-

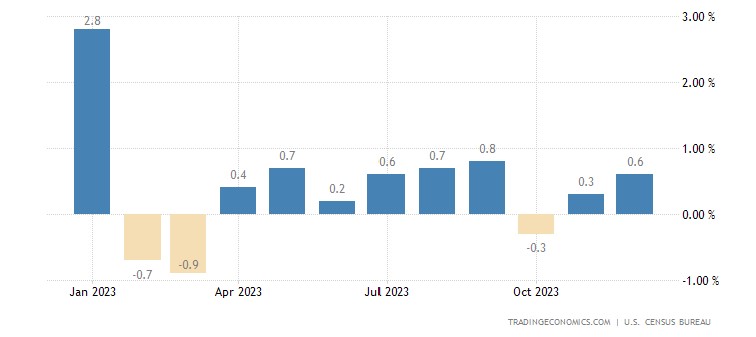

Retail Sales are up 0.6% vs 0.4% as expected, but what is really going on.

The bond market just flinched and I don’t know why. December’s data is seasonably adjusted but everything cost more this year compared to last year so of course the Retail Sales numbers are going to be higher.

We have a strong economy regardless of the naysayers.

The 10 yr yields ended the day slightly higher and we lost some of our rate gains this week.

I am headed to a sales meeting in LA so will be cutting this short.

-

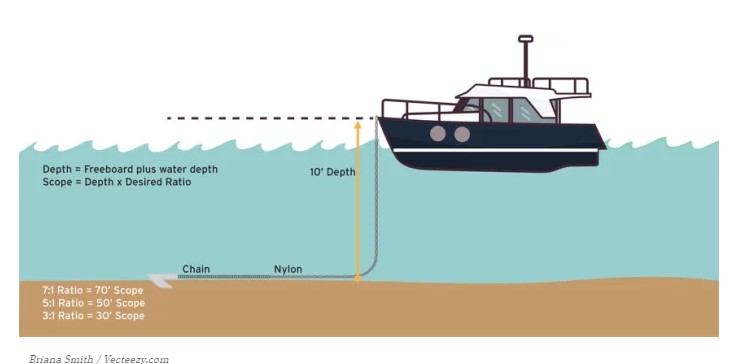

We need a lighter Anchor with better holding power. Our scope is off just a bit.

This is going to be a stretch, but its worth it. We have had rough seas the last two years and looking for sunlight and calm.

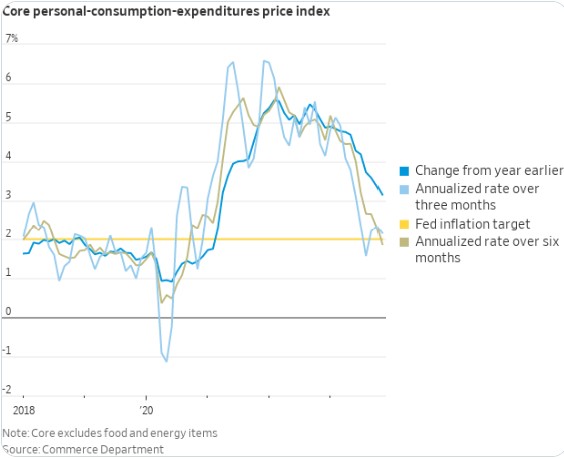

Inflation continues to normalize as Fed Governor Christopher Waller stated yesterday’s confidence the 2% inflation rate is on the horizon.

The challenge is determining whether this is the right time to anchor our boat. The water seems much calmer, but do we have enough chain? The chain is what ultimately holds the boat in place. Every 10 feet of depth requires 70 feet of chain.

In our scenario Chain represents the Inflation numbers, Unemployment rate and the continued data confirming we are actually in calm water and can stay in place.

The Feds believe we need more Chain (data). I can’t disagree with them but I think we are all ready to Anchor the boat.

-

Rents rising 2.7% but last year it was 7.5%

It’s important to understand what inflation measures. This may sound simple, but it is quite complicated.

We examine the price of a good or service today compared to last year. When there is a spike in pricing, such as the supply shortage generated by the pandemic and high demand, the comparison to the previous year’s costs becomes dramatic.

As prices settle and the supply line evens out, prices stabilize. Consumers become a bit more discerning, and retailers adjust.

A better gauge of inflation might be a six-month perspective, which Fed Chair Powell prefers. Personal Consumption Expenditures (PCE) is currently 1.85% below its 2% target.

PCE measures the prices consumers pay for goods and services.

-

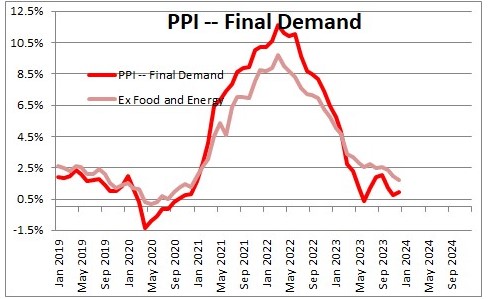

It’s getting Chilly, PPI numbers in and cooler than expected.

The Producer Price Index (PPI) report indicates a decrease in wholesale or producer inflation, contrary to market expectations. Here’s a breakdown of the key points:

- December PPI Movement:

- Actual: -0.1%

- Expected: +0.1%

- This means that prices at the wholesale level fell by 0.1% in December, against the market’s anticipation of a 0.1% increase.

- Year Over Year (YoY) Rise:

- Actual: +1%

- Expected: +1.3%

- The YoY rise is only 1%, falling short of the market’s expected 1.3% increase.

- Core Rate (Excluding Food and Energy Prices):

- Actual: 0%

- Expected: +0.2%

- The Core Rate, which excludes volatile items like food and energy, remained unchanged at 0%, while the market expected a 0.2% rise.

Implications:

- Lower inflation: The decline in producer prices suggests lower inflation, which can benefit consumers as cost savings may be passed on to them.

- Mortgage rates: Lower inflation often translates to lower mortgage rates, which could spur the housing market.

Future Outlook:

- The data might increase the likelihood of the Federal Reserve (FED) lowering interest rates in March. Lower inflation and the potential for economic stimulus are factors that could influence the FED’s decisions.

Conclusion: The PPI report indicates a trend of lower inflation, potentially leading to benefits for consumers and impacting financial markets. Keep an eye on how these trends evolve, especially with regard to FED decisions. Have a great weekend, and see you on Tuesday!

- December PPI Movement:

-

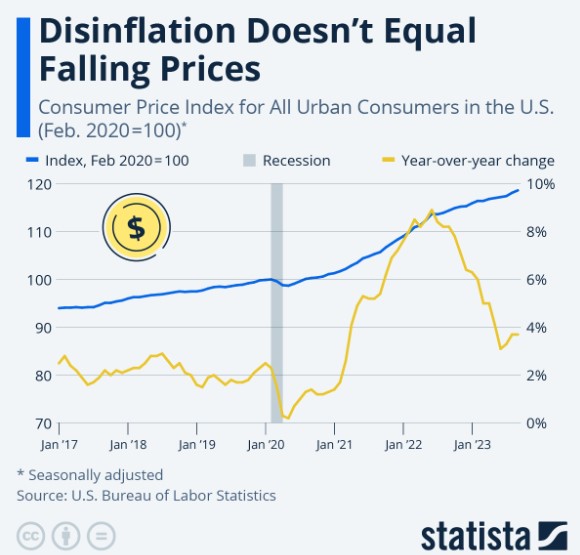

Deflation or Disinflation What’s the difference? CPI numbers in.

Consumer Price Index (CPI) numbers are in, with inflation rising by 0.3%, slightly higher than expected. We are now at 3.4%.

Taking a closer look, these are year-over-year comparisons, so as we move forward, the previous year’s inflation data comparison becomes tougher to surpass.

You may hear that the last mile is the toughest. The Fed wants a 2% inflation rate.

One reason consumers are dissatisfied, even though the unemployment rate is at historic lows, inflation has dropped significantly and new and used car sales have dropped over 37%, is because what you purchased a year ago is over 7% more expensive today.

If inflation were 0%, that loaf of bread would still cost 7% more than last year.

Disinflation is the slowing of inflation, which is what has happened over the past year.

Deflation occurs when the inflation rate is negative, and prices are falling.

We are in the Disinflation period not Deflation.

-

Refinance? Yes and the applications tell a larger story.

The Mortgage Bankers Association (MBA) measured a 19% volume increase from the previous week and up 30% from the same week a year ago. This is also true for Purchase applications but not quite as dramatic.

The buyers and sellers are coming out of the woodwork and testing the waters. When refinances are up, it’s a strong indication the Home Owners have noticed the rate drop.

The flood gates are going to open so be financially prepared and get pre-approved for a mortgage.

-

Inflation Data over the past six months Indicate…. -Fed Gov Bowman

What a difference a day makes. Fed Governor and voting member Michelle Bowman stated that the Fed’s actions are bringing down inflation.

Why this is important is that she was one of the more hawkish members, indicating two more rate hikes just last month.

Thursday is the day the CPI – Consumer Price Index inflation report comes out for the month of December. We may see a slight rise in inflation from 3.1% to 3.2% or it might remain flat.

The Core inflation, which strips out food and energy, is expected to drop, which the bond market will likely favor.

-

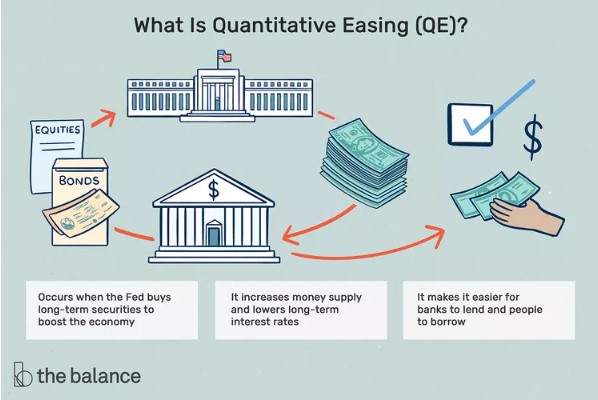

What Happens when the FED starts buying Treasuries again?

For the past two years, the Fed has been selling off its balance sheet of Treasuries or Bonds. The impact is the reduction of the money supply, making it more difficult and expensive to borrow money, in turn, slowing the economy and raising interest rates.

On the flip side is Quantitative Easing or QE. This is what the Fed had been doing starting as far back as the 2008 financial crisis and ending two years ago. The effect of all this purchasing has been lower interest rates and arguably, artificially low interest rates.

QE is used when the Fed wants to stimulate the economy and reduce interest rates on long-term securities.

Dallas Fed President Lorie Logan said she feels it’s appropriate to consider reducing QT or their sell-off of the balance sheet.

This is another data point when the question comes up: ‘When will interest rates drop?’”

-

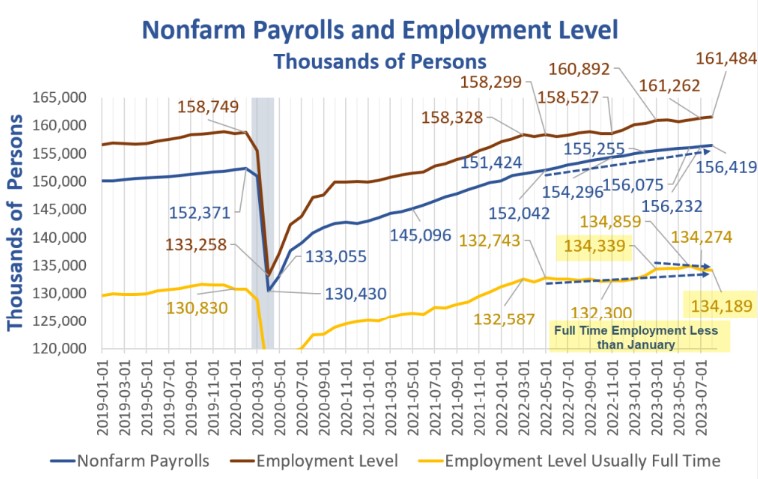

Is the BLS Jobs Report correct?

BLS – Bureau of Labor and Statistics has revised their prior numbers lower every month on average by 40k, totaling almost 500,000 job revisions since January 2023.

October was revised lower by 45,000 to 105,000, and November from 199,000 to 173,000.

The market relies on these data points, but if you can’t trust the data, who can you trust?

This morning, the market reacted negatively to the better-than-expected jobs numbers but then remembered two things: it’s December’s numbers, which are always strange, and the anticipated revised numbers surely to come out next month.

The 10-year bond yield is lower but started off the morning up.

Average Hourly Earnings rose 0.4%, hotter than estimates. This puts pressure on inflation and the Fed’s pending rate cuts.

But as we look under the covers, the actual job creations to job losses paint a weakening picture with more part-time jobs. This is why the bond market shifted gears to our positive, i.e., lower rates.

It takes a bit to read and digest the vast amount of data that came in this morning, so we forgive the market for initially overreacting.

Slightly dated graph, but it still gives me a headache just looking at it.

-

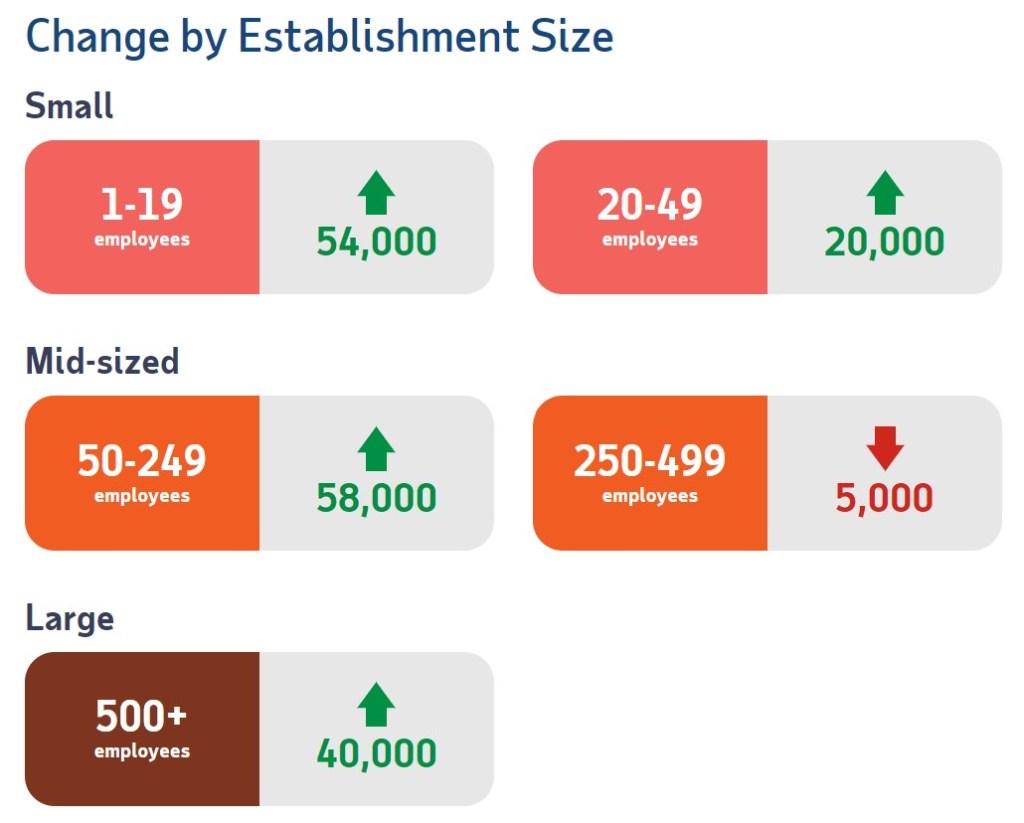

ADP Numbers, Construction leads the way. Changers still benefit over Stayers.

ADP Employment report is out and was slightly stronger than expected at 164,000 jobs compared to the 130,000 estimated.

October and November numbers were 100,000.

Another aspect of the ADP report is the Stayers vs the Job Changers. Both these numbers or % are on the decline. The job stayers had a pay increase of 5.4% slightly down from 5.6%, the job changers averaged an increase of 8.0% down from 8.3%.

To put this in context, last year the Stayers saw an increase of 7.6% and a 15.1% increase for the Job Changers.

What this means is we are settling in. The benefit of changing your job is less attractive and the employers know it but still want to retain their employees.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.