-

Divergence between CPI and PCE and why it matters more than you think.

Let’s Talk CPI and PCE. it’s important so put down your cell phones and pay attention.

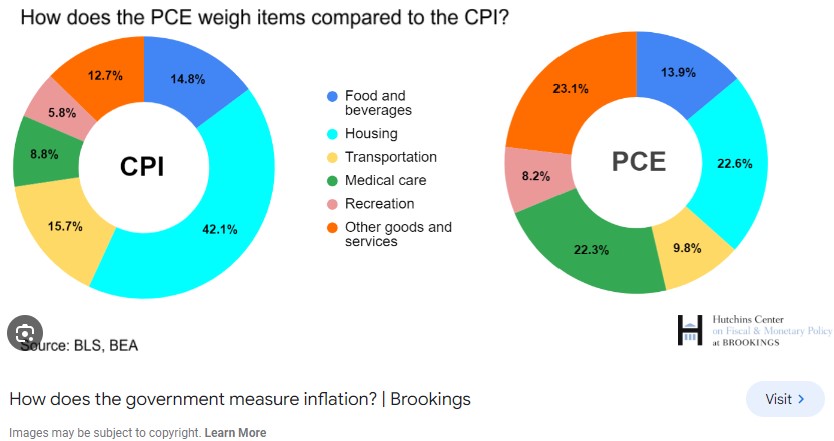

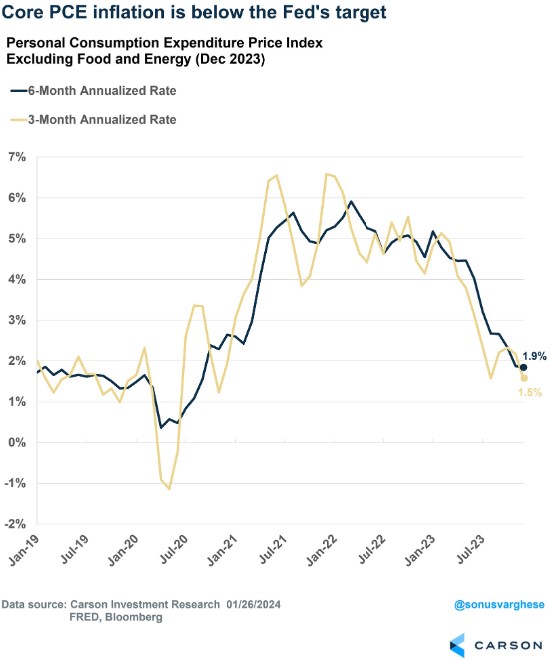

CPI updates the “weight” of its items Annually, while PCE updates Quarterly. So what does that mean?

CPI typically has a higher inflation rate because they can not capture in relative real time consumers switching to cheaper products.

To get a bit further in the weeds, CPI only captures a narrow definition of Urban consumer expenditures made directly from Consumers. PCE considers expenditures made by all consumers as well as those made by other third parties.

Here is an example: A Healthcare insurance provider who purchases prescription drugs on behalf of patients. PCE weighs health care at 22.3% while CPI is at 8.8%.

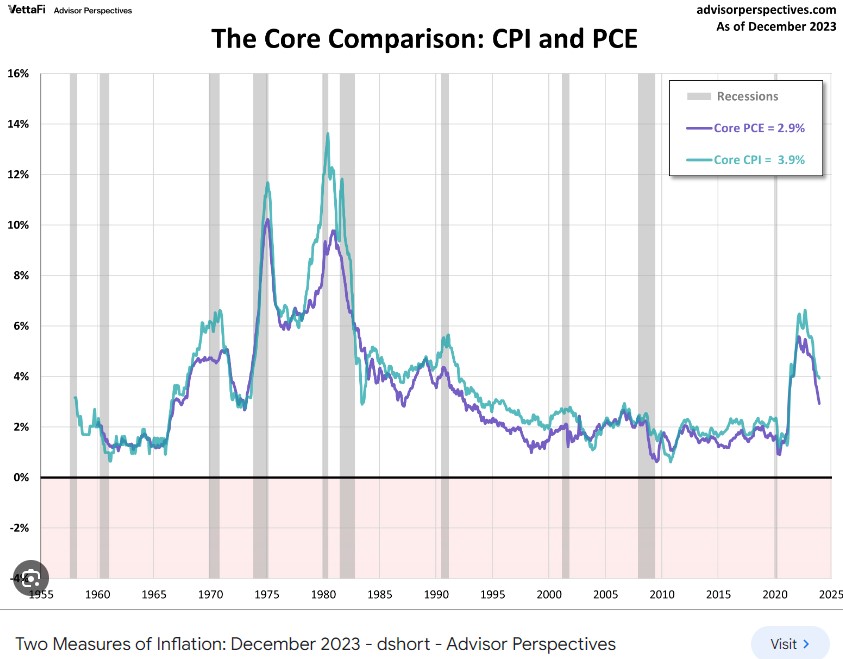

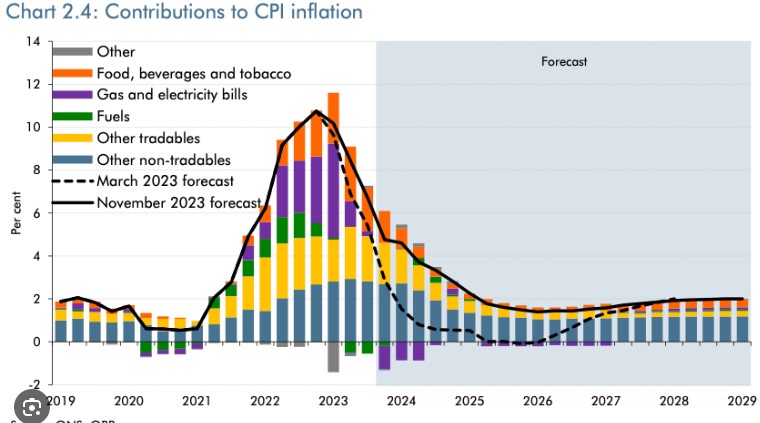

The second graph demonstrates the divergence and that we are closer to the target 2.0% inflation than we realize.

-

I wanted the whole Pie, not just 7/8s of it… PCI numbers hot.

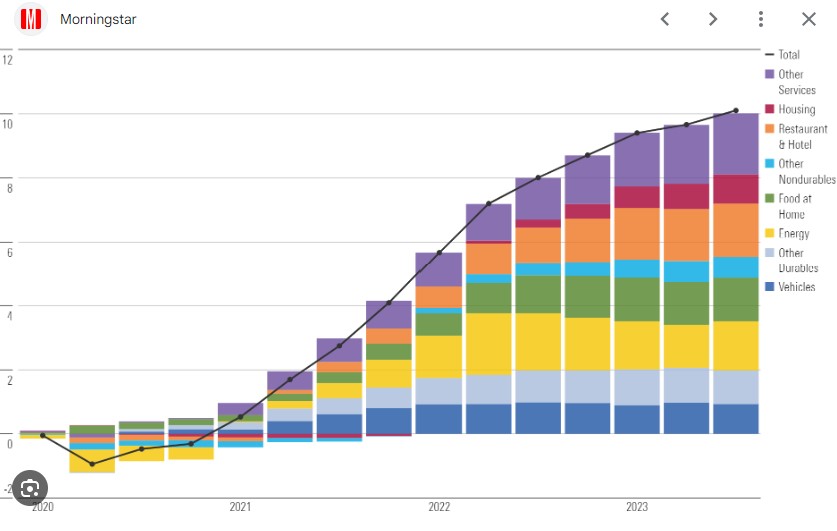

The good news is that the PCI numbers show a year-over-year inflation decrease from 3.4% to 3.1%. The problem is, we Buruca’ed it.

The Core rate, which strips out food and energy prices, increased by 0.4%, one-tenth higher than expected.

Here are the numbers:

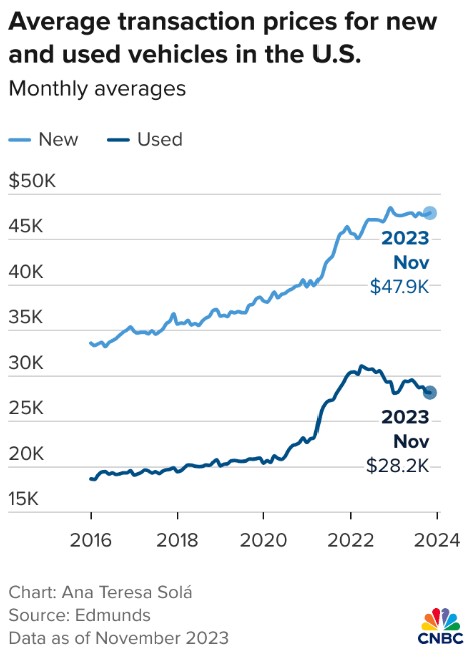

Energy prices fell by 0.9%, gasoline dropped by 3.3%, and used car prices decreased by 3.4%.

Shelter costs, which make up 44% of the index, rose by 0.6%. Lodging away from home also increased by 1.8%.

Auto insurance, which accounts for 3.6% of the inflation reading, rose by 1.4%.

The bottom line is, inflation is decreasing, just not as rapidly as we expected or anticipated. We’re all ready to Get-to-Getting but are struggling to move forward.

-

88M or 34% of adults use “Buy Now, Pay Later”.

Consumer financing companies like Affirm play a vital role in providing options for individuals who may not have access to or qualify for traditional credit cards. However, the increase in consumer debt by 12% since 2022 raises important considerations about financial health and its impact on discretionary incomeThe challenge lies in how effectively consumers manage and repay these debts, as it directly influences their ability to pay for non-essential purchases later on.

How healthy are the consumers? well it depends on when you look. Consumer spending is up, but how is the big question. Retailers are already seeing the pinch as buyers are becoming more savvy leading to more cautious spending habits.

This will bring prices down as competition for the consumers attention rises.

Tomorrow morning the Consumer Price Index – CPI will be out and expected to drop from 3.4% to 3.0%. This is positive news for the Bond market as we expect rates to continue to drop.

-

CEO Confidence Survey – not as boring as it reads.

I tried to cook up a witty subject line but failed.

The Conference Board released their Q1 CEO Confidence Survey and it was what we expected in a roller-coaster kind of way.

The Index took a leap from 46 to 53% thanks to a sprinkle and dash of lower interest rates and inflation.

However, and hold onto your hats – 23% of the CEO’s up from 13% expected to show some workers the exit door. The enthusiasm for expanding their workforce seems to be losing steam, dropping from 38% to 35%.

All eyes are on next week’s January CPI number on inflation. The industry is anticipating a decline from 3.4% to 3%. Remember these numbers are based on last year’s inflation numbers so as we journey forward the drop in inflation will be smaller and smaller.

-

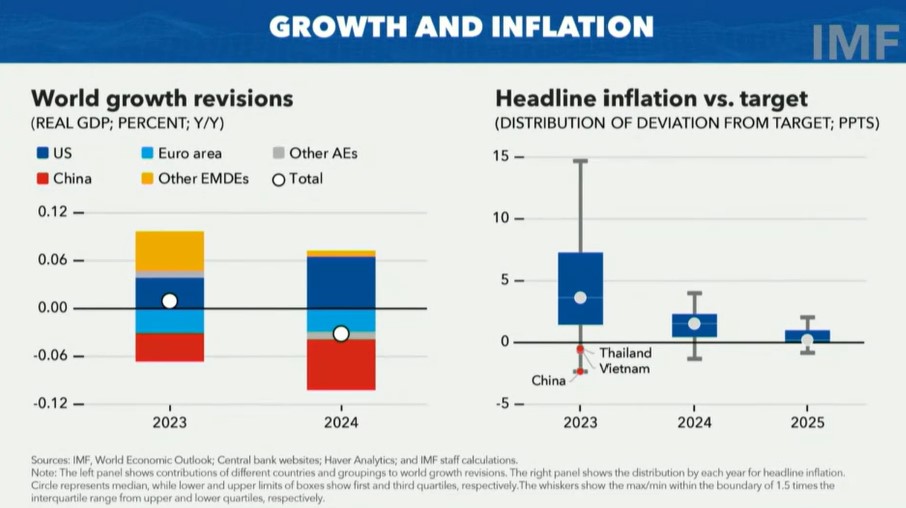

Growth, Inflation and Divergence

In 2023, the United States marked a significant milestone as it surpassed China in imports of goods and services from Mexico for the first time. This shift was influenced by factors such as geographic proximity and heightened tensions between the US and China.The robust US economy continues to outshine others globally, with efforts focused on addressing inflation and bolstering the labor market.

Initial Jobless Claims fell 9,000 to 218,000. Continuing Claims fell 23,000 to 1.871M.

Mexico

In 2023, the US imported $475 billion worth of goods from Mexico, which is a 5% increase from 2022. In the first 11 months of 2023, goods imported from Mexico accounted for 15% of US imports.

China

In 2023, the US imported $427 billion worth of goods from China, which is a 20% decrease from 2022.

-

The Feds are being stubborn and won’t play with others…

Fed Minneapolis President, Neel Kashkari said the Fed is not as restrictive as it appears.

Translation, they are holding off cutting rates.

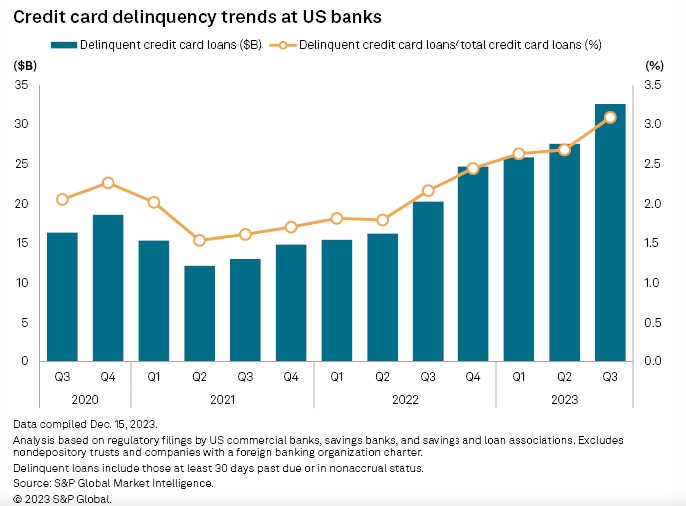

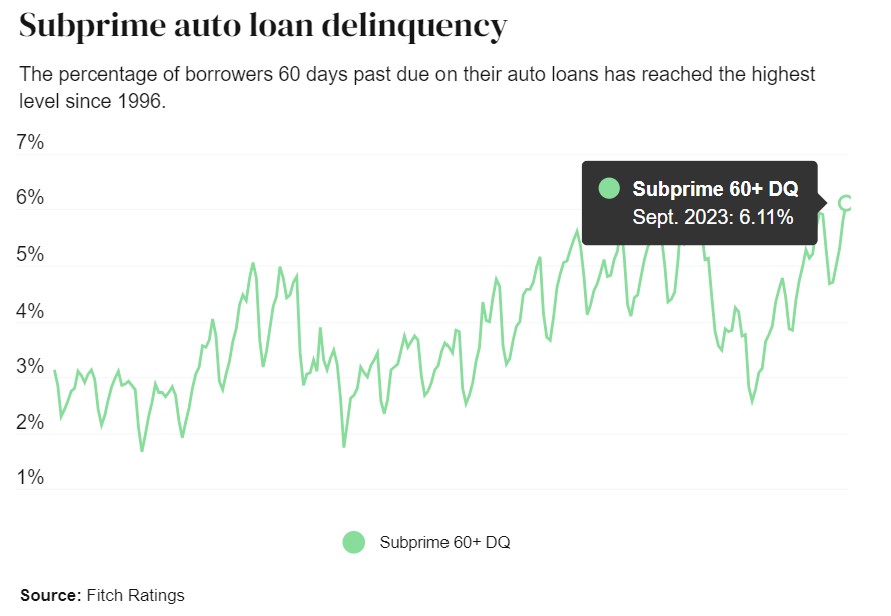

Regardless of the Raw data, the Feds continue their stubbornness regarding the true nature of what is going on. Credit card and auto loan defaults are on the rise. This is the canary in the coal mine. The ongoing layoffs in the high-tech sector will undoubtedly affect employment figures, compounded by a notable exodus from the labor market, resulting in the exclusion of those individuals from official counts.

Used car prices are down per Manheim Used Car Index. it’s an important component of inflation. The cost to finance is expensive and the Covid money disappears.

We are still holding on to our improved rates this year, so get out there and start looking for your new home.

-

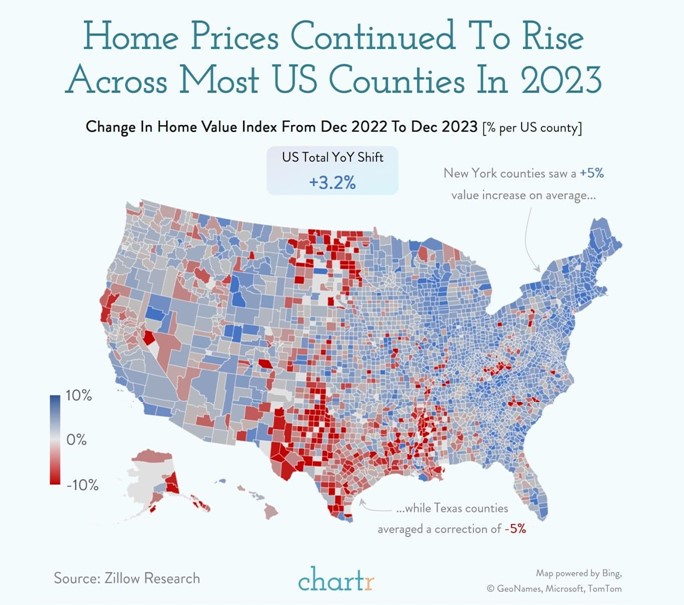

Cost of Waiting. Home Values up 5.5% Y/Y

Home values continue their climb, up 5.5% year over year. Black Knight reported the average homeowner has over $300k in equity. Most mortgage holders loan to value is under 46%.

The equity position of home owners is incredibly strong. Refinances, especially debt consolidation are on the rise. 1.7M people could benefit because they purchased it last fall at higher rates. When rates drop to 6% there will be over 3.8M who would benefit from refinancing.

The forecast for home appreciation is 2.8% per CoreLogic and Black Knight Appreciation Reports.

I have a YouTube Video explaining the Cost of Waiting to purchase a home. Enjoy and have a great rest of your week.

-

Thank you Powell, NOT. Debbie Downer just walked into the room.

Fed Chair Jerome Powell spoke on 60 minutes Sunday and basically took the air out of the room. There is a phrase in the industry called Analysis Paralysis.

The Feds are so afraid to make a decision, they end up deciding by not deciding.

Let’s put this into context. The 6-month annualized rate of core PCE inflation is at 1.85% and the 8-month annualized rate is at 2.08%. Remember the target is 2.00% annual inflation.

Oil prices, rents-shelter costs and other components of the PCE report continue to drop. The Jobs market is also not quite what it seems. Employees are staying put as it’s harder to find a job once they quit.

-

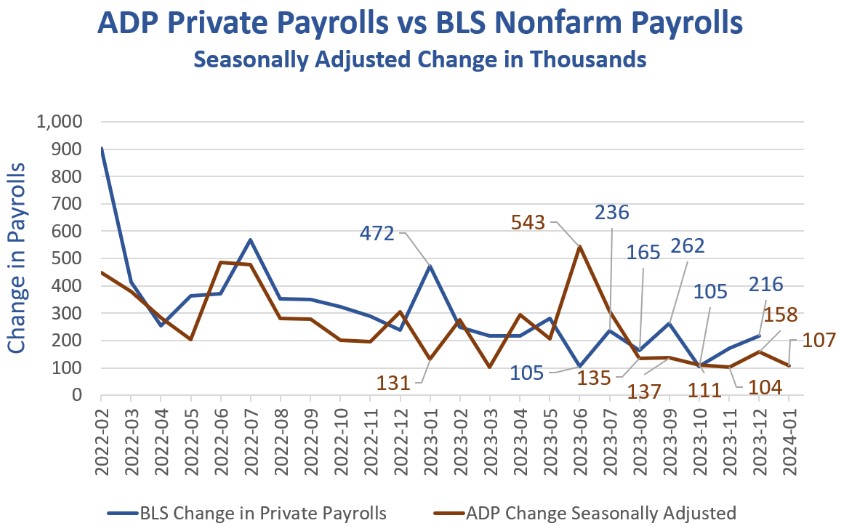

Double the pleasure or Double the Trouble?

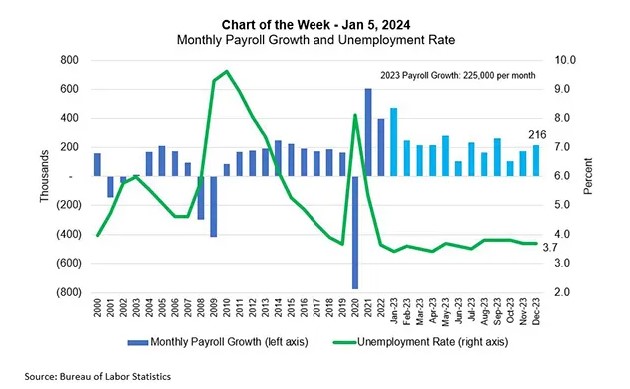

The Bureau of Labor and Statistics (BLS) reported 353,000 Jobs created in January, which is double the expectation.

What is really odd is the contract to the ADP report that only showed 107,000 jobs created.

Here is another contrast between the two reports. Average hourly earnings, which measures wage pressure on inflation, rose 0.6%. This is double the expectation. ADP showed significant declines. ADP samples 10M actual employees.

Average weekly hours worked declined from 34.3 to 34.1. The lowest level since 2010 (minus the pandemic). This is why hourly earnings rose. Working less hours but producing the same result. This translates to 30 minute less per week compared to January 2023. This is a way for businesses to cut costs.

However, amidst these contrasting data points, a challenge persists with the potential manipulation or omission of crucial data elements.. The BLS report has two components, the Business Survey and the Household Survey. The Business Survey is the headline report. The Household Survey is where the unemployment rate comes from.

The Household Survey was much much weaker than the headline 353,000 jobs created.

I’m rambling here but bear with me. All this data, regardless of how it’s presented, paints the picture the Feds want. Weaker economy and inflation. This translates to the Feds lowering their rate sooner than later and the Mortgage rates will follow.

-

All Eyes and Ears on Powell. Whatcha gonna do???

Jerome Powell Chair of the Federal Reserve is EF Hutton (dating myself on that reference). When Powell speaks everyone listens.

Acknowledge GDP better than expected.

Growth has slowed from Q3.

Better balance of employment and inflation goals

Less likely Confidence by March 20th to cut rates.

Mum on the balance sheet ie buying Securities/bonds and stop selling them.

Unemployment rate 4.2%, benefits for the first time rose 9,000 to 224,000. This is Holiday adjusted. Continuing Claims rose 70,000 to 1.898M. A big rise and a sign that once you are laid off, its harder to find another job.

I don’t see exactly what the Feds are waiting for. We see what is happening with Rents dropping, the Used car industry on the ropes, Layoffs and more. My suggestion is for Powell to quit looking through the rear view mirror and drive the car.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.