-

It’s baked in. Let’s crunch the numbers on Inflation.

There is a feeding frenzy in the news. Inflation is up, oil prices keep climbing….The world is ending… Let’s break down the numbers and take a deep breath.

Yes the CPI August Consumer Price Index which measures overall inflation increased 0.6%, and was in line with expectations. The Core CPI decreased from 4.7% to 4.3% again as expected.

Energy prices rose by 7.3% Y/Y, and was down from 7.7%.

Rents rose 0.5% last month and up 7.8% Y/Y but down from 8%.

Lodging away from home also fell 3%.

A wealth of data flows in, yet many news outlets seem reluctant to delve deeper into the true essence and beauty of the data. It’s akin to observing a single bird soaring through the sky, swiftly changing course from left to right. Only when you step back and broaden your perspective do you witness the mesmerizing spectacle of a flock of birds engaged in a graceful ballet.

We are headed in the right direction. The FEDs will most likely pause on the rate hikes in September given the true long term data that has been coming in this year.

-

Disneyland Opened its gates 68 years ago.

I’m just trying to find my happy place.

Wednesday the CPI Consumer Price Index and Thursday the PPI Producer Price Index for Retail Sales comes out. These are two important gauges of inflation for the FEDs.

Remember the FEDs are data driven.

Definition of CPI: It is the Measure of the overall change in consumer prices based on a representative Basket of goods and services over time.

Forecast for tomorrows CPI is 3.6% from 3.3% but the Core CPI estimate is 4.3%. But it’s down 0.2% for July from 0.6%.

Definition of Core CPI: Is the change in prices of goods and services, except for those from the food and energy sectors.

In a nutshell, Inflation is not going away. The FEDs may say, one more rate hike then we are done.

-

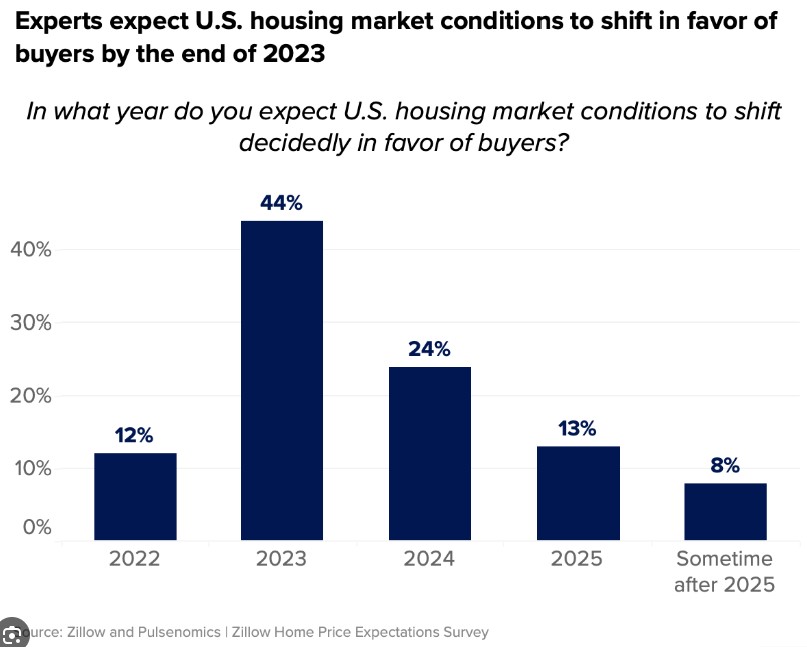

Price Cut concerns, are home values going down?

I was at the grocery store yesterday and I noticed quite a number of sale prices on items I actually wanted and needed. I have enough laundry detergent to last two lifetimes…

This struck me as a consumer for the first time in two years that prices are dropping for actual items we want and need. It’s anecdotal but sure seemed real to me.

In the housing market we are seeing price reductions rising year over year. But here’s the rub.

2018/2019: Home values up even with price reductions climbing.

2020: Home prices rose, reductions still strong.

2021: Home prices up 19% and price reductions rose sharply.

2022: Home prices skyrocketed as did price reductions.

Today: Home values are still rising as are price reductions.

Having been in the industry for over 19 years, the glaring omission in the data is inventory and greed. High demand, low inventory. Low inventory sellers get greedy and overprice their homes.

-

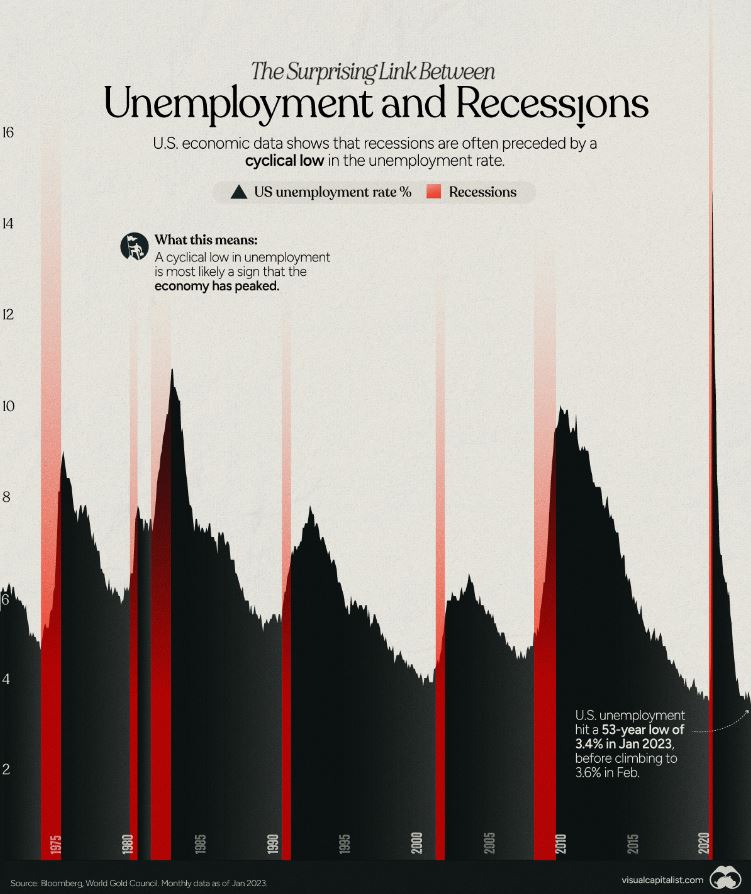

Feds Thinking Hold, Recession? What Recession.

NY Fed Pres John Williams said monetary policy is in a good place. He also said recession talks have now vanished.

Here is the interesting part; how can there be a recession if the unemployment rate is so low. and we never get recessions when the unemployment rate is higher.

It’s about the differential. When the unemployment bottoms and then moves higher, that is when we see a recession with 100% accuracy. Unemployment then moves higher during the recession. The April unemployment rate was 3.4% now it’s 3.8%.

Consider what we are up against this fall. Higher spending on credit cards. Those cards have higher rates, the delinquencies are higher, student loan payments are coming, savings rates are declining, and almost all of the excess from the stimulus is spent out of the system.

The silver lining is if we were to see a recession, inflation and mortgage rates would decline as they always do.

-

Rates

It’s the question that comes up daily. When are the rates going to drop? Should I buy now while the home values are going up or just wait for the rates to drop.

At this point it’s a crystal ball. We just don’t know. Technically we see the indicators but it’s just not happening yet.

The Feds are Data Dependent. If they see less growth and inflation, the Fed will set a more friendly policy stance and rates will move lower.

Remember what the Feds are doing; they are making it less attractive to borrow money to expand businesses and do other purchases that stimulate the already hot economy.

-

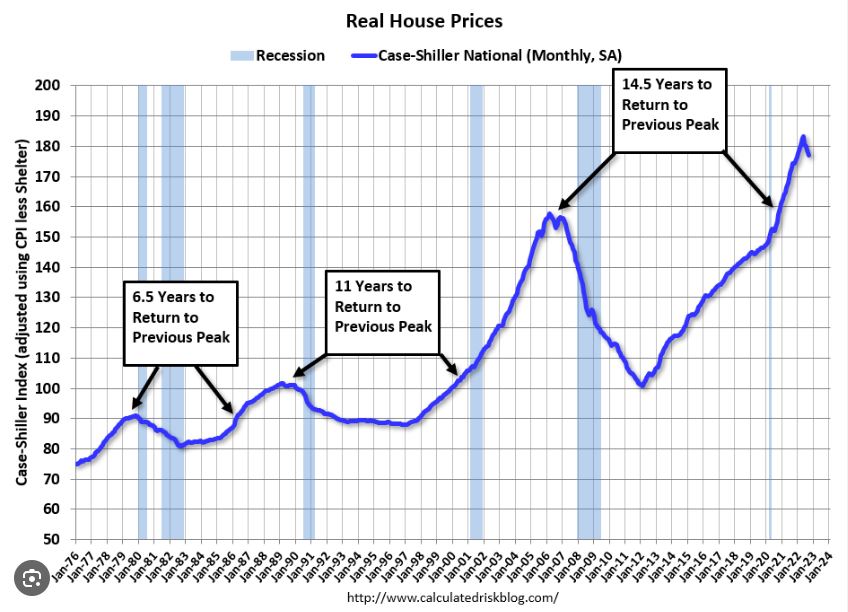

Home Prices rose 1.5% in July, 4.4% this year.

I am now speaking to all that are waiting for the rates to drop. Stop waiting to purchase. Home values continue to rise and offset any gains by waiting for the rates to drop.

When rates drop your competition will be drastically higher as more buyers get into the market.

Feds are talking and I see the doves in the air. Let’s look for a pause in rate hikes this month.

-

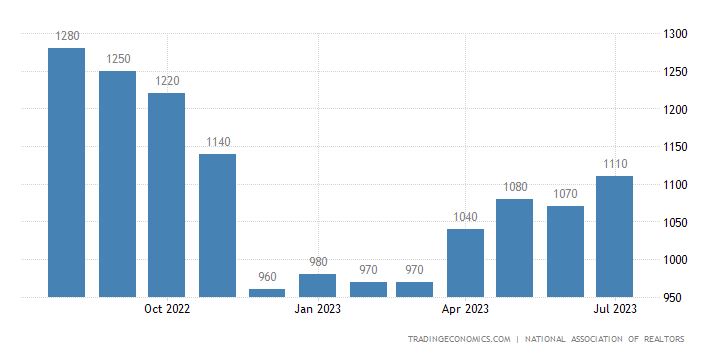

Housing Inventory increased 3.5%

Realtor.com’s August Report shows an increase in listing by 3.5% and only down 7.5% year over year.

Remember we were seeing 20 to 25% declines over the previous five reports.

This is going to be a FED heavy news cycle this week. Fed Governor Chris Walker has provided an even handed look opposed to the Hawkish commentary. We may be at the peak for fed hikes.

Later this week a slew of Fed Presidents in their respective reasons will be talking this week.

Have a great rest of your week and always feel free to reach out.

-

“Watch the Dog, not its Tail, to find out where it’s going”

Labor data came out and the initial numbers look like we are still adding more and more jobs and not retracting. 187,000 jobs created in July, slightly higher than the 170,000 estimate.

The issue is the revisions that come out for the previous months. As an example June was revised lower from 185,000 to 105,000. Same with July from 187,000 to 157,000.

The 3-month payroll average is now 150,000 vs the 6 months average of 194,000. Watch the dog, not it’s tail, to find out where it’s going.

New HELOC program 5 minutes to apply 30 seconds to get an answer. See video below.

Have a great Labor Day Weekend.

-

ADP Data is in and it was Normal.

I use the word Normal because that is what we want. Back to normal jobs reports post pandemic.

The August ADP Employment report showed 177,000 jobs created, which was weaker than the 200,000 expected. But July was revised higher from 324,000 to 371,000.

Job Stayers saw their annual pay increase 5.9% down from 6.2% and Job Changers saw an average increase of 9.5% but this was down from 10.2%.

You can kind of read the tea leaves with this report. Employers want to hold onto their employees and those same employees are not receiving as much benefit but switching employers.

There is a weakness in the labor market as large companies like Adidas, Adobe, IBM and Salesforce are “quiet cutting” their employees. This means reassigning workers with lower pay and lower title so they can trim costs.

It’s a strong indication we are getting back to normal and all the post pandemic hiring is subsiding.

I was fortunate to be a contributing writer for Mia Taylor for the BankRate article below. Enjoy.

-

Largely Inaccurate but Dangerous in Volume

I have been saving the below graph for a few months now. As I head to CE training, continuing education all day today, I wanted to share.

I have heard and read countless experts talk about inflation, rates, housing market, you name it there is an opinion. If enough people say it or the news presents it, it has a way of creating its own life.

The rates will go down, the housing marking will not crash and inventory will bounce back. Stop building a bomb shelter and get out there and live a little.

Always feel free to reach out anytime. Lunch break at noon pacific time.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.