-

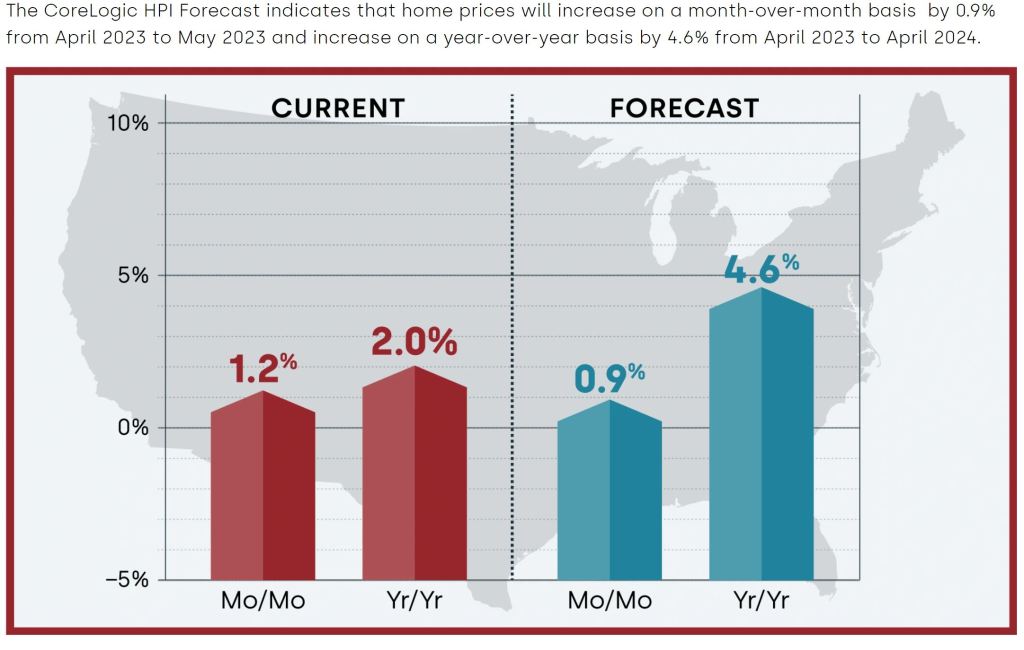

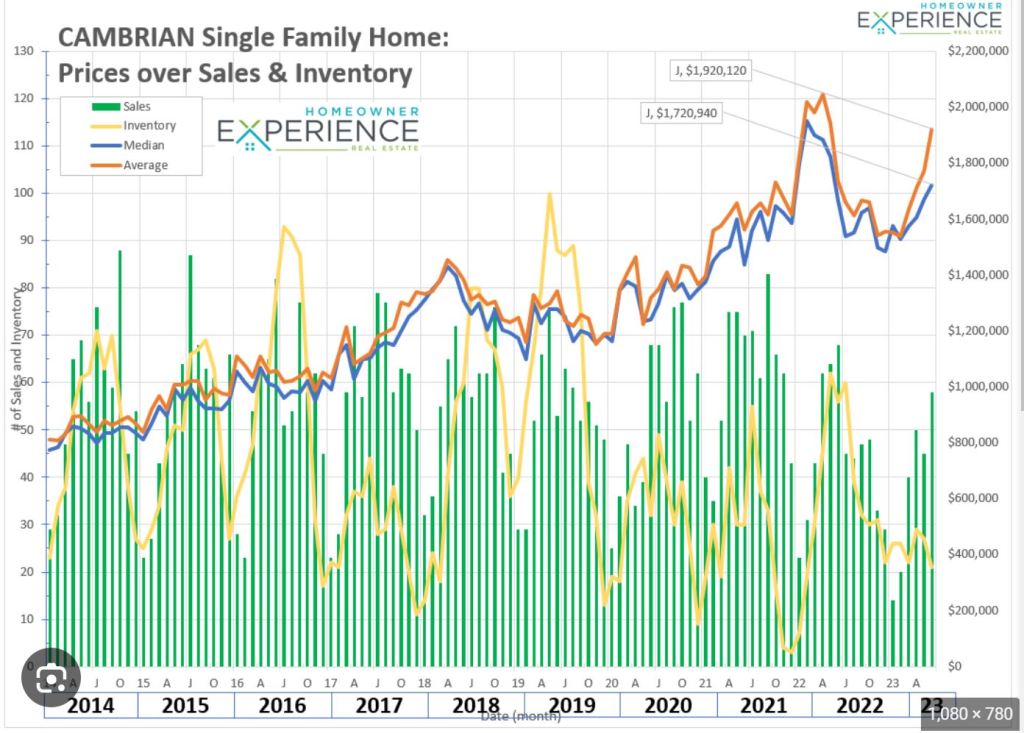

Non-insignificant Impact and Home values projected 10% appreciation.

Home Value Projection: Given the current 4.8% increase in home values this year, it is reasonable to extrapolate that home values are on track to appreciate by 10% over the remaining year.

Yellow – Freight Services, a carrier specializing in pallet-sized shipments, made a significant decision over the weekend by terminating 30,000 employees and shutting down its operations.

The Federal Reserve’s aggressive approach to rate hikes has been concerning, as it seems to disregard the toll it’s taking on real businesses. Yellow failed to reorganize and refinance over $1B of debt due to much higher rates. This may be the canary in the coal mine.

This week is all about Jobs. Opening, jobless claims and job cuts. Stay tuned.

-

PCE Personal Consumption Expenditures Down from 3.8% to 3.0%

Inflation rose 0.2% in June as expected. the Y/Y index decreased from 3.8% to 3.0%. The peak last year was 7.0%. We are moving in the right direction.

Next week is all about Jobs, Manufacturing and Services reports.

Leaving you with the below. Have a great weekend.

-

When you hear hoofs think horses not zebras

Frequently, we find ourselves avoiding the obvious and instead leaping towards the obscure.

We tend to overcomplicate everything and this applies to the Mortgage and Real Estate industry. Home values are up because we don’t have enough inventory. Rates refuse to drop because the economy keeps plugging along stronger than everyone thought.

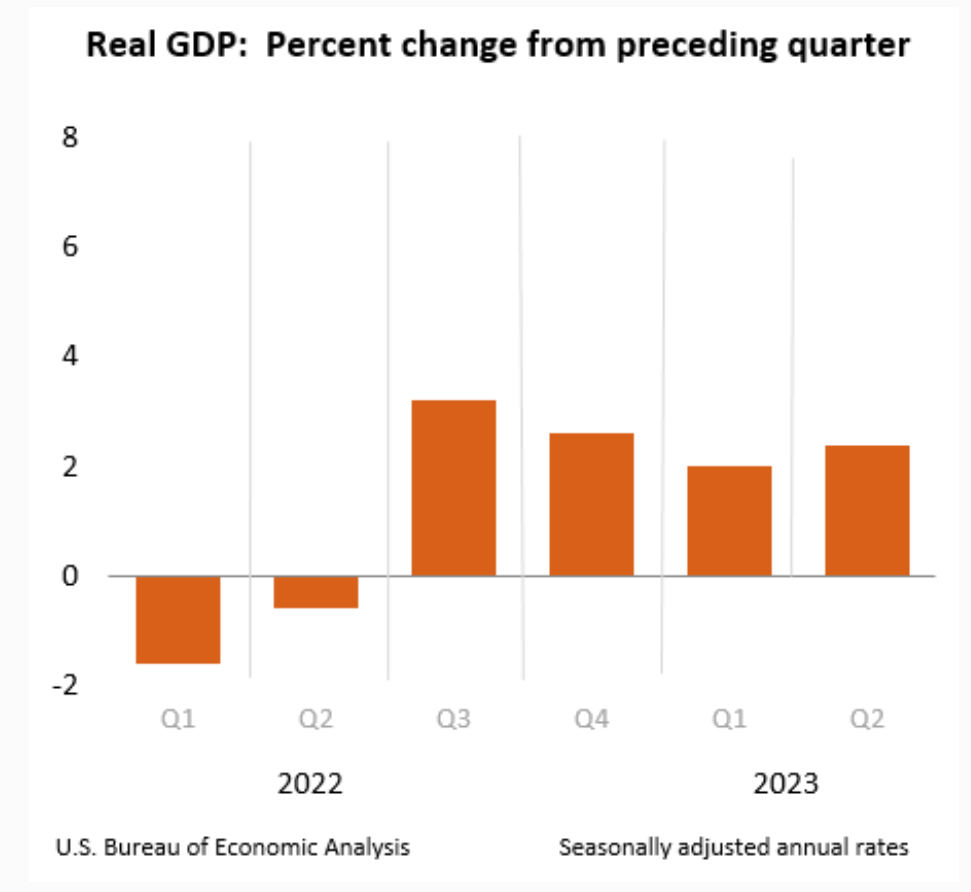

Gross Domestic product – GDP is Up 2.4% from the expected 2.0%. We have a strong economy and right now the Feds don’t like it.

Potential sellers are shackled to their low interest rate Mortgages and are hesitant to make a move.

So here we sit waiting for the other to blink. Stop waiting for tomorrow because tomorrow may be a year away.

Always feel free to reach out anytime.

-

New Home Inventory increased 0.7% to 432,000. Fed Comments today.

The good news is New Home Inventory is up but rates are stubborn as a mule. The challenge is Builders are Selling Air. Looking at the completed homes, the actual available supply is only 1.2Months of inventory.

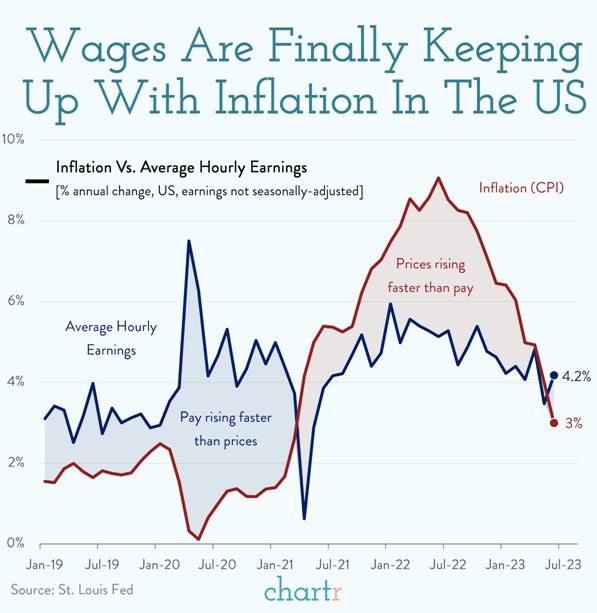

Wages are keeping up with Inflation with Fridays PCE report, we should see favorable inflation numbers and positive rate change.

Always feel free to reach out anytime.

-

Tomorrow, Tomorrow, I love you Tomorrow, it’s only a day away…

That song is stuck in my head, but seriously this is a busy week starting with the FED rate hike decision on Wednesday and the PCE report Friday.

Remember the FED rate is not the Mortgage rate and typically helps the Bond Market i.e. lower rates.

Home prices are still rising. Inventory levels are stubbornly low.

Have a great rest of your week and always feel free to reach out.

-

Put your seat belts on, it’s going to be a Bumpy Ride..

We have quite a week ahead of us. The Federal Reserve will be making their rate hike decision Wednesday and the PCE – Personal Consumption Expenditures report will be released Friday. This will give us more insight into inflation.

Housing we have Case Shiller, FHFA and New Home Sales and Pending Home Sales reports.

Interesting data from the Realtor Confidence Index Highlights:

- Average bids per home sold 3.5 up from 3.3

- Sold over list price 33% up from 31%

- % of home Sold that were on the market less than a month i.e. 30 days is up to 76% from 74%.

That last bit of information demonstrates the pent up demand. The flood gates are going to open once the rates drop below 5% or maybe sooner.

Get pre qualified. Have us help you get your ducks in a row before you jump into the water.

-

Consumer cash buffer dwindling

There is an interesting correlation between inflation and Savings. Inflation generally is more demand than product. Demand requires ability and that ability is cash.

The dwindling cash reserves puts pressure on corporations to compete with fewer buyers causing the prices to drop.

The housing market on the other had has low inventory and high prices.

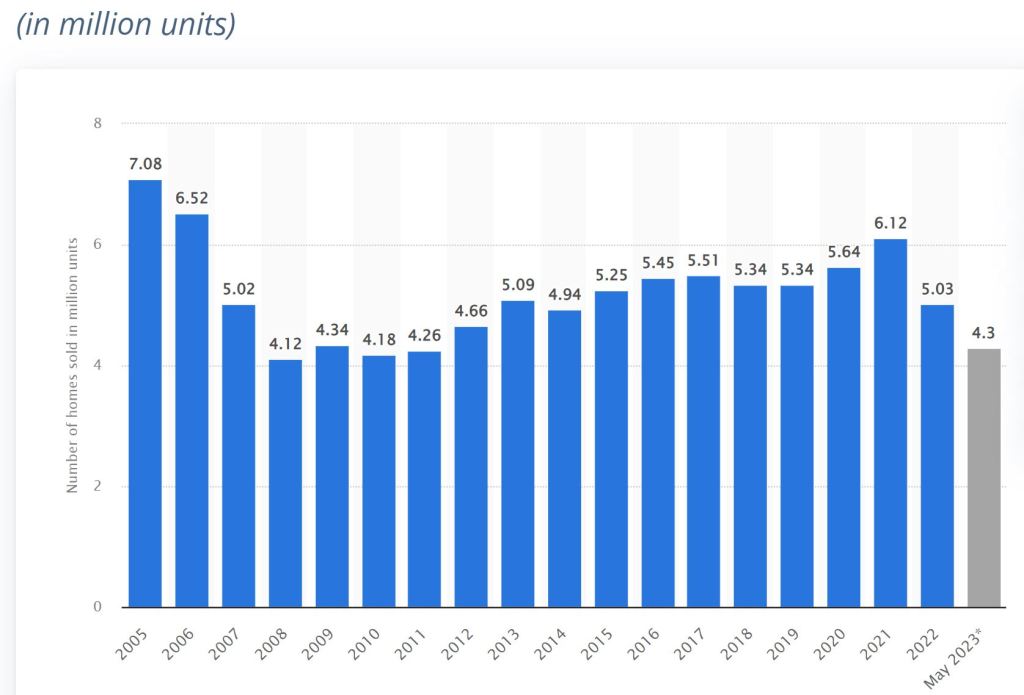

Existing home sales fell 3.3% in June. Y/Y down 18.9%. Inventory is half the levels we saw in 2019, a year that was already tight. Homeowners with low interest rates or own their home outright are the artifact of this low inventory.

-

Time to get off the porch and go find a Home.

Getting pre-approved for a mortgage is more important now than I have ever seen. Low inventory demands a clean and attractive offer. To that end, a full underwritten approval is not only necessary but required by more and more sellers.

If this is your first time buying or you are a pro, dust off the W2s and get you qualified.

Below video steps through the process.

Always feel free to call or email.

-

“You want a statement made by someone other than a nut, but, by making such a statement, that person becomes a nut”

Yesterday when I was surfing the financial channels I heard a voice that said “We do not expect a Recession, soft landing or otherwise”.

Get ready, Fun facts below – source Primerica Q2 survey Middle-Income:

- 76% cutting back on non-essential purchases

- 36% using their credit card more often

- 71% say income falls short of cost of living

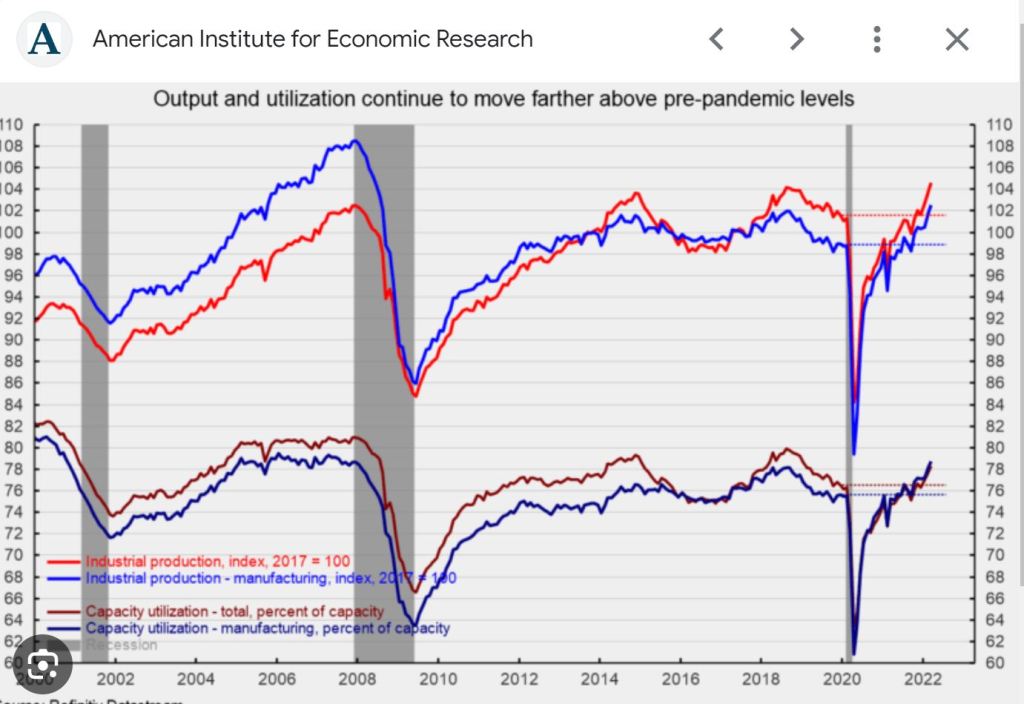

Industrial Production and Capacity Utilization

Think 100% is a factory working 24 hours a day. Currently we are at 78.9% slight drop from last month. This decline directly correlates with the buying activity of consumers.

Below you can see the 2008 Global financial crises and the 2020 pandemic affect on capacity usage.

Happy Tuesday, and always feel free to reach out.

-

If You’re constantly living in the future- you’re not enjoying the present.

The Powerball jackpot is over $900M and yes I bought a ticket this morning. But it begs the question; Dreams are fun but reality is real.

I have met and talked to many buyers and sellers who voice the same sentiment. “We are just waiting for the rates to go down” and “I heard home prices might drop next year”.

Redfin released their housing report for June, showing what we already know, housing supply remains very tight. Active listings are down 15% Y/Y and equally as important New listings are down 31%.

More inventory is not coming online and this is keeping home values up.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.