-

Jobs Report Weaker, Bonds improve, rates keep dropping.

ADP Employment report showed 107,000 jobs created in January, but was weaker than the 150,000 expected.

Here is the breakdown

Goods-Services Added 30,000

Manufacturing Added 2,000

Construction Added 77,000 *155,000 last month

Hospitality Added 28,000

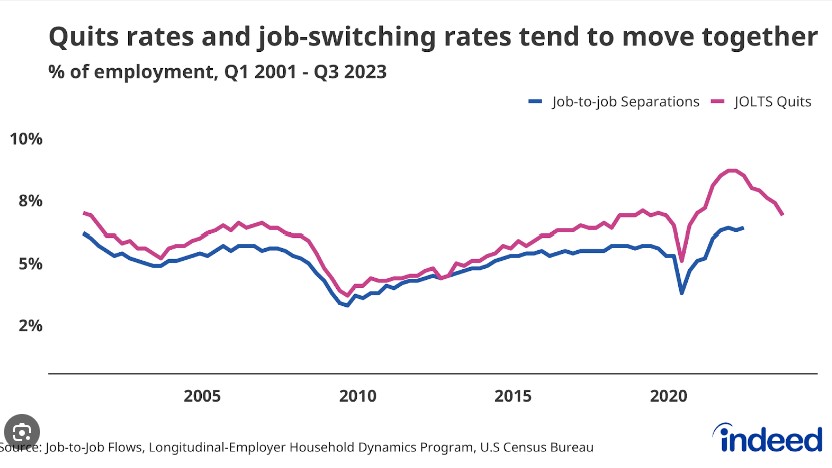

Annual Pay for Job Stayers increased 5.2% down from 5.4%. Job Changers increased 7.2% down from 8.0%. Still strong but moving down.

Going back 19 months, Stayers saw a 16.4% increase in pay, while job Changers was 7.8%. What the Math tells us is the difference between last year and this year’s stayers/changers is only 2%. It was over 7%. Employers are holding onto their employees and employees are more reluctant to change.

The Fed concludes their 2-day meeting today with a Press Conference at 2:00pm ET.

Rates continue to improve as we expect the Feds to pause on rate hikes as we look towards March for a possible rate cut.

-

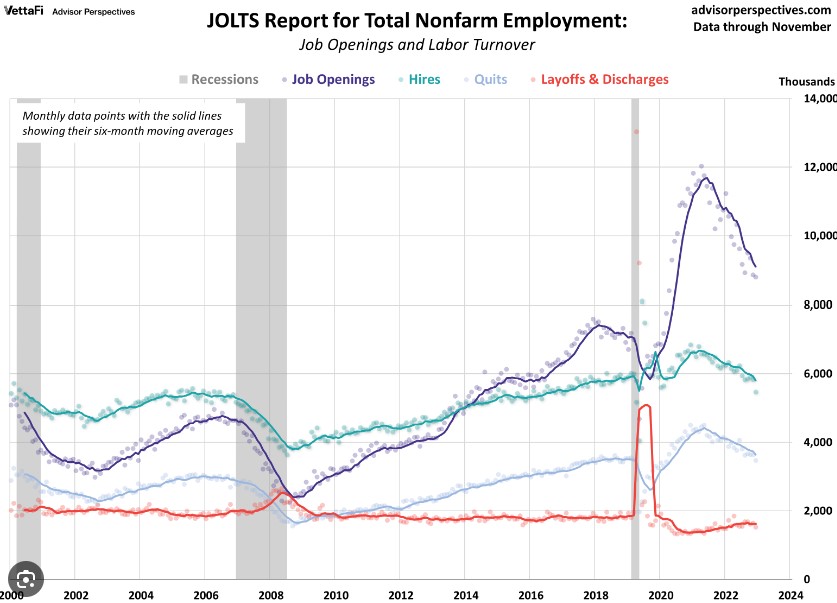

Headlines say Layoffs but JOLTS report says otherwise. Home Values UP.

With high-profile companies like UPS announcing layoffs, it’s easy to feel like the sky is falling. However, the JOLTS report, which measures Job Openings and Labor Turnover, showed a rise in December from 8.925 million to 9.026 million.

Despite this, the number of quits remained at 2.2%, suggesting a decrease in hiring and less poaching of employees from competitors.

On another front, the Case Shiller Home Price Index saw a 0.2% increase in November, marking a 5.2% rise from the previous year.

In contrast, the Apartment List Rental Report experienced a 0.3% decline, down 1% year-over-year. This marks the sixth consecutive monthly drop and is significant as shelter costs are a key component of inflation.

The Bond Market reacted predictably, experiencing a slight hit to rates.

Tomorrow, the Bond Market will respond to the ADP Employment Report and the Federal Reserve’s statement at 2 pm EST.

-

Hindsight is 20/20 but you could have just kicked a field goal to tie the game.

Hindsight Bias is the illusion of predictability. We understand the world looking backwards but life moves forward.

The Fed will begin their 2-day meeting tomorrow. We will hear from Powell at 2:00pm ET on Wednesday.

The Feds will leave the Fed Funds Rate where it is but Powell has a tightrope to walk.

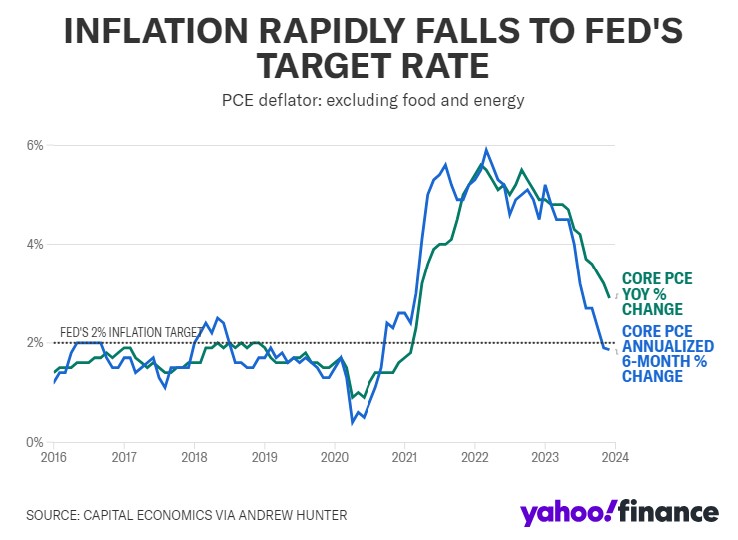

Core PCE is at 2.9% Y/Y, 6 month view 1.85% and an 8 month view is at just 2.08%. Remember the goal was 2% Inflation Y/Y.

We are seeing rents drop, the used car market shaking up and gas prices going down.

The BLS Jobs Report comes out this week as well as the ADP report. We are anticipating 135k to 170k new jobs created. Unemployment report due Friday and expectations are a rise from 3.7% to 3.8%.

Rates are holding steady but we have an important week ahead.

-

Inflation below 3% for the first time since March 2021

The Fed prefers the Personal Consumption Expenditures (PCE) as a gauge of inflation. The PCE index grew 2.6% year-over-year in December as expected.

The Core PCE, which excludes food and energy, grew 2.9% down from 3.2%.

During the December Fed press conference, Powell told Yahoo Finance’s Jennifer Schonberger that the Fed would want to be “reducing restriction on the economy” well before inflation hits 2%.

The Bond Market is holding tight and hanging onto the rate improvements so far this year.

-

Perfection of Imperfection – Wabi-sabi

The gap between good and perfect is immeasurable. In my interactions with numerous clients, agents, and trades, the recurring topic revolves around the anticipation of when mortgage rates and housing prices will decrease.It seems like we’re all yearning for a utopian world where gas prices are low, inflation is in check, unemployment is minimal, and so on. Surprisingly, we’re currently experiencing many of these favorable conditions.

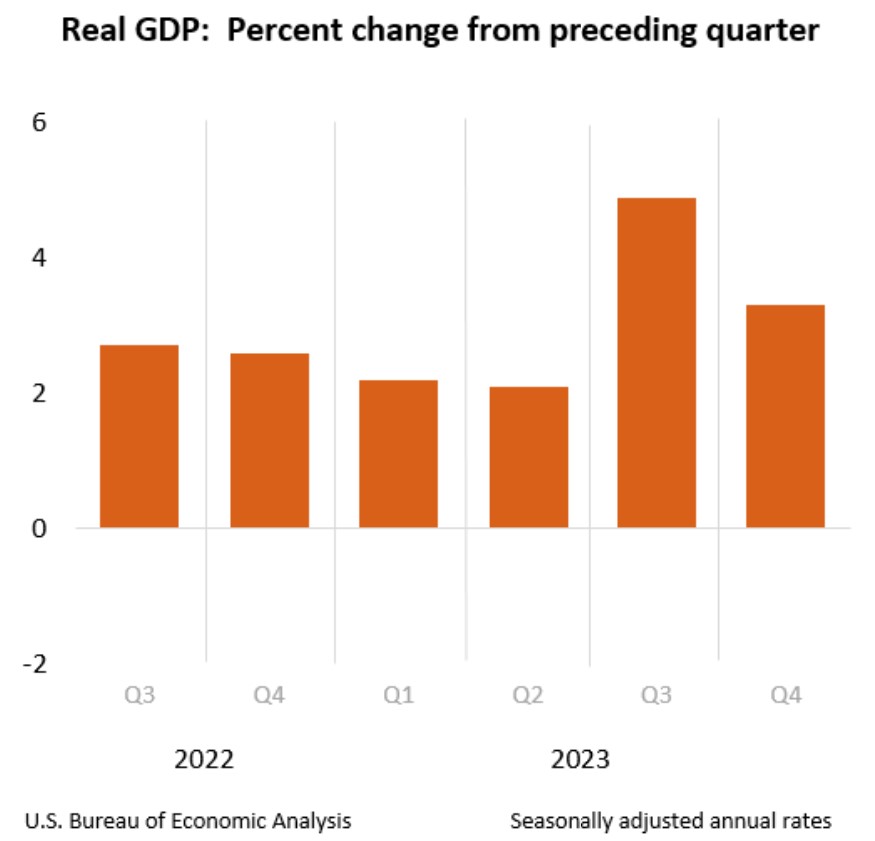

This morning’s revelation of a 3.3% rise in Q4 GDP, surpassing the estimated 2.0%, follows Q3’s impressive 4.9% growth. The economy appears remarkably robust, with Consumer Sentiment surpassing the 78% mark.

The challenge lies in being too fixated on perfection, potentially causing us to overlook the opportunities presented by the imperfect.

Get out there and start looking for a home, or list your home. Take advantage of the day/week/month/year.

-

CPI is 3.4%, PCE is 2.6% and Truflation is at 1.87% inflation.

Attempting to count a room full of cats or a pond teeming with fish is futile.Similarly, the Federal Reserve employs various indices, including the Consumer Price Index (CPI), Personal Expenditures (PCE), and Truflation. While CPI and PCE analyze around 80,000 data points, Truflation delves into a staggering 10 million data points.

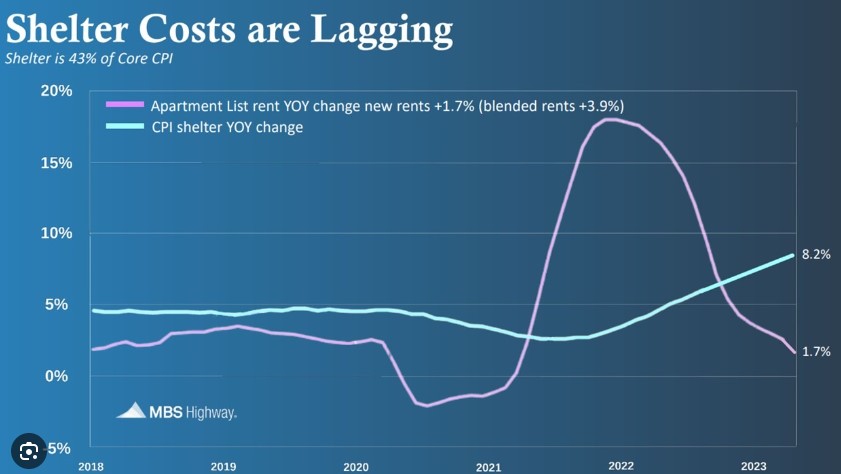

Within CPI and PCE, Shelter or Rents constitute the largest component. The disparity between CPI at 3.4% and PCE at 2.6% arises from CPI assigning twice the weight to Shelter costs compared to PCE.

Shelter costs are akin to looking through a rearview mirror, lagging in reporting their true numbers or decline. Anticipations suggest more accurate shelter data reporting by March/April.

Obtaining an accurate glimpse of the true costs of products and services proves nearly impossible. Keep an eye out for Personal Consumption Expenditures (PCE) numbers releasing on Friday, as we anticipate a positive impact on the Bond market and rates.

-

Leading Economic Index (LEI) Says recession ahead- here’s why.

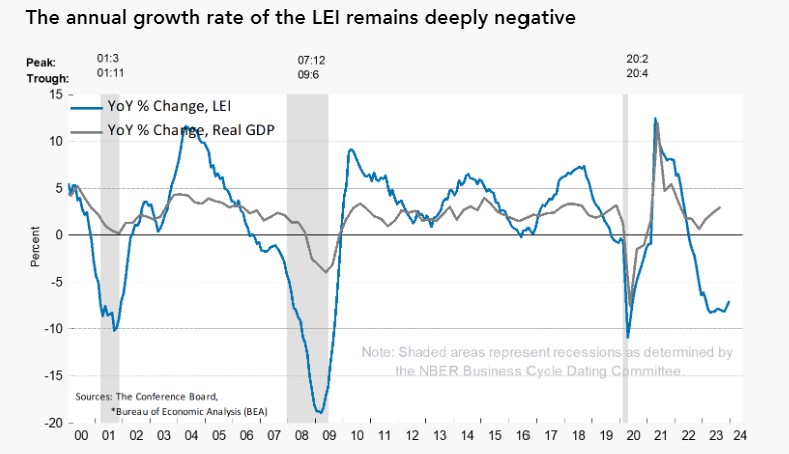

LEI, or the Leading Economic Index, serves as a comprehensive indicator aiming to anticipate the global economic trajectory. It assesses various data sets, including the yield curve in the bond market, durable goods orders, the stock market, manufacturing orders, building permits, and the Producer Price Index (PPI).

Imagine it as a panoramic view of everything happening worldwide, all considered simultaneously. Remarkably, this marks the 21st consecutive month of negative readings.

The Conference Board, the entity behind the LEI release, is indicating a potential negative GDP growth in Q2, with expectations of recovery in Q3 of 2024.

In my perspective, this might explain why, despite low employment and decreasing inflation, there’s a pervasive sense of unease about the economy. The overall trend suggests a gradual slowdown, not rapid but noticeable.

-

What’s the Rate? Depends on who you ask.

One of the most common questions I get asked is, “what is your rate”.

I could then spend the next hour explaining the nuances of what goes into answering that question including credit score, down payment, loan program, conventional, FHA, VA or Jumbo loan, but I will spare you.

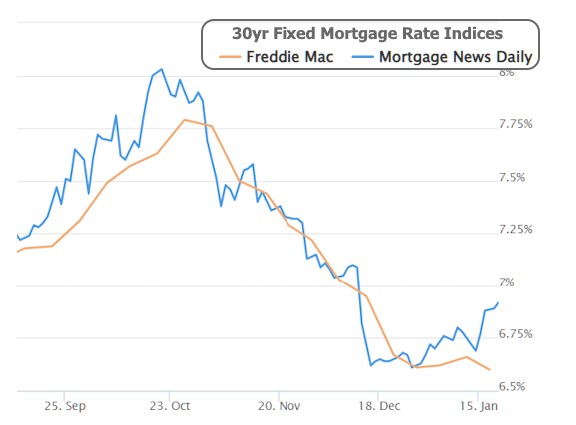

If you just listen to the news or google current rates, it’s all over the place. Mortgage Rates are unique to your specific situation. Call us to get an accurate number and take the news media with a grain of salt. They are usually a week late to the party.

Even though there is a disparity between Freddie Mac and Mortgage News Daily surveys they both show the downward trend.

Personal Consumption Expenditures come out Friday and are expected to be good news for the bond market.

-

What is Consumer Sentiment and does it matter?

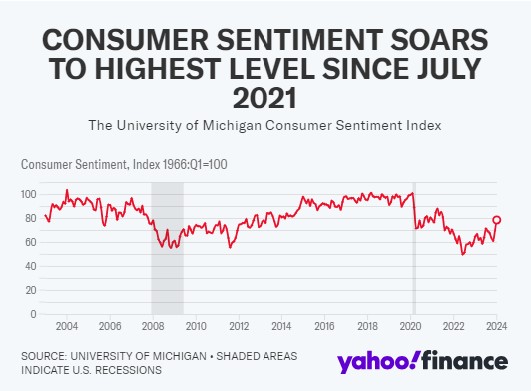

The index reading for the month came in at 78.8, its highest mark since July 2021, and well above economist expectations for a reading of 70.1. The cumulative 29% climb in the sentiment index over the past two months is the largest two-month increase since the US economy recovered from recession in 1991 – Yahoo Finance

If we look at the graph below we can see the large climb was due to a large drop from 2021-2022.

This is another indication we are headed back to a more normal stance as we look back over the last 20 years.

Rates are holding their own, home prices are up 4.4% Year over Year.

Consumer Sentiment is the consumers view by confidence that inflation has turned a corner and strengthening income expectations.

-

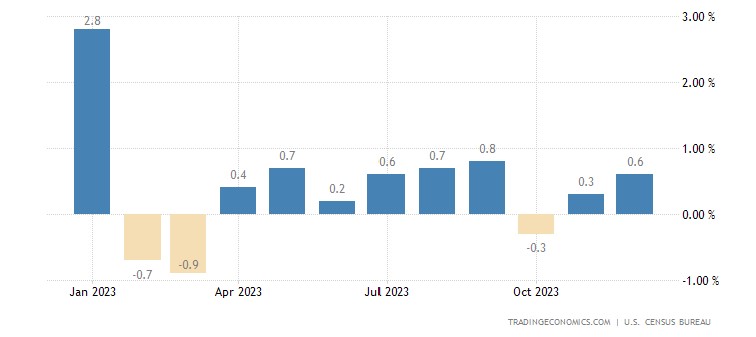

Retail Sales are up 0.6% vs 0.4% as expected, but what is really going on.

The bond market just flinched and I don’t know why. December’s data is seasonably adjusted but everything cost more this year compared to last year so of course the Retail Sales numbers are going to be higher.

We have a strong economy regardless of the naysayers.

The 10 yr yields ended the day slightly higher and we lost some of our rate gains this week.

I am headed to a sales meeting in LA so will be cutting this short.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.