-

The Fed is making Real Progress on Inflation – Richmond Fed President

That is always a good sign.

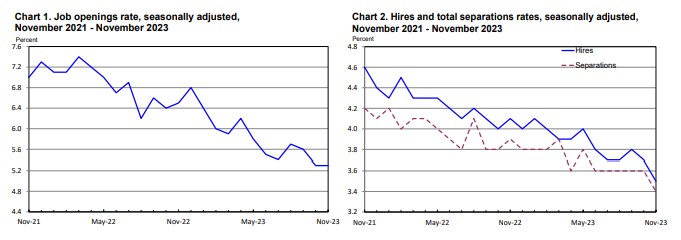

The JOLTS report had a decline from 8.85M to 8.79M slightly below market expectations.

JOLTS is the Job Openings and Labor Turnover survey. This is one of those leading indicators of future employment and employer retention.

Instead of just looking at the Unemployment rate, it covers everything from Vacancies, separations, voluntarily quitting, layoffs and Discharge. The report also looks at deaths and retirements.

For reference the Job Openings at 8.8M is down from the high of 12.0M March 2022.

This is a survey of more than 20,000 businesses and government offices. The takeaway is a strong labor market with employers holding on to their employees.

-

Good morning 2024, the Sun is shining.

The Jobs reports are coming out on Thursday and Friday. These include the ADP, JOLTS, and BLS Reports.

We will also be receiving the Fed Minutes from the December 13th meeting. What is important is that this is when Powell pivoted. We anticipate the Fed cutting rates in March but not sooner.

I am optimistic about 2024 and look forward to the challenges and successes.

“Homebuying Demand Shows Early Signs of Rebound. Declining mortgage rates and a double-digit increase in new listings are bringing house hunters off the sidelines.” – Dana Anderson – Data Journalist

-

It was nice knowing you 2023

In 2023, the Lenders, Realtors and Consumers has demonstrated remarkable resilience and adaptability. Despite various economic challenges, our industry has shown a positive trajectory with lower mortgage rates, encouraging both potential homebuyers and existing homeowners to explore opportunities.

Overall, the positive trends are poised to continue in 2024.

I am looking forward to 2024 and beyond. Be safe this weekend and I will see you on the other side.

-

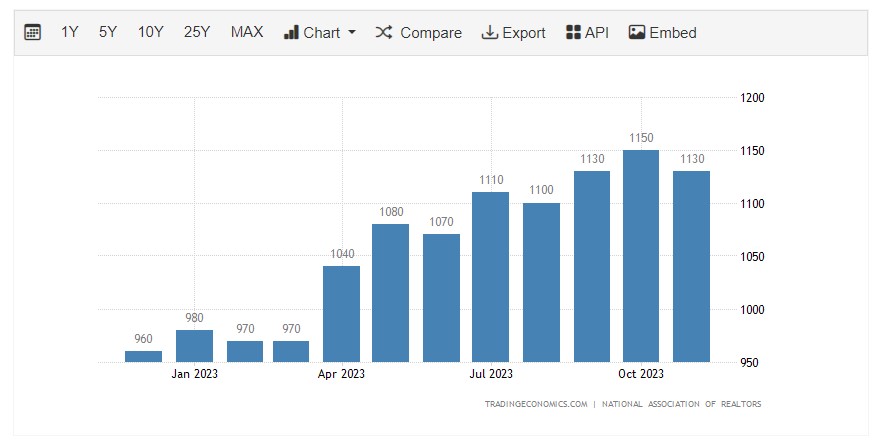

Pending Home Sales, what homes.

Pending Home Sales, which measure signed contracts on existing homes, not new construction, were flat last month, surprising the market that had expected a gain, especially with the lower rates. Inventory is still a major challenge.

December should tell a different story. More potential buyers are applying for loans, and more potential sellers are thinking that maybe it’s the right time to sell.

Initial Jobless Claims are flat, while Continuing Claims rose by 14,000 to 1.875 million, one of the highest readings since November 2021. This is indicative of a weaker labor market.

What this really means is the economy is slowing, which helps with inflation and causes mortgage rates to drop.

-

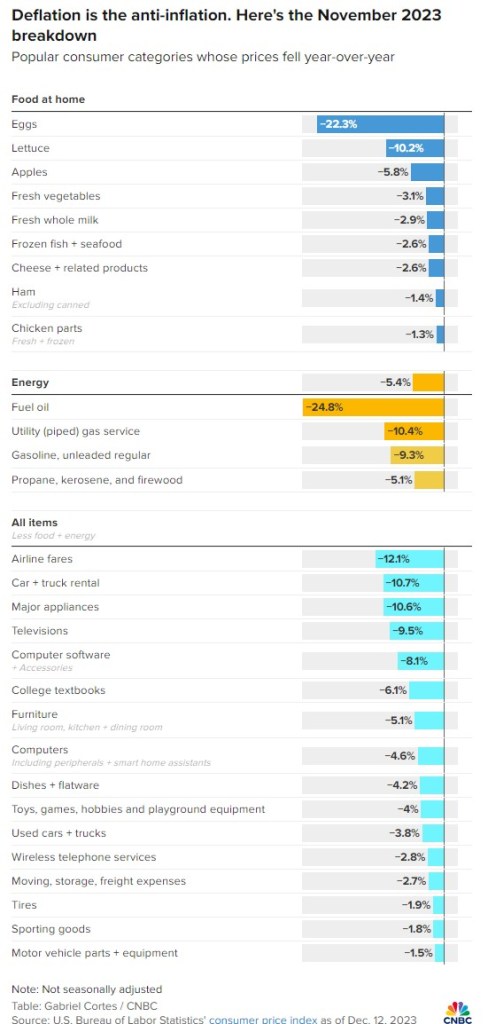

Deflation, there I said it.

What goes up must come down. As Michael Douglas said in Wall Street, ‘Greed is Good,’ until consumers wise up.

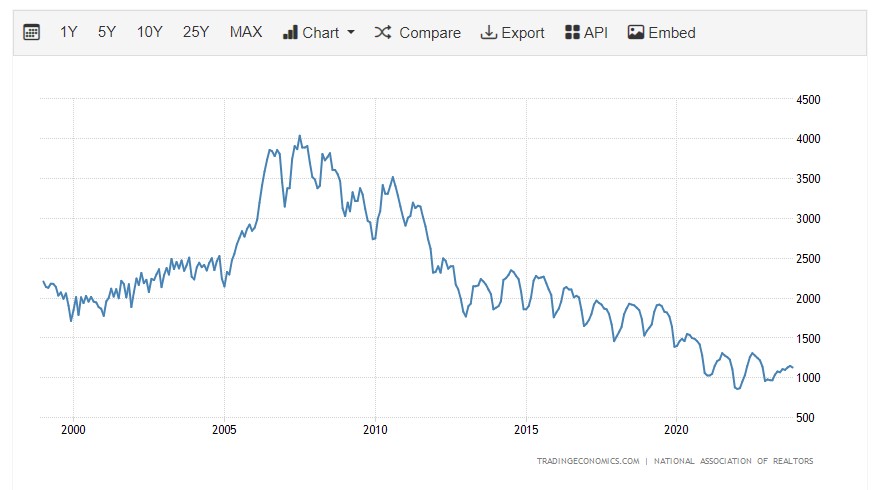

We still face a housing inventory problem, as I mentioned yesterday. Fannie Mae and Pulsenomics Survey released their Q4 Home Price Expectations Survey this morning.

Over 100 of the top housing experts in the country believe home prices will rise on average by 2.4% and by 25% over the next 5 years.

As we continue to see mortgage rates drop, sellers are starting to take notice. A 5% interest rate compared to a 3.5% rate is only a 15% difference in the house payment.

The 5% rate is not in our rearview mirror but up ahead. We don’t know how far, but it’s out there.

-

Its all about Inventory. The Rate drop is fueling demand.

Rates went up in 2023 but the home values continued to rise. Rates are now dropping but the home values continue to rise.

The demand is so high that it will take a larger drop in mortgage rates for the vast majority of homeowners to budge.

Until we have an appreciable rise in inventory, I would not be sitting on the sidelines waiting for home\ values to drop before you buy. This is not 2008 by any stretch.

In 2022 home appreciation hit 6%. This year we will end the year 6-8%.

-

Inflation rate 2.6% below 2.9% estimates. And Thank you.

The Personal Consumption Expenditures (PCE) price index fell by 0.1% in November, putting the inflation rate at 2.6%, which is lower than the expected 2.9%.

The Core PCE, which excludes food and energy and provides a less volatile perspective and is the Fed’s preferred metric, decreased from 3.5% to 3.2%, below the expected 3.4%.

With all that said, the likelihood of the Fed cutting rates at their March 20th meeting is now 86%.

This is all good news and bodes well for continued relief with mortgage interest rates.

A personal thank you to everyone this year. These blogs and video blogs have been an integral part of my life, and I appreciate all the feedback and support.

Cheers and Happy Holidays, and here’s to 2024.

-

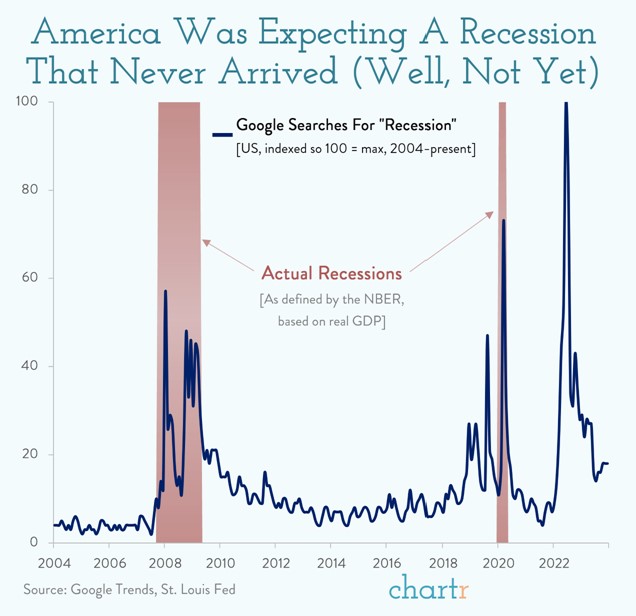

The Recession that wasn’t

It’s always interesting to see the raw data from Google search. We’ve been hearing about a recession for two years now, with experts initially predicting a hard landing, then a soft landing, and now, perhaps, no recession at all.

In 2022, 80% of Americans believed the country was either in a recession or would be in the following year, according to the Harvard CAOS/Harris Poll.

After steady growth throughout the year, the economy expanded by 4.9% in the last quarter of 2023, driven by the same consumers.

Just in, the Gross Domestic Product (GDP) increased by 4.9% on an annualized basis, slightly below the expected 5.2%.

Initial Jobless Claims reported 205,000, surpassing expectations of 215,000. Additionally, Continuing Claims decreased to 1.865 million from the estimated 1.888 million.

-

Consumer Confidence levels hit Highest level Since July.

Consumers between the ages of 35 and 54 exhibit the highest confidence. They believe that interest rates will fall and are more likely to consider purchasing a home.

While consumers have been on the sidelines, they are starting to move and feel encouraged about the future.

Application volume is up by 1.8%, but it is still down 18% from last year. Refinances have decreased, which I found interesting initially. However, upon reflection, it makes sense—why would you refinance when rates are dropping? It would be more prudent to wait for the landing before re-engaging.

2023 is almost in the rear view mirror.

-

Housing Starts & permits Up. Good news.

As more homes are completed, the pressure on the rental market persists. According to CoreLogic, rent prices have increased by 2.5%, though this is lower compared to the previous report.

Housing starts experienced a significant rise of almost 15% in November, reaching 1.56 million, marking a 4% increase year-over-year. Single-family permits also saw a 0.7% increase and are 23% higher compared to the previous year.

Interest rates have continued to show improvement over the last month, with hints of a possible decline in the coming months.

The Federal Reserve is discussing the possibility of three rate cuts in 2024, with the potential for four.

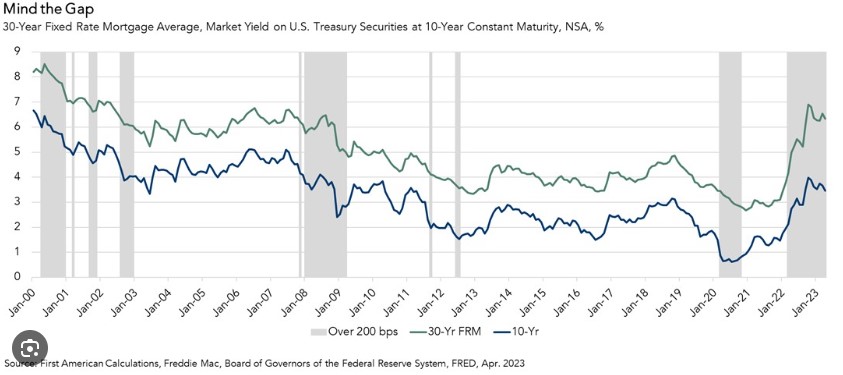

Interest rates, in general, are approximately 2 points higher than the current 10-year yield, which stands at 3.917 at the time of this blog. Despite this, the national average for a 30-year mortgage is 6.65. This indicates that there is room for rates to drop further, even if the 10-year yield remains steady.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.