-

I know its Monday but Friday is the Tell…

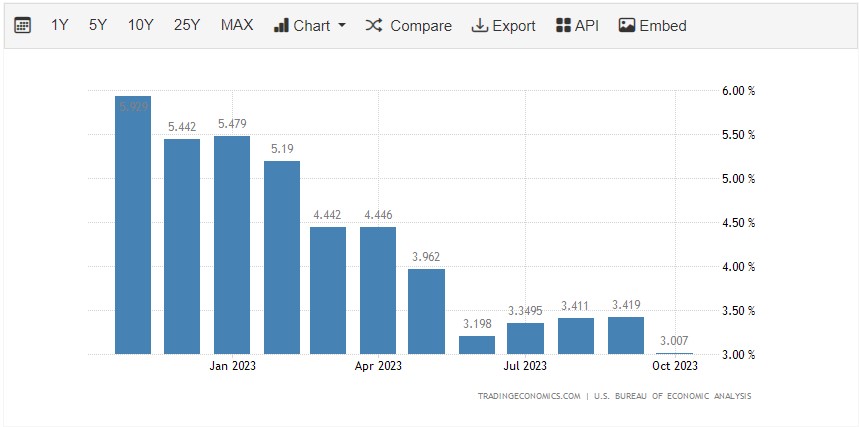

Personal Consumption Expenditures (PCE) measures all goods and services bought by U.S households. This is different from the Consumer Price Index (CPI). CPI is the “Inflation number” you hear in the news.

Friday the PCE numbers will be released. Currently at 3% and may decline to 2.8% to 2.9%.

PCE gives a more inclusive look at all products and services from Urban and Rural consumers. CPI looks at Urban consumers only.

For example, both CPI and PCE measure the price of airfare, but CPI calculates it using a fixed basket of air routes, while PCE calculates it using data on airline passenger revenues and passenger miles traveled.

The key here is CPI excludes a vast amount of Data where PCE tries to grab as much information as possible. What is interesting and shown on the bottom graph, the numbers are pretty close.

-

The Sun is starting to shine, the Wheat is about ready to harvest.

The old catchphrase ‘Cut Wheat while it’s Sunny’ may be appropriate this spring. Rates continue their downward trend, and we hope it keeps going.

With that said, I’ve created a short animated YouTube video describing a typical refinance and its impact. Maybe convert that 30y into a 20y or 15y with the same payment.

You can find it on my channel, @HomeLoanDad.

Buyers are also starting to reenter the market. It’s time to check under the hood and get yourself pre-approved.

-

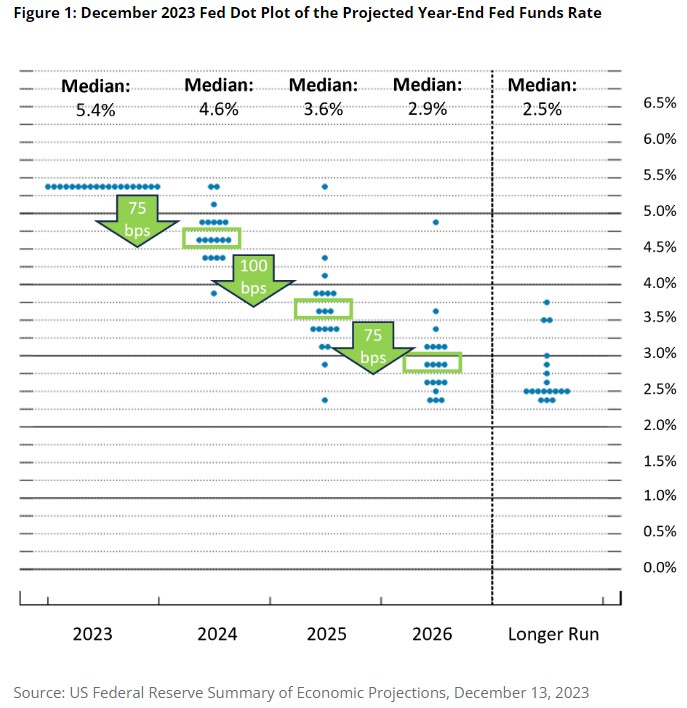

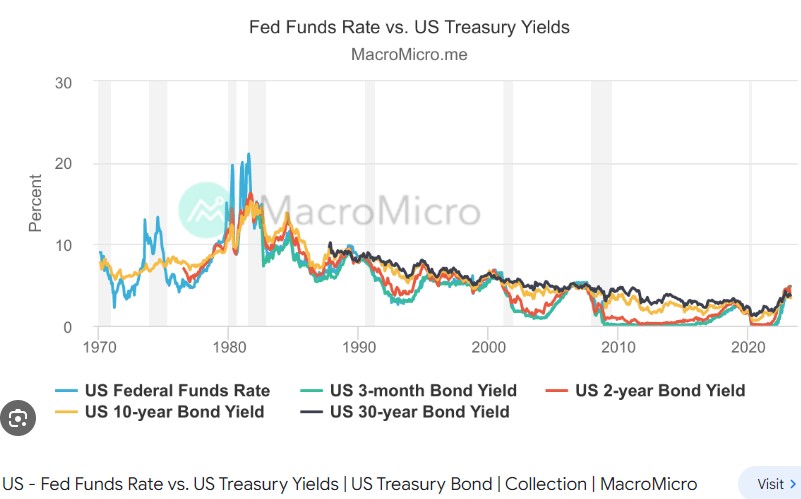

I told you so… Fed’s Pivoting to cuts in 2024 as soon as March.

Let’s break down what the Fed said at yesterday’s meeting. They sounded much more dovish than hawkish, notably stating that meaningful progress on inflation has been made and downgrading their view of the economy.

Powell mentioned that the Fed will not wait for inflation to reach their target before making cuts. Instead, they would act well in advance to account for the lags.

The prevailing thought is that once inflation is below 3% (currently at 3.14%), it will be the green light to cut.

The Fed’s Dot Plot chart below is quite revealing. The majority believes that the Fed will cut between 50 to 100 basis points, with one member advocating for a 150 basis point cut and another proposing no cuts.

Each dot represents a Fed member’s projection of future rate cuts.

We are now at an 84% chance of cuts in March, aligning with my projections over the last few months.

-

Flat is good, especially when you’re riding a bike. – PPI numbers

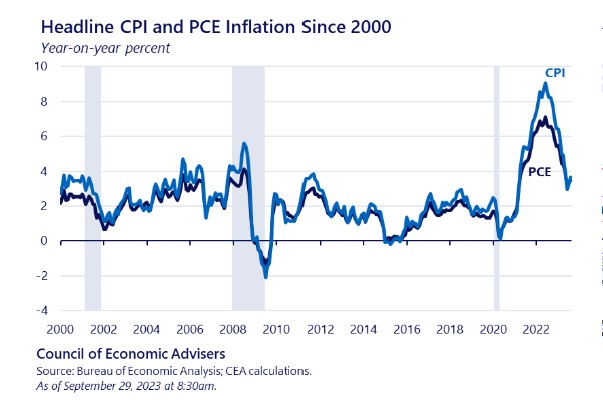

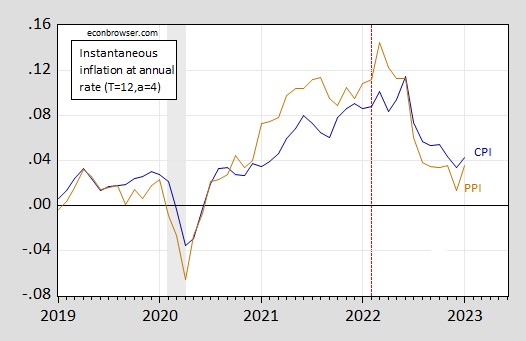

The Producer Price Index (PPI) is a measure of wholesale inflation, representing the prices paid to U.S. producers for goods and services. It serves as a leading indicator. On the other hand, the Consumer Price Index (CPI) reflects end-user inflation and accounts for the purchase of goods and services.

It’s important to distinguish between the two indices. PPI measures price changes from the perspective of the seller, while the CPI represents the inflation experienced by the end consumer. The impact of these changes is eventually felt by consumers, reflected in the CPI inflation rate, either bringing pleasure or pain.

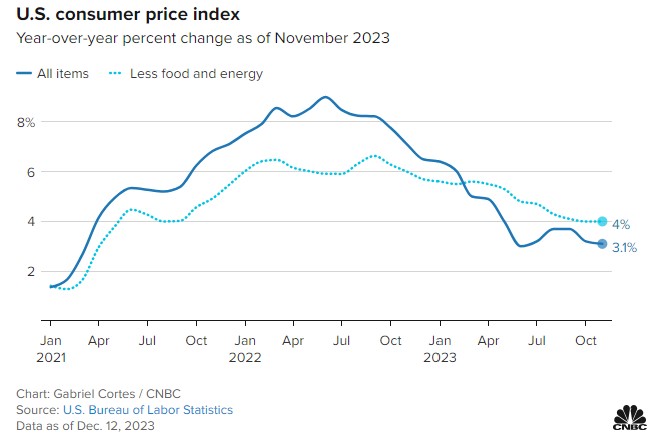

The Feds are trying to get the CPI down to 2.0%, its currently sitting at 3.1% .

-

Inflation slowed to 3.1% in November.

With a 2.3% decrease in energy prices, gasoline fell by 6% and fuel oil was down by 2.7%. Food prices saw a slight increase at 0.2%.

The results were in line with expectations—slightly lower, though not as much as anticipated. Rates remain essentially unchanged.

While the November figures still surpass the Fed’s 2.0% target, the slowdown persists. I had anticipated a more aggressive deceleration, but as we enter the holiday season, spending is on the rise. Coupled with limited supply, we find ourselves reverting to the traditional supply and demand model.

I am particularly focused on the January inflation figures set to be released in February. Despite going against the prevailing trend, I am optimistic about the possibility of Fed rate cuts in March.

-

In the crucible of this Important Week, every economic heartbeat resonates with the weight of consequence. -ChatGPT

I had asked ChatGPT to rewrite my original headline “important inflation numbers this week.”

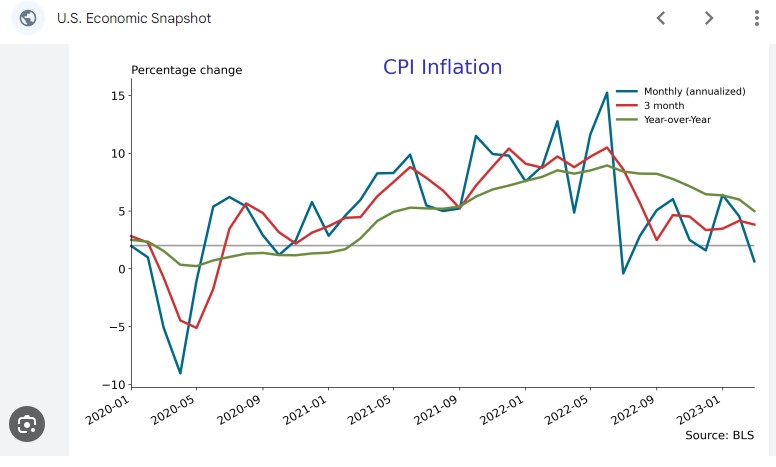

The Consumer Price Index (CPI) and the Producer Price Index (PPI) are set to be released this week. These reports are eagerly awaited indicators of inflation in the market.

We expect a decrease in the inflation figure, but the challenge lies in comparing or replacing figures in the year-over-year calculations.

The graph below illustrates the difference between month-to-month, three-month, and year-over-year analyses.

-

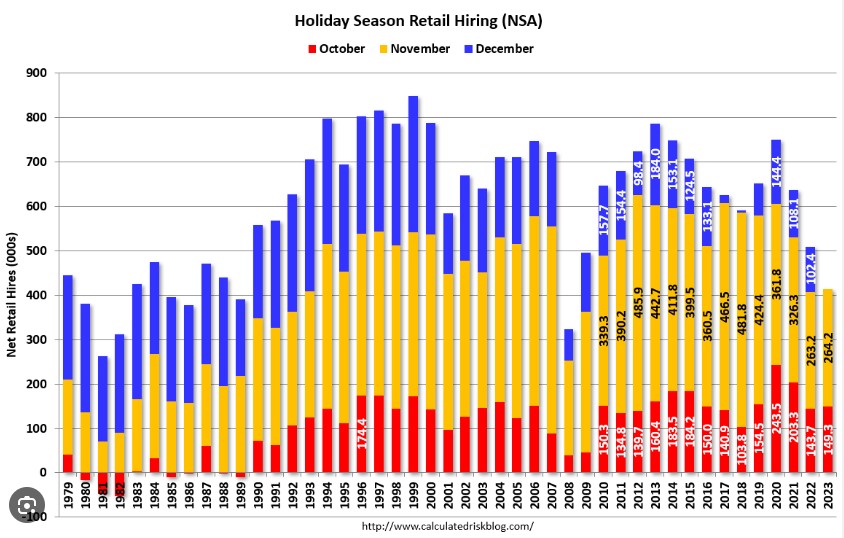

Jobs report Strong, Market does not care.

The Bureau of Labor Statistics (BLS) reported the creation of 199,000 jobs in November, slightly stronger than the expected 190,000.

The birth/death model contributed only 4,000 jobs, virtually having no impact. This model considers the birth and death of companies and analyzes the trend in their ratios.

Average Hourly Earnings, which examines wage pressure from inflation, rose by 0.4%, a bit higher than expected.

Average weekly hours worked increased from 34.3% to 34.4%, a minimal rise, resulting in a 0.6% increase in weekly earnings.

In summary, it’s not the ideal jobs report for the bond market. The trend in job growth is clearly lower, yet undeniably strong.

Federal Reserve Chair Powell will likely maintain a hawkish stance, i.e., holding or potentially raising rates at next week’s meeting, though uncertainties persist.

All in all, the market did react, bringing positive news for interest rates.

-

Tomorrow, Tomorrow, I love you Tomorrow.

The November Jobs report will be released tomorrow morning. The BLS Jobs Report estimates 180,000 jobs added year-over-year, with the unemployment rate expected to remain at 3.9%, and average hourly earnings to decline from 4.1% to 4%.

What this means is continued data pointing towards a soft recession or the absence of one.

Jobless Claims, which measure individuals filing for unemployment benefits, rose by 1,000 to 220,000. While not a significant increase, it’s noteworthy. Continued Claims, indicating those who continue to receive benefits, fell by 64,000 to 1.861 million.

This suggests a weakening labor market, providing another data point for the Fed’s consideration.

The CoreLogic Home Equity Report in Q3 shows a 6.8% year-over-year increase. This is attributed to amortization (mortgage payments over time) and appreciation, with the average Loan-to-Value (LTV) ratio at 42%. It means you have 58% equity in the house.

It’s worth noting that during the Bubble years, the average LTV was 81% or 19% equity.

What this means is get off the couch and buy a house….

Anticipate significant data in tomorrow’s Jobs report. Hang on and have a great rest of your week.

-

That’s a 32 ounce Idea in a 16 ounce cup…

We begin the day with stocks higher and Mortgage Backed Securities, i.e., Bonds, lower, bringing rates down.

The ADP Employment Report indicates an increase of 103,000 jobs created in November, slightly below expectations of 130,000. The previous month’s figure was revised lower from 113,000 to 106,000.

The Mortgage Bankers Association released their Mortgage Application Data for the week ending on 12/1, showing a 2.8% increase. Perhaps someone out there is paying attention and getting prepared.

What does all this mean? It’s more data telling us that the economy is slowing down as expected, nudged or pushed by the Fed rate hikes. This implies that we may see those Fed rate cuts sooner rather than later. It also means we should start seeing further declines in mortgage rates. So, get ready, put on your seatbelt, and get pre-qualified.

My idea is simple: look forward, not backward. It’s almost impossible to drive a car while constantly looking through the rearview mirror.

-

Home Values Up, Job openings lower, Rates improving.

The CoreLogic Home Price Index rose by 0.2%, bringing it up by 4.7% year over year.

According to Black Knight, home prices increased by 0.2% in October and are now 4.6% higher year over year.

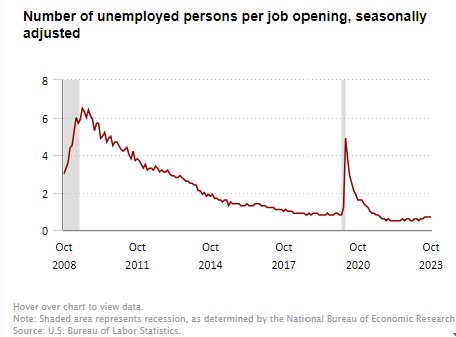

The JOLTS report for Job Openings and Labor Turnover showed a decline from 8.7 million to 9.25 million, while we expected 9.3 million. This slowdown in the economy wasn’t good news for my two recent graduates looking for work, but it does contribute to overall inflation and recession data. The Quit rate remains at 2.3%, unchanged.

In Leisure and Hospitality, there were 1.2 million job openings, reflecting a 10% decrease or 136,000 fewer openings. This suggests that the post-pandemic re-employment in this sector has completed.

Rates continue to improve. Will Powell indicate a Fed rate cut sooner rather than later? I think so.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.