-

Jobless claims lower, Rates Higher, Feds watching!

Economically speaking a very strong positive report. The downside is the economy is cruising right along and not slowing down. This affects the bond market as the Feds are eyeing two additional rate hikes this year.

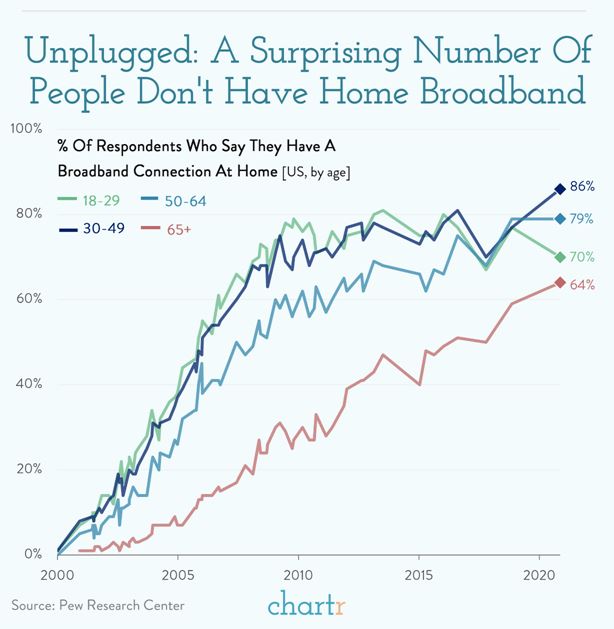

As I write this blog, I wondered who might not be on the internet. Well of course everyone is right??

I am headed to Disneyland next two days, ahead of the long weekend and 4th of July. Always feel free to reach out anytime.

-

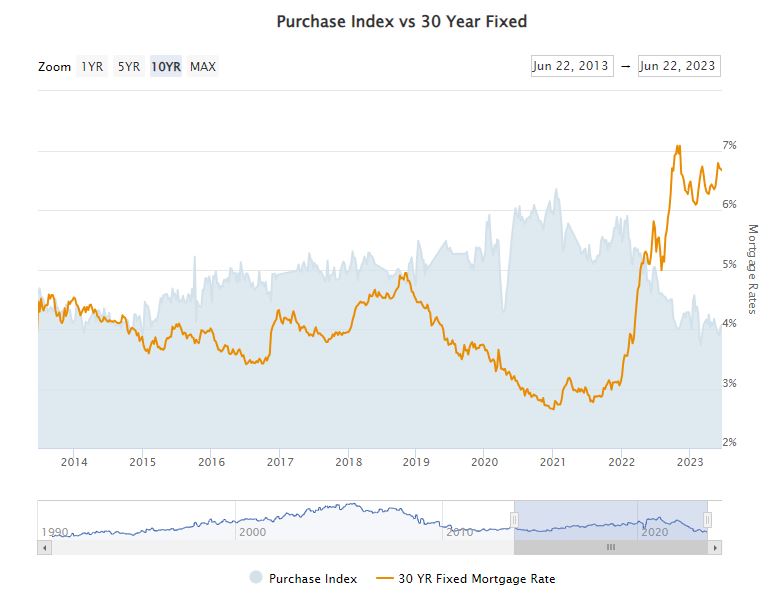

Mortgage Applications Rose, Third straight week.

Given yesterdays strong new home sales and earlier improvement for pre-owned homes, Mortgage application volume is up.

Tomorrow we have Pending Home Sales and Initial Jobless Claims, Friday Personal Consumption Expenditures. We anticipate continued rate improvement.

-

New Homes sales up 12.2% and how efficient are Electric cars

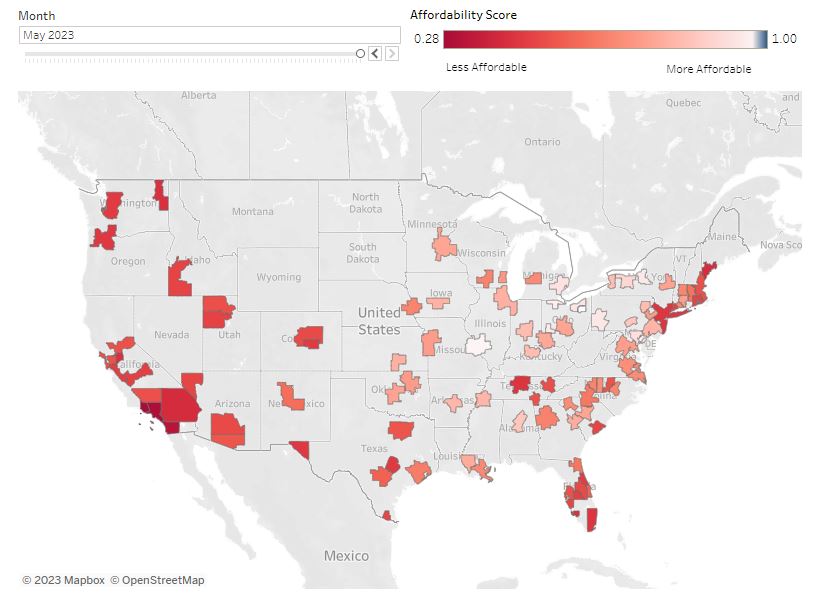

New home sales and completions are up 12.2%, which is great news but we have our familiar frenemy inventory. Low inventory means home values continue to go up, great for sellers but not so great for buyers.

Interest rates and inflation are just not budging. As a lender this is frustrating. We have a large swath of clients sitting on the sidelines either because of fatigue trying to buy or not willing to sell until the rates go down.

I don’t have a good answer for you except time heals all wounds.

Found this graph interesting. EV’s tailpipe emissions are zero but producing the raw electricity is carbon heavy.

Always feel free to reach out anytime.

-

63% of all Homeowners have Mortgages and gained $1 trillion in equity.

How can you harness that valuable resource of home equity without jeopardizing your low mortgage rate? The United States is currently experiencing a record level of home equity, surpassing $27.8 trillion.

Traditionally, accessing your home equity while maintaining a low mortgage rate would involve providing comprehensive documentation, such as paycheck stubs, W2 forms, or tax returns. However, there are alternative options available that leverage the equity in your property. These are referred to as low doc or no doc loans, also known as SIVA (Stated Income Verified Assets) loans.

With low doc or no doc loans, the emphasis is less on extensive documentation and more on the value of your property’s equity. These loans enable borrowers to state their income without extensive verification, while the focus shifts towards verifying the assets they possess.

By opting for a low doc or no doc loan, you can tap into your home equity effectively, allowing you to access the funds you need without disturbing your low mortgage rate. These loans provide flexibility and convenience for borrowers who may have unconventional income documentation or prefer a streamlined application process.

It’s important to carefully consider your financial situation and consult with a qualified mortgage professional to determine the best approach for leveraging your home equity while safeguarding your low mortgage rate.

Have a great rest of your week.

-

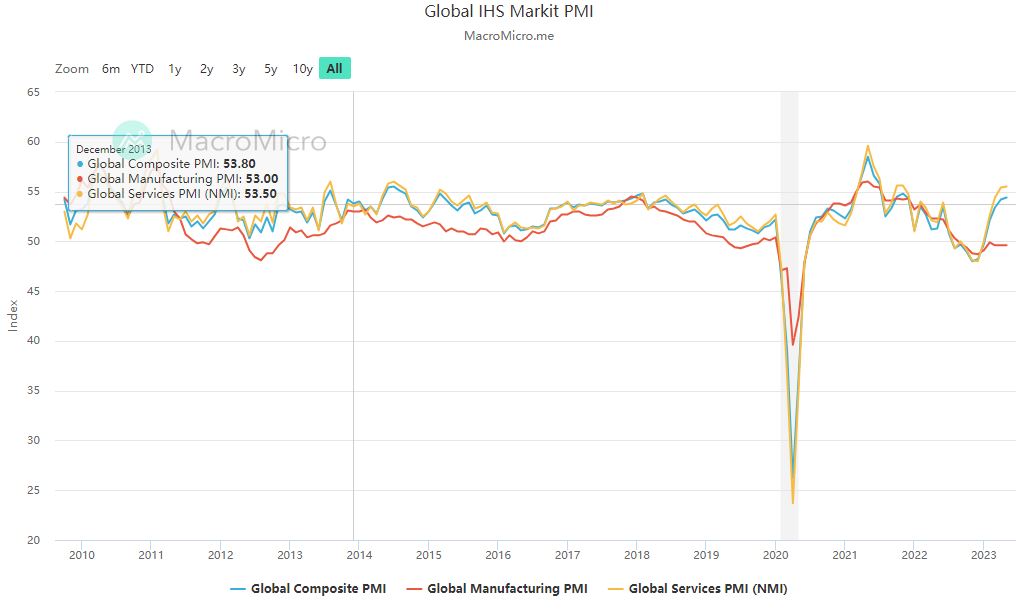

Contractionary Territory

The Global PMI (Purchasing Managers Index) report came out this morning showing evidence of a global slowdown.

Below we are specifically looking at the orange line showing14 months of contraction. We are also seeing a slowdown in the US, as evidenced by the Leading Economic Indicators repot

Rates are still stubborn as always as we look towards July and August for relief. Have a great weekend.

-

Inventory is Up and Homes are selling.

Existing Home Sales showed sales rose 0.2% in may at a 4.3M unit annualized pace. This is stronger than the estimated 1.0% decline.

Inventory levels increased slightly to 1.08M but are still very low. There is a 3 Months’ supply of homes. to put this into perspective, 4.6 months is considered normal.

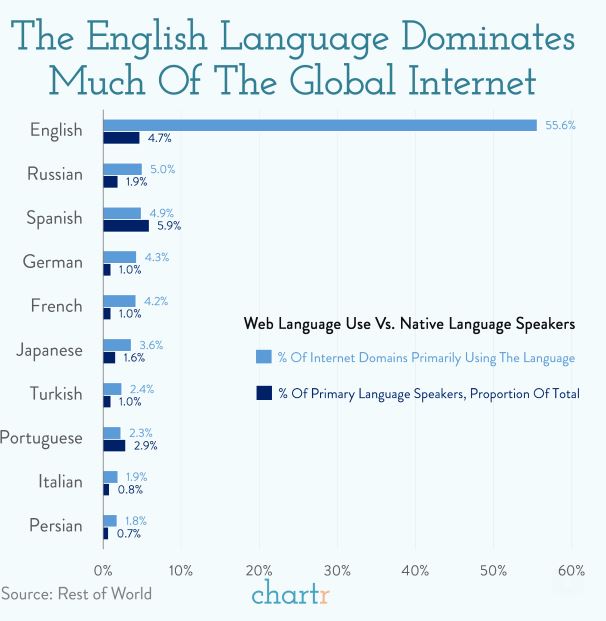

I thought this was interesting given I am currently on the internet and never actually thought about the dominance of the English language.

Have a great rest of your week.

-

If the Shoe don’t fit, it just ain’t your Shoe.

It’s possible that you find yourself living in a home that simply doesn’t suit you anymore, either because you have outgrown it or were compelled to purchase it within the past two years.

While it’s true that the interest rates have increased significantly compared to two years ago, it’s worth noting that once the rates reach the 5% range, the monthly payment only rises by approximately 20% compared to the existing total payment.

Have a great rest of your week.

-

Housing Starts & Permits up double digits

Housing Starts in May rose by 21.7% to 1.63M Units, Which is much stronger than estimates.

Single Family starts rose 18.5% last month to 997k units. The key to future activity is the Housing Permits, which were up 5.2% last month at 1.49M units.

Completions also increased by 9.5% last month of which 3.9% were single family homes. We need inventory in a very bad way. This is a good start but not out of the woods yet.

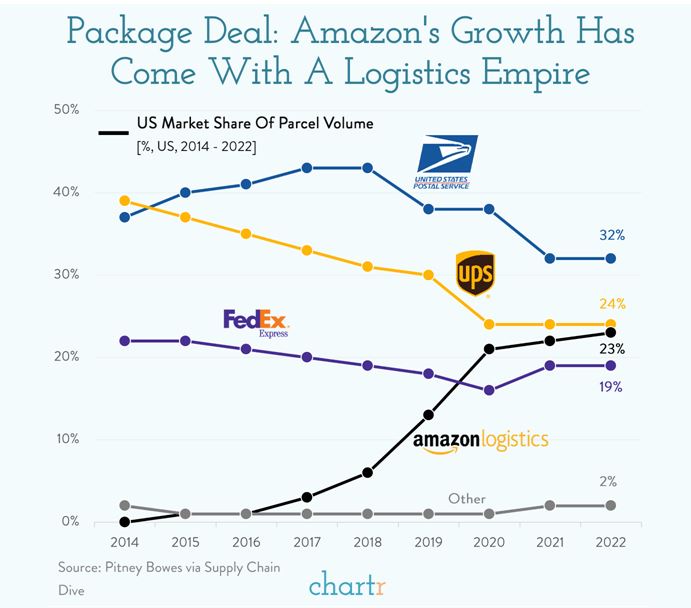

On Friday, the Teamsters union with over 340,000 UPS workers, voted to overwhelmingly strike.

Have a great rest of this short week.

-

Consumer Sentiment moving up. We are back to Multiple offers, Again.

The Consumer Sentiment shows greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. This is a 28% increase from the historic low of 51.5% in July 2022.

Anecdotally I have been seeing multiple offers on almost all of my clients purchases. This is backed up by Redfin recent report showing 33% of transactions have been sold over asking price.

If you are not fully underwritten by your lender, ask why and if you don’t get a good answer, let me know. The key to an accepted offer is a fully underwritten file with no conditions except the appraisal.

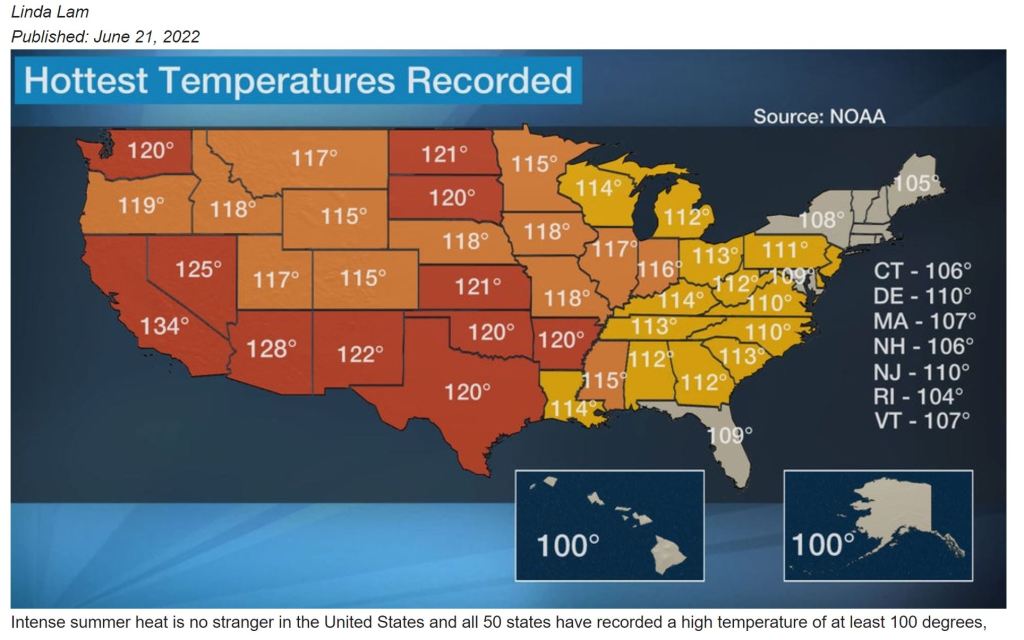

Have a fantastic weekend. 100 degrees in Palm Springs CA tomorrow but its a dry heat…

-

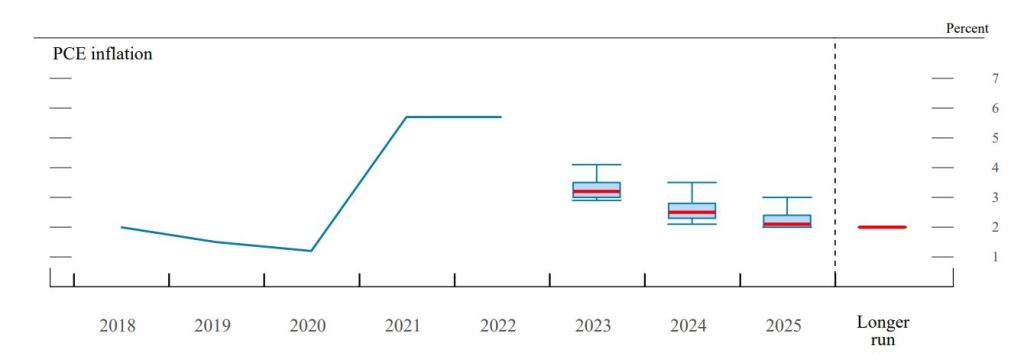

FED Dot Plot and Perspective

Below is the graph from http://www.federalreserve.gov showing Inflation projections. Yesterdays positive inflation numbers hit the bond market hard in a very odd way. We expected better rates but got the exact opposite. Today we are seeing recovery from those lows.

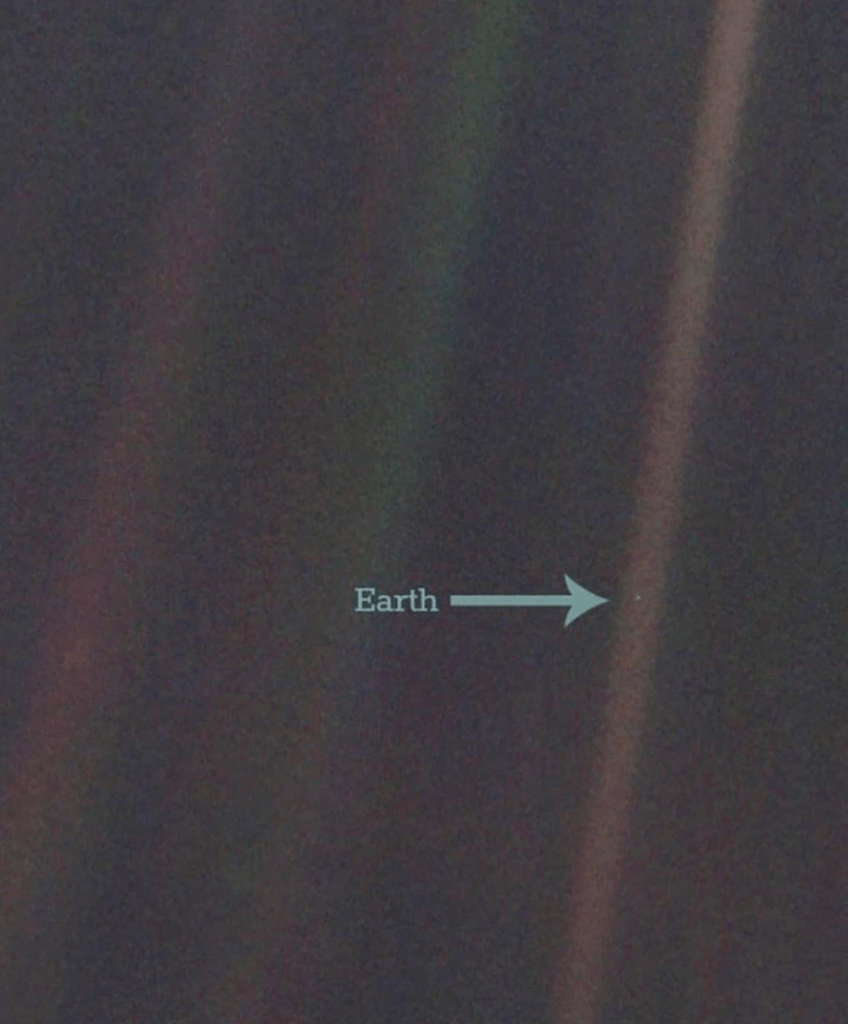

To put life into perspective. see below Picture from Voyager turning around to take a Pic of the Earth. Location just past Saturn.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.