-

Imputation and why it’s a big deal.

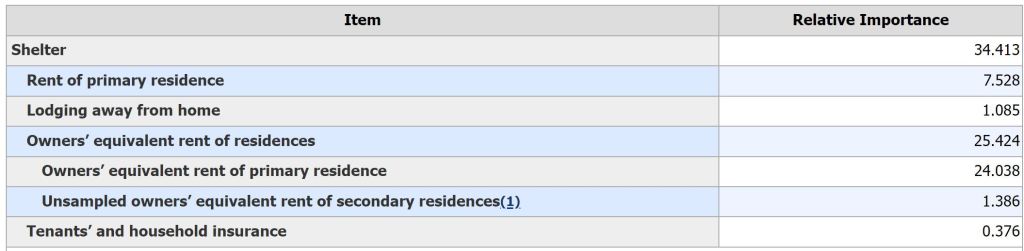

Last weeks CPI-Consumer Price Index includes Shelter costs – Rent rose 0.4% in July and 7.7% year over year. Shelter cost account for 2/3 of the CPI number.

But here’s the question: how does the industry measure or attain that data?

One of the measurements is called Owner’s Equivalent Rent or OER, which tries to capture an increase in homeownership costs and help direct individuals to either buy or rent based on monthly cost. This is done by survey only with no real hard data. This is called Imputation.

-the assignment of a value to something by inference from the value of the products or processes to which it contributes.

The question to the homeowners is “what would you rent your property for?”.

The point is there is hard data and then there is soft data. The Fed is making decisions based on both. Shelter costs are a big component of the CPI Consumer Price Index.

Have a great week and always feel free to reach out.

-

“You miss 100 percent of the shots you don’t take.” – Wayne Gretzky

Too often we sit on the sidelines or push things off for the next day.

The Real Estate market is what it is and if we wait for it to chance or wait for the rates to drop, we miss the shot.

Home prices continue to go up more than offsetting any delay in purchasing for a lower rate.

An interest rate of 5% on a home that has appreciated 10%while you wait gets you nowhere.

On a soap box today. Road trip so a bit punchy last few days.

Get out there and take on the world, its there waiting for you.

-

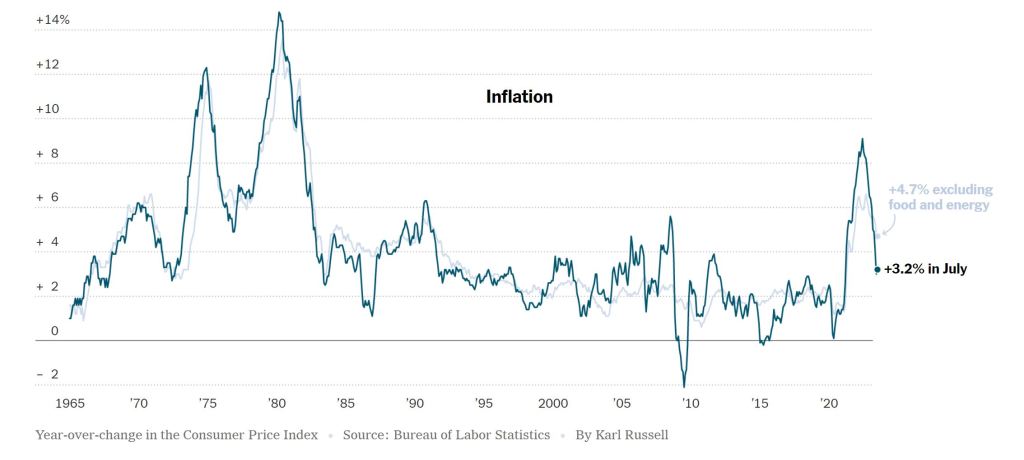

Inflation data in and just a bit cooler than expected.

The CPI – Consumer Price Index for July is out. Overall inflation increased by 0.2% lower than expectation of 3.2%.

The Core rate, which takes out food and energy prices also increased by 0.2%, again inline with estimates. Shelter costs rose but slowing down.

Initial Jobless Claims rose 21,000 to 248,000 but the Continuing Claims dropped 8,000 to 1.68M.

Rates are taking this with a grain of salt as we wait for more data this week and for the Feds September meeting.

-

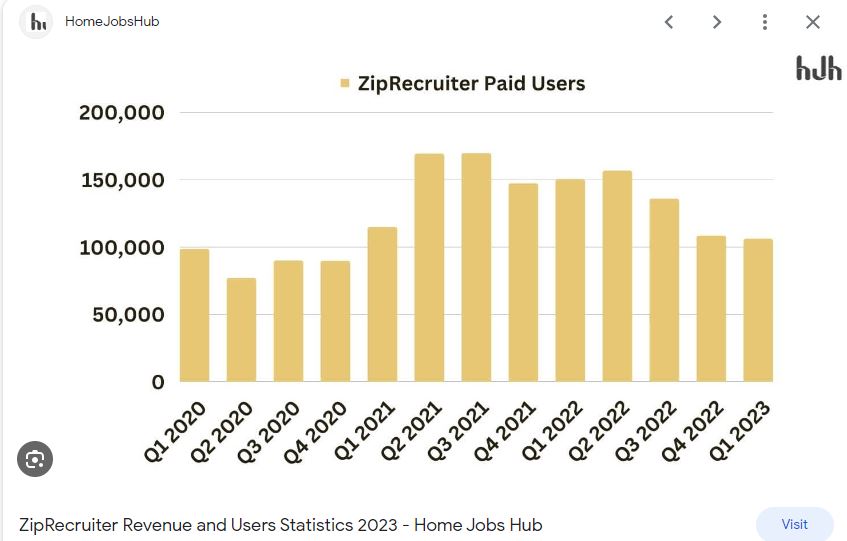

ZipRecruiter Slowdown in Hiring and Fed Speak.

We are getting conflicting data from the San Francisco and Cleveland Fed.

The SF Fed wrote an article on shelter costs which is the biggest component to CPI inflation report. They anticipate a big decline in Shelter costs this year from 7.8% down to 5% by November. Their projections are to go negative by May 2024.

The Cleveland Fed is forecasting inflation will increase by 0.4% in July which is an increase from 3%. The forecast for July is even higher at 4.1%. This part is not good for interest rates.

These numbers are based on a year over Year comparison so it’s a bit tricky teasing out the correct data.

ZipRecruiter is showing a slowdown in opening and willingness to hire. This is the third quarter in a row suggesting a big slowdown in the job market.

-

Philly FED said all good ease up, but Fed Gov wants more hikes.

Philly Fed President Patrick Harker spoke this morning and stated or suggested that the Fed can now be patient and hold rate hikes later this year.

His comments are the exact opposite of Fed Governor Michelle Bowman, who wants more hikes.

Here is the Kicker… The difference is Bowman was a lawyer with no financial or economic background, while Harker is a PHD in Economics.

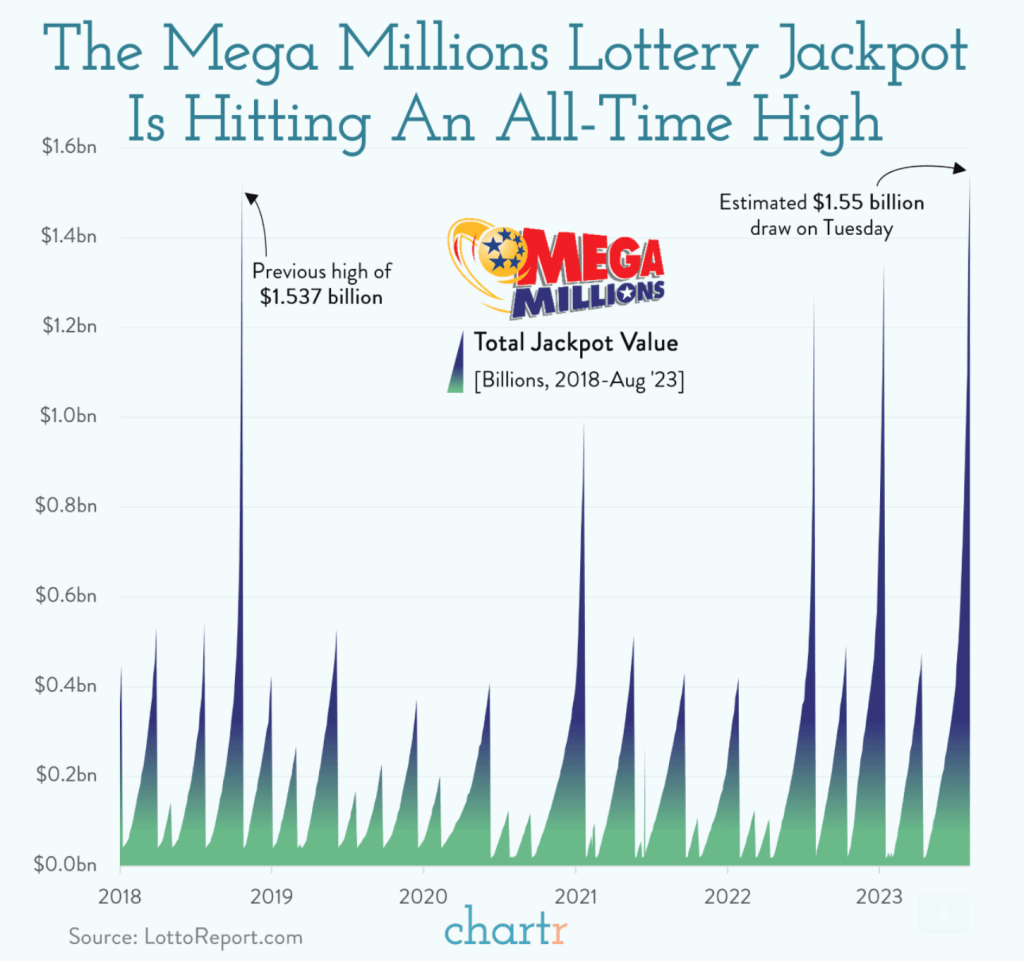

Did you buy your lottery ticket yet?

-

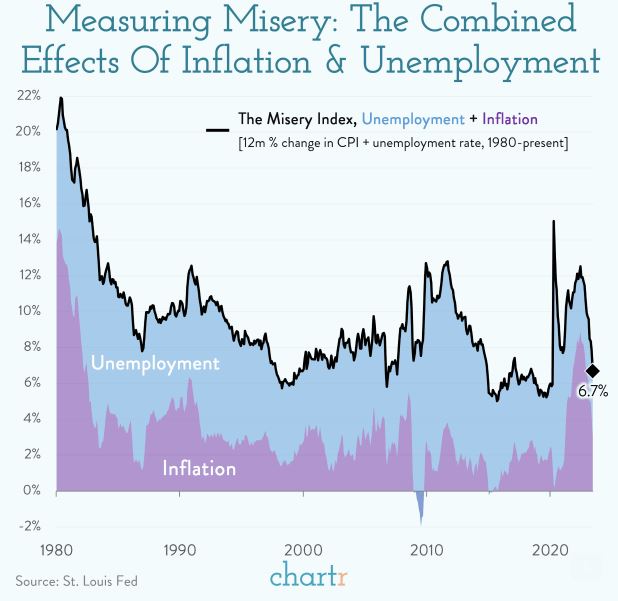

What does Inflation have to do with Unemployment, Hint, Everything.

As we wait with anxious breath for the CPI and PPI inflation numbers later this week, I ran across the below graph.

I find it absolutely fascinating the correlation between these two data points. Is inflation causing unemployment or the other way around? From a consumer’s perspective it sure seems like manufacturers raise prices to offset or compensate for dipping sales due to the lack of demand from the unemployed.

But this goes against high school economics 101; supply and demand.

This graph is called the Measure of Misery or the Misery Index. Right now it stands at 6.7%, not too miserable compared to the average of 9.5% from 1980 to 2023.

Have a fantastic week and always here to help.

-

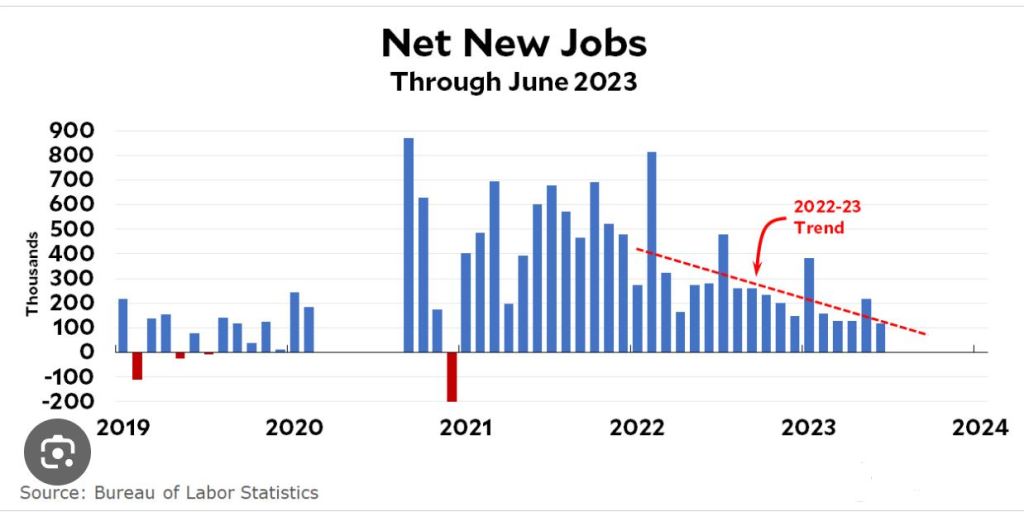

Soft landing is far better than a Hard fall.

The Bureau of Labor and Statistics (BLS) reported 187,000 Jobs created in July. The estimate was 200,000. June numbers were also revised lower from 209,000 to 185,000.

We are looking at the trend line. This is what a soft landing looks like.

Ran across this graph the other day and thought it was interesting given a new Nuclear Power Plant just went online last month in the state of Georgia. First reactor in the USA since 2016.

-

What a difference a Day Makes, we hope.

Jobs report coming out tomorrow. Been a tough week for rates. I am going to make this short as I am taking a in person test updating my National Mortgage credentials for TX and AZ license.

I will update in the Morning.

-

Should I stay or Should I go now….

Annual pay for job stayers increased 6.2% year over year, but job changers saw an average increase of 10.2%.

ADP the payroll company Employment report for July, showing 324,000 jobs created. The estimate was 190,000.

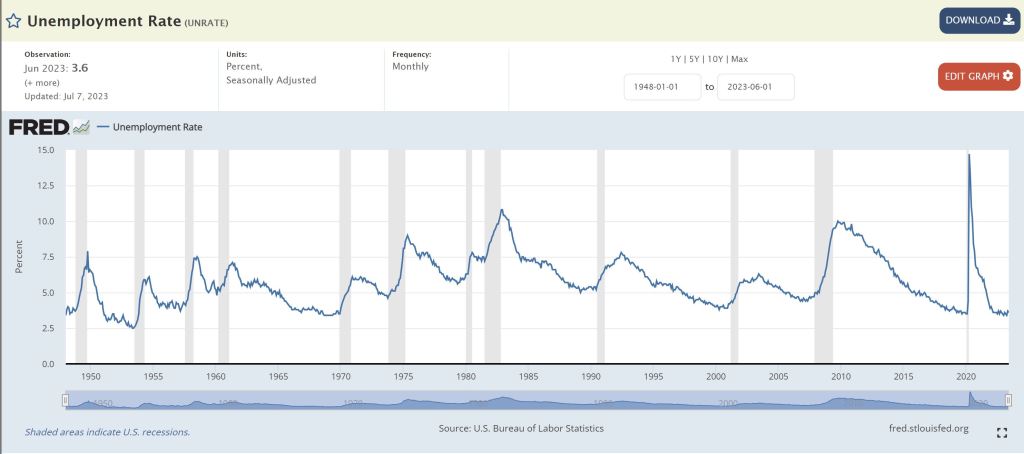

There are many more stats I could write or sum it up. Economy is strong, unemployment is low but a clear trend of fewer openings on the horizon.

The real data comes out Friday. Stay tuned. Below is the Unemployment rate going back to 1948.

-

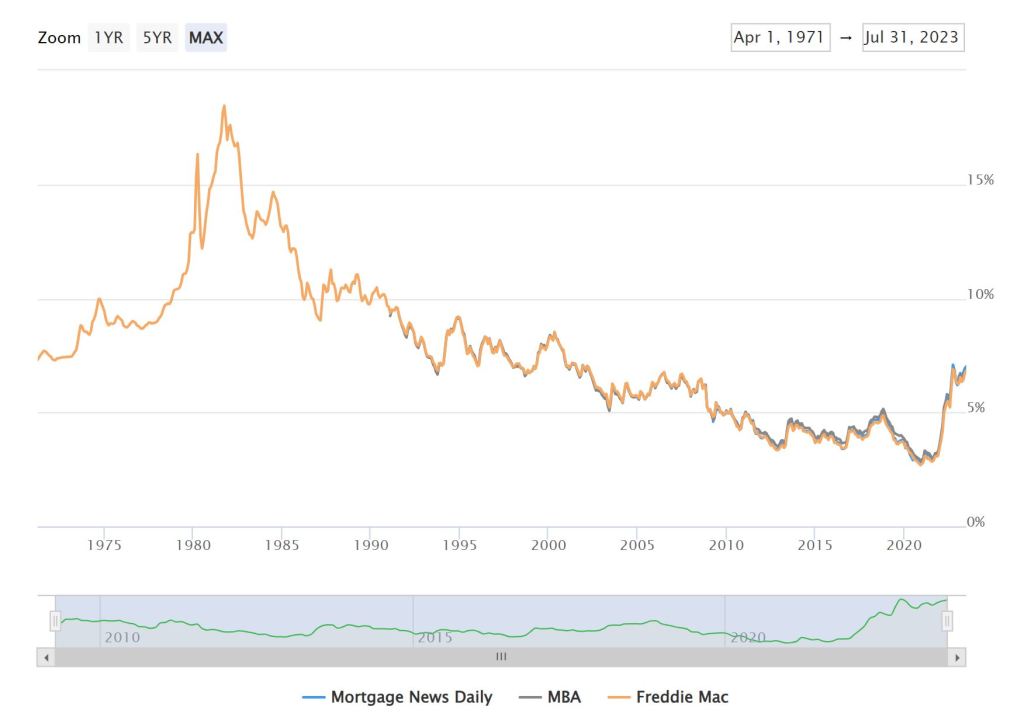

Watch where the Dog is Walking not how his tail is wagging

If we look too closely at anything we focus on the wrong cue. The first thing I do in the morning is check rates. Am I going to have a good or bad day?

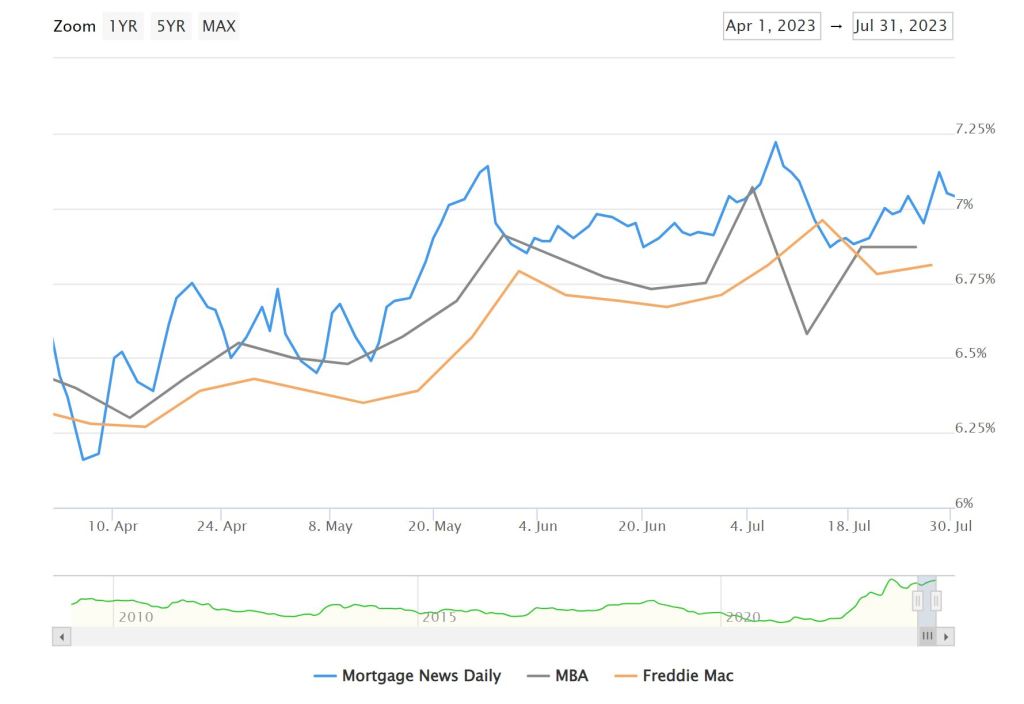

Take a look at the two graphs below. The first is a 50+ year view, while second graph covers three months. We all want the rates to go back to sub 3%, but the likelihood is next to zero.

In the long term, rates in the 6’s and even the 7’s are normal, and in some cases, low. We hope to see rates come down closer to the 5’s or high 4’s, if only to shake loose the 3-percenters (coined a new word) and encourage them to get back in the market and sell their homes.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.