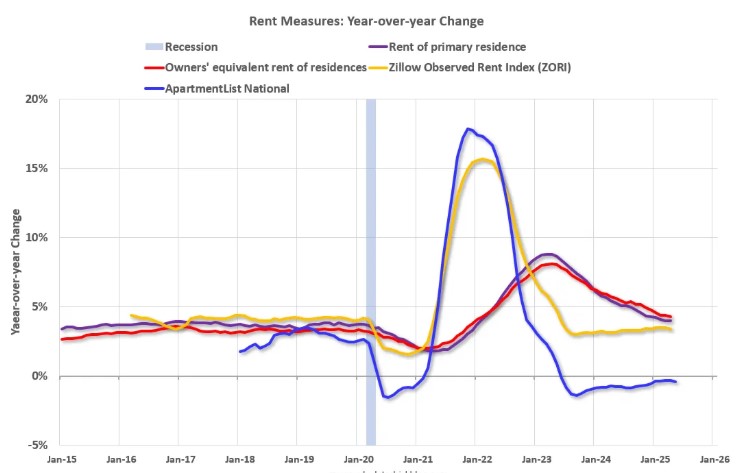

OER: The Fed’s Biggest Guesswork on Rent, and Its Outsized Impact on Inflation – CPI.

What is OER?

OER stands for Owner’s Equivalent Rent. It’s the survey-based measure the government uses to estimate housing costs. In short, homeowners are asked: “How much could you rent your home for, unfurnished and without utilities?”Yes, seriously. And here’s the kicker: OER makes up about 33% of the Consumer Price Index (CPI), meaning this one survey-driven number has an outsized influence on reported inflation. it rose 0.4% last month.

CPI report showed inflation rose 0.4% hotter than expected and brough overall inflation from 2.7% to 2.9%.

Energy prices rose 0.7%, a reminder that energy costs touch every corner of the economy, from production to transportation and everything in between.

My take: Yesterday’s 10-year Treasury auction came in strong, which helped push yields lower, and with them, mortgage rates. The trend continues: rates are drifting down. It may not feel dramatic, but the steady, consistent movement lower is exactly what we want to see.

http://www.YourApplicationOnline.com

-

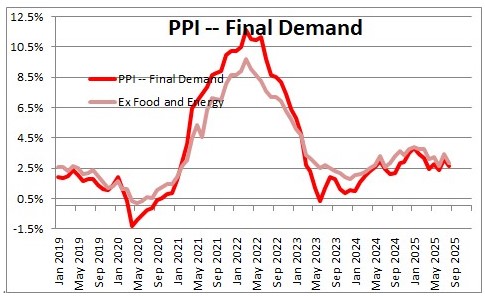

PPI – Producer and Wholesale inflation cold. Yes we are surprised.

Today’s PPI report came in surprisingly soft, falling 0.1% versus expectations of a 0.3% increase. That moved annual inflation down from 3.1% to 2.6%, giving the Fed even more reason to consider rate cuts — more fuel on the fire for lower rates ahead.

We’re already seeing the impact: national average mortgage rates slipped from 6.625% to 6.5%, which sparked a surge in loan applications. A good reminder, the earlier we get your file fully approved, the better positioned you’ll be to take advantage of these moves.

Tomorrow we get the CPI report, the consumer’s read on inflation. Let’s see what happens.

My take, and I know I sound like a broken record, is this: get ready to buy, sell, or refinance. The pending and current rate drops are exactly what the doctor ordered.

http://www.YourApplicationOnline.com

-

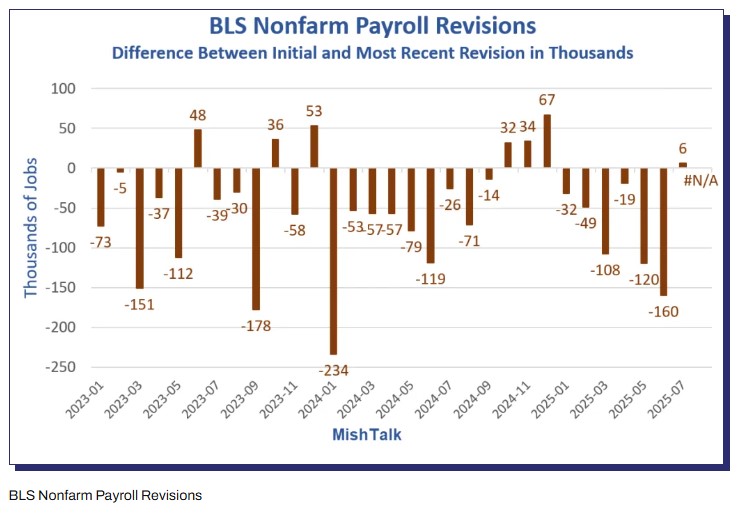

Turns out half the jobs never existed. The QCEW revision just wiped out 911,000. (Told you I wasn’t crazy!)

This is the largest revision on record. On average, that means 76,000 jobs per month, or 52% of the jobs previously reported, never actually existed.

We all knew something was off, and this confirms it. It’s yet another strong signal pushing the Fed toward more aggressive rate cuts.

For now, we’re holding onto the lower rates gained over the past two weeks, following Powell’s testimony at Jackson Hole.

Housing Index Ticks Higher

The housing index finally rose 3 points to 27 on a 100-point scale. While 50 marks the line between contraction and expansion, today’s move shows things are at least headed in the right direction.

Let’s get you pre-qualified so you’re ready when conditions improve. We start with a soft credit pull, no impact on your score.

http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.