-

Life is like riding a bicycle. To keep your balance, you must keep moving. -Albert Einstein

This is a tough post. I am going to share numbers that sound harsh and depressing but it’s the pill we have to take in order to get to the other side.

BLS Bureau of Labor and Statistics reported 150,000 jobs created in October below the estimated 180,000 expected. September and August job numbers were also revised down.

Unemployment rate now at 3.9% up from 3.8%. Hourly earnings rose 0.2% but lower than estimates and average weekly hours worked fell slightly from 34.4% to 34.3%.

Multiple job holders, increased 205,000 indicating people are having to pick up extra work to get by.

The economy is slowing down giving the Feds the green light to continue pausing the Fed Fund Rate and start looking at lowering next year. Rates are expected to drop, housing inventory will rise and we will be back on our feet.

Remember if the Unemployment rate is 3.9% that means that 96.10% are employed.

-

What is Quantitative Tightening?

Read the blurb below and I will talk on the other side.

Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet. This process is also known as balance sheet normalization. In other words, the Fed (or any central bank) shrinks its monetary reserves by either selling Treasurys (government bonds) or letting them mature and removing them from its cash balances. This removes liquidity, or money, from financial markets.

The Feds paused on raising the Fed Fund Rate. His keyword in Yesterday’s statement was “Financial”. This is what Quantitative Tightening means. They are selling Treasurys (bonds) and those that mature are being removed from its cash balances.

The Fed has a high likelihood of not raising the Fed Fund Rate. In fact with (QT) they could start talking about cut in rates.

-

There is a Wild Card in the deck and Rate projections 2024

What will the Fed statement be at 2pm ET and Powell’s comments at 2:30pm ET. We entirely expect a pause but Powell stirs the pot.

JOLTS report – Job Openings and Labor Turnover Survey, shows job openings in September, rose 9.5M to 9.55M. Job openings rose but hiring rate stayed the same at 3.7%. This is a low number. Also the quit rate is 2.4%, another low number.

Now let’s look at the ADP Employment Report. 113,000 jobs created in September, expectations 150,000. Let’s put this into perspective.

3-month average: 127,000

6-month average: 236,000

12-month average: 225,000

2022 average: 306,000

Another interesting data point is the annual pay for job stayers (increased 5.7%) and job lookers (increased 8.4%). You might think these are high numbers but when you take a closer look you see they have cooled considerably from the highs of 8% and stayers 16%. This can be equated to the big post pandemic pay increases that seem to be behind us.

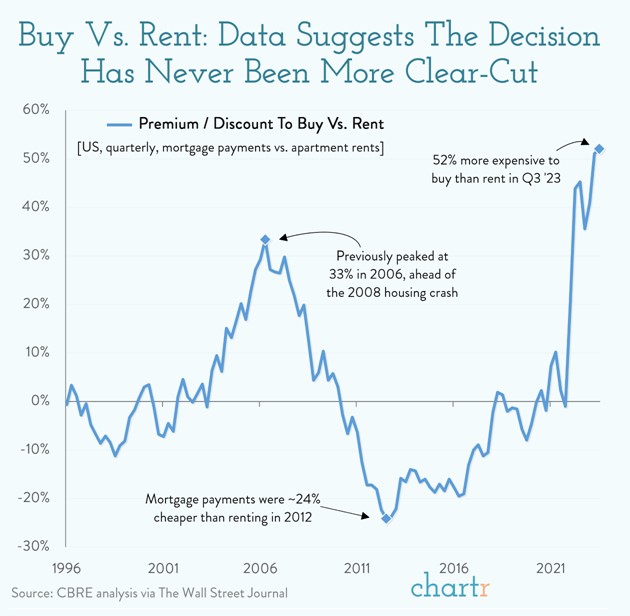

The Mortgage Applications report from MBA shows both purchase and refinance applications down. If you are looking for a home, now might be the time. less competition.

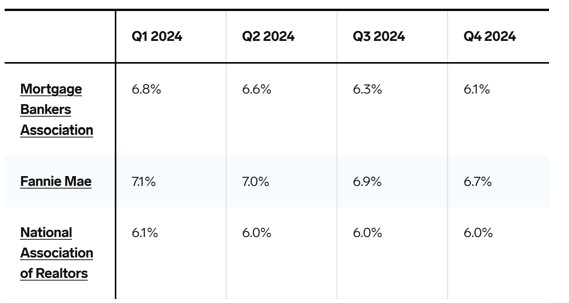

Projected interest rates for the next 12 months.

-

I know its Scary out there.

Let’s first go Global. Oct CPI Consumer Price Index out of the Eurozone has an inflation figure two tenths less than forecasted and down from 4.3%. 11% drop in Energy prices.

Some GDP Gross Domestic Product out of Europe were negative showing countries like Germany and France heading for a recession. But this is helping Bonds.

Other side of the pond, the Treasury refunding figure was announced and we only needed $776B vs the $852B expected. Good news for the Bond market as well.

Other good news we received was the Case Shiller Home Price Index for appreciation showing home prices rose 0.9% in August. Now up 2.6% from last year.

The FHFA House Price Index, which is the Federal agency for conforming loans and excludes jumbo and cash buyers, shows prices rose 0.6% in August up 5.6% Y/Y.

It might be scary out there, but a lot of good news so far this week.

-

Its an Acronym Soup Salad

Here is what’s in store this week. A lot going on so hold on to the hand rail. Feds meet this Wednesday and we expect them to pause. The market is expecting 150,000 job creations in the ADP and 180,000 in the BLS report.

HPI – House Price Index

FHFA -Federal Housing Finance Agency

ECI – Employment Cost Index

Mortgage Apps – Number of new mortgage applications

ADP and JOLT – Job Openings and Labor Turnover

Initial Jobless Claims

BLS Jobs report. Bureau of Labor and Statistics.

Tomorrow I have a special Halloween addition to my Blog.

-

We have a Petunia in our garden

Ever wonder what that means? Have no fear:

This statement suggests that someone is observing or discussing the presence of this specific plant in their garden.

The Petunia is analogous to a light, to the light at the end of the tunnel. I have in general spoken to this over the course of this year. As data comes in suggesting a recession or no recession, lower inflation, strong economic data, housing reports, more homes on the market and home values going up.

We have a solid foundation. We just tend to look too close at the cracks.

-

When you pray for rain you got to deal with the mud.

The economic data is messy and counterintuitive. Q3 GDP shows US the grew at a 4.9% pace up from estimates of 4.3%. More inventory available, more consumer and government spending. Q4 projections show things slowing and even a negative number.

The Bank of Canada left rates unchanged, citing the global economy slowing. The European Central Bank also paused after ten straight hikes. They said they would use their emergency bond buying powers if bond yields go unruly.

Feds meet next week and we expect a pause.

The appetite for Bonds is perplexing. It’s the flight to safety/security. But that is not happening. the Bond Yields continue to go up, Bond rates continue to drop. Remember the correlation between Bond Yields and Interest rates. With the lack of Bond purchasing, the mortgage rates keep going up as do the Yields.

Initial jobless claims rose 10,000 to 210,000. Continuing claims also rose 63,000 to 1.79M.

Pending Home Sales rose 1.1% projection was a 2% fall. Sales are down 11% Year/Year. And at the heels of yesterday’s blog, showing New Home Sales rose 12%.

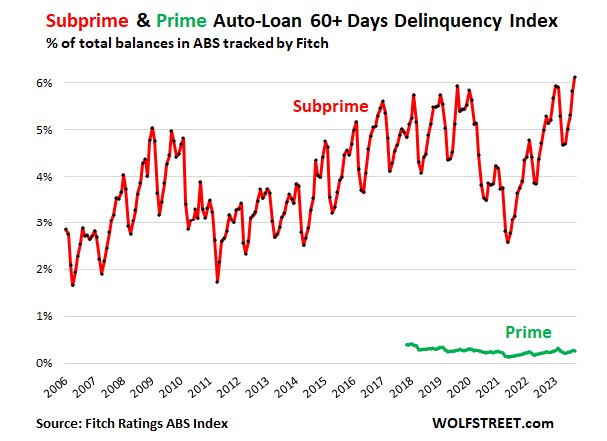

Delinquencies are down to their lowest levels in almost 25 years. Foreclosures are almost at their lowest mark in 25 years at 0.3%.

-

New Home sales up 12.3% last month up 34% Y/Y.

60% of new homes sold were either not started or under construction. The builders are selling air.

Anecdotally I have spoken to many Title company officers and they are stating the same thing. If home prices are that high and the builder can incentivize the buyer with rate buydowns and upgrades, why wouldn’t you buy a brand new home.

I have done a few presentations this week and one analogy kept hitting me. We in our industry including Agents, home buyers and sellers, have been treading water for the last two years just to stay afloat. What we miss when we are so focused on breathing is we forget to straighten our legs to see if there is sand under our feet.

I feel sand and I want you to straighten your legs, you might be surprised.

-

The Feds have won the battle of the American Consumer – B of A CEO Brian Moynihan

Its not just Brian stating the obvious but other well respected players suggesting the economy is slowing faster than the data suggests.

Not to bring up the pandemic, but… I remember telling my wife that some day and sooner than later we will wake up one morning and this will all be behind us. Our intense focus sometimes blinds us to the broader picture.

In retrospect, my future self might view this moment as the turning point when society collectively decided “enough is enough.”

The dilemma of buying versus renting hits close to home for me, especially with my two daughters who have recently graduated from college. They wonder aloud, “When will we ever be able to afford a home?”

To the Real Estate Agents out there, this is a good time for your sellers to start thinking 2/1 buydown. Lets get borrowers in reasonable rates for what we anticipate will be lower rates in the next two years.

-

Delinquencies on Subprime Auto loan Borrowers rose to 6.11%, highest on record.

This is the Canary in the coal mine as the economy starts to slow. I saw this coming years ago and was a bit surprised it took this long. When you can get an auto loan with no proof of income, the lesson has just not been learned.

Housing inventory up 1.4% per Redfin report. Great news but seasonally expected. 40% of homes went under contract in September. Inventory is still at historic lows.

10-year yield touched 5% briefly this morning. The one good news is it becomes more attractive to Bond investors. This will inevitably lower yields and rates.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.