-

How will the Government Shutdown affect Mortgages and Rates

Here is the breakdown:

Fannie Mae and Freddie Mac will likely still continue processing mortgage loan applications but federal employees in the middle of buying a home may not be able to have their income verified.

IRS processes transcripts for income verification and social security verification

FHA, VA and Rural Housing USDA, Reverse Mortgages will become backlogged with minimal staff.

Will it affect rates? There is a slight chance rates will go up due to uncertainty. The Buyers of the bond, which are mortgages that are bundled together and sold so lenders can free up funding to make new loans, are likely to want higher mortgage rates to compensate them for the unpredictability in the market.

But those rates are likely to come down once the government reopens.

The overall impact is more of an inconvenience of time and funding than a complete meltdown.

-

Consumer Confidence is perplexing

“Consumer confidence fell again in September 2023, marking two consecutive months of decline,” said Dana Peterson, Chief Economist at The Conference Board. “September’s disappointing headline number reflected another decline in the Expectations Index, as the Present Situation Index was little changed. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular. Consumers also expressed concerns about the political situation and higher interest rates. The decline in consumer confidence was evident across all age groups, and notably among consumers with household incomes of $50,000 or more.”

We are all in this together and there is light at the end of the tunnel.

-

Feds are Sticking to their guns on 2% inflation target.

I’m in Boston MA this week so this will be a quick post.

Chicago Fed Pres, Austan Goolsbee stated this morning that the risk of inflation remains higher than they would like.

Bess Freedman CEO from Brown Harris Stevens stated the obvious or what I have stated for the last year, that demand remains high and no inventory. Once rates come down, More inventory will come onto the market and home values will decline.

Except the last part. There is so much pent up demand for homes that even if we doubled or tripled the inventory we still may not have enough. Home values may adjust but The consensus is not meaningful.

We are headed for a perfect storm in a very good way. Rates will drop with inflation but when we can’t say. Get yourself ready and call us or your lender to get pre-approved with a mortgage checkup.

-

It must be easier was is to make a living but not this much fun…

That was deliberately confusing and Chat GPT agreed, but the point is there.

The Mortgage and Real Estate industry has been put on its head with everyone thinking if we just walk a little further, just over that hill the skies will open.

The reality is the housing market is stuck. Stuck with home owners afraid to let go of their low interest rate mortgages, afraid of what they can or can’t get after they decide to sell and afraid to do the wrong thing.

Not that long ago we went through the 2008 global financial crisis. The same buyers who lost homes 14 years ago and purchased in the last 5 years, don’t want to live through that again and will hold onto their homes even tighter.

Jerome Powell made it clear that 2024 looks to be the same as 2023. Like it or hate it, it is what it is. Get busy or stay on the porch, you decide.

-

Thank you FED … NOT

We continue to see interest rates rise the last two weeks and Jerome Powell, our fearless Fed Chair, did not disappoint.

Though he did not raise the Fed Rate he did state that the rates will remain high for the foreseeable future meaning deep into 2024.What you are seeing below is the UMBS 30YR. This is the 30year Uniform Mortgage Backed Securities. They are passthrough securities, representing an undivided interest in a pool of residential mortgages.

To make it more clear, Down is Bad – higher rates. But as you can see it’s cyclical so we are not falling off a cliff, I hope. To put this into perspective, the top compared to the bottom is about a point and a half of interest rate.

-

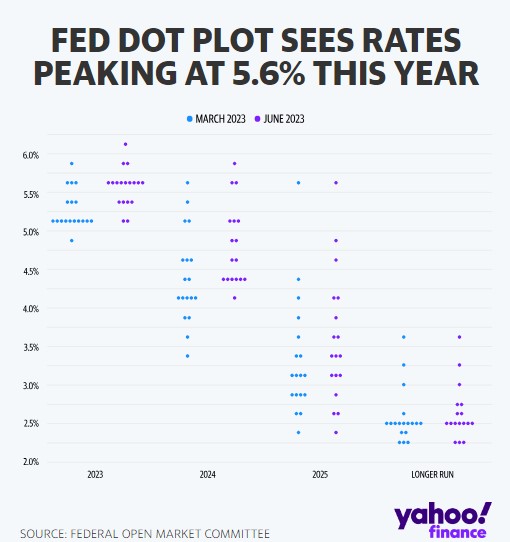

What is a FED Dots Plot chart and why you should care.

The Fed Dots Plot is a chart that shows you where each FOMC – Fed Open Market Committee member thinks interest rates will be by the end of the current year, two consecutive years after, and the more ambiguous “longer run.” Each “dot” represents a member’s individual view.

The graph below is the March and June Plot. Later today we will see the FOMC members projections.

What you are seeing is a strong consensus that the Fed rate will drop in 2024.

We have new projections on GDP, the unemployment rate, PCE Inflation and the new Dots Plot.

Look for Tomorrows post for mor information.

Are you Purchasing or refinancing? happy to help.

-

“The economy is weaker than it appears.” – Kaplan, former Dallas Fed Pres.

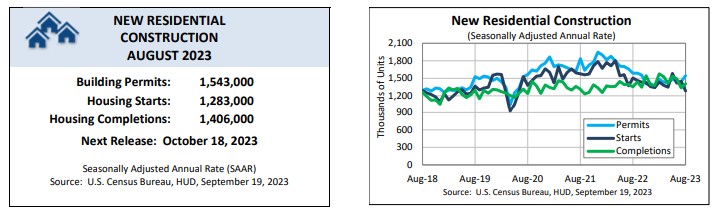

Supply is not keeping up with demand. Housing Starts fell by 11% in August. This means we are 15% down from last year. The decline was mainly in Multi-Family homes.

Single family starts fell 4% last month but up 2% Year over Year. Housing permits, which foreshadow the future supply, were up 7%, but down 3% from last year.

To put this into context. The Demand for new construction housing is 2M+ units. Actual production is 1.4M units. This is one of the reasons housing prices continue to rise.

Not to be too depressing but here are a bit more data points.

Current Sales fell 6%, Future Expectations fell 6 points and below 50%. Buyer Traffic fell 5 points.

Rising mortgage rates, lack of workers and buildable lots, and ongoing shortages of distribution transformers that connect the home to the grid.

To defend the Builders, they are the ones taking the risk. Spend all that money on land, materials and labor in hopes that one year or two years later you made the right decision with no control over inflation or interest rates.

I promise I will be happier tomorrow.

-

Fed Speak, You tell me.

Here are a few quotes from different Fed Presidents across the Country.

“Acknowledged shelter lags and said inflation would be at 2.5% today.”

“Said Fed policy is appropriately restrictive”

“Can be patient and hold rates steady, let actions taken do their work”

“Not how high to take the Fed Fund Rate, but how long”

“If tighter financial conditions are a headwind to the economy, the path of Fed Funds Rate may be lower.”

I will predict today that the Feds will not raise the Fund Rate 25bp. Some top economists disagree but let’s see. Feds meet later this week.

-

Signs signs everywhere a sign. – 5 Man Electric band

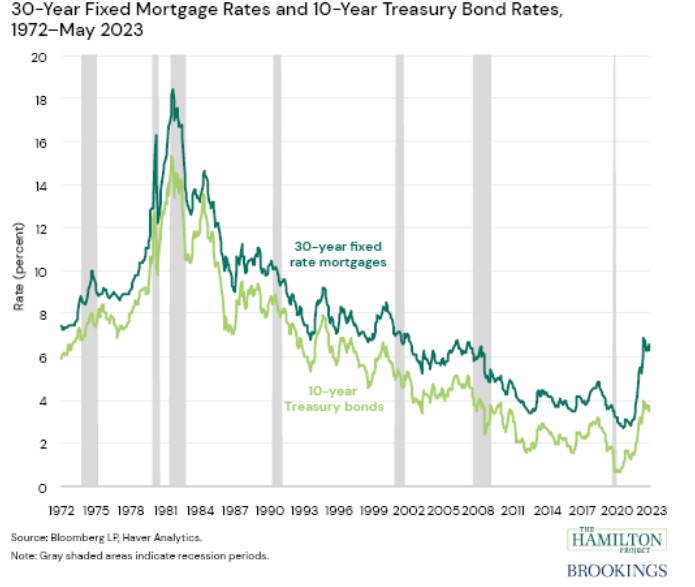

Did you know that the Fed Funds rate at 5.5% is above the 10-year Treasury yield.

Here’s what is interesting. It’s only happened 4 times in history, including right now. Though they don’t follow each other it does show once the Feds start lowering the Fed rate, the Mortgage rates will follow.

Zillow Home Price Index

Home Values rose 0.2% now 4.5% since the beginning of the year. Looking at a 7% full year appreciation.

Have a great weekend and enjoy the song.

-

Only the Past can’t be Changed

NY Fed President John Williams commented on inflation and the real estimates of inflation being closer to 2.5%.

This is the first sign that the Feds are not looking back but forward and projecting the data correctly in our opinion.

An example is retail sales. It rose 0.6% in August, hotter than the 0.2% expected. But when you strip out gasoline, sales only rose by 0.2%.

The idea is to look closely at the numbers and not have a knee jerk reaction.

There are 17% more homes on the market compared to January. This is good news.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.