-

You Get what You Plan For. Success is a Reflection of the quality of your Preparation.

With the market changing and interest rates trending down, there are allot of buyers and sellers starting to get back into the market.

Your Success is largely a result of preparation, foresight, and actions in advance.

Back to the Data:

ADP Employment Report for September higher than expectations at 143,000 jobs created but with August’s report factored in, it still remains a weak report.

CoreLogic Home Prices Insights reported home prices fell in August just slightly by 0.1% with Home prices year over year up 3.9%.

Mortgage Applications up 1% for purchases and 9% year over year.

Refinances fell 3% but that is only because of the big increase the last two weeks. 55% of applications are for refinances.

-

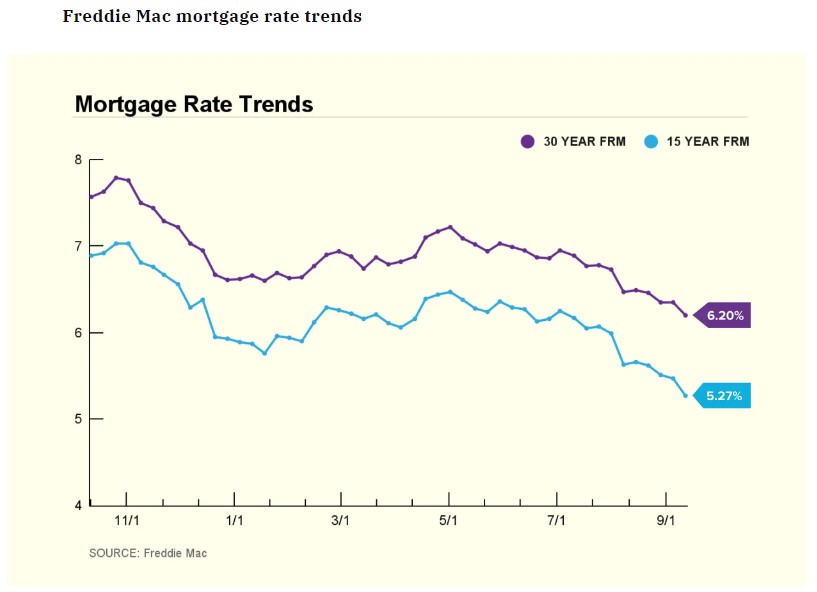

1% Rate Drop last 30 days, what’s to come. ILA strike and impact to rates.

Looking back to the beginning of September, it’s remarkable that rates have dropped by a full percentage point. A quick calculation shows that this translates to roughly $84 less per month for every $100K borrowed. For a $700K loan, that’s nearly $600 in monthly savings.

This morning, the International Longshoremen’s Association (ILA) went on strike, potentially affecting up to 50% of U.S. imports, with Walmart holding a significant share of these goods.

Initially, you might expect the bond market to react negatively due to potential inflationary pressure. However, with global tensions on the rise, savvy money managers are turning to bonds as a safe haven.

And that’s exactly what’s happening. While yesterday’s stance was “Lock, baby, lock,” I held off—and rightly so, as the bond market has improved, positively impacting mortgage rates.

Sometimes, what seems obvious at first glance deserves a closer look (that’s a headline I’ll use for the next update).

-

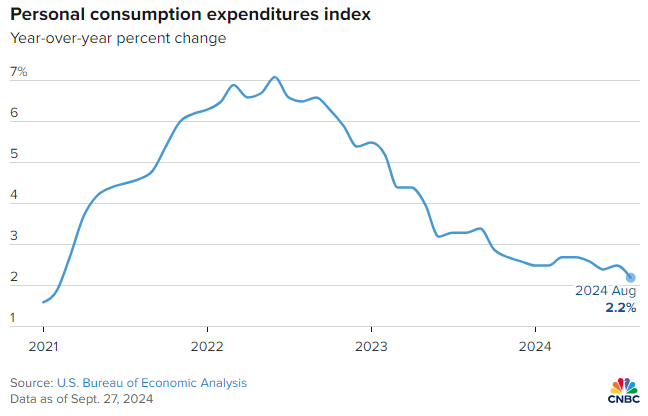

As Inflation drops so goes the Fed Rate. Inflation at 2.2%

The Personal Consumption Expenditures – (PCE) which measures the cost of goods and services in the US, rose 0.1% in August putting the 12 month inflation rate to 2.2%.

Personal income remained steady with a slight increase of 0.2%, while spending also grew by 0.2%. However, caution prevails in the market, prompting manufacturers to lower their prices in an effort to attract a restrained consumer base.

We’ve observed ongoing improvements in interest rates, accompanied by a growing sense that the market is shifting. There’s been an uptick in activity, with more applications for purchases and refinancing, an increase in homes on the market, and a generally more optimistic outlook.

-

More Oil, More Home Sales and More buyers hitting the streets.

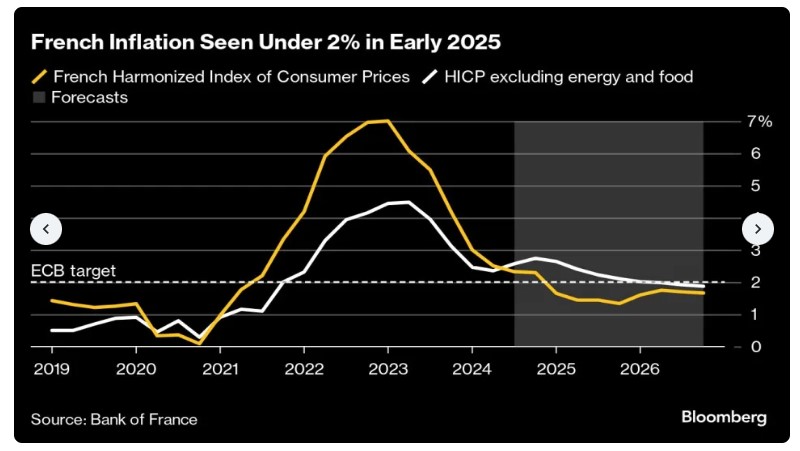

One of the larger components of the Personal Consumption Expenditures (CPE) is Shelter and Energy. Saudi Arabia who is the world’s largest oil exporter will be increasing Production by the end of the year. Right now oil is running just under $68 per barrel. They abandoned their $100 target.

As oil prices go down so does inflation. When inflation drops so does the Feds proclivity to drop their rates, as their rates drop….

Pending homes sales rose 0.6% in August stronger than expected.

Initial Jobless Claims fell for the first time in awhile 4,000 to 218,000.

Q2 GDP shows the US economy grew 3%, stronger than expected.

All in all generally good news but a mixed bag. We have seen a pull back with the bond market that has not helped rates this week..

Lets see what tomorrow brings when the PCE Inflation numbers hit.

-

Not Surprising, Refinance applications are up 175% Year over Year.

According to the Mortgage Bankers Association (MBA), interest rates are now 1.25% lower than this time last year, dropping from 6.15% to 6.13%.

While new home sales fell 4.7%, they still surpassed estimates of 700,000, though only 105,000 homes were completed. What’s more interesting is the pace of sales compared to the number of available or completed homes.

Last month, 716,000 contracts were signed, equating to 7.8 months of inventory, but only 1.7 months of that inventory represents completed homes.

Despite these dynamics, housing demand remains strong, especially as interest rates continue to decline.

-

Who’s the Cheese wrapped around that dog pill?

Bonds are sensitive to global events, and a major one occurred today. The People’s Republic of China announced several stimulus measures to boost their economy.

Key actions include cutting the average interest rate on existing mortgages by 0.5%, lowering minimum down payment requirements, and other steps to release a significant amount of funds.

While this may seem positive on the surface, it raises global inflation concerns and China’s stability. More global funds drives demand, limits supply and increases prices.

When I’m asked how far and when I expect rates to drop, the answer is more complex than it initially appears. The Bond Market around the world moved lower in price. Translation slight rate improvement.

Case Shiller Home Price Index rose 0.2% in July with Home prices up 5% year over year.

-

Fed Gov Waller “Inflation on lower Path than we Expected…”

I never thought I’d hear these words. Here’s the exact quote:

“Inflation is on a lower path than we were potentially expecting. I think inflation is on the right path, as log as we don’t let it get too low”.

Even Fed Pres Minneapolis Neel Kashkari said even after the 50bp cut the Fed is still restrictive. He wants another 50bp by end of the year.

What’s coming up this week.

- Tuesday – Cash Shiller Home Price and FHFA house Index

- Wednesday – Mortgage Applications and New Home Sales

- Thursday – GDP, Initial Jobs Claims

- Friday – Personal Consumption Expenditures – PCE.

PCE is the big news of the week. If expectations come in at 0.1% in August that will put inflation at 2.3% down from 2.5%.

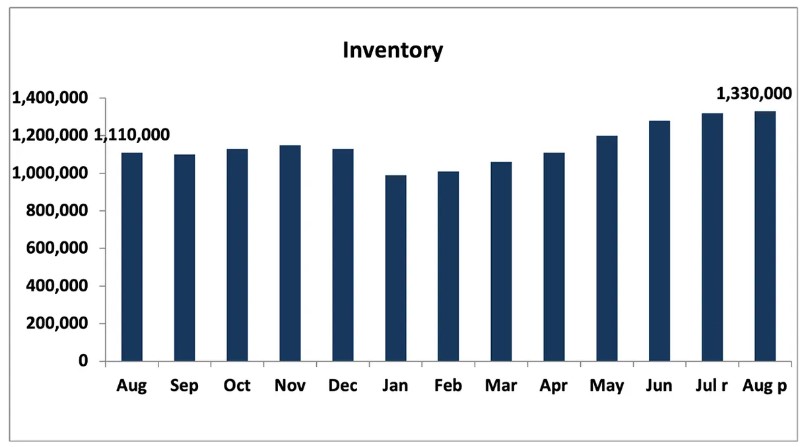

In my view, interest rates are falling. How much they’ll drop remains uncertain, but we’re finally seeing some light at the end of the tunnel. For years, low inventory has been a challenge, with homeowners locked into 3% rates and buyers either unable to afford homes or waiting for rates to decrease.

If you’re a homeowner looking to move, now’s the time to tune up your finances and get pre-approved—just in case you find your new dream home. For home buyers, inventory is up 22% from last year, and more homes are hitting the market, with more expected in the future.

-

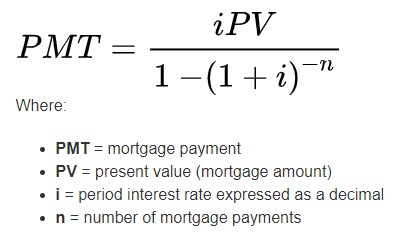

A Surprisingly Simple formula to calculate house payment in your head.

Here’s an example: if you have a $500,000 loan at a 6% interest rate, with typical property taxes and homeowner insurance, your total monthly payment would be around $3,210. That breaks down to $642 per $100,000 borrowed.

To simplify further, you can estimate that every $100,000 borrowed will cost you about $700 per month, which gives you a slight cushion to overestimate the final payment.

If you live in a State or County with lower property taxes, you might be closer to $625 per $100,000 borrowed. In higher-tax states like New Jersey or Texas, the figure could be closer to $700 per $100,000 borrowed.

It’s an easy way to get a rough idea of your total monthly house payment.

“I found a beautiful home, Sales price is $700k and I want to put $100k down. $600k loan is 6x$700 or $4,200 a month total house payment.“

Here is the actual Math if you want to pull out your calculator or just use my simple trick.

-

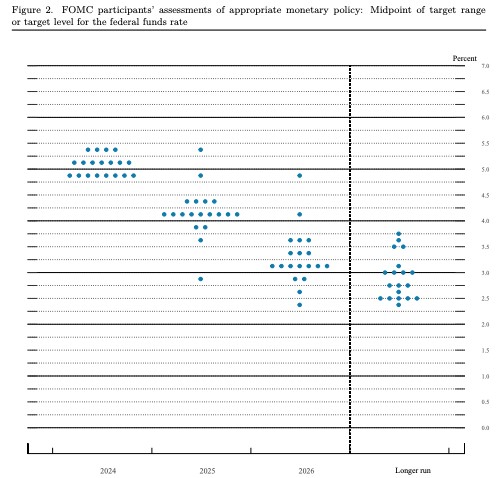

Fed Dot Plot Gives us Insight- It’s more exciting that it looks…

The dot plot below represents each Fed official’s projections for future Federal Reserve interest rates.

This plot is updated every three months, with the next update in December.

Now that we’ve covered that, let’s dive into how this affects you. Credit card and auto loan rates will gradually decrease, and HELOCs or home equity loans tied to these rates will start to decline as well.

What about mortgage rates? While the correlation between the Fed rate and mortgage rates isn’t exact, they generally move in the same direction. So, as the Fed rate drops, mortgage rates are likely to follow.

Mortgage Interest Rates are dropping and will continue into 2025.

-

Rate Cut Cycle Begins: A New Era, Whether 25 or 50 Basis Points.

The greatest challenge arises when the remedy becomes worse than the problem. Prolonged restrictive Fed rate policies lead to higher costs for everyone, ultimately prolonging inflation.

The industry is pricing in a 63% likelihood of the Fed cutting rates by 50 basis points, as reflected in the recent decline in rates over the past two weeks.

Anecdotally, feedback from the real estate community suggests that clients are waiting for a Fed rate cut, regardless of its actual impact on mortgage rates. It’s the perception of rates dropping that is motivating those on the fence to take action.

At 2pm PST the Federal Reserve will release a statement on the rate cut and a summary of economic projections.

Reach out to our team to navigate your refinance/purchase. www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.