-

“Are we there yet? I feel like I’ve aged a hundred years in this car, and I haven’t even grown a single gray hair!”

Fed Chair Jerome Powell gave us some clues as to what the Feds are thinking. A bit of a hawkish tone. He is flexing his muscles but maybe just for show.

Other Fed Presidents are more optimistic of a rate pause and cut mid to end of 2024.

Zillow has adjusted their home price appreciation forecasts down from 4.3% to 3.3% for 2023. Over the next 12 months the revision has been adjusted down from 4.9% to 2.1%.

At this point home values are hitting rates square in the face. The appetite for an 8% mortgage is too much to bear.

-

The First Time Since…….

The 30-year fixed mortgage rate just hit 8%, the highest Since 2000.

Highest bond Yields Since 2006.

Mortgage Applications Plummet to lows not seen Since 1996.

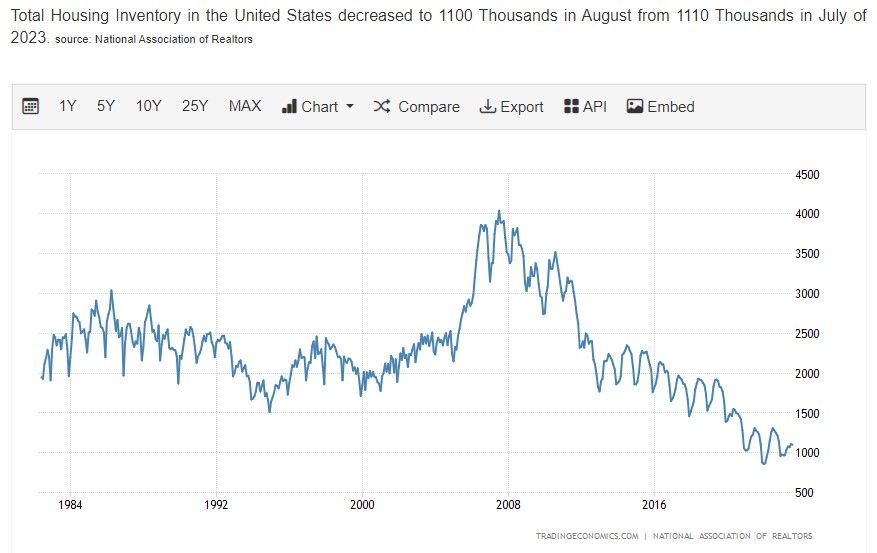

Housing inventory 2023 lowest level Since before 1984.

Unemployment rate in 2023 lower than its been Since 1969.

So what do I think? I don’t. I had to stop thinking, my head hurts too much.

-

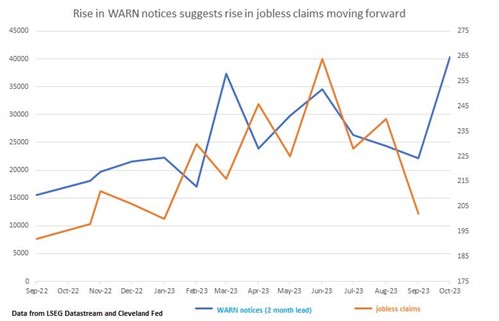

What is a WARN Notification? Let me tell you why it’s important.

There is a plethora of data to sift through to help focus the lens on the future. I feel like calling my psychic advisor but before I do that, let’s take a look at what a WARN notification is and the graph below.

WARN stands for Worker Adjustment and Retaining Notification Act. This Act protects workers, families and communities’ by requiring companies with over 100 employees to provide at least 60 days notice of a plant closing or mass layoff affecting 50 or more employees.

It’s a kind of 60 day time machine.

Housing Starts and Permits

Supply is not not keeping up with demand even if supply has increased. Single -Family Permits rose 2% and up 12% year over year. But Housing starts are down 7%.

It sounds like I’m talking from both sides of my mouth. You have housing starts rising, Building permits (future supply) falling 4%. Single family and multi family projects and the permitting process standing at a 3-year low.

It’s all over the place. If you want good news you’ll find it. If you are doom and gloom, you will find that data as well. Take a deep breath we will all get though this.

-

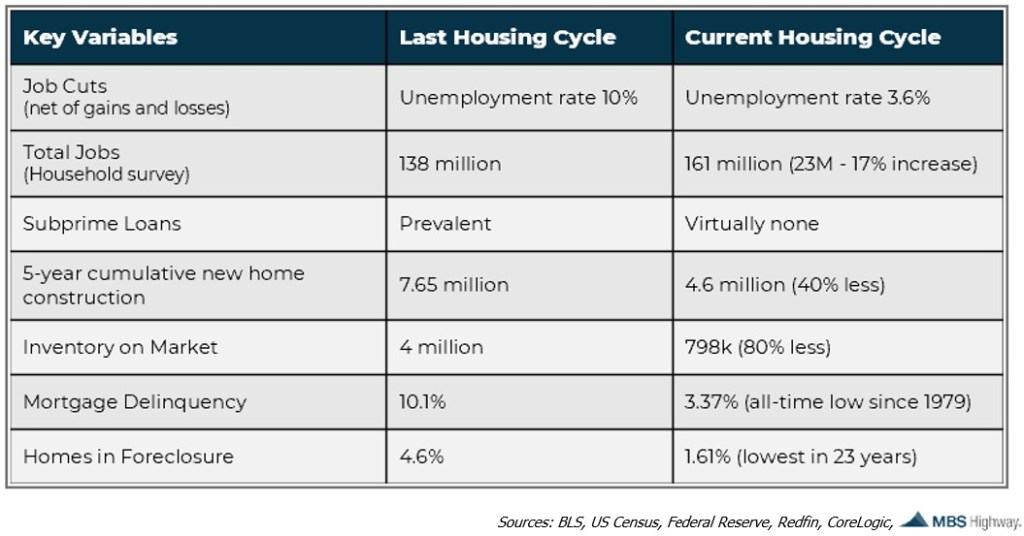

Why this Housing Cycle is Nothing like 2008.

In the news and always on social media is the drumbeat of the highly anticipated housing crash. This is False and the numbers bear it out.

Unemployment rate at historic lows, no Subprime loans, low inventory, Mortgage delinquencies and minimal homes in Foreclosure.

Remember in 2008 when the housing market crashed, the borrowers still hanging on to their homes were looking at an Adjustable Rate Mortgage ready to mature.

The second wave of foreclosures were just around the corner.

Today we have none of that. Home Owners are highly motivated to keep their homes to preserve the low fixed rate mortgage. Home Values keep going up along with the interest rates.

There is a diminishing likelihood of a recession as the indicators are begrudgingly eking out data telling us so. The problem is its taking far longer than anyone expected.

Have a great rest of your week.

-

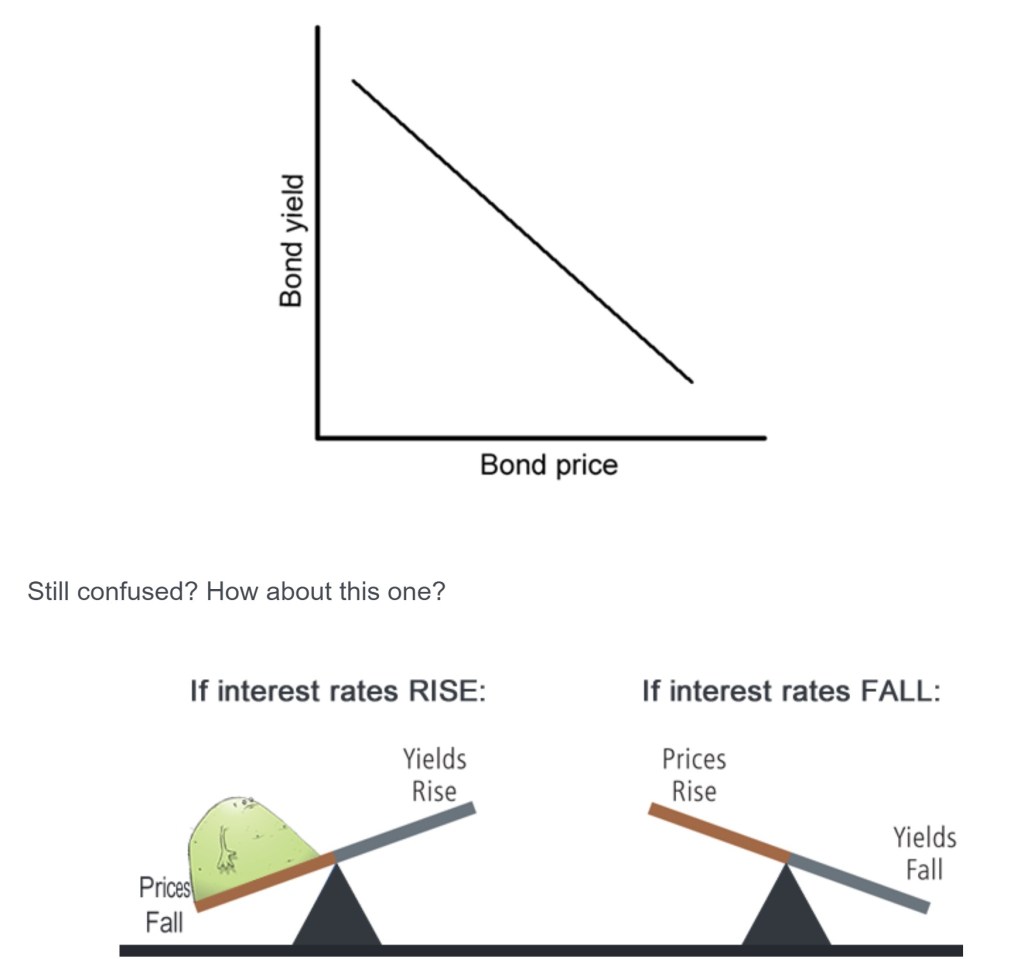

Financial Flight to Safety – understanding the Bond Market

Mortgage rates are driven by the Mortgage Backed Securities i.e. Bonds. Uncertainty in many forms causes a flight to financial safety.

The bond market is confusing especially when you hear bond yield and bond price used interchangeably.

During the financial crisis in 2008, the US Government was purchasing bonds at a breakneck pace. This caused the bond prices to go up and the interest rates to drop.

When the Federal Reserve buys bonds, bond prices go up, which in turn reduces interest rates. Open market purchases increase the money supply, which makes money less valuable and reduces the interest rate in the money market.

We have seen some rate improvement this morning as expected.

-

Ok Now What……

BLS the Bureau of Labor and Statistics reported 336,000 jobs created in September. This was far higher than the estimated 170,000.

The bond market reacted exactly as expected. Higher Yields, higher interest rates this morning.

There are two Surveys within the jobs report.

Business Survey – is where the headline job creation numbers come from and includes a lot of modeling and estimations.

Housing Survey is where the unemployment rate comes from and is derived from calling households to see if they are employed. This has its own job creation component, and tells a completely different story, only showing 89,000 job creations.

This is why the unemployment rate stayed at 3.8% from the expected 3.7%.

Trying to understand all of this is an apt comparison attempting to grasp a handful of Jell-O, which incessantly shifts and eludes your grip with the slightest movement.

-

Initial Jobless Claims Rose for the first time.

Initial Jobless Claims, which measures an individual’s filing for unemployment benefits for the first time, opposed to Continuing Claims.

These two reports show what we already know is happening. Employers are holding onto their workers. The Labor picture has been slowing down as seen by Employers hiring less.

Those Employers are not trimming jobs, just hiring less. Tomorrow is the big Jobs Report data. What we expect to see is job growth miss the expectation which would lead to a positive reaction in the Bond market.

Speaking of the bond market, I’m guessing you have noticed rates have gone up quite a bit the last few weeks. Treasury Yields at their highest since July 2007.

-

The Fog of War – Data that is…

As I mentioned yesterday the JOLTS report showed better than anticipated employment openings, Hiring rate and Quit rate.

But now the ADP Employment report for September is showing only 89,000 jobs created much weaker than the 153,000 expected. August had 177,000 jobs created. Far different than the JOLTS report.

Most of the jobs came from the services sector. There was a decline in professional/business services.

Nela Richardson from ADP said that we are seeing a steepening decline in jobs this month.60% of people on payrolls are hourly workers, and hourly wages have been stuck at $17/hour since February.

I say this because there are analysts out there that are equating higher wages fueling inflation. This is not the case.

The JOLTS report is self reporting and only 32% of requested companies responded. Its the Fog of War when trying to grasp at every bit of data to produce a coherent picture of what is going on.

Inflation and the Fog of War -WSJ

-

What is a JOLTS report you may ask….

The Job Openings and Labor Turnover Survey (JOLTS). Here is why it’s important and another datapoint.

This report tells us the number of job openings each month, how many workers were hired and how many quit their job. Additionally how many were laid off and how many experienced other separations.

Here are the numbers:

- Job openings in August, rose from 8.92M to 9.61M. Stronger than expected

- Hiring rate stayed the same at 3.7%.

- Quit rate is 2.3% unchanged. Lowest since January 2021

- Job openings down 6% Y/Y. Indeed reported September showing job openings down 15% Y/Y.

When workers are more confident about the labor market, the quits rate tends to increase.

One of the challenges is the Feds are still talking rate increases. The data is telling us the economy is slowing down.

-

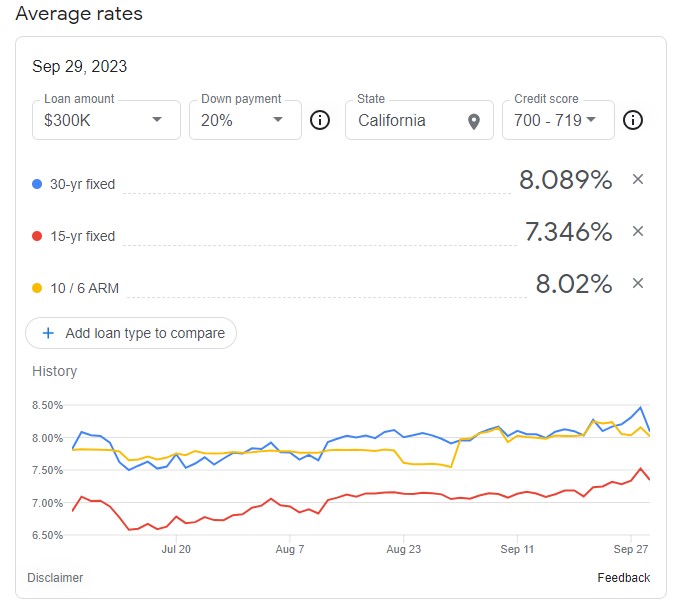

Average Mortgage rate 8.089% seriously… but there is a positive outlook

The 10-year bond currently stands at 4.676%, according to UBS investment banking company. They anticipate a decline in both 10-year and long-duration bonds, possibly reaching 3.5% and even as low as 2.75% in 2024.This strategy takes a long-term view, considering the upward trend in home values. Despite the relatively high rates, the substantial increase in home appreciation outweighs the impact of the higher payments.

Difference in house payment 30y fixed Principle and Interest only. $500k loan using average national rates.

8.089% $3,699 Current Average National rates

4.500% $2,533 Projected Average National rates late 2024

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.