-

The FEDs are having a tough time agreeing to disagree agreeably

Bowman and Daly hold wildly opposing views on what to do with the Fed rate. Mary Daly isn’t solely focused on inflation but also on the rising unemployment rate. On the other hand, Bowman is against cutting rates this year and is so data-driven that she is actually discussing raising the Fed rate.

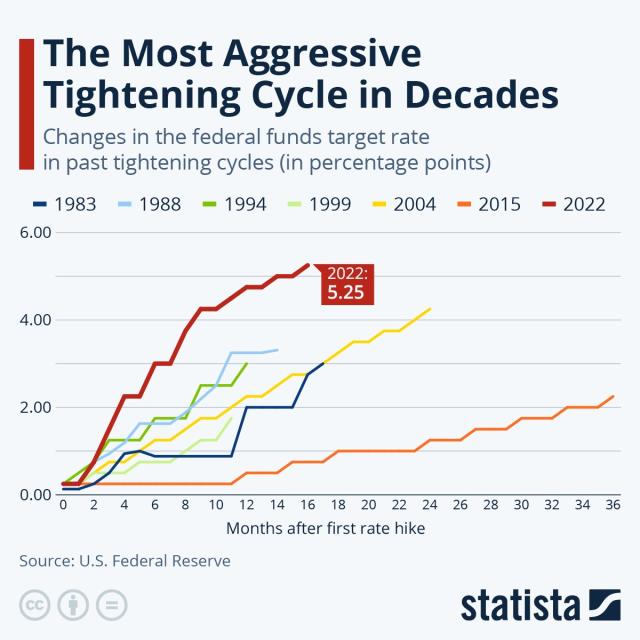

Let’s examine the impact high Fed rates have had on our economy. The objective was to slow down a hot market/economy to curb inflation, which sounds great and is historically accurate—except when the Fed rate remains high for an extended period.

Over time, higher costs for producers contribute to inflation. What costs me more will end up costing you more.

Home Prices hit all time high.

Case Shiller Home Price Index is the gold standard for appreciation. Prices rose 0.3% in April and up 6.3% year over year.

FHFA Housing Price Index which does not include Jumbo loans reported a 0.2% rise and a 6.3% year over year increase.

-

Restrictive nature of the FEDs is shifting quickly. Doves are flying

Goolsbee, Chicago Fed President said the Fed is at a historic level of restrictiveness. In English that means he is talking rate cuts sooner than later.

The jobs report is a big tell as the rising unemployment claims and higher consumer delinquencies are strong indicators of a slowing economy.

Friday, the Personal Consumption Expenditures (PCE) will give us an important look at inflation specifically the Core rate.

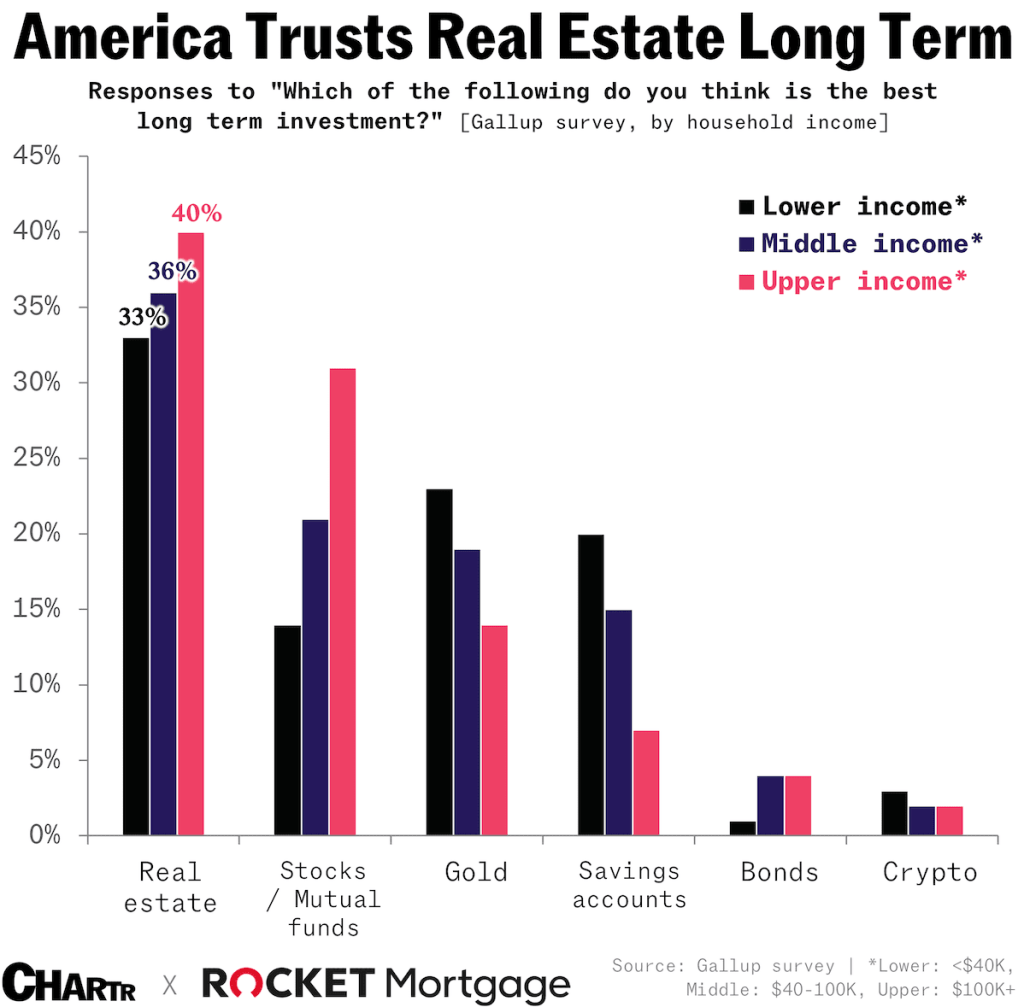

Real Estate is still the most trusted long term investment.

-

Retail Sales, a perspective on the numbers

Retail sales year to date are only up 0.3%. Consumer spending is slowing.

Consumer behavior has become more evident, with many opting for cheaper alternatives, like substituting steak with chicken.

To put this in perspective, the first five months of 2019 saw a 4% increase, while last year recorded a 2.7% rise.

In May, retail sales edged up by 0.1%, below the 0.2% estimate. Last month’s figure was revised down from -0.3% to -0.5%. Core retail sales, which contribute to GDP, increased by 0.4% but fell short of the 0.5% estimate.

For us, this means more data for the Fed to consider potentially earlier and more frequent rate cuts this year.

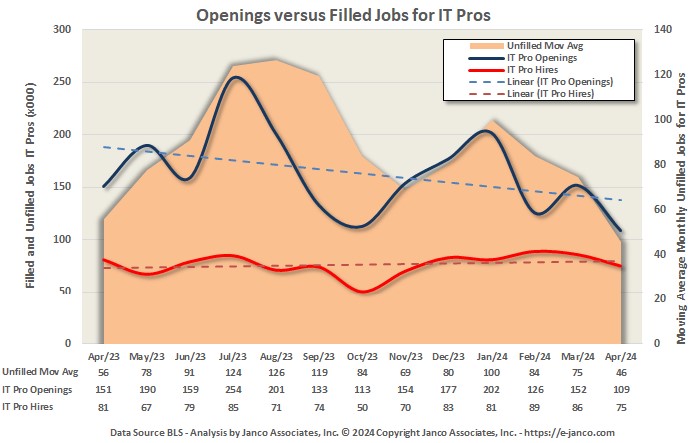

The job market shows significant revisions:

- October: revised from 165,000 to -9,000

- November: revised from 182,000 to 8,333

- December: revised from 290,000 to 116,333

The truth eventually surfaces.

Despite weaker retail sales, industrial production in May rose by 0.9%, surpassing the 0.3% estimate. This tempered the bond market’s reaction to the retail sales report.

There was some rate improvement, but not as much as anticipated.

-

Fed Speak, PPI and Jobs. Lets do the numbers.

Powell spoke yesterday and admitted that the Fed’s policy is currently restrictive. It’s like saying, “I know I’m being tough right now, but I’ll ease up later.”

Unemployment rate ticked up, Quite rate is lower, which means less job movers and the ones that have a job as staying put. Wage increases slower as well.

The Fed’s Summary of Economic Projections (SEP) indicates that members are considering one or two rate cuts this year. They are extremely data-driven in their decisions. While the economy remains strong, there is growing unease among the public.

The Producer Price Index (PPI) report fell 0.2%, lower than the 0.1% rise. PPI measures wholesale or producer inflation.

Initial jobless claims up for the first time in 10 months. The job market is tightening up.

The result of all this is lower interest rates. Lets see if the trend can continue through the summer.

-

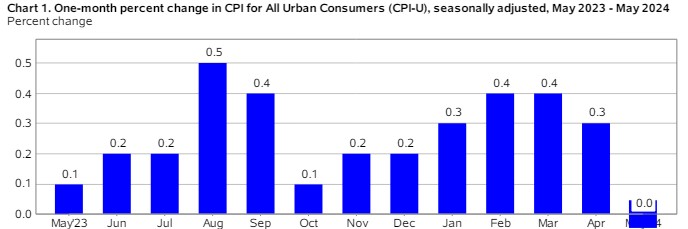

Zero, صفر, 零, nula, nul, μηδέν, शून्य, 零, cero – Inflation

May Consumer Price Index (CPI) reported zero inflation for the month. The estimate was 0.1%. This is significant and a powerful indicator for the Feds to start lowering their rate.

Looking at the Year over Year, almost all the inflation that was present was from Shelter and Motor Vehicle insurance.

Everything else only rose 0.21% from last year. Let that sink in. Shelter cost make up 45% of the core index.

Today the feds will be meeting to talk about rate future rate cuts. We do not expect any cuts this month or summer.

Rates have rebounded nicely this morning.

-

Why the Huge Jobs Report number? It’s wrong by the way.

The unexpectedly high job gains reported by the Bureau of Labor Statistics (BLS) in May can be attributed significantly to the Birth/Death model adjustments. This model plays a crucial role in estimating employment changes that arise from the natural churn of businesses starting up and shutting down. Here’s a detailed breakdown of the situation:

Birth/Death Model Overview

The Birth/Death model is designed to account for the dynamic nature of the business landscape. It estimates the number of jobs created by new businesses (births) and the number of jobs lost due to business closures (deaths). This model is particularly important because real-time data on new businesses and closures is not immediately available, and these factors significantly impact overall employment figures.

Impact on May’s Job Report

In May, the BLS reported a total of 272,000 jobs created, which significantly surpassed the estimated 185,000 jobs. Out of these 272,000 jobs, a substantial portion—231,000 jobs—were attributed to the Birth/Death model adjustments. This suggests that the majority of the reported job gains were derived from the model’s estimates rather than direct data from business surveys.

Why the Huge Job Gains?

- Economic Recovery and Expansion: The economy might be experiencing a phase of robust recovery or expansion, leading to the creation of numerous new businesses. As these businesses start operations, they contribute to job creation, which the Birth/Death model captures.

- Data Estimation Methods: The Birth/Death model relies on historical data and statistical techniques to make its estimates. If there are significant deviations from past trends or unexpected economic developments, the model’s estimates might be larger than anticipated.

- Seasonal Adjustments: The model incorporates seasonal adjustments to account for regular fluctuations in business activity. These adjustments can sometimes lead to higher estimates during certain times of the year.

The Dilemma

The challenge with relying heavily on the Birth/Death model is that it is an estimation tool. While it helps provide a more complete picture of employment changes, there is inherent uncertainty because it is based on statistical projections rather than direct measurements. This can lead to discrepancies and debates over the accuracy of the reported figures.

- Reliability Concerns: Critics argue that the model might overestimate job gains if it does not accurately reflect the current economic conditions or if there is an unexpected downturn in business activity.

- Adjustment Lag: The model’s estimates are based on past data, which means there can be a lag in reflecting real-time economic changes. Rapid economic shifts, such as those seen during economic recoveries or recessions, can make the model’s projections less reliable.

Conclusion

The significant job gains reported in May are largely driven by the Birth/Death model’s estimates of new business activity. While this model is essential for capturing the dynamic nature of the labor market, its reliance on historical data and statistical methods introduces a level of uncertainty. Therefore, while the reported figures suggest strong job growth, they should be interpreted with caution, understanding the underlying estimation processes and potential limitations of the Birth/Death model.

-

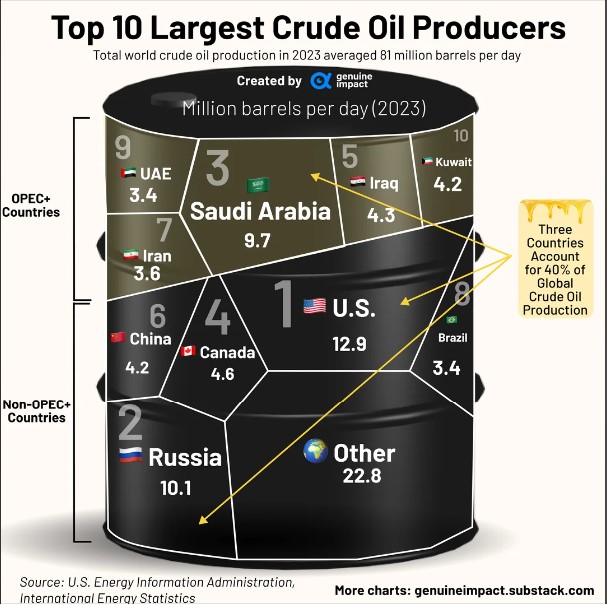

Contraction of Job openings and more Oil Production

The recent JOLTS report revealed a decline in job openings, particularly noticeable in the Leisure and Hospitality sector with a decrease of 109,000 openings—a sector that had previously shown robust job growth.

Despite this, the Labor Turnover or Quit rate has remained steady at 2.2% for the sixth consecutive month, reflecting an overall softness in the labor market.

Looking ahead, if the upcoming ADP and BLS Jobs Report indicates lower numbers as anticipated, and the unemployment rate surpasses 4%, there could be further improvements in rates.

On a different note, both the CoreLogic Home Price Insights and Black Knight HPI have reported heightened home values, with April showing a 1.1% increase following a 1.2% rise in March. Black Knight specifically noted a 5.1% year-over-year increase.

Over the years, I have observed a convergence of various factors in the industry. Consumers today are more cautious and discerning about their spending habits, choosing when and where to allocate their funds wisely.

With eight OPEC+ producers planning to ramp up production in the coming months this should lead to reduced oil prices and easing the energy component of inflation.

It seems that the Federal Reserve’s sought-after data and trends are aligning, providing a clearer picture of the economic landscape.

-

PCE as Expected but What is Rounding Numbers.

Personal Consumption Expenditures (PCE) came in as expected. Inflation rose by 0.3%. The year-over-year inflation also remained the same at 2.7%. A significant part of that was due to the increase in energy costs. We had expected a decline in inflation.

Let’s take a closer look at these numbers. The core rate, which excludes food and energy costs, rose by 0.2%, but it actually increased by 0.249%, rounded down to 0.2%. The year-over-year inflation number is not 2.7% but actually 2.75%, again rounded down.

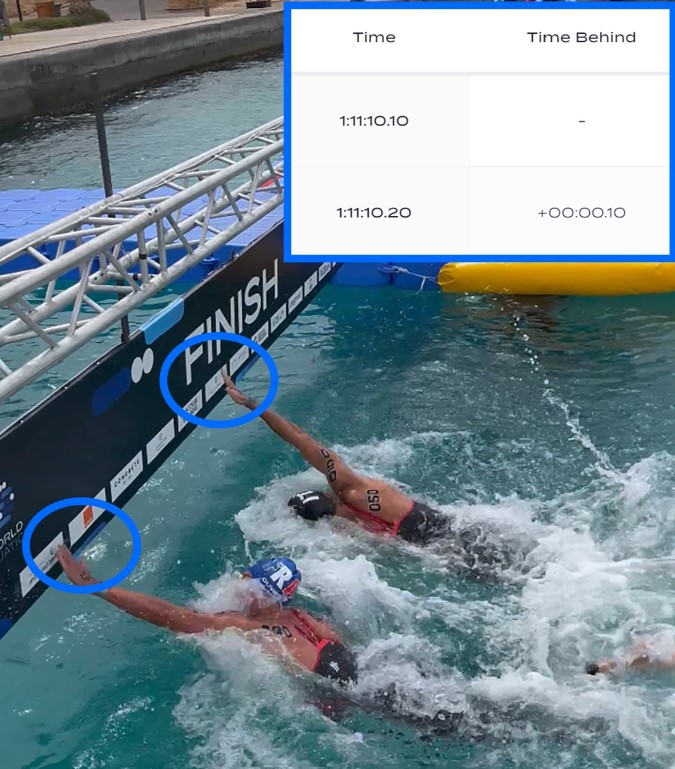

The larger question is why are we looking that closely? If you are going to win, win big. Swimming competitions can come down to 1/100th of a second. Do you know what that is? That’s two coats of paint.

Inflation is no longer trending upwards, and we anticipate it will decline as the year progresses.

Rates continue to improve this week. Have a great weekend and enjoy the Sun.

-

Who benefits from High interest rates an low housing inventory?

Those with money and property are reaping the benefits of the high-interest rate environment. Yields on savings accounts have surpassed 4.5%, and low housing inventory has driven home values to unprecedented heights. The stock market has also seen remarkable gains, with the NYSE hitting 40,000 for the first time. The S&P 500 rose 23% last year and is up over 11% this year.

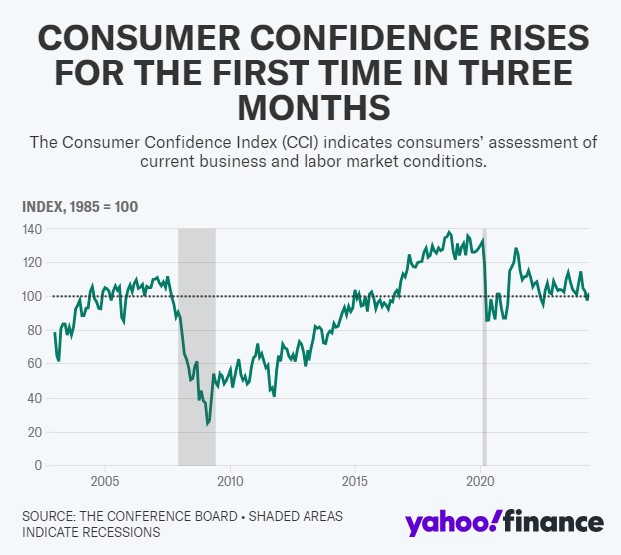

When I see the Consumer Confidence Index (CCI) rise above 100, I can’t help but wonder how it’s possible.

There is a segment of the population that is very content to keep things exactly as they are.

The Federal Reserve faces a dilemma. Plans for home purchases are at their lowest level since August 2012, and lower-income consumers are being hit the hardest.

High Federal Reserve rates might be causing inflation rather than curing it. The economy is being driven by the wealthy, particularly those earning $100,000 or more. This group comprises 37.43% of households, totaling 49,281,397 households.

-

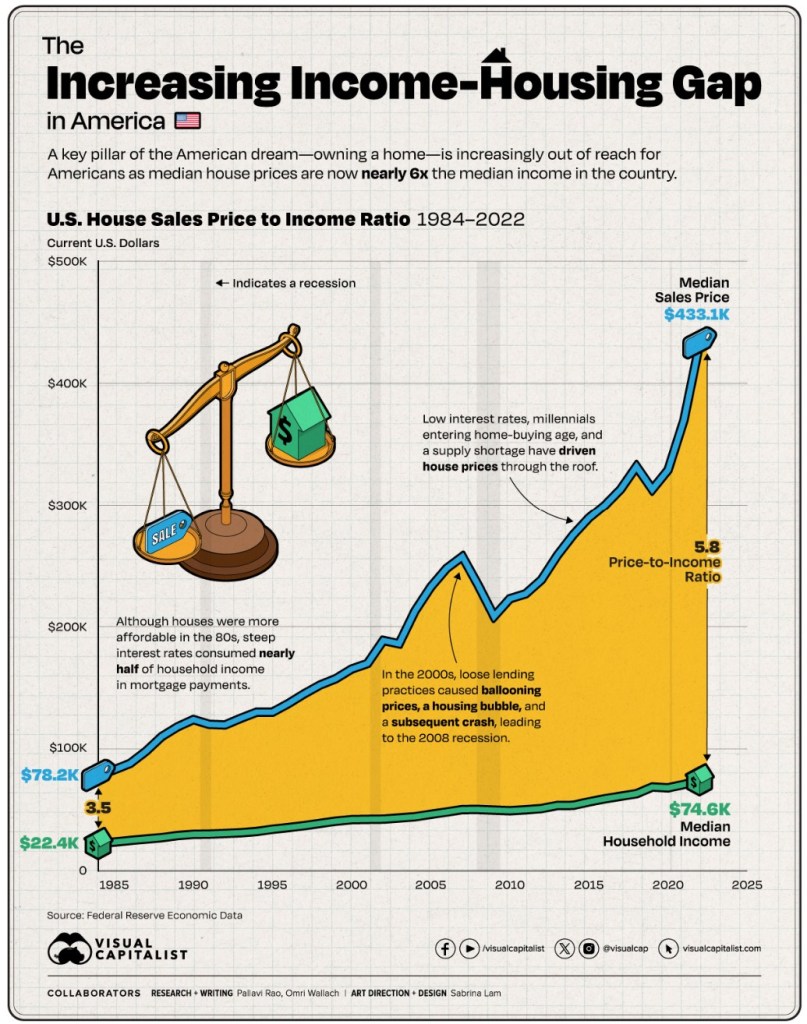

Home Values continue to Rise, but there is a gap that keep growing.

Case Shiller Home Price Index, year over year 6.5%.

FHFA House Price Index year over year 6.7%.

The problem is that the affordability gap continues to widen, driven by the persistent housing shortage. Incomes can’t keep up, so something has to give.

It’s a conundrum. Lower interest rates enable sellers to sell and buyers to buy. This frenzy can lead to skyrocketing prices as more buyers emerge. We saw this happen in 2020 when rates dropped.

I believe that lower rates will encourage sellers to finally put their homes on the market. Many of my clients are ready to sell. Some bought during the pandemic and have since realized their new location no longer suits them. Others are looking to downsize or upsize.

Even though close to 30% of the home purchases are first time home buyers, quite a number of them are getting help from their parents to make up the Price to Income gap.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.