-

BLS and ADP who is correct. Both lower than expectations. Unemployment 3.9%

Here’s an interesting twist to the Bureau of Labor and Statistics (BLS) report of 175,000 jobs created. If we look at the Birth/Death or online vs offline company starts and fails, the jobs report would have been -188,000.

Not trying to be a downer in all this but the reality of the job market became much clearer this morning despite the best efforts of those reporting the numbers this past year.

The Federal Reserve relies heavily on accurate data for decision-making, and uncertain data requires time for analysis.

By the numbers:

- Jobs Created 175,000 expected 243,000

- Unemployment was 3.8% now 3.9%

- Hourly earnings rose 0.2% expected 0.3%

- Weekly hours worked decreased from 34.4 to 34.3

These figures suggest a weakening job market, which could influence interest rate decisions. There’s pressure on the Federal Reserve to consider a rate cut in September rather than waiting until November.

-

Hedonic Treadmill -what goes up must come down.

An individual’s level of happiness tends to return to its baseline after experiencing either positive or negative life events, a phenomenon known as the Hedonic Treadmill.

Consumer Confidence, gauged by factors such as job availability, difficulty in finding employment, and expectations for future job prospects, has recently shown a decrease in the perceived availability of jobs (a 1.5-point drop), an increase in the perceived difficulty of obtaining jobs (a 2.7-point rise), and a decrease in expectations for future job opportunities (a 2.6-point drop).

However, these indicators contradict the current unemployment rate at 3.8%.

Getting into the weeds but lets take a deeper look. There are two key Census readings. 12M entities with the Census and 700k in the BLS report. Census data shows 192,000 job losses vs the BLS showing 521,000 job gains.

The Feds lean into the BLS report.

-

What should You do today that “You” Tomorrow would be happy You did?

In our lives, we craft meticulous five-year plans and set ambitious New Year’s resolutions, envisioning a future filled with growth and achievement. Despite our best intentions and careful planning, life has a remarkable ability to throw unexpected curveballs our way.

This unpredictability extends to mortgages and real estate. Families often find themselves navigating through shifting landscapes and unforeseen circumstances. It’s easy to become complacent or overly comfortable with our current situation, failing to anticipate the dynamic nature of the market and the ever-evolving needs of our lives.

Be prepared. Do today what you might put off for tomorrow. If you are thinking about selling your home, call your agent and start the conversation. If you don’t know if you are qualified for a mortgage, find out today not tomorrow.

Think about you tomorrow.

-

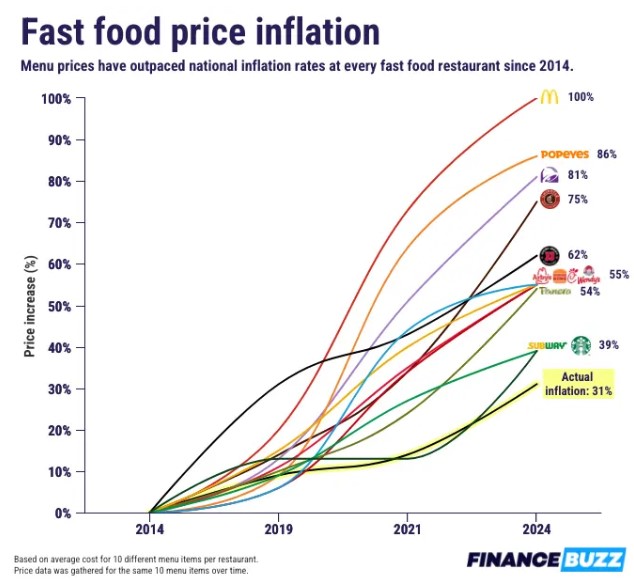

Egg McMuffin, Hashbrowns and Coffee please. It’s how much???

Let’s get the business stuff out of the way first.

Personal Consumption Expenditures (PCE) rose by 0.3%, which is about what we expected. The core rate rose as well, though it remained in line.

Personal income went up by 0.5%, but we are spending more than we make, and our credit cards and savings are feeling the pinch.

Have you been to a fast-food restaurant lately? I was a bit shocked. I am not giving companies like Nestle, Walmart, Tyson, and other food and beverage companies a pass for taking advantage of an inflationary atmosphere.

Take a look at their balance sheets. In 2023, Nestle’s profit was up by 17.3%. McDonald’s reported a 52% operating profit margin in 2023.

There is a wolf in sheep’s clothing.

-

Should I Stay or Should I Go – Clash 1982

On Tuesday, the US Federal Trade Commission voted 3-to-2 in favor of a near-total ban on non-compete agreements, the contract stipulations that prevent millions of employees — from bankers to biochemists to bartenders — from finding new work or starting businesses in their field after leaving their jobs.

I have presented these numbers throughout the last year, but graphically, you can see who is in control: the employee or the employer.

The health of an economy can be reflected in the differentials. Look at 2001 compared to 2004, the drop after 2008, the rise after COVID, and now the dramatic drop in job switchers today.

What does this mean? Although the unemployment numbers are historically low, there is a crack in the foundation. The Fed is waiting for more data that I believe is already staring them in the face.

-

Would you Like you, if you Met you?

I am going to be confusing right off the start…

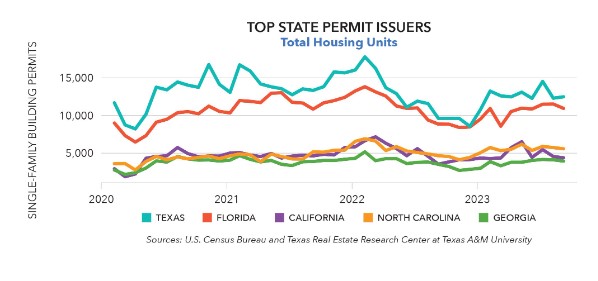

New Home Sales, which measures signed contracts on new homes rose 8.8% in March. Big number but here is the confusing part.

There were 477,000 new homes for sale in March. That is an 8.3 month’s supply, slightly lower than previous month.

However, only 89,000 homes are completed. When we look at the pace of sales vs completed homes, the supply is only 1.53 months.

Bottom line, I want to be a builder.

Builders know this and are cutting incentives and home prices to attract buyers.

-

Are you writing this down because I don’t have a crayon.

Personal Consumption Expenditures (PCE) are coming out this Friday. It’s the Fed’s favorite measure of inflation.

And speaking of inflation, one of our move Dovish Fed Presidents Austan Goolsbee of Friday said that we never want to overreact to one reading, but we have had three months of readings and inflation is just not budging.

How long do we sit back and wait for the right situation to happen before we make our move? There will never be a perfect time. There will never be a wrong time. The world moves forward regardless.

I used this graph last week, but it’s worth repeating: Rates are high, from the hindsight perspective of two years.

-

If you are Coasting, you are going down hill.-Paul K.

Mid week we had a bit of a rally in the bond market which started to erase the higher yields/mortgage rate movement. But like any good news, we have a Debbie Downer at the party.

Yesterday, New York Fed President John Williams dampened the spirits. He stated that he wouldn’t rule out further rate hikes until the data showed lower inflation figures.

This announcement prompted a sell-off in bonds. Think of it as Quantitative Tightening rather than Quantitative Easing (buying bonds/securities to lower rates).

Next week, we’ll see New Home Sales, Mortgage Applications, Durable Goods Orders, Jobless Claims, and Friday’s Personal Consumption Expenditures (PCE).

The bottom line is that there’s a growing tendency toward lower yields, so the prudent approach is to exercise patience.

Regarding the headline; if you’re simply coasting along without putting in effort or actively working towards something, you’re likely to experience a decline or negative consequences.

-

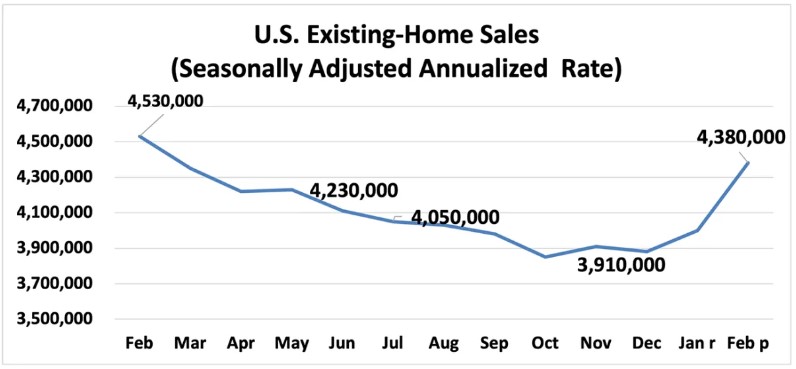

Nothing has changed, it’s just your desire for something different. – Michelle K.

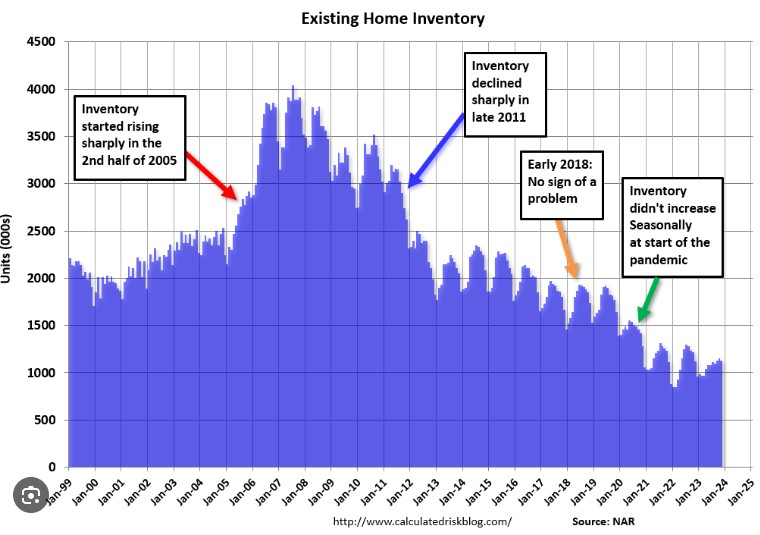

In the context of the housing market and economic conditions, there are concerns such as low inventory, high interest rates, or stagnating economic growth. These factors have been persistent and are not fundamentally changing.

The feeling of frustration or urgency to see improvements may stem from a desire for conditions to be more favorable rather than any real shifts in the circumstances.

What’s our next step? We keep moving forward. Life doesn’t pause to accommodate a perfect scenario. Waiting for ideal conditions means missing out while life keeps moving.Inventory increased 4.7% month/month. We now have a 3.2 month supply. 4.6 months is considered normal.

Median home price rose to $393,500, up 4.8% from last year.

First time home buyers account for 32% of sales, up quite sharply from 26%. Cash buyers are 20% of sales down from 32%. Investors made up 15%, down from 21%.

29% of homes sold over list price up from 20% in February.

Spring has sprung and the market is getting hot.

-

That speed bump ahead is just an Illusion. Don’t borrow trouble from the Future.

Mortgage applications have shown resilience despite higher interest rates, with a 5% increase from the previous week. However, they are slightly down compared to the same period last year.Refinancing activity has surged, up 11% even with rates being 0.75% higher than last year. This suggests that despite the higher costs, homeowners are still seeking to refinance their mortgages, likely due to various factors such as reducing monthly payments or accessing equity.

Federal Reserve Chair Jerome Powell’s recent remarks on U.S.-Canadian economic relations indicated a concern about the stagnation in reaching the Fed’s 2% target and a decrease in confidence. This sentiment could impact the outlook for future rate cuts, potentially leading to a more cautious approach by the Fed.

The sentiment expressed about the current state of the housing market reflects a broader trend observed in the industry. Low inventory levels coupled with higher interest rates are causing many agents and borrowers to adopt a cautious stance, resulting in a sort of holding pattern. While there is an expectation that these challenges will eventually subside, the process may be slower than desired, creating uncertainty in the market.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.