-

Rate improvement

This will be a short post today. Headed on a plane to change the weather and a few meetings.

Rates have improved quite a bit the last few days with the debt ceiling deal almost behind us. Also the Inflation indicators are looking more and more favorable as we move into June.

Have a fantastic rest of your week.

-

Debt Ceiling, Stock Market and Rates.

Its appears we are out of the woods with regards to the debt ceiling but what does that mean for the Stock market and interest rates.

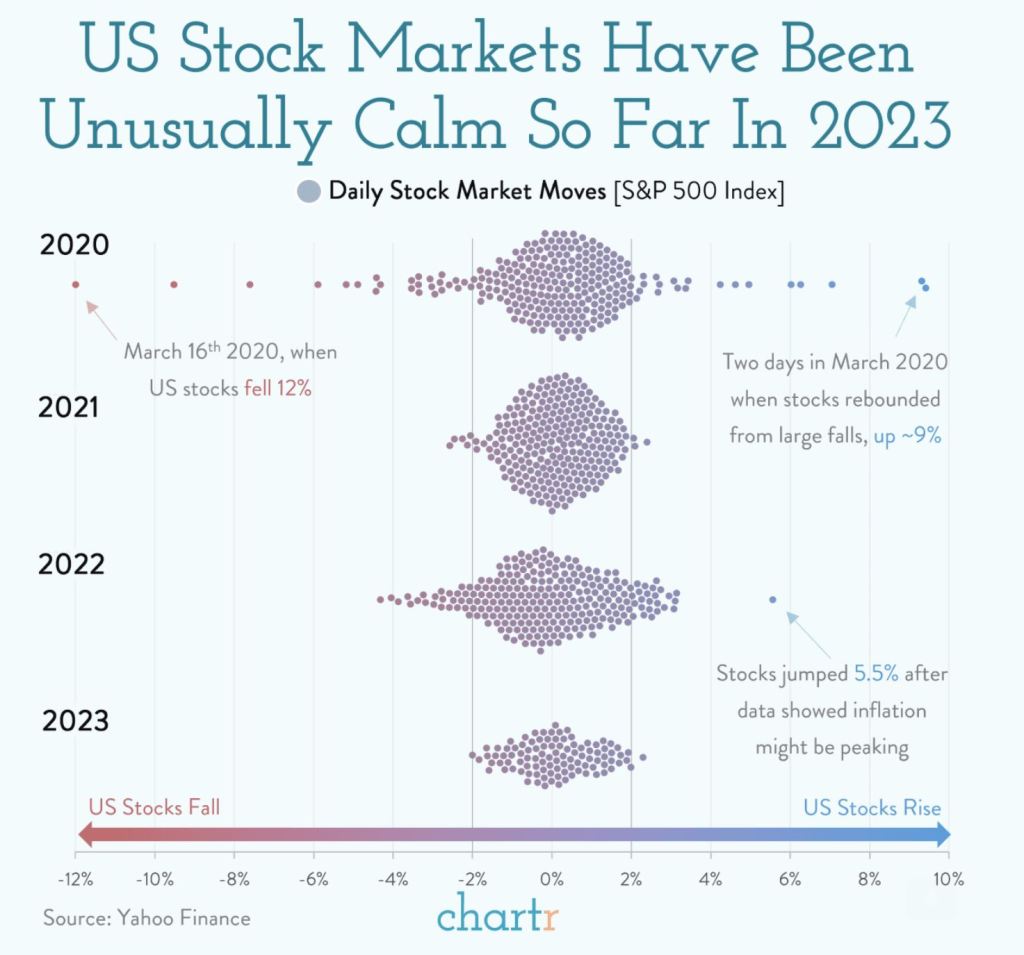

The first chart is the Stock Market activity last 3 years. 2023 so far is calm very calm. Operating in a narrow +-2% range.

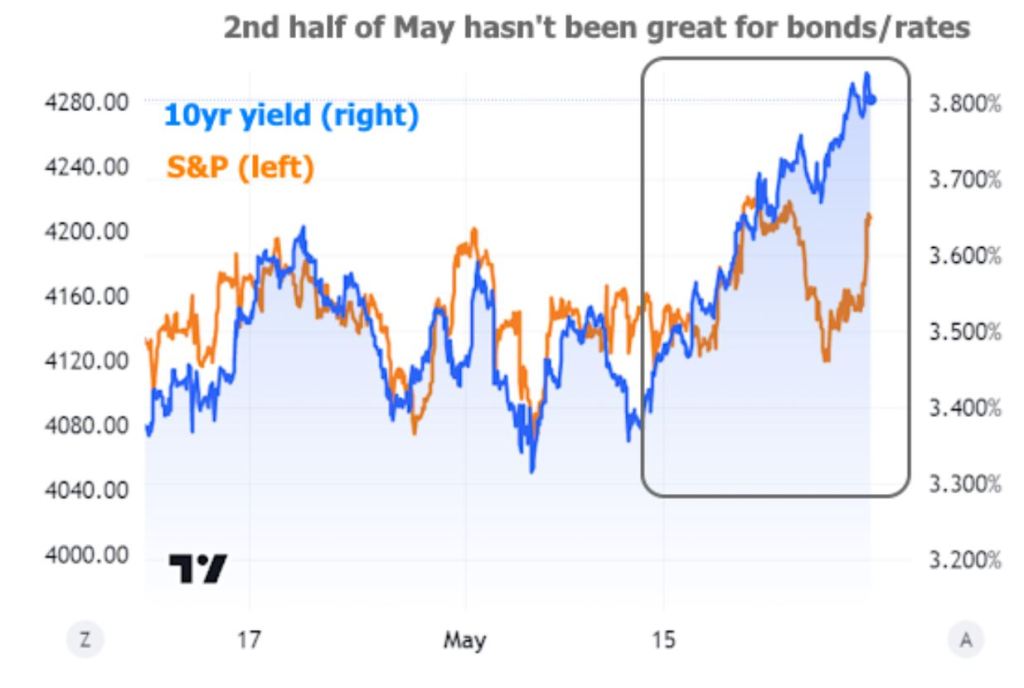

The Bond Market has been steadily rising this month, not helping interest rates.

Interest rate peaked over 7% last week according to the daily Average.

Its a short week with ADP employment report and initial jobless claims.

Have a great week and always feel free to reach out with any questions.

-

PCE (Personal Consumption Expenditures) Inflation Report not cooperating (Silver Lining)

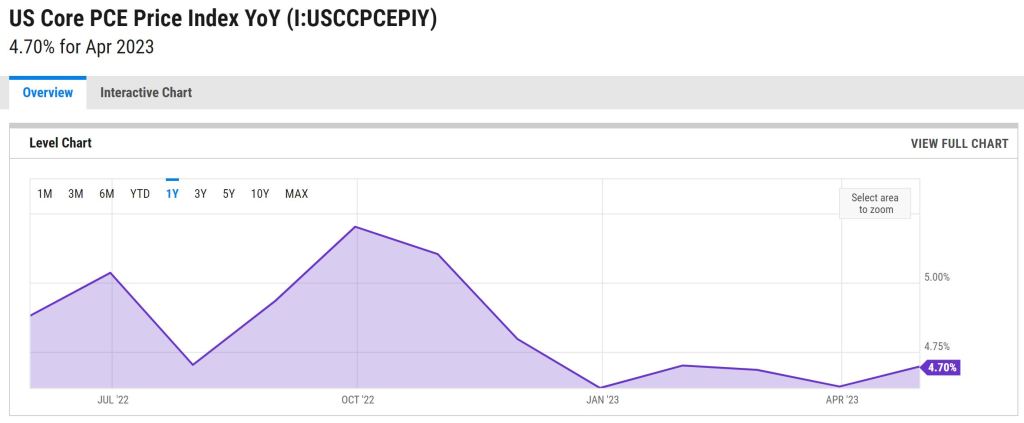

The past two weeks have been challenging for rates, as indicated by the latest data on Personal Consumption Expenditures (PCE). Inflation has increased by 0.4% in April, surpassing the estimated 0.3% rise.Energy rose 2.4% last month and Used Cars up 4.7%.

There is indeed a positive aspect to consider. We expect to observe progress in the coming two months due to higher comparisons with last year’s inflation rates. It’s important to note that we are focusing on year-over-year inflation comparisons.

Looking back at 2022, the inflation rates for May and June were 0.6% and 1.0%, respectively. If we continue to see readings around 0.4%, we can anticipate a decrease in year-over-year inflation from 4.4% to 3.6%. Furthermore, we project that inflation will decrease even further once the pressure from energy, used car prices, and shelter costs subsides.

Have a fantastic long weekend. Bond Market will be closing today at 2:00pm ET in observance of Memorial Day Holiday and the markets will be closed on Monday.

-

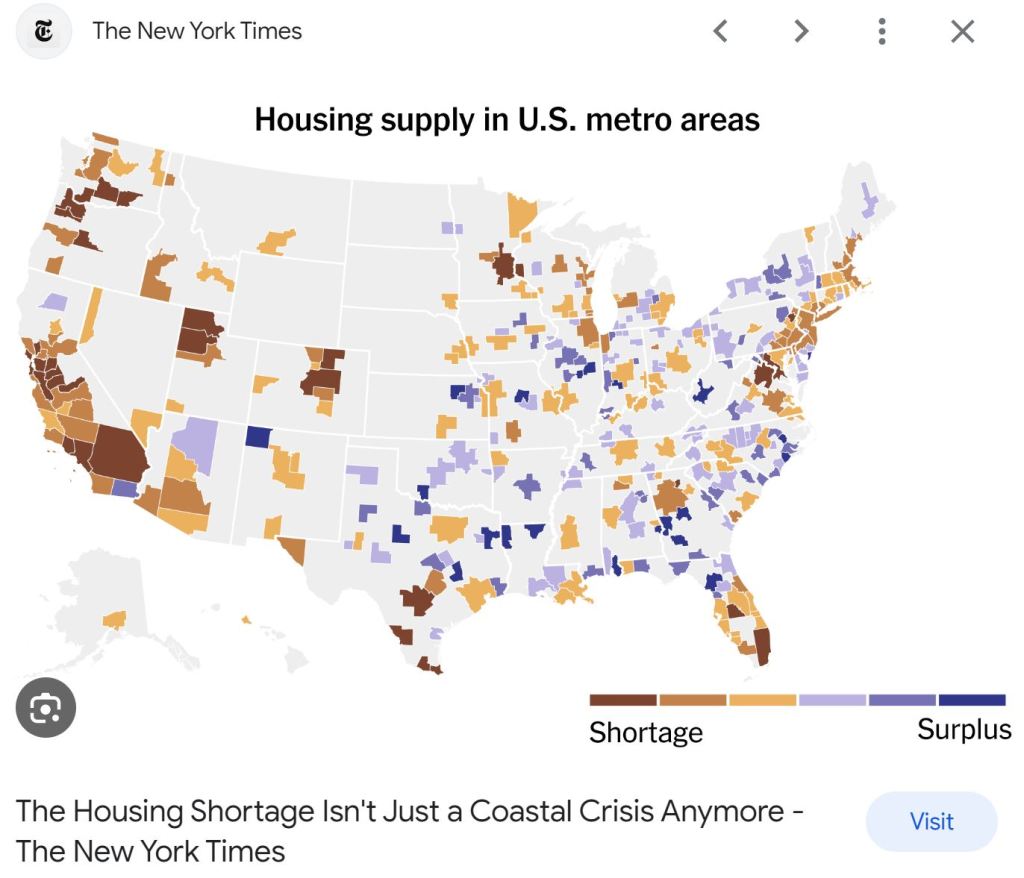

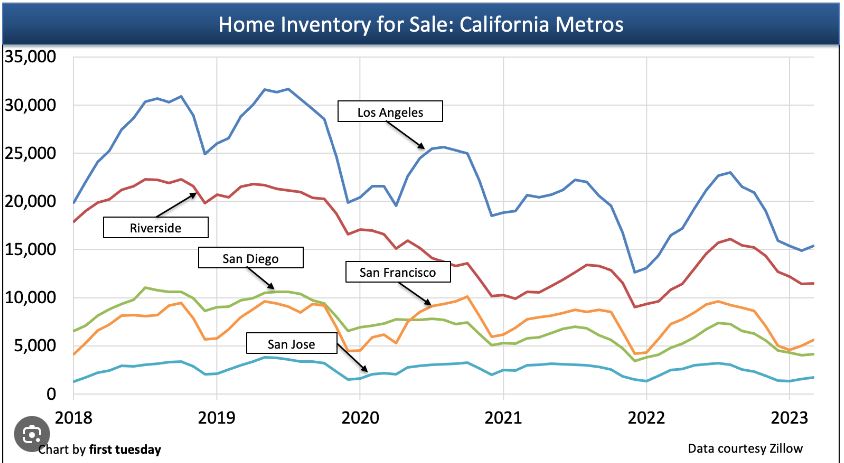

New Construction grabs 33% of the Home market Up from 10%.

According to the National Association of Home Builders, builders emphasize the scarcity of listings in the resale market, which grants them a significant advantage. Despite national average interest rates exceeding 7%, prospective buyers exhibit a strong preference for new homes.

Just a friendly reminder, if your mortgage rate is 6.5%, your monthly payment will be 30% higher compared to the same mortgage at a rate of 3.5%. However, if the rate is 5.0%, your payment will only be 15% higher.

It’s Thursday, which means that tomorrow is Friday heading into the three day weekend.

-

Give a Mouse a Cookie and they will ask for Milk.

The Feds have put themselves in an untenable position. With a recession looming and inevitable, they are stuck. If they cut rates, it will help the banking sector, specifically the regional banks, making the recession less painful.

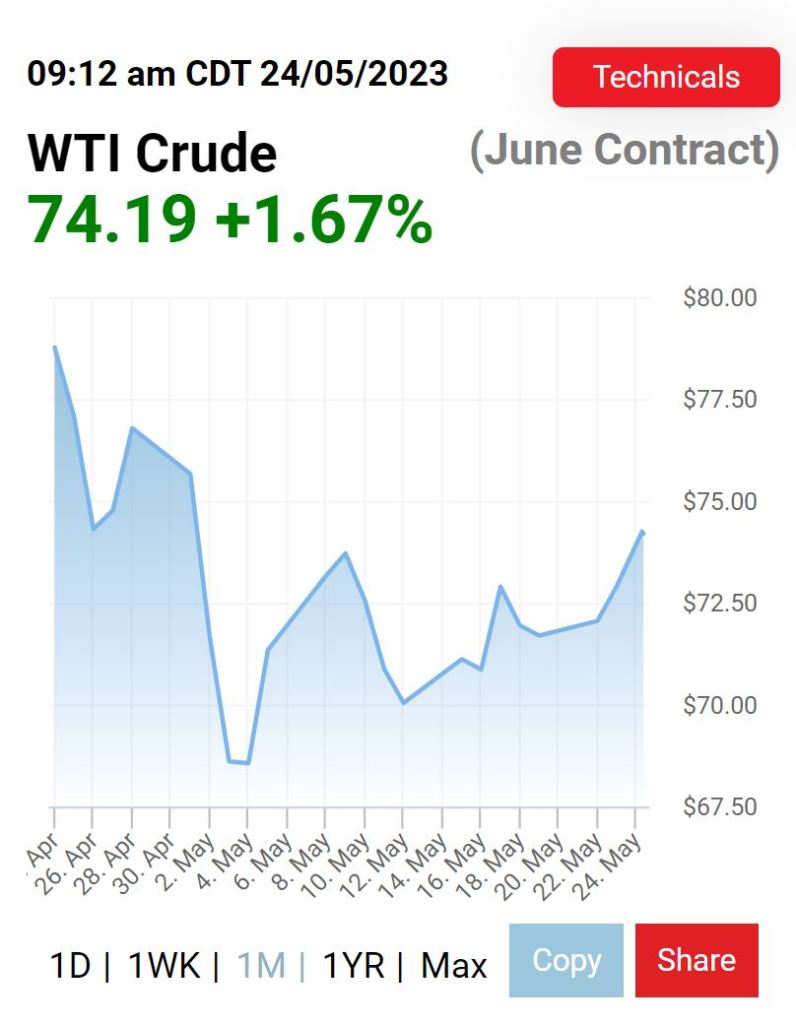

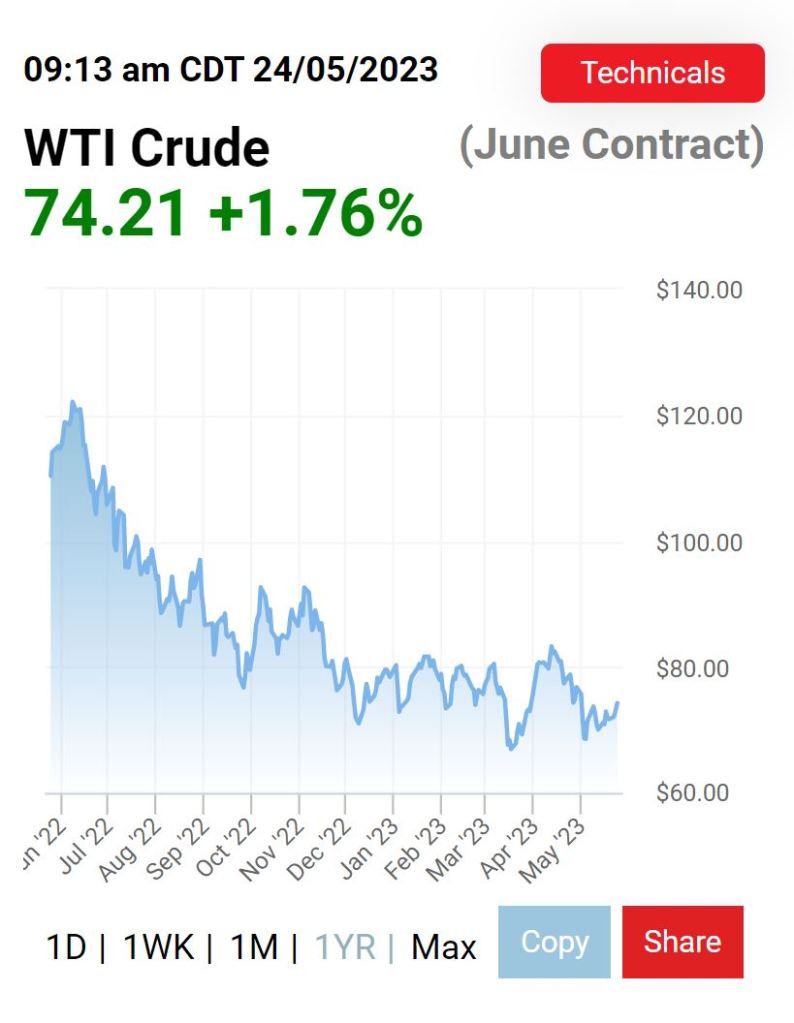

Oil prices are dollar dependent so if the Feds cut rates too much, oil prices move higher. Oil is holding around $73/barrel up just a bit after the Saudi Energy Minister comment to “watch out”.

This graph is the last month, but take a look at the second graph spanning the last 12 months.

-

The Bond Market has nothing to chew on.

We have entered a lull in the bond market ahead of Memorial Day weekend. No key reports or events except for the debt ceiling ordeal.

We are waiting for rate-friendly data as we are seeing the rates inch higher last week and into this week.

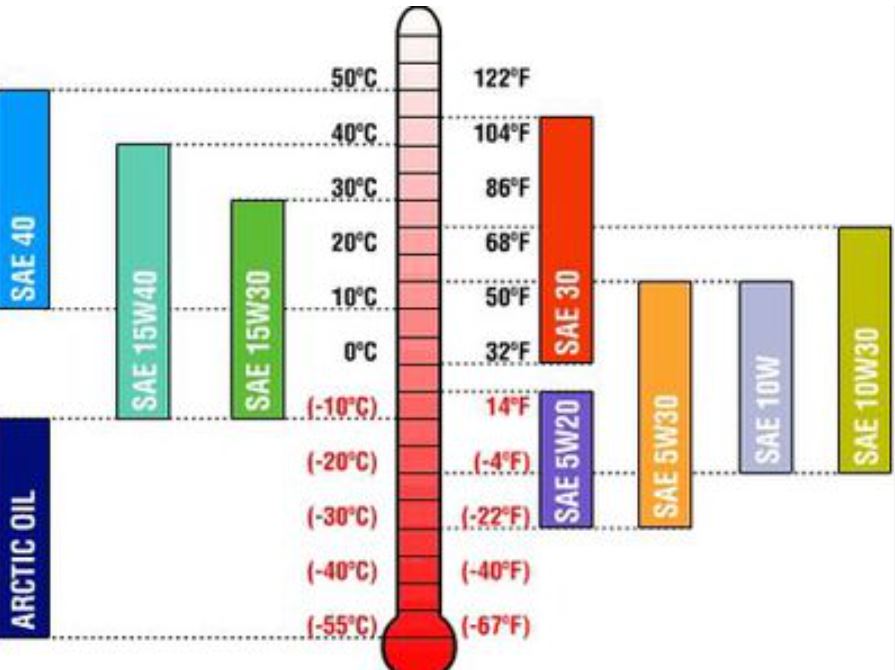

Have you ever wondered what all those numbers on Oil cans mean? Have no fear I am here to help.

It’s Tuesday Morning, take on the day and I will see you tomorrow morning.

-

If Inflation is Down and Shelter Costs are Down, why are the rates not following?

We are in a conundrum. Supply and Demand for Mortgage bonds are the issue. The FDIC who assumed $114B in Treasuries after SVB and Signature bank went under and Banks are selling their Bonds in an attempt to raise capital for depositors. Those depositors are taking their money and investing it in better options.

In 2021 the opposite happened. Inflation was moving higher causing rates to move higher, but rates did not. The reason was the FED was doing the lion share of buying of MBS – Mortgage Backed Securities and Treasuries.

We just need to weather the storm. It’s temporary and all this selling will be exhausted.

Monday morning, Make it a great week.

-

When E.F. Hutton Speaks People Listen…

I’m dating myself with that comment but in reality when certain people speak, people or the Bonds listen.

Fed Presidents, Bullard, Logan and Ray Dalio’s warning the debt ceiling crisis could be “catastrophic” to the economy.

Powell will speak at 11am ET (8 am PT for us on the West Coast). The odds of a rate hike went from near zero to 40% today.

Waiting for the Used Car market to drop. You may have to wait.

It is finally Friday, what a week. Have a fantastic weekend and always feel free to reach out anytime.

-

Not feeling Pause(y)

Pace of wage growth not consistent with 2% inflation. Fed- Jefferson

He also noted that wage growth is still strong and will remain that way through the end of the year.

The Bond market is up, which translates to higher rates. The graph below shows the movement of the last 30 days. Down is higher rates. This is about a .250 swing.

I will be at the Palm Springs Affiliate Showcase. Hope to see you .

-

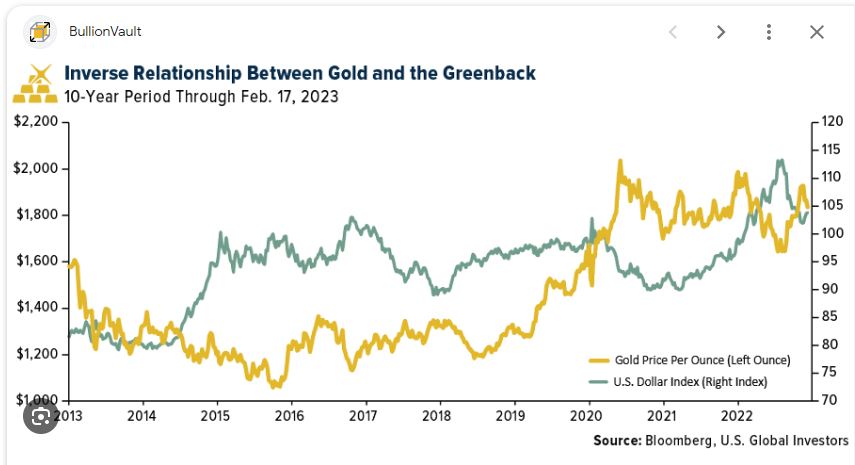

Sellers are Rate-Trapped and what about Gold.

Sellers are holding on to their 3.50% interest rate (or lower) even if they don’t like their home. If the interest rate was 5%, it’s only 15% higher than your 3.5% mortgage. Numbers are magical if you don’t dig a little deeper to understand.

Gold is the most non-reactive of all metals and does not rust. Gold is so pliable that it can be made into sewing thread. Gold can conduct heat and electricity.

You ask, Hey Jack, what is the boiling point of gold. Well it’s 5,086 degrees Fahrenheit.

It’s Wednesday, half way through the week.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.