-

The Insidious Damage of Revised Numbers.

The market reacts to the news not the revision. When we look at inflation as an example, we always couch it in terms of “year over year”. But most of the other numbers and gauged by “month over month”.

A good example is todays Durable Goods Orders. We expected -0.8%. What we got was a rise of 0.7%. The market, specifically the Bond market saw the 1.5% differential and reacted accordingly (negatively).

Last months reading of 2.6% was revised lower by 1.8% bringing March to 0.8%. The actual reading today fell -1.0% which was worse than the expected -0.8%.

Another example: Core Durable Goods rose 0.3%, which was stronger than the estimates of 0.1%. There was a negative revision from the previous month of 0.3%, which brought March to -0.1%. When factoring that in, the reading was 0.0%, lower than the expected 0.1% stated above.

The Bond Market, which is what rates are based on, reacts to the headline not the math. The consumers are slowing their roll. First it was Retail Sales and now its Durable Goods.

Walmart and Target both announced store wide price cuts. Others will follow and inflation will drop.

The Train is coming but the Feds are too busy looking in the rear view mirror to realize they are parked on the track.

-

You say Potato, I say Potaato

Fed Minutes can be a bit frustrating to read. Here is an example.

“Some participants emphasize that the recent increases in inflation had been relatively Broad Based”.

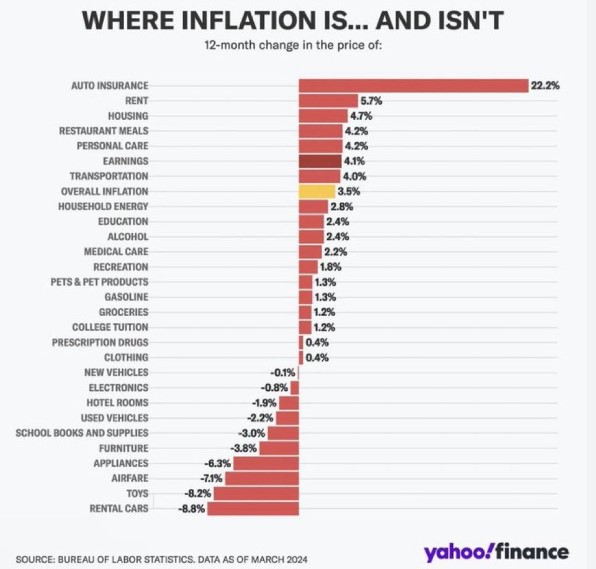

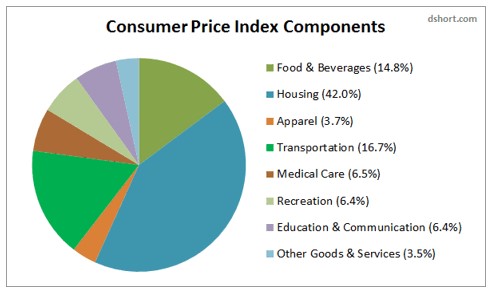

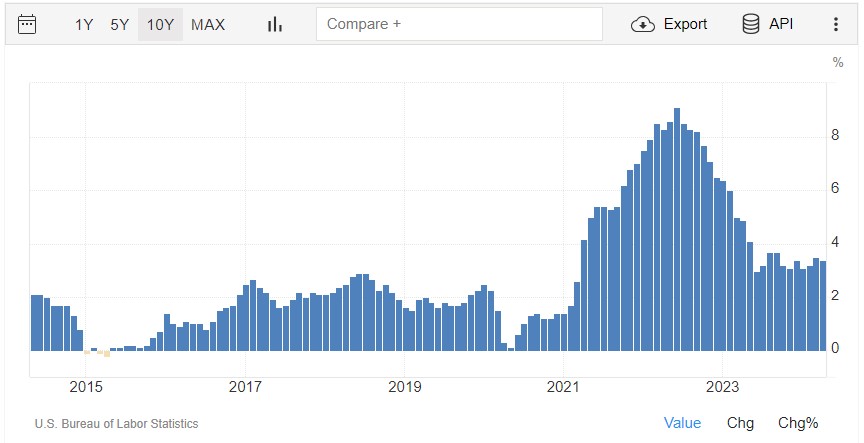

Take a look at the graph below. The top three items are Auto Insurance, Rent, and Housing. Housing and Transportation make up 58.7% of the Consumer Price Index (CPI).

If we pull these out, inflation is only up 0.27% year over year. This is not broad-based but specific.

Inflation is stubborn, that is true, but its makeup is also as important.

The bond market reacted to the news today on Initial Jobless Claims and the Fed Minutes. Rates slipped but only a bit.

-

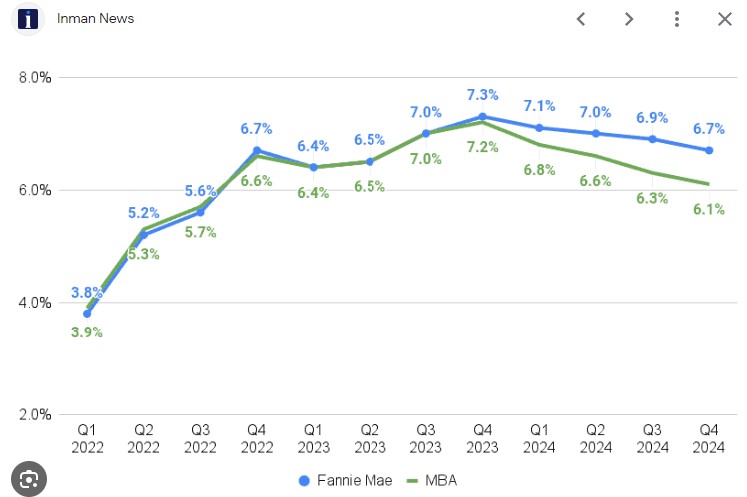

Rates hold onto gains this week. Fed Minutes out today.

At 11am PST the Fed Minutes for the May 1st Fed meeting will be released.

- Next move may not be rate hike

- Inflation continue to stall.

- Unemployment rate going up

- Feds slowing down Balance sheet reduction (quantitative tightening)

- Feds increasing their Balance sheet (quantitative easing) -good for rates

Existing home Sales

This is the sale of existing homes not new builds.

- Fell 1.9% in April. Slightly lower than expectations

- Higher rates in February did not stall sales

- Inventory increased 9% mont/month

- Inventory up 16% from last year.

- Median home price up 3.7% to $407,600

The bigger news is first time home buyers make up 33% of the sales, which is up sharply. Cash buyers accounted for 28%, Investors 16%.

27% of homes sold above the list price. Mortgage applications down slightly and 11% lower than this time last year.

Inventory is headed in the right direction and with fewer borrowers looking, Now might be the right time to make your move.

-

8 Fed Members Speaking this week. What to expect and what we know this morning.

Raphael Bostic a voting member and Fed President said he thinks inflation will continue to come down, but slowly. He has talked to a lot of business leaders, and they are all telling him that things are slowing down.

Leading Economic Index

The Conference Board released their LEI, which decreased in April by 0.6%. We have had 22 months of negative readings in a row. This points to serious headwinds to growth ahead.

What’s going on this week

- Tuesday: CoreLogic Rent Index

- Wednesday: Mortgage Apps, Existing Home Sales, 20-year bond Auction, Fed Minutes

- Thursday: initial Jobless Claims, New Home Sales

- Friday: Durable goods Orders.

How will this affect Mortgage Rates?

What the Federal Reserve is hearing from the market aligns with the broader economic observations both anecdotally and technically. This indicates that the Fed is analyzing the data and recognizing that a recession may not be imminent. However, they might need to reconsider implementing rate cuts sooner rather than later.

Translation

Mortgage Rates should move in a positive direction moving forward.

-

Trading Down, Feds are you Listening?

Being in this business for over 20 years, there are words that stick out like a sore thumb.

One of those words is Trading down. During the 2008 Financial crises, I recall the headlines about how well the beer industry was doing. Generic brands got a boost as did other Trading Down brands.

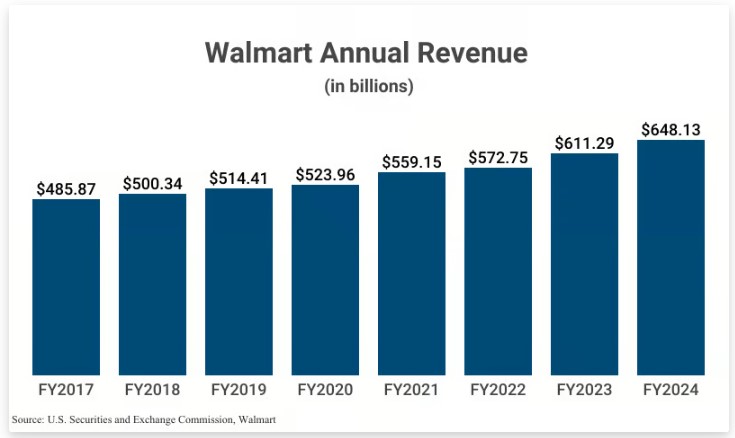

Walmart posted strong earnings yesterday. The reason this is important is they are a good barometer on the overall economy.

The higher income earners are Trading Down. They have a long way to drop opposed to lower income consumers who are close to the bottom. This is a sign that consumers are struggling with the pandemic savings exhausted and personal savings rate at very low levels.

Credit appears to also be tapped out. Buy now pay later has a very high delinquency of over 43%.

-

It’s not Free, but it’s just Free enough.

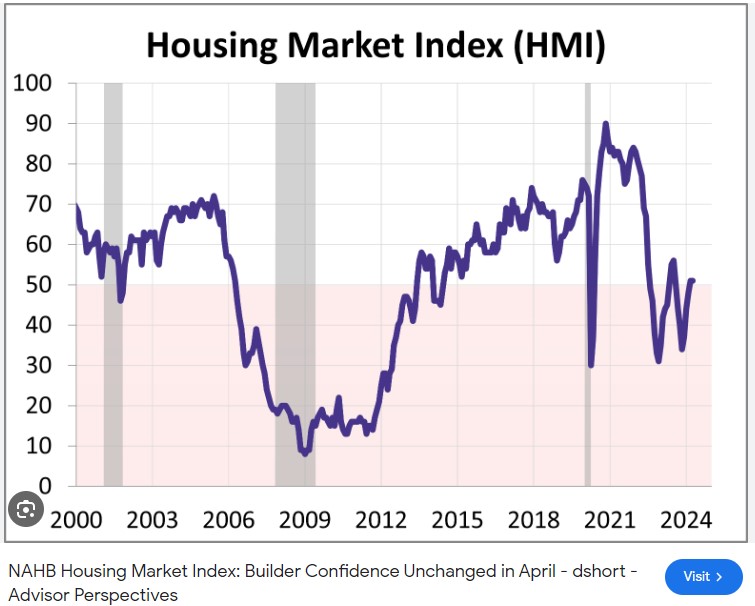

The use of sales incentives ticked up to 59% in May. The May HMI survey shows 25% of builders cut home prices to boost sales.

Its a builder confidence thing. The May NAHB Housing Market Index, which measures builder confidence, fell 6 points to 45. It’s under the 50 number but this is still an expansion confidence. Weak but still confident.

Initial Jobless Claims fell 10,000 to 222,000. This is higher than previous levels.

Continuing Claims rose 13,000 to 1.794M. These are the highest numbers since November 2021.

Big bond movement yesterday and holding onto those gains today.

-

Progress not Perfection – Inflation behaving itself

The Consumer Price Index (CPI) for March showed inflation rose by 0.3%, which is cooler than the estimated 0.4%. Year-over-year inflation decreased from 3.5% to 3.4%.

The core rate, which strips out food and energy, increased by 0.3%, as expected.

Here are the numbers:

- Energy prices rose by 1.1%

- Gasoline prices increased by 2.8%

- Auto insurance rose by 1.8%, up 23% year-over-year

- Used car prices fell by 1.4%, and new car prices dropped by 0.4%

- Shelter costs, which make up 45% of the CPI, rose by 0.4% but declined from 5.7% to 5.5% year-over-year

- Rents, similar to shelter, declined year-over-year from 5.7% to 5.4%

- Retail sales were flat, compared to an expected 0.4% increase.

The market is pricing in two rate cuts by the end of the year. These numbers strongly indicate that inflation is dropping and that the dreaded word “stagflation” will not rear its head.

-

It’s Hot in here, Oops sorry BLS report revisions.

It’s all about inflation, and when the Bureau of Labor Statistics (BLS) makes revisions, like they did in March, it becomes difficult to determine the true inflation figures.

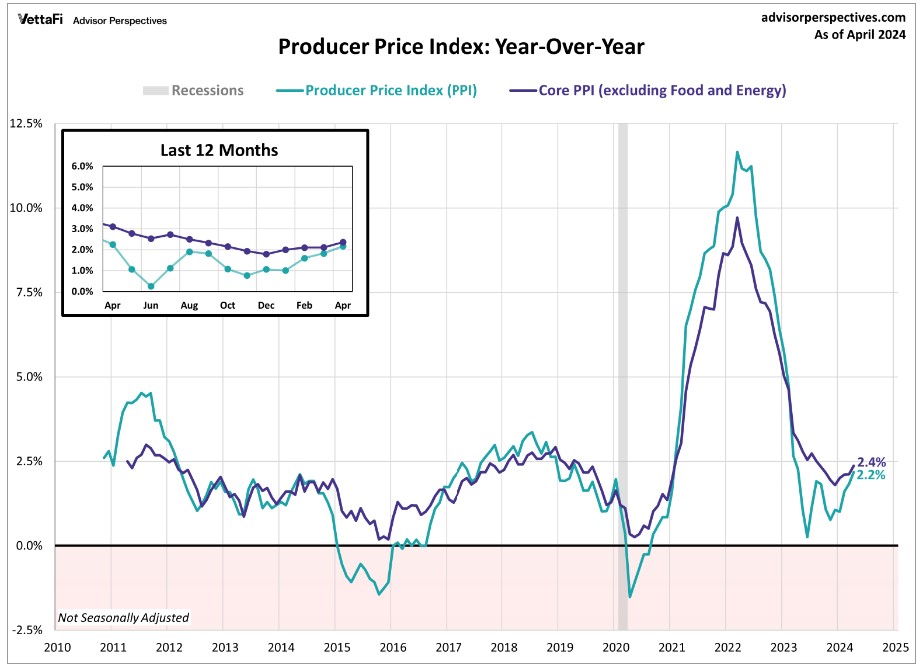

The Producer Price Index (PPI) report, which measures wholesale or producer inflation, rose by 0.5% in April. That is a much hotter number than the expected 0.4%.

The reason for this disparity lies in how these numbers are calculated. Inflation is based on a comparison of previous data, either from the last month or the last year as an example. Remember Inflation is the change in pricing from a previous data point.

Tomorrow’s Consumer Price Index (CPI) should shed some light on inflation, as it is a more crucial data point than the PPI.

What this means is the Feds should start thinking rate cut starting in June and potentially cutting mid summer. This is a positive outlook for interest rates.

-

Home Values Continue to Rise.

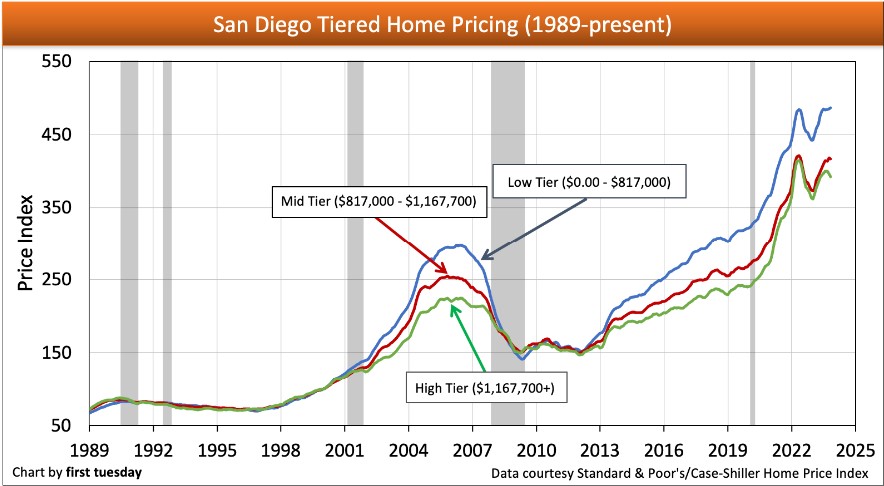

CoreLogic Home Price and Black Knight HPI both show strong home prices.

CoreLogic reported home prices rose 1.2% in March. This is showing an acceleration from 0.7% in February. Year over year, home prices are now up 5.3% CoreLogic has bumped up their forecast for next month to 0.8%.

Black Knight reported prices rose 1.2% in March and 5.6% year over year.

Real estate remains a robust investment option, even with current rates surpassing those of two years ago. Concurrently, home values continue to climb, making it an opportune time to invest.

Inflation has a fight on its hands. We have seen inflation stall but there is hope on the horizon.

The NY Fed Supply Chain Pressure Index fell from -0.3% to -0.85% in April. this is the lowest figures since August of last year when we saw great progress on inflation.

Oil prices have a big influence on core readings but over the last few weeks, we have seen oil prices decline by roughly 11%.

Stay resilient; I anticipate a significant drop in inflation, driven not only by the factors mentioned above but also by major players in the food industry, such as McDonald’s, scaling back on their historically aggressive stances in recent years.

-

4,094 People are relying on you. Don’t mess this up.

In order to be born you needed:

- 2 Parents

- 4 Grandparents

- 8 Great-Grandparents

- 16 Second Great-Grandparents

- 32 Third Great-Grandparents

- 64 Fourth Great-Grandparents

- 128 Fifth Great-Grandparents

- 256 Sixth Great-Grandparents

- 512 Seventh Great-Grandparents

- 1,024 Eight Great-Grandparents

- 2,048 Ninth Great-Grandparents

For you to be bon today from 12 previous generations, you needed a total of 4,094 ancestors over the past 400 years.

Think for a moment about how many struggles, how many battles, how much sadness, happiness, love stories, and hope for the future that you ancestors had to undergo for you to exist in this present moment. –Nathalie Anna

Interest rates are rebounding. Get out there and get to getting…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.