-

Rates are as stubborn as a mule.

Inflation has decreased, yet the rates appear to be persistently resistant to change, like the adhesive nature of a sticky substance.

To illustrate this, imagine tugging on an elastic band, only for it to inevitably recoil and snap back towards you. This analogy may offer a glimpse of what could potentially occur during the upcoming summer months.

Back on the road this morning for the final leg of my trip.

-

Is it Cold outside? Inflation seems to think so.

Half way through my road trip and the pillows are just not the same.

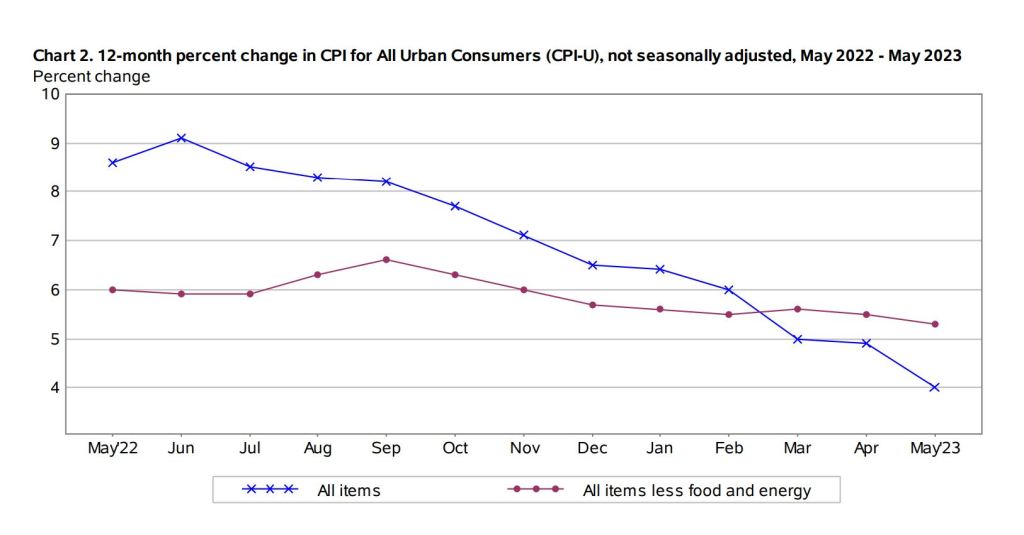

CPI – Consumer Price Index year over year as expected and down significantly from last year. This is favorable for the bond markets and more importantly the Mortgage rates.

Back on the road, have a great rest of the day and week.

-

Road Trip and Inflation Report Tomorrow

The CPI Consumer Price Index inflation report for May will be released.

Here are the technical bits. last year 0.9%, this year (Y/Y) should come in at 0.2% showing inflation dropping from 4.9% to 4.2%. This will be a significant drop.

Wednesday the Producer Price Index report will also be released. This is the wholesale inflation number. We anticipate an already low 2.3% to go down to 1.5%.

Feds are kicking off a 2-day meeting with their rate hike decision on Wednesday 2:00pm ET. They will have the benefit of seeing both the CPI and PPI numbers before deciding on a pause or rate hike.

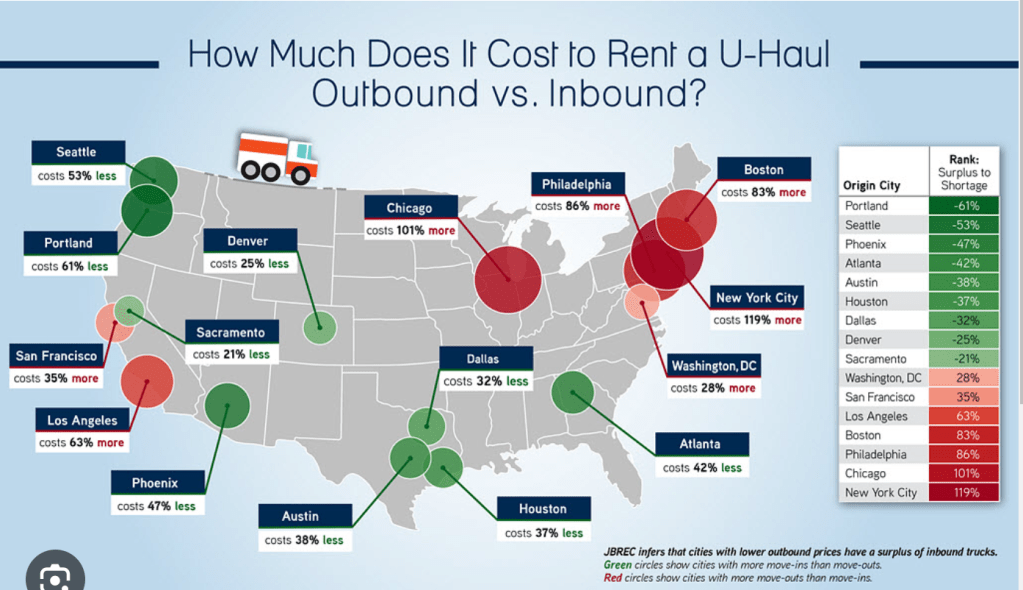

Driving from University of Washington (daughter) to Palm Springs this week. Love road trips but maybe not necessarily in a 20 foot U-Haul.

-

Home Value Gains, larges in Midwest but West Coast sees large price gains off slump.

Zillow May Market report shows home values increased 1.4% April to May with the larges gains in the Midwest. West Coast markets have recovered from the price drops in 2022.

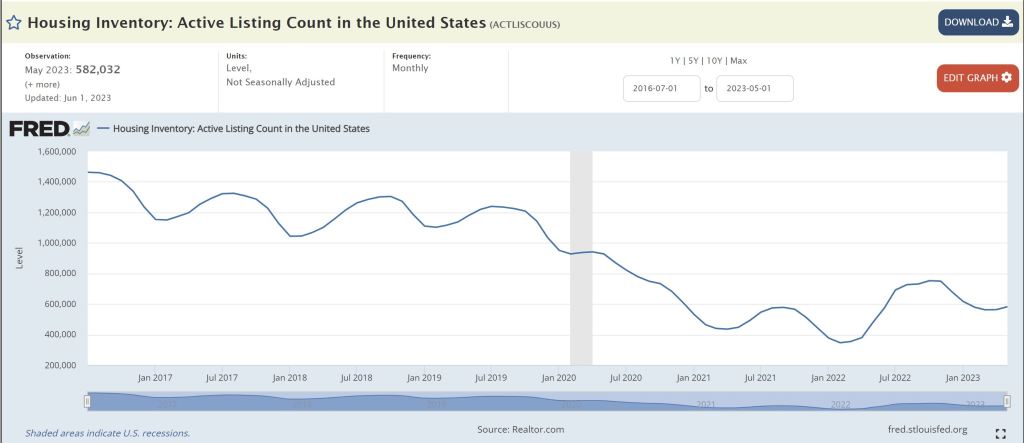

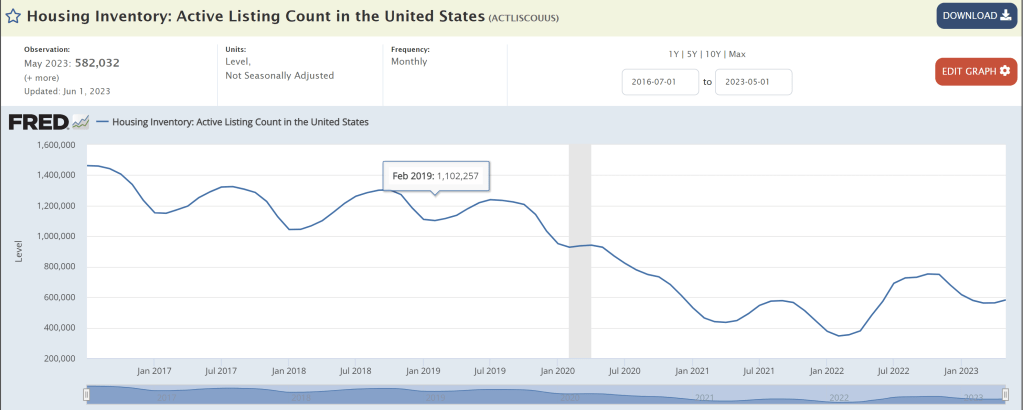

However, one third of home buyers expect home prices to decline. Inventory is at one of the lowest points in years.

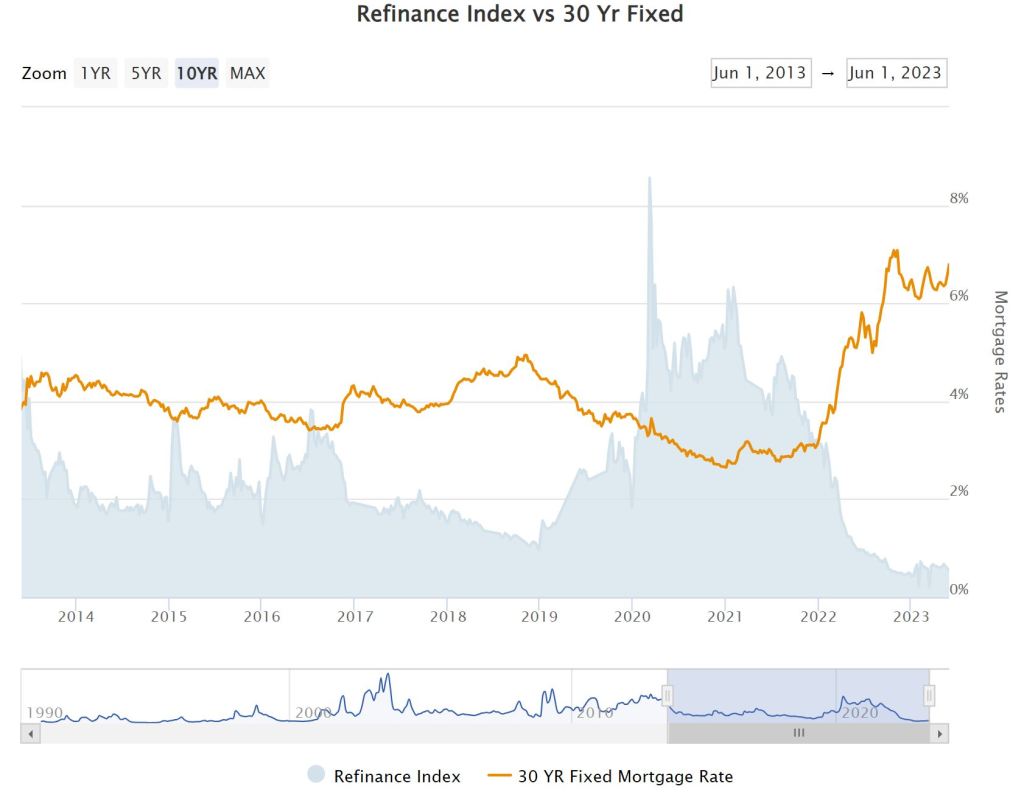

The situation is further exacerbated by the proportion of borrowers with interest rates below 4.0%. Remarkably, 33% of FHA and VA borrowers currently benefit from rates below 3.0%. An astonishing 50.7% of VA borrowers also fall under the category of securing an interest rate below 3.0%.

From my perspective, I don’t foresee a decline in home values. Although inflation is gradually decreasing, it has not reached a point where the Federal Reserve would consider easing the Fed rate. Moreover, the inventory remains persistently low, with minimal or no incentives for it to increase.

Road Trip Monday and Tuesday so the blogs and videos will be short. Have a great weekend.

-

Initial Jobless Claims finally rose, but what does that mean.

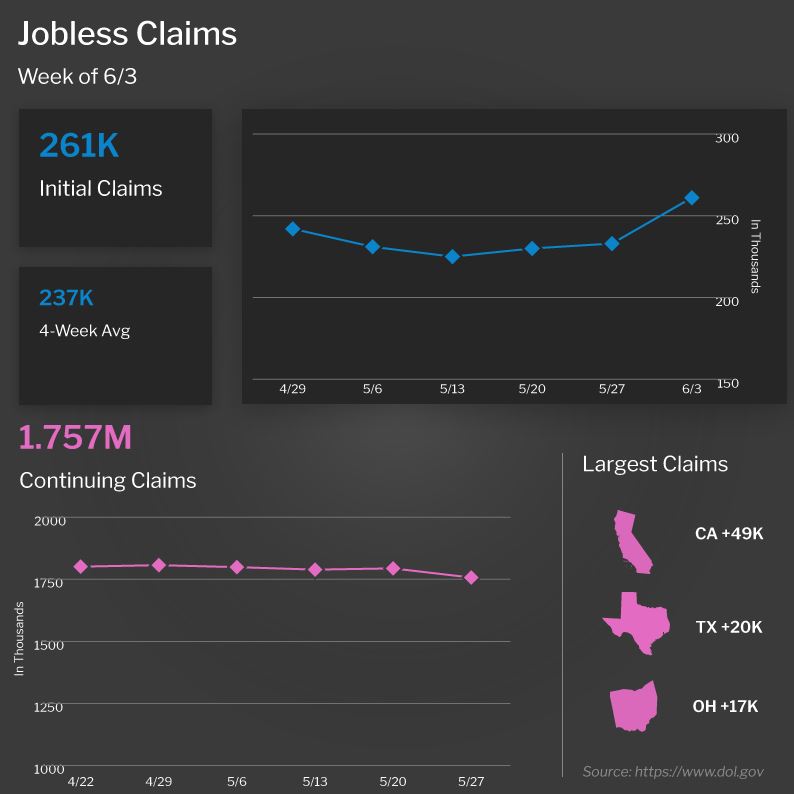

The initial jobless Claims that measure individuals filing for unemployment benefits for the first time rose 28,000 to 261,000.

The Continuing Claims, those that continue to receive benefits after their initial claim, fell 37,000 to 1.75M. This is a high level and shows that hiring has slowed.

Internationally according to European statistics office Eurostat, the euro zone has entered into a recession in the first quarter of this year. This trend appears to be continuing for the remainder of the year.

Rates have responded to this news in a positive or lower interest rate direction.

-

Mortgage application drop despite rates coming off recent highs.

The national average for 30y mortgage rate dropped from 6.91% to 6.81% but applications for a mortgage to purchase a home fell 2% this week and 27% lower than last year according to the Mortgage Bankers Association.Refinance applications as expected fell 1% and were 42% lower than last year.

Its about rates, its about inventory and the fear of a recession. Its Wednesday, have a fantastic rest of your week.

-

Home prices rose again but what’s up with Austin Tx.

Both CoreLogic and Black Knight are reporting home prices continue to rise and expect a 4.6% increase over the next 12 months.

The outlier is Austin Tx. They are back and above pre-pandemic levels. This has forced significant price corrections. Lack of inventory drives prices up, too much inventory drives prices down.

It’s understandable that people may feel hesitant and adopt a cautious approach when it comes to significant financial decisions such as buying or selling a home. However, it’s important to consider a few factors in this scenario.

- Interest Rates: Waiting for rates to go down can be a valid strategy if you believe they will drop significantly in the near future. However, predicting interest rate movements can be challenging, even for experts. While rates may fluctuate, they are influenced by various economic factors that are difficult to accurately forecast.

- Home Prices: Similarly, waiting for home prices to fall can be a strategy to secure a better deal. However, it’s important to remember that the housing market is influenced by supply and demand dynamics, among other factors. While prices can experience fluctuations, trying to time the market perfectly is challenging, and it’s difficult to predict when prices will significantly decrease.

- Inventory and Competition: If rates do drop and more inventory becomes available, it can lead to increased competition among buyers. This means that even though home prices might become more favorable, you might face more competition and potentially end up paying a higher price due to increased demand.

- Personal Circumstances: It’s crucial to consider your personal circumstances and housing needs when making decisions. If you’re ready to buy or sell a home and have found a property that meets your requirements, it might be worth proceeding instead of waiting for ideal market conditions that may or may not materialize.

Ultimately, the decision to buy or sell a home depends on various factors, including your financial situation, housing needs, and your long-term goals. It’s advisable to consult with a real estate professional who can provide you with local market insights and guide you based on your specific circumstances.

Get pre-approved, talk to your lender or us. lets start the process before it passes us by. Have a great rest of your week.

-

Don’t Pull the cord on the bus until you are ready to get off.

The Federal Reserve finds itself in a state of uncertainty, pondering whether to raise interest rates in the upcoming week or wait until the following month. The dilemma arises from the fact that while inflation is decreasing, the recent job numbers have surpassed expectations, as highlighted in a blog post published on Friday.

What are the current interest rates. It’s important to understand that this is a complex question influenced by numerous variables. Interest rates fluctuate daily, and the chart below provides a snapshot of the rates over the past month, with a downward trend indicating higher rates.

When you pose this question to your lender, their brief pause indicating how best to respond. This hesitation arises from the intricate nature of the question and the need to factor in various elements before providing an accurate answer.

Translation, it drives us crazy. but seriously there are so many different factors, its impossible to be accurate.

Have a fantastic Monday and the rest of the week is ahead of us.

-

Wow, 339k new jobs, blows the estimate away.

The unemployment rate has inched up to 3.7%, but the number of new jobs has far surpassed expectations, slightly impacting the rates.

Although the Federal Reserve’s actions remain uncertain, knowledgeable individuals in the room are increasingly inclined towards a rate hike.

Notably, the Household Survey revealed a loss of 310,000 jobs, which accounts for the elevated unemployment rate.

Its Friday, already. Another weekend ahead of us. Enjoy and always feel free to reach out.

-

What’s in a Rate

We have witnessed significant improvements in mortgage rates as the resolution of the debt ceiling becomes inevitable. This development raises a question previously posed regarding the difference in house payments between a 3.5% 30-year mortgage and mortgages with rates of 6.5% and 5.0%.Comparatively, a 6.5% mortgage results in a 30% higher total payment, while surprisingly, a 5.0% mortgage leads to only a 15% increase. This difference is viewed as the tipping point for borrowers who are constrained by interest rates.

With these changes on the horizon, it is crucial to be prepared. We encourage you to reach out to us or your lender and get pre-approved. Obtain a fully underwritten file to address any minor issues that may arise.

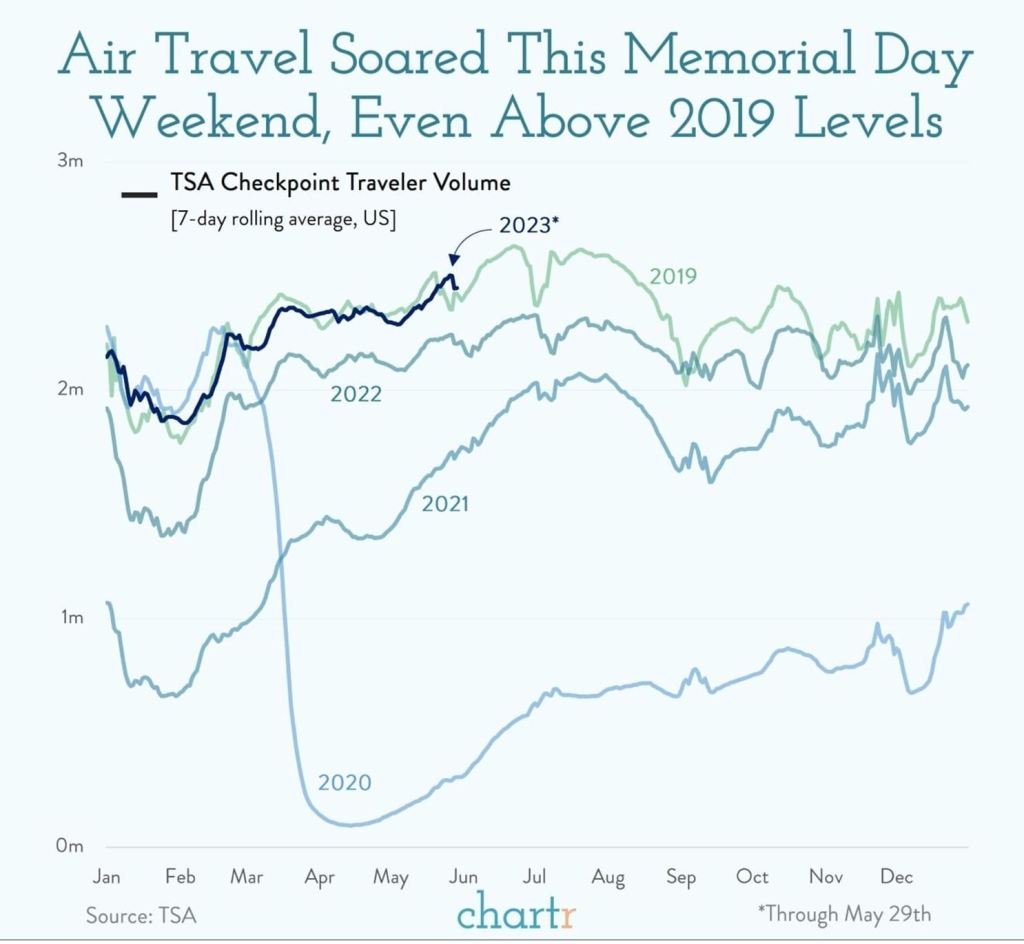

As I am currently traveling this week, I came across an intriguing graph that I wanted to share with you. It’s quite fascinating! Have a fantastic rest of the week.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.