-

Super Share Friday and Cardboard Boxes

I spent the better part of yesterday driving from Palm Springs, CA, to Newport Beach to help my two young adults move into their new apartment.

The reason I bring this up is more about the process than the finish line. Weeks of effort have gone into searching for the right place at the right price, packing, unpacking, and repacking for the trip.

My daughter made a comment after everything was done about how quickly we unloaded the U-Haul. I stopped to think; there has to be a life lesson here.

Being prepared is not just the foresight to anticipate an obstacle or challenge, but to put in place those things and processes that turn a mountain into a molehill.

We had the luxury of time, and we did not squander it. We spent the time tossing out what was once valuable, finding the important items, and keeping those close. We turned on utilities and cable so that when we arrived, all we had to do was unload far fewer boxes than we started with weeks earlier.

The life lesson is to be prepared not just in your head but with your finances. Get in touch with us or your lender and find out exactly where you are in the process. Take advantage of this time and our time.

When you decide to sell, buy, or just look, you will know exactly what you can do and be able to act on it quickly and accurately.

Thank you for listening to my Ted Talk. Have a great weekend.

-

The Writing is on the Wall, and the Ceiling and the floor

We have additional data pointing towards lower prices, with indicators in shipping and production all suggesting a trend towards reduced inflation, lower interest rates, and a potential decrease in the Fed Rate in early 2024.

In the job market, actual jobless claims stand at 231K, slightly higher than the forecasted 220K, and continuing claims increased to 1.865M, slightly surpassing the estimate. While this might seem concerning, these numbers reflect a return to more ‘normal’ figures.

Retailers, particularly Walmart, are exercising caution due to concerns about consumer spending, which can contribute to price stability. We may be entering a period of deflation over the next four months.

The key takeaway here is normalization. Take action now – start exploring homes, get pre-qualified, and if you’re considering selling your home, reach out to your real estate agent. If you’re a first-time homebuyer, let’s have a conversation and guide you through the process.

-

Are you the Horse or the Jockey

We all have choices: either sit back and let the ride go where it pleases or take the reins and tell the horse where to go.

The October Producer Price Index (PPI) report decreased by 0.5%, much lower than the estimates of 0.1%, marking the largest decline since April 2020.

One more stat: Year over year, producer inflation fell from 2.2% to 1.3%, well below the estimated 1.9%.

A much cooler inflation report than expected. This is what we are looking for and gives the Fed more fuel to cut rates as soon as the March meeting. Remember back to previous reports when we thought maybe 4th quarter 2024 rate cuts. This is big news.

My suggestion is to stop sitting back and get in the driver’s seat, ready for the real ride ahead of us. Get pre-approved, and tell your clients to get pre-approved. Home values are up. It might be the right time to sell.

-

There is a crack in the Armor and it’s good news.

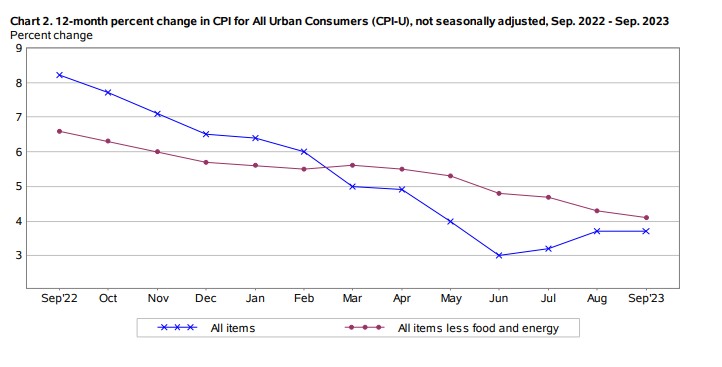

CPI Consumer Price Index is the measure of change over time and is the prices paid by consumers for a market basket of good and services.

Why this number is important is it reflects inflation which is the value of money over time. The lower the inflation the less erosion of value.

October’s CPI number was unchanged and seasonally adjusted only rose 3.2 percent over the last 12 months compared to September’s numbers at 3.7%.

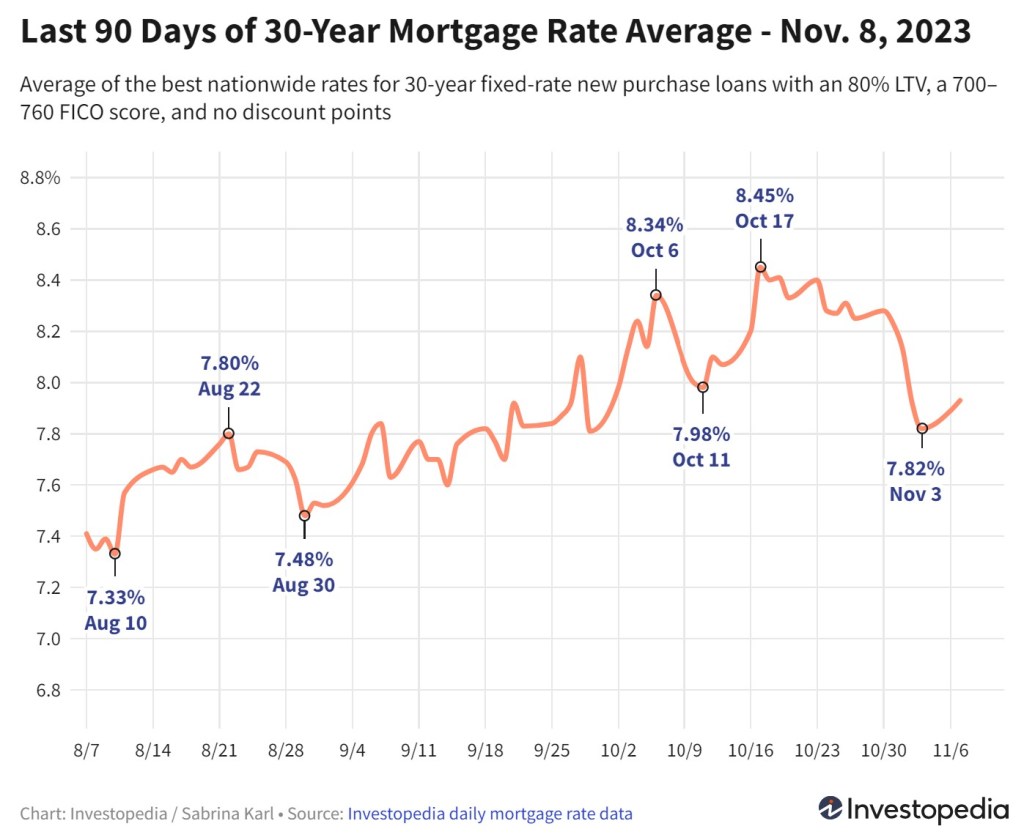

The graph below is the daily change in Mortgage interest rates. Up is lower rates. October 16th was 8.0% interest in the news. As you can see we have slowly and steadily moved off those high rates.

Get out there and get pre-approved. I keep harping on this for a good reason. We do Soft Pull Credit on all of our pre and conditional fully underwritten approvals. No harm to your credit.

We can already see it getting busier, so don’t be caught off guard when the rates really drop.

-

You can Use Logic to justify almost Anything, that’s its Power and its Flaw.

We look at numbers all day long and this week is no different. As I parse out the data, its easy to justify a conclusion.

The Consumer Price Index Report will be released tomorrow morning with a consensus that inflation will drop from 3.7% to 3.3%. This is partially due to decline in oil prices.

The Core inflation that strips out energy and food prices should stay flat. Shelter costs have been on the decline and are now 1.2% lower year/year.

We are holding onto rate gains like a 2 year old and their blanket.

As more data comes in this week, we hope to see continued drop in rates. Lets all be ready for 2024. Remember we do all Soft Pull credit for pre-approvals and fully underwritten pre-approvals. No harm in being proactive.

-

Triple Whammy but we recovered

Mortgage bonds were impacted by comments from Fed Governor Bowman, a weak 30-year bond auction, and remarks from Fed Chair Powell. However, we managed to recover.

Bowman continues to advocate for more hikes, despite being a lawyer rather than an economist. She highlights higher energy costs (down 17% in the last month), questionable job and wage growth.

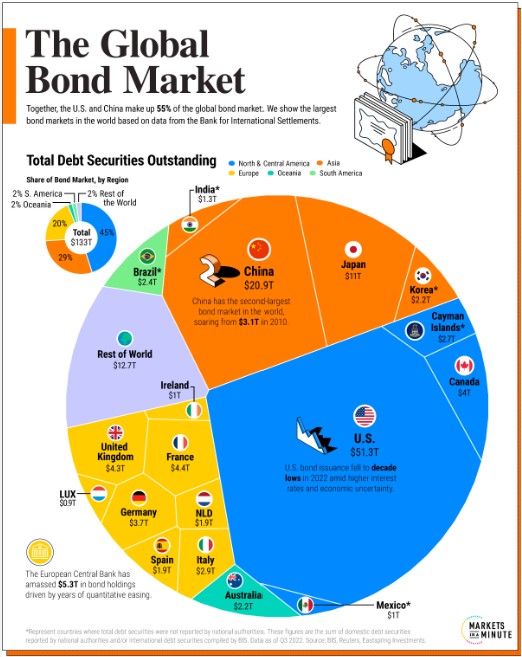

The 30-year bond Auction did not meet expectations. China reported a system hack, preventing them from buying bonds, and there has been a noticeable decrease in foreign demand. In 2010, 50% of Treasuries were foreign-owned, whereas now it stands at 30%.

Powell’s recent statements caused a spike, and he appeared more hawkish than in his previous statement.

The good news is the market and rates are holding steady.

-

Don’t Worry Be Happy

Average, Normal, predictable all good words the market loves. Initial Jobless Claims came out remaining at a relatively low 217,000. Continuing Claims rose 22,000. Employers are holding onto their workers.

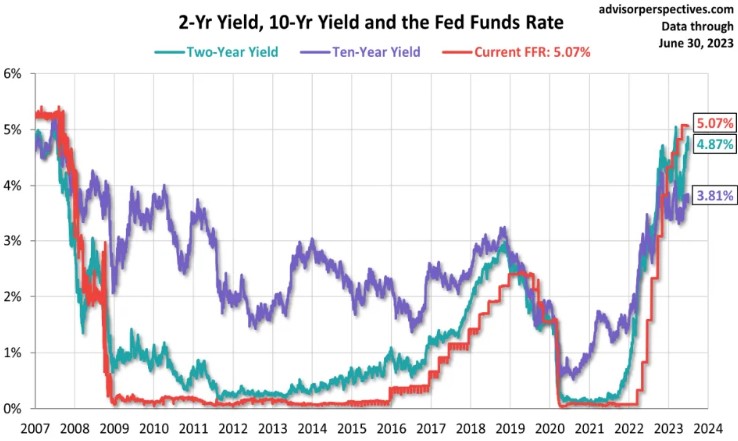

Interest rates are holding their gains over the past week. We are advising our clients to Float any existing pre-locks as we watch the 10-year Mortgage50-day moving Average.

There are floors and ceilings in the stock and bond market. These are imaginary barriers but turn out to be real resistance levels. Right now the 10-year bond broke beneath that 50-day average at 4.57and has created a new ceiling. The floor is 4.42% and if we can fall through we will continue to see rate improvement.

Looking at the graph below, Normal for the 10y bond is arguably around 3.00%. we are at 4.57%. I want my cake and eat it too but that’s not realistically in the cards.

2024 will be an amazing year, I see it coming. Feds will lower their Fed Funds Rate, Bonds will be back to normal and Mortgage rates should be more palatable.

-

People choose their path out of fear disguised as practicality

Mortgage applications up in responds to lower rates.

Oil Prices now below $77/barrel. Manheim Used Car Index fell 2% last month down 4% for the year and slower job growth. These are all strong participants in the inflation calculation giving a positive impact to rates.

“Last week’s decrease in rates was driven by the U.S. Treasury’s issuance update, the Fed striking a dovish tone in the November FOMC statement, and data indicating a slower job market,” said Joel Kan, vice president and deputy chief economist at the MBA.

We could be headed for a perfect storm. The adage the early bird gets the worm may be right.

We might think we are being practical and smart by waiting, but I believe it’s hiding our fear of commitment. Go get your worm…

-

“Two things define you: Your patience when you have nothing and your attitude when you have everything.” –George Bernard Shaw.

In the upcoming two quarters, we could witness a significant decrease in inflation rates. Energy prices have fallen, rental data indicates a decline, and the trend of decreasing prices for used cars has persisted.

Maersk, one of the largest shipping companies responsible for 18% of worldwide capacity, reported their earnings and indicated a subdued demand.

Think of the last two years playing the musical chairs game. The problem is we have been walking in circles so long hearing the same song, we forgot what we were doing.

The music is going to stop and you need to be ready for the drop in rates, increase in housing inventory and be ready to pounce.

All of our loan applications for pre-approvals and full underwrites are SoftPull credit. Get pre-approved and be ready.

-

Rates Holding onto gains

This week and the next two months will be the Tell. Will the interest rates and Bond Yields continue to drop?

Now is the perfect time to take the proactive step of getting pre-qualified with a complete underwrite. The market can fluctuate rapidly, and being prepared is crucial. All our loans involve Soft Credit Pull, allowing us to fully underwrite your file without the need for a hard credit inquiry. Once you are in contract, then we will do a hard credit pull.

Pre-qualification offers you peace of mind by giving you a clear understanding of what you can afford. Stay ahead of the game and make informed decisions about your financial future.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.