-

Comparison is the Thief of Joy. Holding onto rate gains.

The University of Michigan has released its Consumer Sentiment Index, showing a decline in consumer confidence from 68.2% to 66%. This marks the fourth consecutive drop.

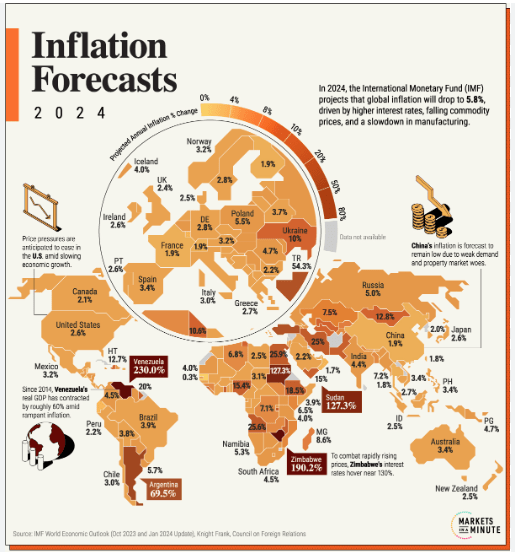

Inflation expectations have decreased slightly from 3% to 2.9%, and the employment outlook remains weak. Additionally, spending intentions across various categories have also declined.

This trend indicates that consumers are becoming more discerning about their spending habits. The Consumer Price Index (CPI) has been adjusted from 2.5% to 1.4%, and import prices have been revised from 3.8% to 1%.

These are promising indicators that the Federal Reserve (FED) is monitoring closely ahead of potential rate cuts.

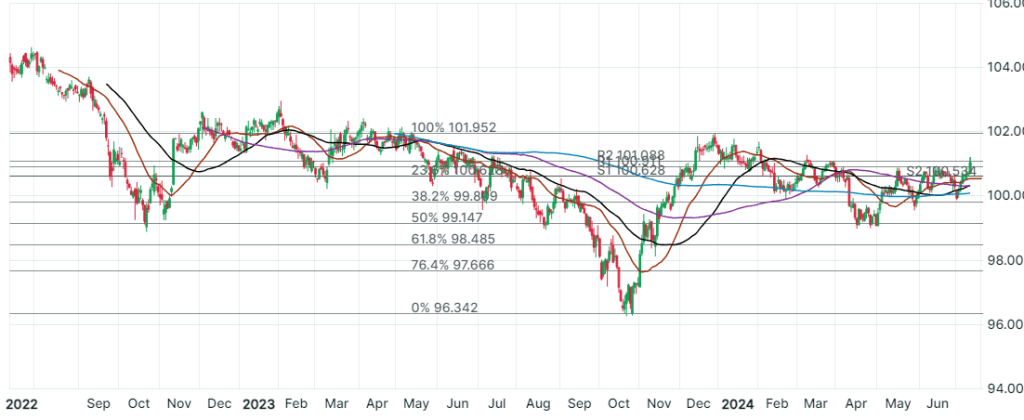

Though rates are far from their lows a few years ago, they are very much inline historically. Green is lower rate movement.

-

Go to the Light… Please

The Feds given yesterdays Soft Consumer Price Index inflation report, are starting to see the light and in favor of cutting rates sooner than later.

Today we see more rate improvement even from yesterdays big move.

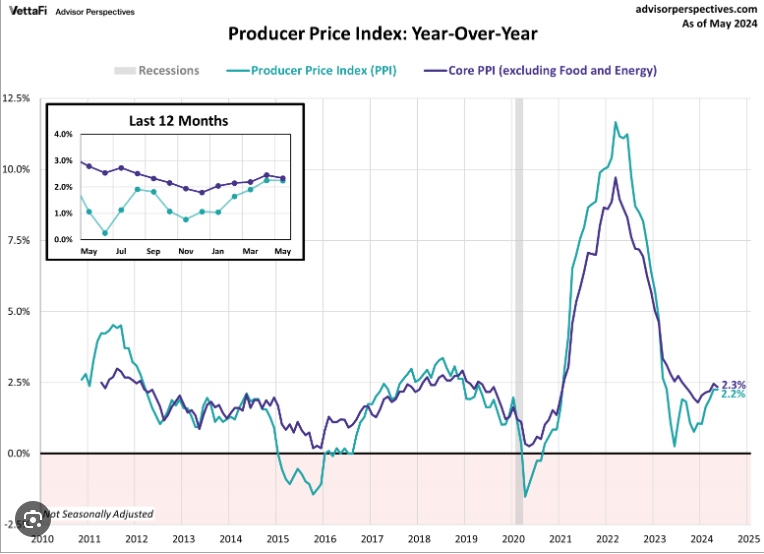

The Producer Price Index (PPI), which measures wholesale or producer inflation, rose by 0.4% in June, surpassing the expected 0.1%. Year-over-year, producer inflation increased from 2.4% to 2.6%.

The reasons behind this increase are not entirely clear and have raised some concerns. One theory is that as producers slow production, their suppliers are earning less and may be raising their prices, passing the additional costs on to the producers.

Bottom line is we are moving in the right direction regardless of the bumps in the road.

Have a fantastic weekend.

-

Rates, Rates, Rates That’s what I’m talking about.

The Consumer Price Index (CPI), which measures inflation from the consumer’s perspective, decreased by 0.1%. This marks the first significant drop in two years, contrary to expectations of a 0.1% rise.

Initial Jobless Claims, which represent individuals filing for unemployment benefits for the first time, fell to 222,000 from last week’s 239,000. Continuing Claims also decreased slightly to 1.852 million from 1.856 million.

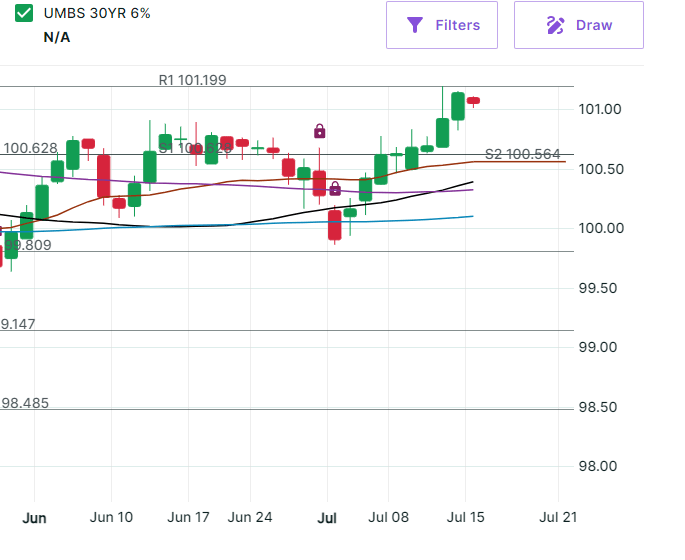

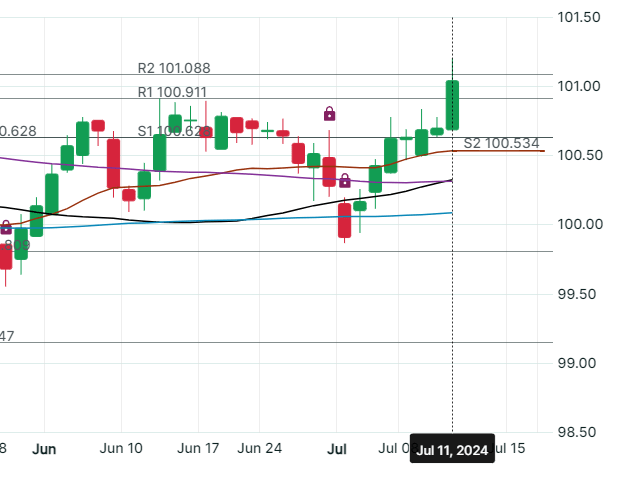

The chart below shows the movement of the UMBS 30-year Bond. An upward movement indicates lower rates. The difference between the red lower candlestick and the July 11th green candlestick reflects a 3/8th point decrease in interest rates.

For every $100,000 borrowed, a 3/8th point drop translates to a $45 lower payment. This reduction can be significant, especially when purchasing a million-dollar home.

The second graph provides a two-year view for perspective.

-

Rate Cut in September??? and more about Powell and the FEDs

There is a dichotomy between Hawks and Doves, especially a shift towards a more Dovish approach concerning potential rate cuts as early as September.

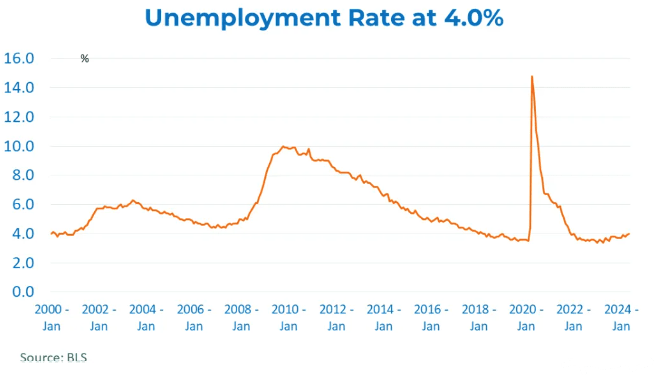

Yesterday, Powell addressed the Senate and is set to testify before the House today. He acknowledged the slowing economy, rising unemployment, and downward revisions in GDP estimates.

Another significant indicator is the increase in Corporate Bankruptcies. June saw 75 new filings, surpassing pre-pandemic levels. This year has recorded 346 filings so far, marking a 13-year high. It’s worth noting that the BLS Jobs Report heavily incorporates the Birth/Death model, which tracks business startups and closures. However, recent Jobs Reports have consistently exceeded actual employment figures.

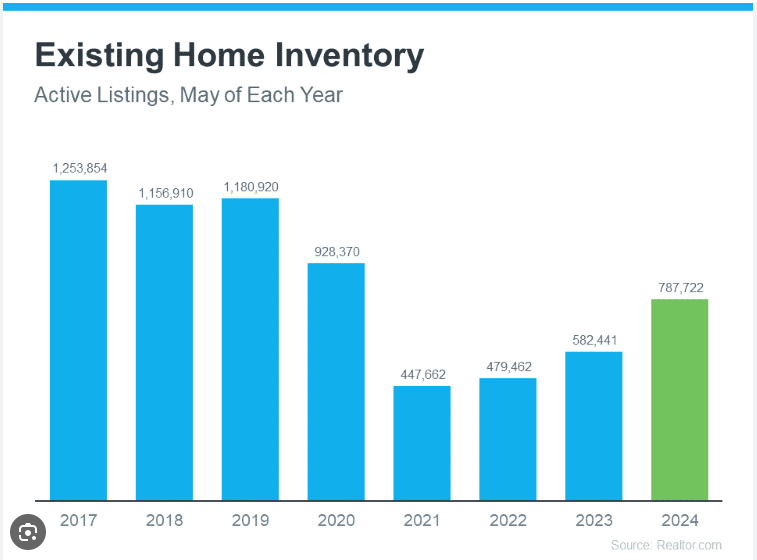

Shifting gears, lets talk Housing Inventory and why its important to look under the covers to see what is really going on.

Inventory has risen 6.7% in June and is up 37% from last year. Wow you say, well if the inventory is low to begin with, a small change can amplify reality. Also two-thirds of this rise is from two states, Florida and Texas.

Comparatively, the Midwest is 49% below pre-pandemic levels, while the Northeast is 57% below.

-

The Feds, CPI and Inflation expectations. Should be interesting

There’s speculation that this week could hold more significance than initially anticipated.

The Consumer Price Index (CPI) is forecasted to show a 0.1% monthly decrease, potentially lowering year-over-year inflation from 3.3% to 3.1%.

Key events include:

Tuesday: Small Business Optimism Index

Wednesday: Mortgage Applications, 10-Year Bond Auction, and Powell’s testimony before the House

Thursday: Consumer Price Index (CPI) and Jobless Claims

Friday: Producer Price Index (PPI), which indicates producers’ costs of goods sold and serves as a leading indicator for potential future inflation declines.

-

Put away your Driver, Your 5 Wood will do. Accuracy over Distance.

The Federal Reserve is shifting focus from inflation to the job market. Sustained high interest rates contribute their own inflationary pressures due to increased business costs.

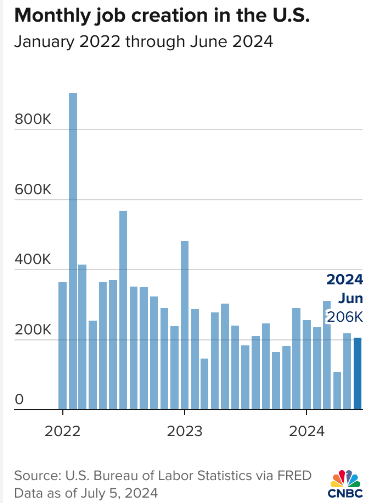

According to the Bureau of Labor Statistics (BLS), 206,000 jobs were added, meeting expectations. However, given the BLS’s tendency for revisions, April and May saw 111,000 fewer jobs combined. It is anticipated that June’s figures will also be revised downwards.

Here are my thoughts: The Federal Reserve is beginning to indicate a move towards rate cuts, which is positive news. I’ve spoken with several clients who are becoming anxious about rising competition as rates decrease and more buyers enter the market. This trend is promising because it should also benefit sellers.

Have a fantastic weekend! Feel free to reach out via call, email, or text anytime—I’m here to assist.

-

Goolsbee to the Rescue and the ADP Jobs report helps rates

There are cracks in the armor and the ADP Employment Report showed 150,000 jobs created last month, slightly weaker than estimates. This was true for May as well.

4th of July is tomorrow but remember the ADP report when the BLS Jobs Report comes out Friday.

The reason is BLS uses birth/death model for small businesses typically comes in hotter than the ADP report showing the only 5,000 of the 150,000 new jobs were for companies with 50 or fewer employees.

Jobless claims rose 4,000 to 238,000. These are the highest numbers since last year.

The Feds are starting to think rate cut as the data keeps streaming in. Dust off your W2s and paystubs and lets get you pre-qualified (soft credit pull).

Have a fantastic 4th of July.

-

What goes up, Must come down, unless you’re a Flat Earther.

But seriously, Gross Domestic Product – GDP estimates are released by the Atlanta Fed weekly. They just revised their Q2 estimate from 3% to 1.7%. May not seem that much, but its the equivalent $400 Billion adjustment down.

More signs of a slowing economy, with a lean towards rate cuts.

Job Openings and Labor Turnover Survey – JOLTS as I mentioned yesterday came in as expected at 8.1M. this is the lowest level of job openings since February 2021.

Home Values are still on the rise but holding steady at 4.9% increase year over year.

-

Short week but important

Quick update, Beth Hammack is replacing Loretta Mester as the new Cleveland Fed President and a voting member.

Why is this important you may ask? Its because she has real world experience at Goldman Sachs and managing director. The Fed needs this.

The JOLTS – Job Openings and Labor Turnover is coming out tomorrow. The numbers are expected to stay relatively stable. To note, Feb 2021 the number of openings was over 12M, Last report was 8M, tomorrows expected at 7.9M.

Wednesday ADP Employment report and Initial Jobless Claims will be released. Unemployment rate expected to stay at 4%.

Friday the BLS jobs report will be released.

-

Bostic, Daly, Goolsbee and Cook all aiming for Rate Cuts

Fed members are starting to join the ranks of rate cutters than rate holders.

Atlanta Fed President, Raphael Bostic spoke this morning and seems to be in favor of a cut sooner than later. He specifically called out the slower economic conditions and labor market.

Pending Home Sales fell 2.1% in May. We expected a gain of 1%. This is a clear response to higher rates.

Apartment List National Rent Report rose in June but still down 0.7% year over year.

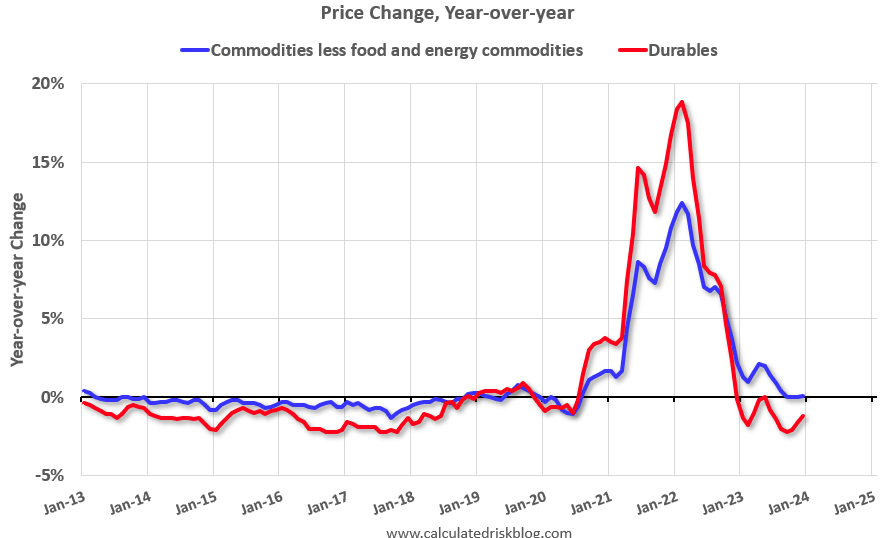

Durable Goods Orders rose in May, but Core Durable Goods fell 0.6%. Far softer than the expected 0.1%.

From my perspective, the Data is coming in strong in favor of rate cuts.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.