-

I had a dream I ate a big marshmallow, I woke up and my pillow was gone.

Now that I have your attention, let’s talk rates, mortgages, and the Fed. With the holidays upon us, the inevitable question at gatherings is, ‘What do you do?’ The next question is, ‘When will rates drop?’

The short answer is, no one knows. That’s the safe response. However, given that I woke up way too early this morning, even for me, I’m not feeling safe.

There are strong indicators that rates will drop. Inflation is set to decrease significantly. The car industry has returned to reality, and big-box companies may have overstocked their shelves. It’s all about supply and demand.

Supply is up, and demand is waning. Oil prices have also declined, including rent, particularly with commercial rentals. We are running out of Pandemic government money and waking up to the correct reality.

I am excited for 2024.

Look for the Fed to make overtures in January/February for potential rate cuts. Home inventory will grow, as will demand. Get ready for 2024.

-

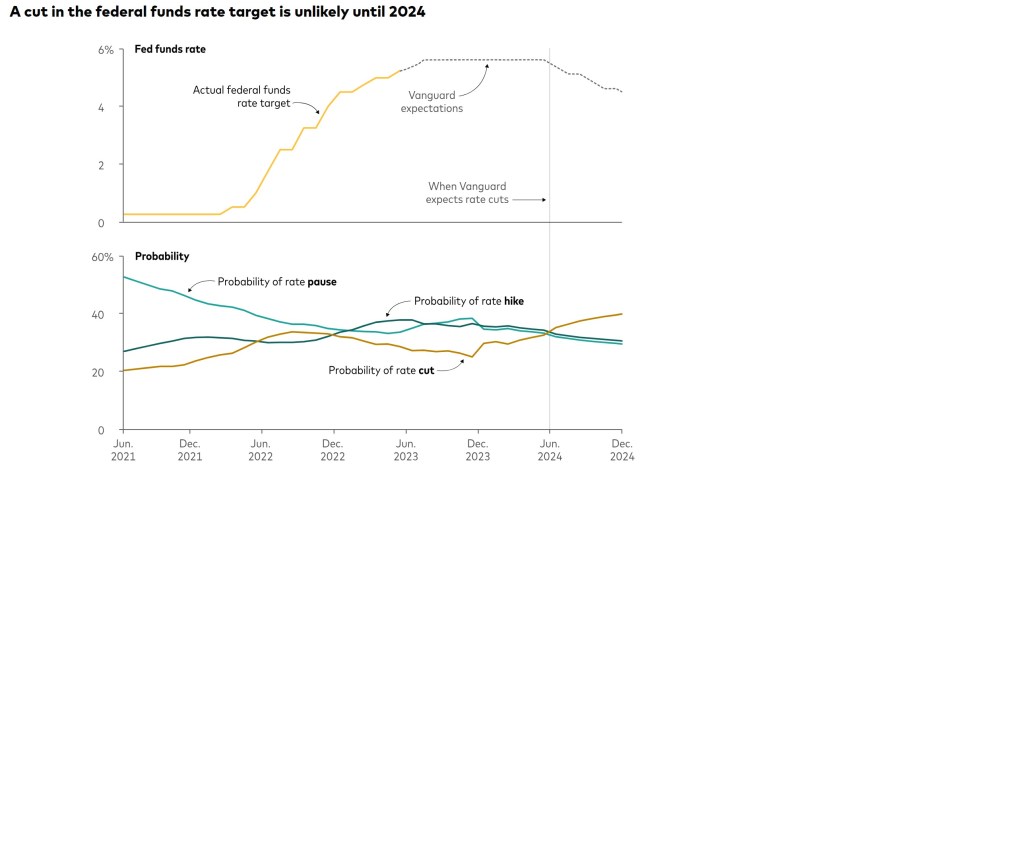

50% chance the first Fed rate cut in March – Solita Marcelli CIO UBS

UBS Global Wealth Management forecasts the 10-year Treasury yield will end 2024 at 3.5%. Today we are at 4.27%.

Translation: Mortgage Rate improvement will continue in 2024

Fed Chairman Jerome Powell said Fed’s interest-rate committee “is moving forward carefully.”

Translation: Feds will hold Fed Rates and eying cuts in 2024

Fed Chicago Pres Austan Goolsbee said that worries by economists that inflation would get stuck above 3% have been proven unfounded. “I just don’t get that. There’s no evidence that we are stuck at 3%.”

Translation: We will hit the Target 2% inflation number sooner than later.

-

Inflation Rate down to 3.24% compared to 3.70% last month.

PCE, Personal Consumption Expenditures is the Fed’s favorite measure of inflation year over year, the index decreased from 3.4% to 3%. CPI as we mentioned yesterday was down as well.

Looking at the last 6 months of core readings (strips our food and energy), which Powell mentioned at the last meeting shows the core inflation at 2.4%.

What this means is the rates will likely continue to drop. The Fed’s may cut rates as soon a March. Three months ago, this was not even on the radar.

If you are looking to sell or ready to buy, get prepared. If your a Realtor, get your clients pre-approved and ready to go.

We are here to help with the pre-approval process.

-

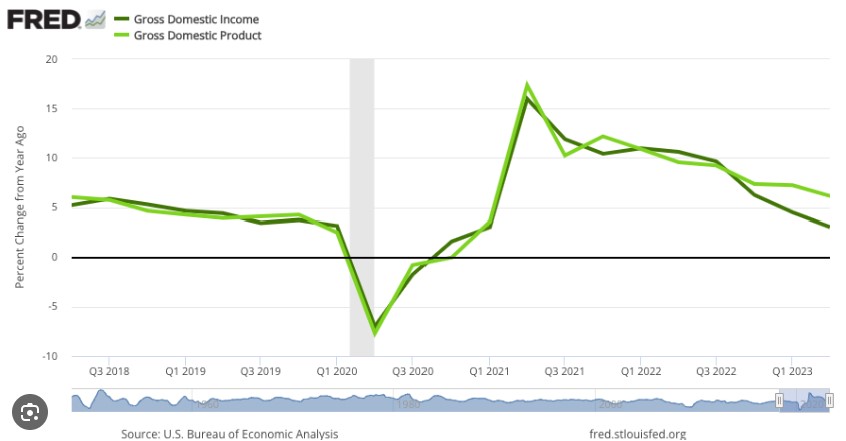

Fresh data shows U.S economic growth better than previously thought. Lets look at the numbers

The Gross Domestic Product (GDP) increased by 5.2%. Why does this matter? The data from the July to September period serves as another indicator pointing to a booming or robust economy, defying gloomy warnings of a slowdown.

GDP measures the value of the final goods and services produced in the United States.

What else is going on? The Q3 data reflects stronger spending by corporations. It also shows increased state and local government spending and imports.

Here’s the kicker: Gross Domestic Income (GDI) increased rapidly compared to the second quarter, with GDP increasing by 1.5%, a full percentage point above the last quarter.

GDI stands for Gross Domestic Income, representing the total income generated by all sectors of an economy within a specified time period. This includes employee wages, profits from businesses, taxes, and costs incurred in production.

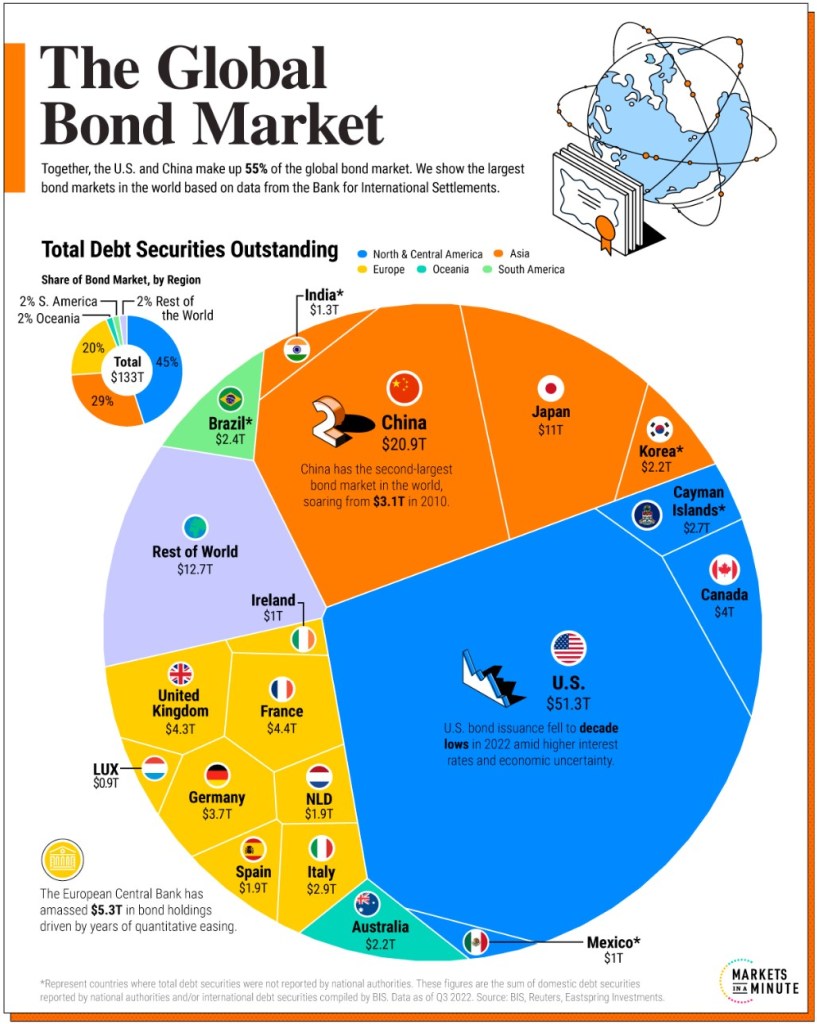

How does this affect mortgage rates? Surprisingly, bond market yields have been dropping, as have rates.

-

Home Values up, Rents down, rates down. Lets get to getting.

The Case Shiller Home Price Index, considered the ‘gold standard’ for home appreciation, indicates a 0.7% increase in home prices in September, marking a 3.9% rise from last year. The index is on track for a 6% appreciation this year.

Apartment List Rental Data’s November Rental Report reveals a 0.9% decline in new rents for November, down 1.1% from the previous year. This marks the fourth consecutive monthly drop.

This is referred to as a Shelter Cost, a substantial component of inflation, similar to the drop in oil prices this year.

What does it all mean? Inflation is continuing to decrease, surpassing the Federal Reserve’s expectations. As we reflect, we might find ourselves thinking, ‘I wish I had been more prepared for 2024.’ Consider me your time-travel buddy; 2024 has yet to arrive, so you still have time.

Below is the link to a Buy vs. Rent video I created, illustrating the advantages of purchasing a home. I’m sharing the longer 4-minute video, but the 2-minute version is also available. Feel free to forward .

-

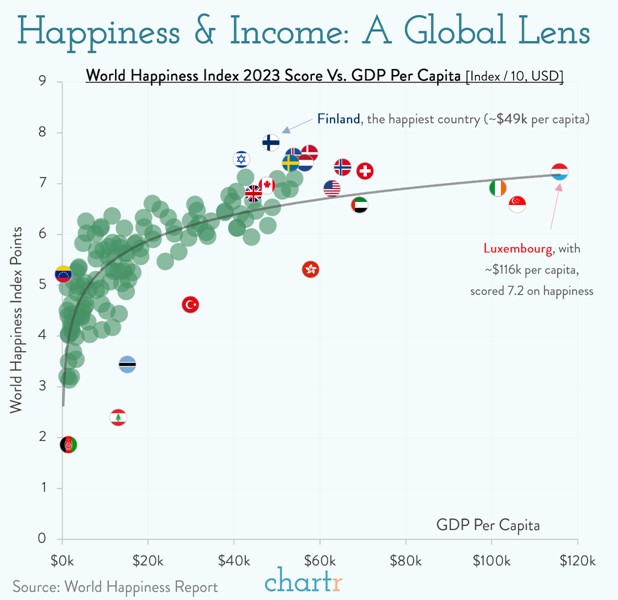

Some cause Happiness wherever they go; Others whenever they go. – Oscar Wilde

The new year is almost upon us. As I woke up this morning I couldn’t help but wonder where the year went.

There is a foundation being built beneath our feet that most of us are blind to, ignore, or have succumbed to a bit of apathy.

It’s been a tough couple of years for the mortgage and real estate industry as a whole. Inventory is down, rates are up, and affordability is a challenge.

But still, the foundation continues. Rates and inflation are dropping, the job market is strong, and builders are thriving. The forecast of a Fed rate cut looms large and may happen sooner than later. We have come around the corner, but the challenge is that the corner is bigger than we thought.

-

Forget about the Turkey; It’s the Hawks and the Doves we care about.

When the Fed members talk like Hawks, they are signaling Fed rate hikes or a pause. When the Doves are speaking, its about pausing and cutting the Fed rate.

The Hawks are starting to get outnumbered, and this is a good thing.

Quantitative Tightening is when the Fed sells off its balance sheet. This is what they have been doing for the past two years.

Quantitative Easing involves the purchase of Mortgage-Backed Securities (MBS) and Treasuries, which was happening after the 2008 great recession.

All this bodes well for lower rates in 2024.

On a personal note, I want to thank everyone for your support and celebrate our continued success. Have a great rest of your week and Thanksgiving.

-

Forget about the Turkey; is it the Hawks and the Doves we care about.

When the Fed members talk like Hawks, they are signaling Fed rate hikes or a pause. When the Doves are speaking, it’s about pausing and cutting the Fed rate.

The Hawks are starting to get outnumbered, and this is a good thing.

Quantitative Tightening is when the Fed sells off its balance sheet. This is what they have been doing for the past two years.

Quantitative Easing involves the purchase of Mortgage-Backed Securities (MBS) and Treasuries, which was happening after the 2008 great recession.

All of this bodes well for lower rates in 2024.

On a personal note, I want to thank everyone for your support and celebrate our continued success. Have a great rest of your week and Thanksgiving

-

A funny thing happened on the way to the forum

As we navigate the sometimes humorous, sometimes chaotic events of the last few years, we have to remind ourselves: this too shall pass.

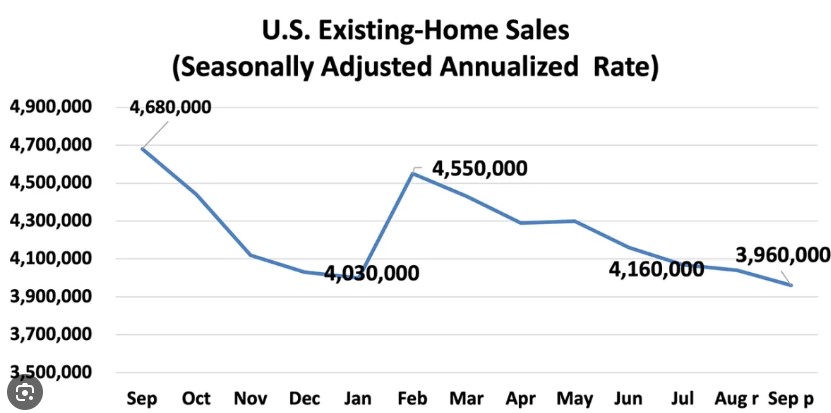

Rates continue to improve this week, but what was a bit of a surprise was the decrease in Existing Home Sales, down 4.1%. Supply was also down 5.7% from a year ago.

With that said, the median existing-home price was $391,800 in October, reflecting a gain of 3.4% from last year.

It’s all about supply and demand.

-

Rent vs Buy? Video link answers that question

Good Morning. Lets look at the hard numbers when it comes to renting or buying. The YouTube link below goes through a typical Southern California home purchase or rent.

If you live in an area with half the rent and half the home price, the numbers still work; just half the net gain. Even in this high Mortgage Rate environment we are still seeing the advantage of buying over renting.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.