-

Let’s look at the Raw Numbers

What the Feds look at and how they’ve been behaving.

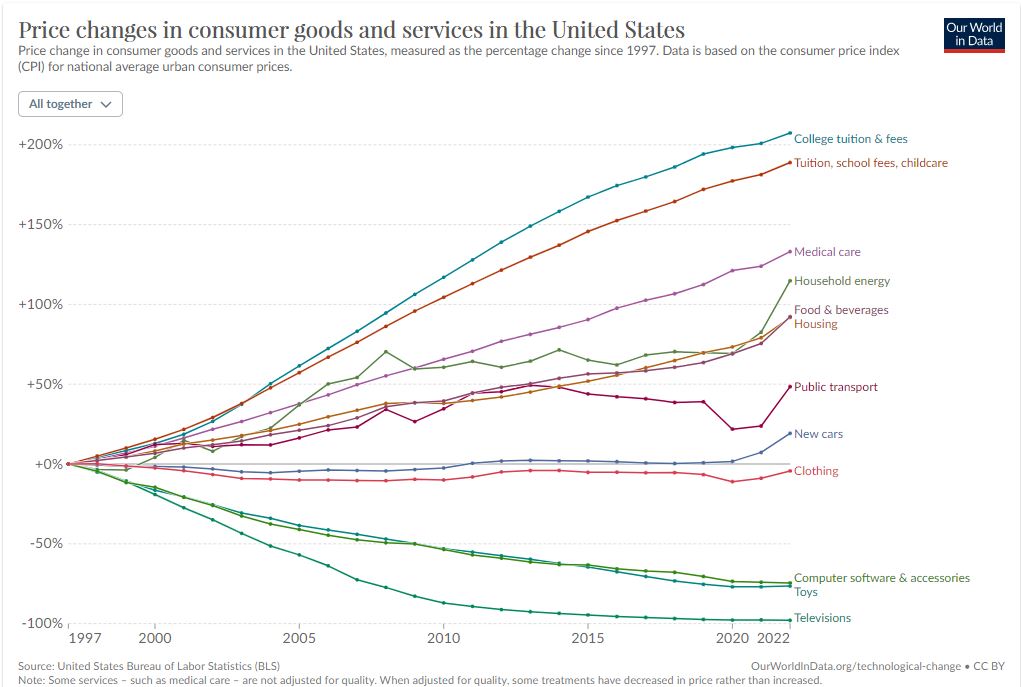

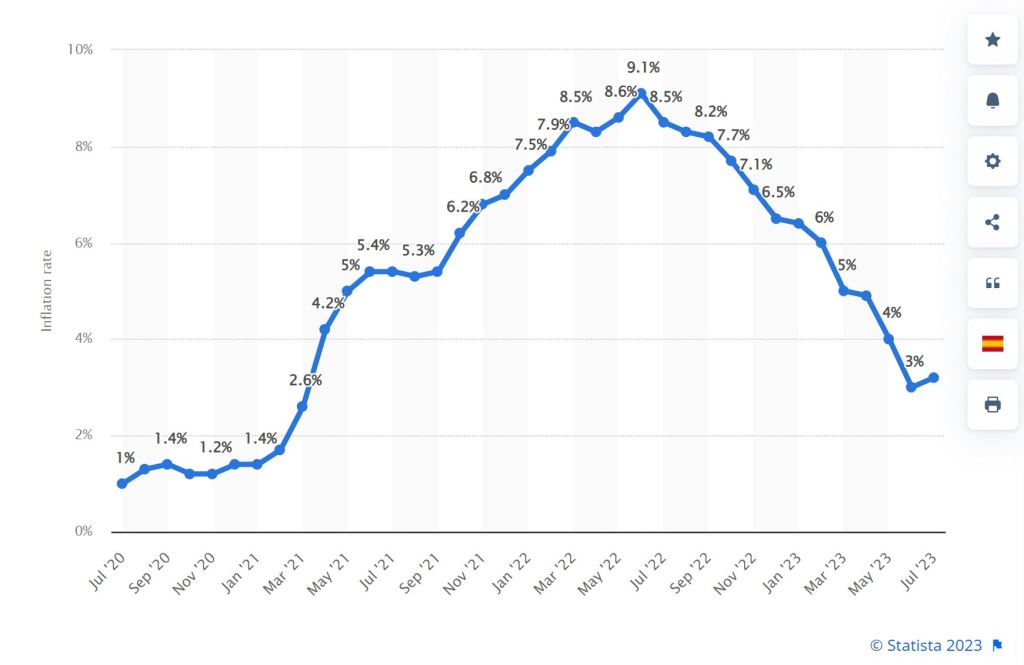

CPI Consumer Price Index down from 9% to 3.2%. Core CPI 6.6% to 4.7%.

Inflation June 2022 9.1% today 3.2%

Shelter costs rose 7.9% in the last year.

Median Home price 2019 $322K today $458k

Housing inventory average 1982-2023 2.3M April 2023 1M.

We are well on our way to lower Fed Rates, Lower interest rates and with that more inventory as the Pain to Sell wanes.

Its Monday almost the end of August already. Someday we will look back at 2023 and say whew got through that year.

-

It’s a 2% Inflation goal so quit asking me – Jerome Powell-summary

Fed Chair Jerome Powell spoke this morning at the annual Jackson Hole Symposium. There are two positions, one is Hawk and the other is Dove. The Hawk is still in the air.

There have been 11 rate hikes pushing the Federal Funds rate to a range of 5.25%-5.5%. Highest in 22 years. Coincidentally the mortgage rates are also at a 22 year high.

Hang in there; this too shall pass. Next week is the big inflation and jobs report.

Have a fantastic weekend, I think I’m going to gold this afternoon and try to get the Feds out of my head.

-

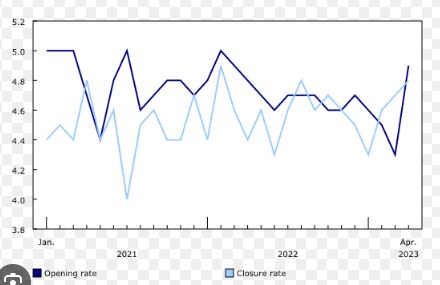

Birth and Death Model and the pandemic

Now that I have your attention. The Birth and Death Model is a traditional workforce health indicator where Birth is the start of a company and Death is the closing of a company. The pandemic saw fewer close business compared to openings.

There is correlation between the two. This is an average of all company types so the percentage can vary from no change in the utility companies to leisure and hospitality which saw an decrease in business starts in January of a negative 16% to a positive 80% this July. Construction varies dramatically throughout the year swinging from a negative 44% in January to a positive 11% in July.

The forecast model predicts a negative Birth to Death Model indicating slower job growth i.e. Fed’s work has done its job.

We are eagerly anticipating Jerome Powell Fed Chair comments on inflation tomorrow.

-

If it Bleeds it Leads – Stop reading headlines

There is an interesting artifact in the jobs market, specifically the BLS The Bureau of Labor Statistics. Job numbers are released and then revised the following two months. This is typical and always happens.

The initial report overstated the job gains by 300k from April 2022 to March 2023. 25,000 per month or almost 9%. The market does not react to it because it’s in the past. That initial headline ruled the day; details matter and sometimes it takes two months to be correct.

If the September 1st jobs report is weaker as expected the Feds should stop the hikes.

New home sales are in demand and the builders are selling air. Of the 437,000 new homes for sale 164,000 were not even started.

I can feel the winds a turning… be ready for it and get pre-qualified and keep saving money for your down payment.

-

Please Jackson Hole Meeting help a brother out…

Rates are seeing their highest levels in over 20 years. We expect this to change favorably after the Central Bankers meet in Jackson Hole. We will also hear from Powell on Friday.

What we don’t want the Feds to be is hawkish.

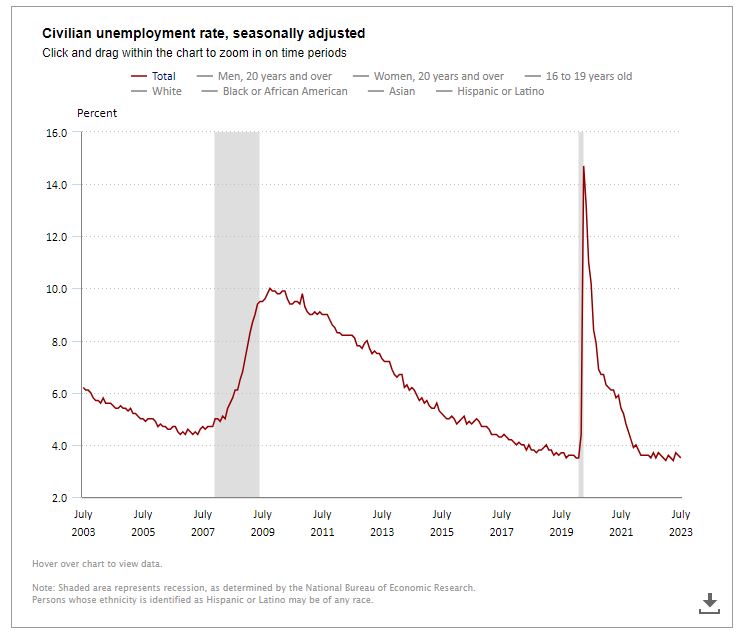

Tom Barkin, the Richmond Fed President, spoke earlier this morning and said the Feds need to stick to their 2% target for credibility. The Feds need to see a weaker labor market before they stop for good or at least for a while.

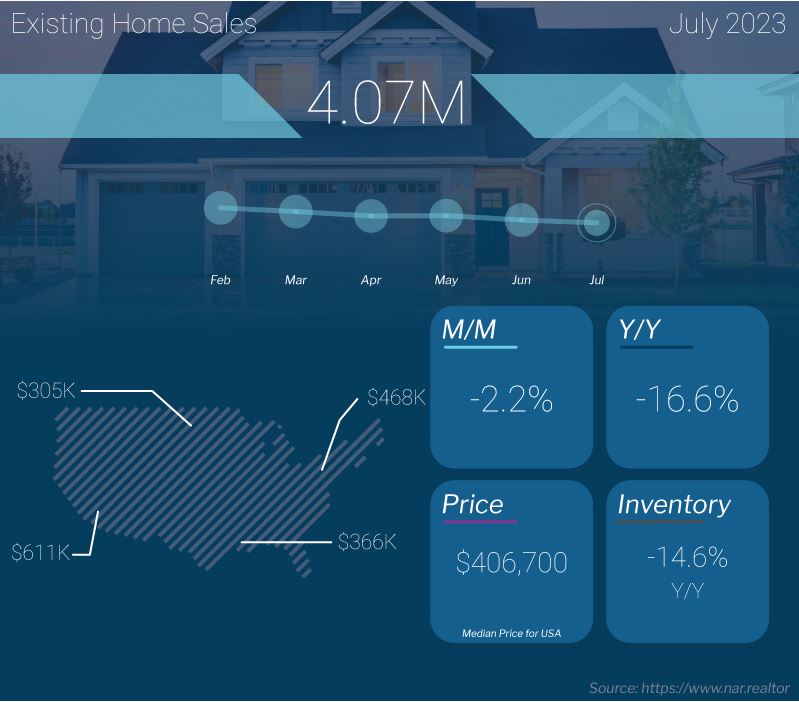

Existing Home Sales, which measures closings on existing homes, showed sales fell 2.2% in July. Sales are down 16.6% Y/Y.

Inventory is half that of 2019. 74% of homes sold in less than 30 days.

-

Pigs have been flying around for the last two years…..

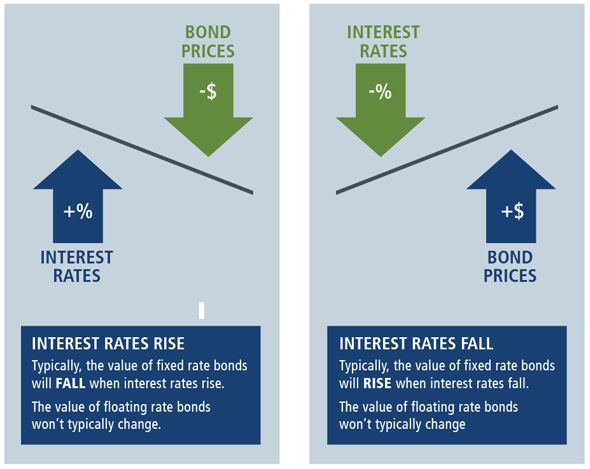

Let’s try to wrap our heads around Bonds. They are the vehicle that drives the interest rate for Home Mortgages, specifically 10y Bond.

What is the difference between Bond Yield and the Bond Price.

If you buy a $1000 bond at the issuance date, the bond price is the face value of the bond. The Yield will match the coupon rate of the bond. All good and if you have a 1% interest rate for a 10y bond, that is what you will be paid out until the maturity date when you get your initial purchase back.

Let’s imagine you buy the same bond but six months later. The new public offering or issuance date is now 2% interest. How does this affect your Bond locked in at 1%?

If you never plan to sell, it does not matter. You locked in your yield.

If you plan to sell, your new Yield is now based for this example on a lesser valued Bond. That old bond may trade at $980 which then translates to a lower yield over time.

What we are seeing in the market is a huge Shorting of the Bond market. The current short interest in 10-year Treasuries (bonds) rose over $800 Billion up 20% just in the last month.

“For the last few decades, if you asked when shorting bonds would be the trade of the year, you might get the classic response: when pigs fly,” she wrote. “I guess we can say that pigs have been flying around in 2022.”

What this all means is we anticipate rates dropping this summer.

-

Why we still might have a recession and the impact.

Most of the talking heads and saying we will not or most likely will not have a recession. Here are a few indicators that say otherwise.

- The Yield curve is severely inverted. This means the 2y note has a higher yield than the 10y note. Usually a longer term means higher yield. Why buy a 10y when the 2y is more profitable.

- The full impact of the slowdown has yet to be felt from the Fed hikes.

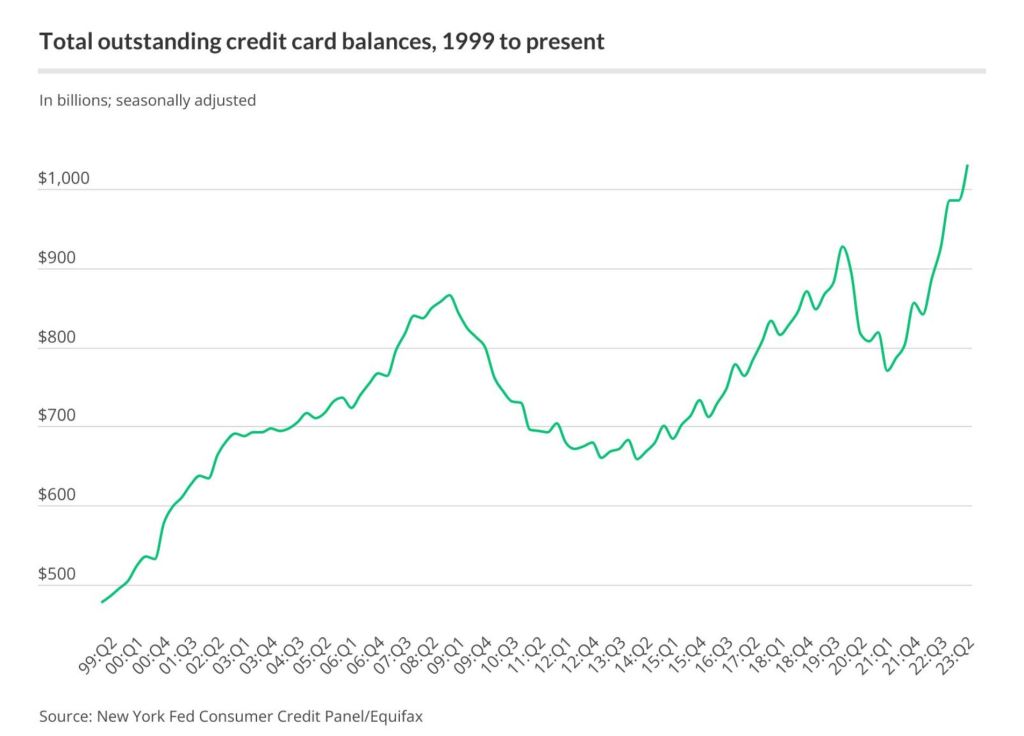

- A lot of consumer spending but a lot on credit cards now surpassing $1T in credit card debt.

- Student loan payments start October 1st.

- Excess savings from the stimulus was $500B in march but is now $190B in June. this money will go away in the next month or so.

-

The battle over Inflation is over, or is it?

The Fed Minutes released yesterday show a consensus that the US economy will not enter into a recession. You would think this is good news but from the Feds perspective the battle over inflation persists and more rate hikes may be needed.

The labor market continues to outperform expectations. The Feds are looking for weaker job figures before calling it quits on the hikes.

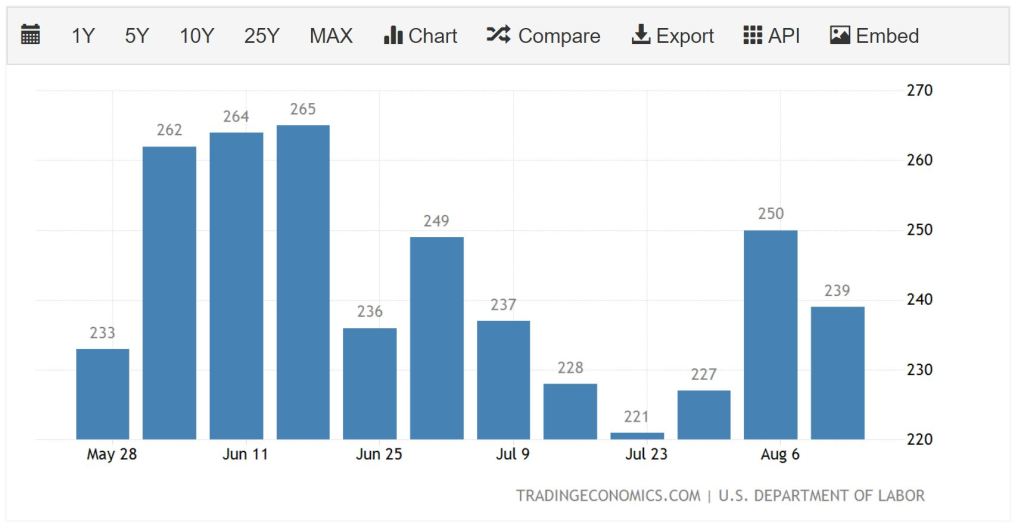

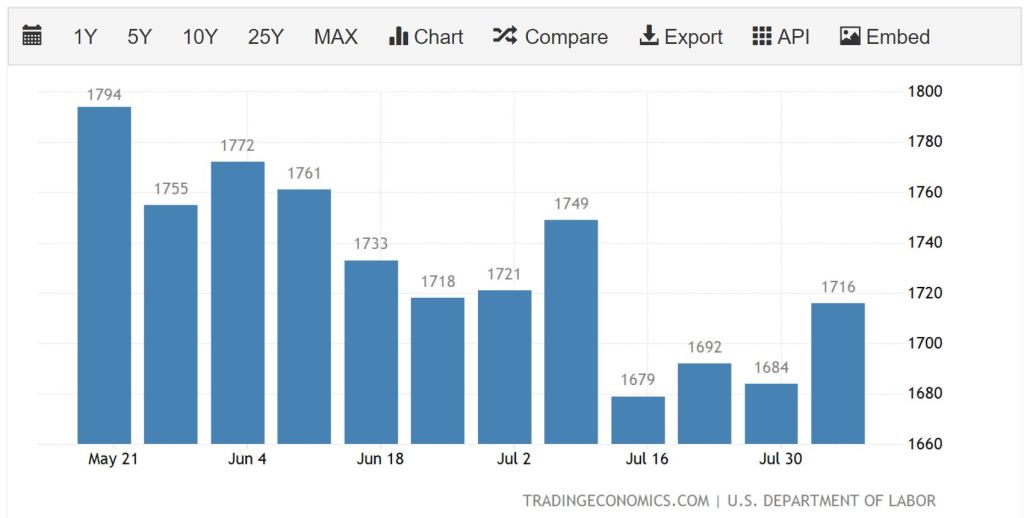

Initial Jobless Claims fell 11,000 to 239,000. Continuing Claims rose 32,000 to 1.72M. Employers are holding onto the employees they already have.

First graph is Initial Jobless Claims, second graph is Continuing Claims.

-

Supply and Demand, I demand more supply -Housing Market

Supply is not keeping up with demand. It’s a problem with solutions that take time and interest rates dropping.

Everyone is holding onto their homes with low interest rates, Builders are nervous to over extend their capacity and be stuck with homes they cant sell for the profit required.

Housing starts were up 4% in July to 1.452M. Single-family starts rose 6.7% in July to 983k. Starts are up 9.5%. But it’s just not enough.

Housing Permits i.e. future supply were flat last month at 1.442M units. Down 13% from last year. The last three months have seen higher starts and permits but still not enough.

My opinion is rates have to drop to shake loose all those homes that people cant afford to sell and buy the home they want.

-

Retail Sales Up, Credit card debt over $1T, Home Buyer activity.

A bit of a conundrum that is coming to roost. Retail sales in July were up 0.7%, almost twice the estimate of 0.4%.

Spending online at restaurants/bars and non-discretionary items topped the list. There is what’s called the “wealth effect”. It happens when the Stock market rises and makes people feel more wealthy and more comfortable spending.

Freight Index came out and its shipments fell 1.2% and now 9% lower year over year. Shipping costs has fallen 17% from last year. So what’s the deal? Less product being shipped but more consumers purchasing non-essential goods.

Credit card debt is over $1T and the rates are approaching 25%. Servicing that debt is becoming more and more expensive.

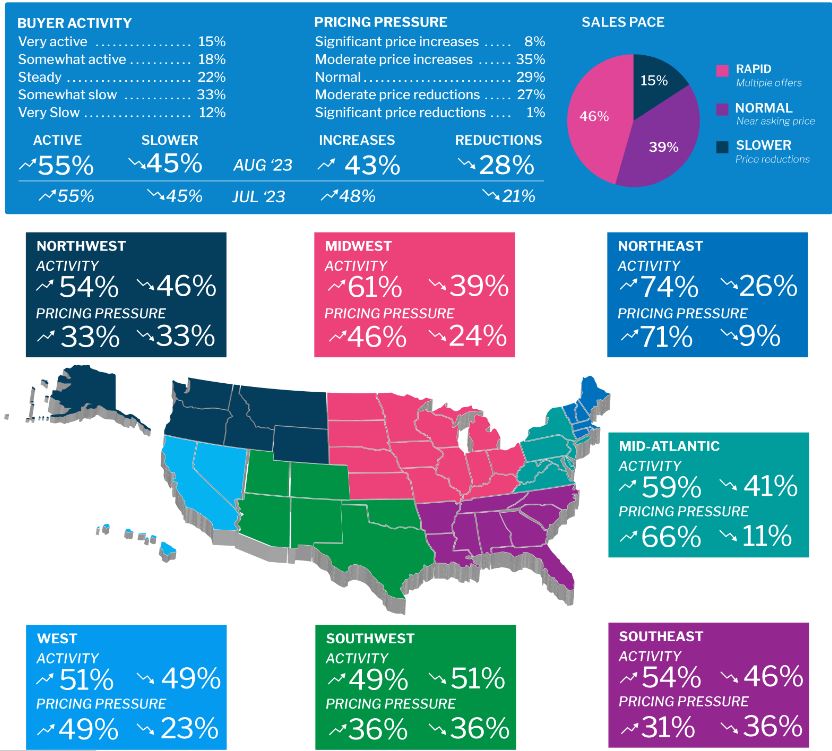

Below Home buyer activity Nationally.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.