-

Inflation dropping from 9.1% to 3.0% in 12 months. But…..

The Feds, specifically Chris Waller, a voting member, wants to hike two more times this year.

I get it and understand the logic, the challenge is how is it going to affect the rest of us. A sprinter is told to Run Through the Tape. The question is are we past the tape or just have it in our sights.

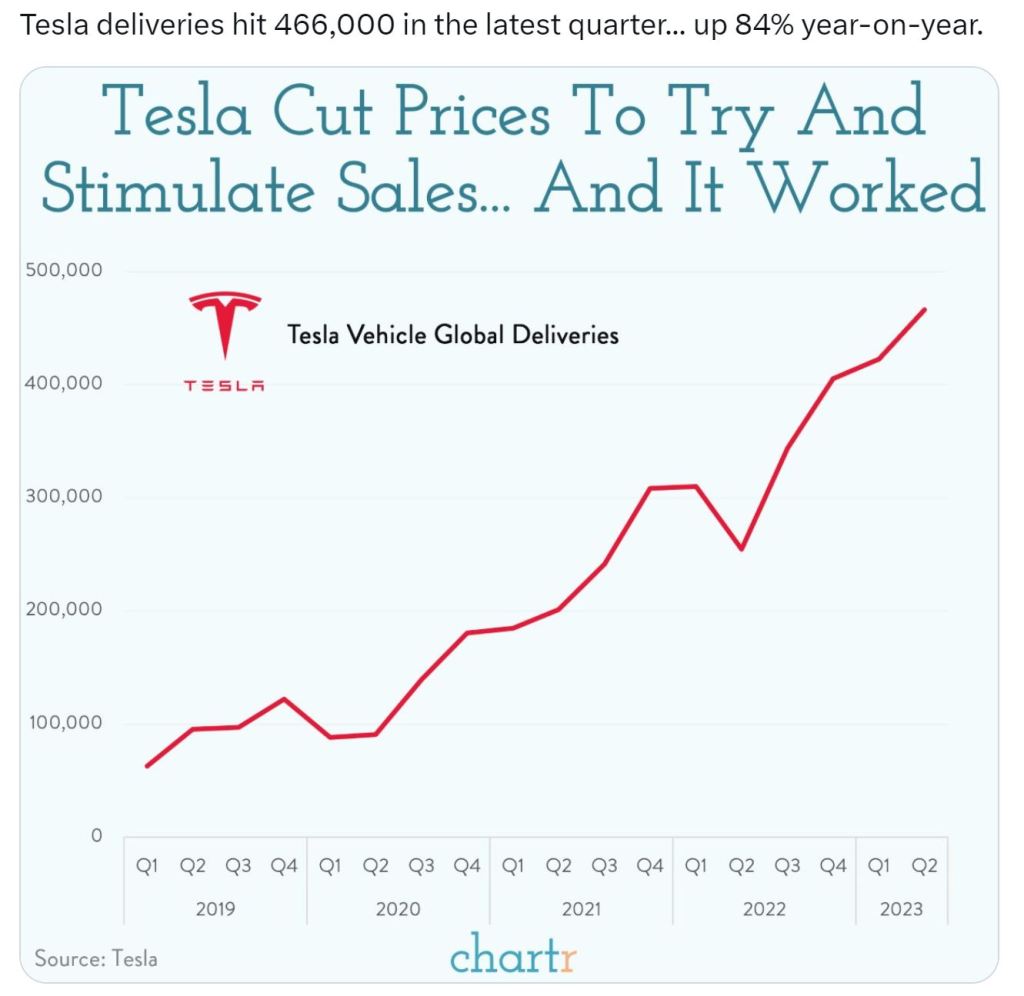

Tesla has been in the news lately due to used car prices dropping. Part of the reason is below. If you can buy a new Tesla for the same price as a used one, why buy a used Tesla.

-

Its getting Cold outside and its July…

Stocks and Mortgage Bonds are both in rally mode after a COOLER than expected PPI report.

The May Producer Price Index (PPI) report showed that overall producer inflation increased by 0.1% in June, which was even lower than the 0.2% expected drop.

There is an 80% chance after the July expected .25 hike the FEDs will not hike again for the rest of the year.

This is very good news for rates as we are starting to see the early June and mid May rates on a national average coming back into the 6’s comfortably.

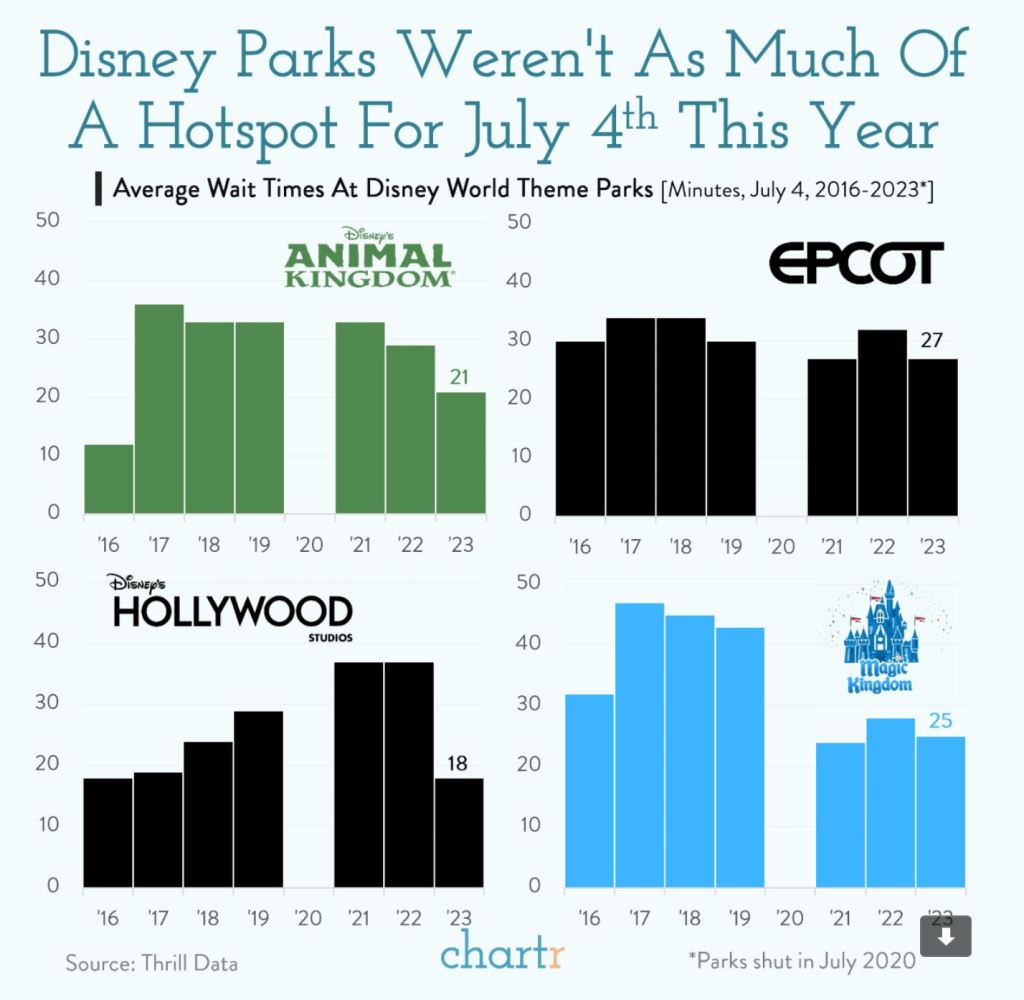

A fun look at Parks and attendance.

-

What goes Up has come down for the past 12 months

June CPI Consumer Price Index has dropped for the past 12 months.

Inflation increased by 0.2% lower than the estimate of 0.3%. Y/Y inflation declined from 4% to 3%. the expected drop was 3.1%. All aspects of the Core inflation, Shelter, and Used Cars also dropped below expectations.

What this means for us is lower rates. Mortgage Bonds have responded in a rate favorable direction.

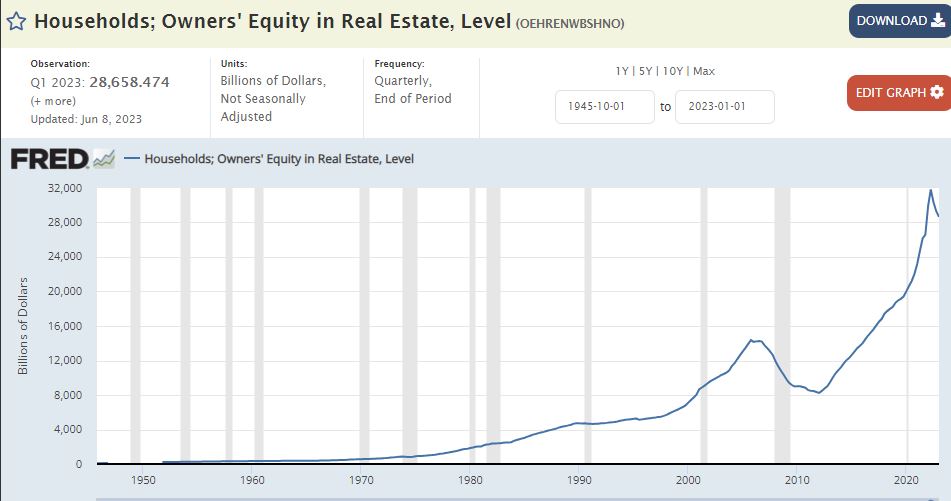

I couldn’t find a good graph of the Bond Yield movement so opted for this one.

Enjoy the rest of your week.

-

Home Prices Continue to rise. Office Space and allot of it.

CoreLogic Reported home prices rose 0.9% in May and 1.2% in April. Home values are now up 1.4% Y/Y.

CoreLogic expects a 1% gain in June with a 4.5% gain over the next 12 months. We may be on a 10% appreciation pace.

With used vehicle price index showing used car prices falling 4.2% in June and over 10.3% Y/Y, the expectation is a Consumer Price Index (CPI) from 4% to 3.0%.

Crossing our fingers as this could be a positive reaction in the Bond market.

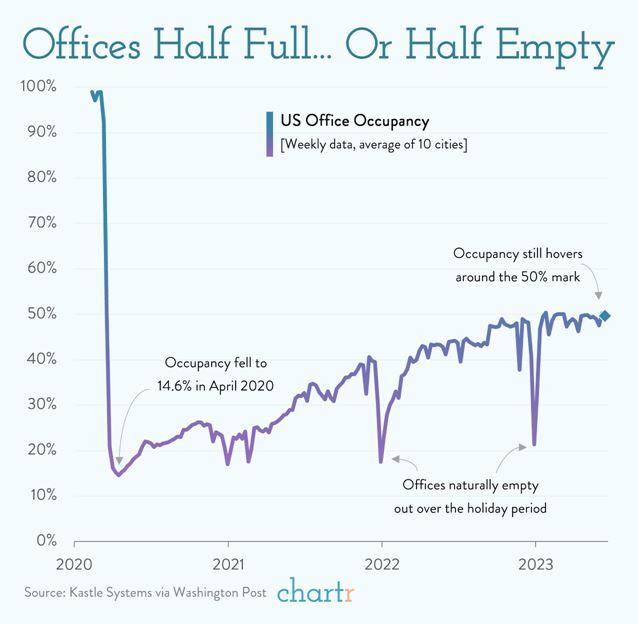

Office Space. This graph says a 1,000 words and will leave you with that.

-

Home Equity Q1 Report showed home equity dropped 0.7%. What’s going on?

I have seen in the media this morning stating home equity has dropped with the assumption that home values have also dropped. This is not the case.

What is actually going on is a large amount of people are doing cash out refinances or Home Equity Lines of Credit.

We are looking for Wednesdays report on inflation Wednesday. But will it be enough for the FEDs from hiking another 25bp on July 26th.

Rates have been hit hard the last two weeks. On Monday, July 10, 2023, the current average interest rate for a 30-year fixed mortgage is 7.38%, up 23 basis points from a week ago.

We are still projecting lower rates this summer but its been a stubborn ride this year.

-

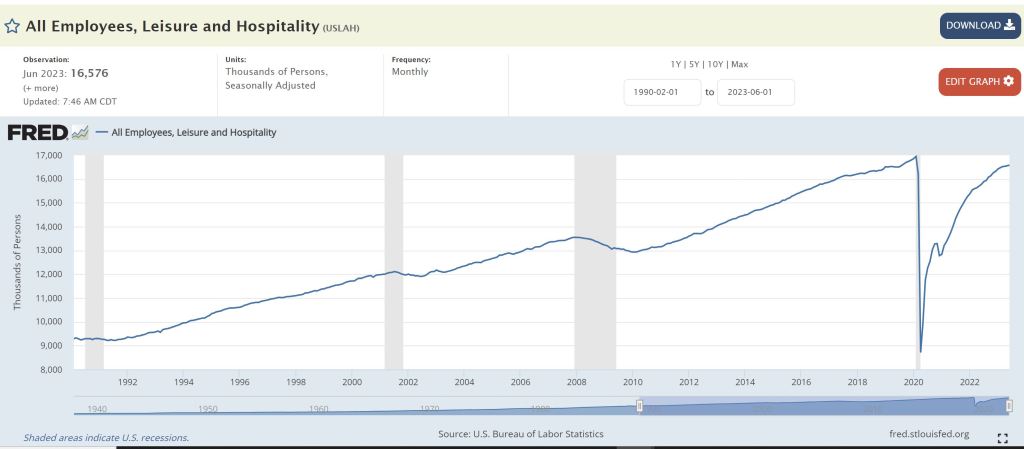

Leisure and Hospitality is the Canary in the coalmine

The Bureau of Labor and Statistics (BLS) reported there were 209,000 jobs created in June which was weaker than the expectations of 340,000.

But… Leisure and Hospitality only added 21,000 jobs. If we look back to my previous posts it’s helps clarify why this is an important trend. Think back last year when this sector was adding jobs let and right and not slowing down after the pandemic layoffs. We are now seeing a dramatic slowdown.

Have a great weekend and always here to help.

-

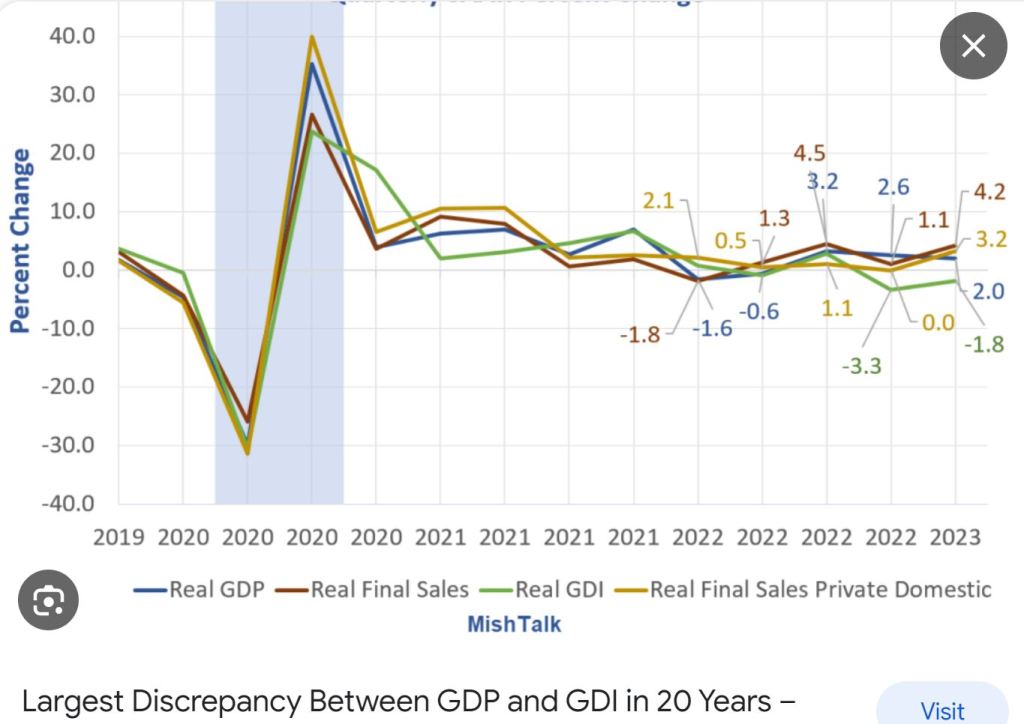

What’s an acronym between friends. GDP, GDI, CPI

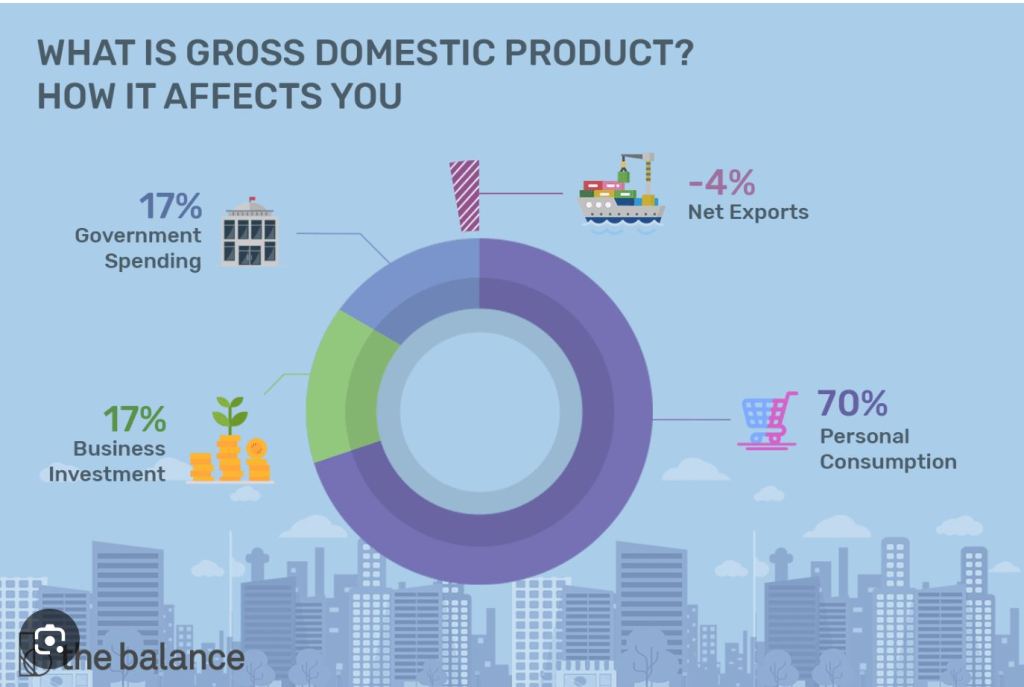

GDP is the Gross Domestic Product and is used by economist to measure national economies by size.

GDI is the Gross Domestic Income and is a measure of a nation’s economic activity based on all the money earned.

In theory, GDI should be identical to GDP which has been showing more strength than expected. GDI on the other hand has been negative for two consecutive quarters.

Think of it this way. GDP is the value of the goods, services and technology. GDI is what all participants in the economy make like wages, profits and taxes. Right now the trending data is telling us we are making more but getting paid less.

Look at the Blue GDP and Green GDI lines.

-

What are FED minutes and why its Important.

This afternoon, last week’s Fed minutes will be released. This is essentially a transcript of the Fed meeting and should give us a better glimpse into the thought process of the Fed. We expect the Fed may hint at a hike at the July 27th Meeting. This is expected to be challenging for the Bond market i.e. higher rates.

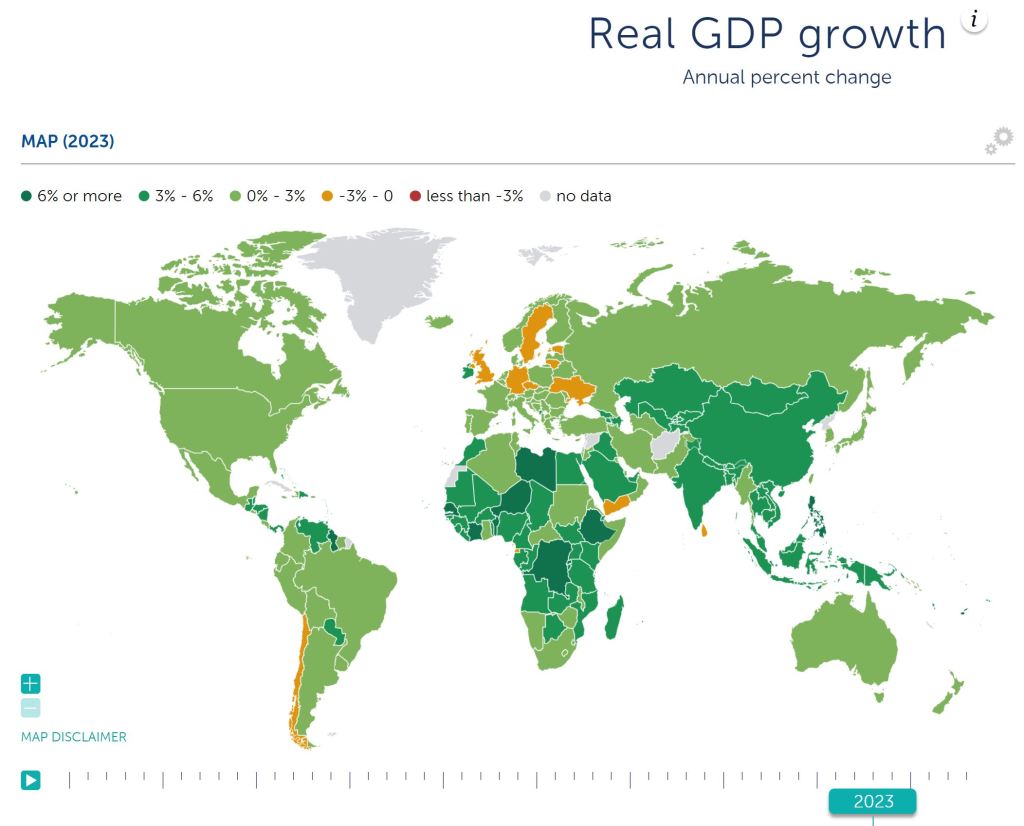

Regarding GDP Gross Domestic Product., the estimates for Q2 are 1.6% to 1.4% annualized growth. This is a slowdown in the economy and a heavy indicator of a pending recession if there are two consecutive quarters of negative GDP.

We expect and historically every time we enter into a recession, inflation and mortgage rates decline.

-

Analysts have a Tendency of falling in love with their Forecasts.

We keep hearing the sky is falling (recession) but the Can keeps getting kicked down the road.

Last week we had bullish updates on durable goods orders, business investment activity, new home sales, home prices, consumer confidence and initial jobless claims.

GDP Gross Domestic Product on Thursday grew in Q1 at a much faster pace than previously estimated.

Many of the bearish economists are now dialing back their calls for a recession.

Here is an example of Bearish (negative) thinking:

Home prices: When they’re up, it’s bad because it means fewer people can afford to buy. When they’re down, it’s bad because existing home owners are seeing their net worth shrink and some could go underwater on their Mortgage.

Happy 4th of July and as always, available for any questions that might come up.

-

Jobless claims lower, Rates Higher, Feds watching!

Economically speaking a very strong positive report. The downside is the economy is cruising right along and not slowing down. This affects the bond market as the Feds are eyeing two additional rate hikes this year.

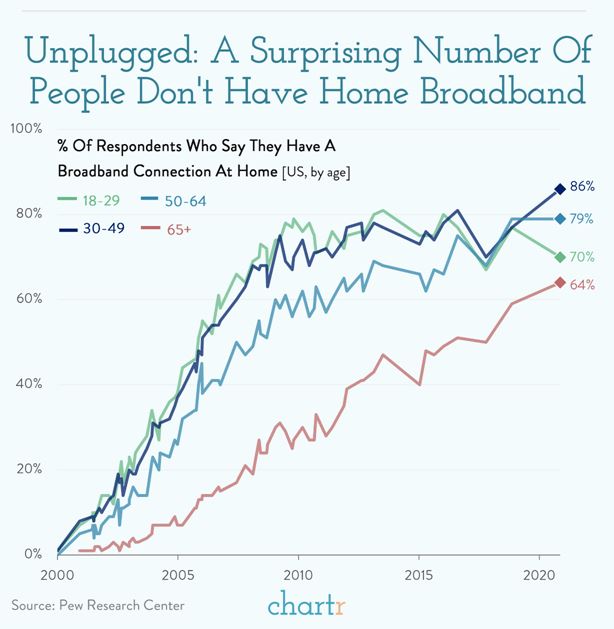

As I write this blog, I wondered who might not be on the internet. Well of course everyone is right??

I am headed to Disneyland next two days, ahead of the long weekend and 4th of July. Always feel free to reach out anytime.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.