-

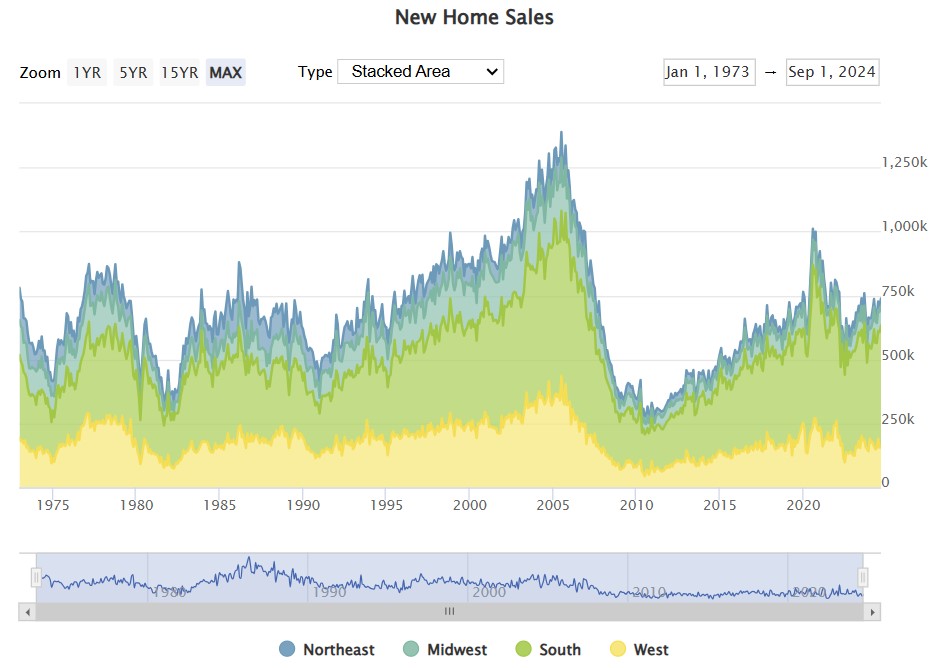

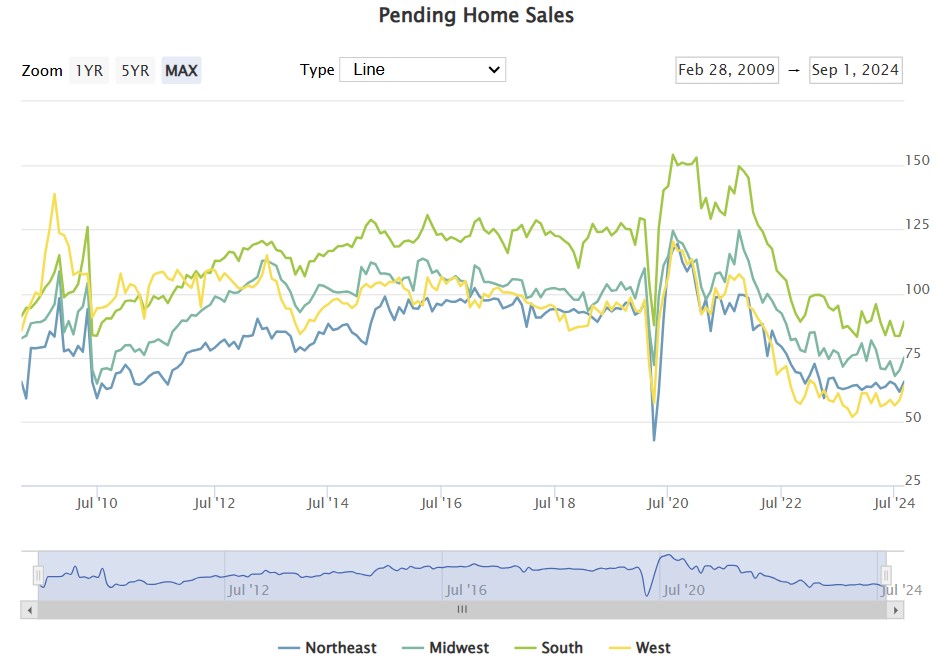

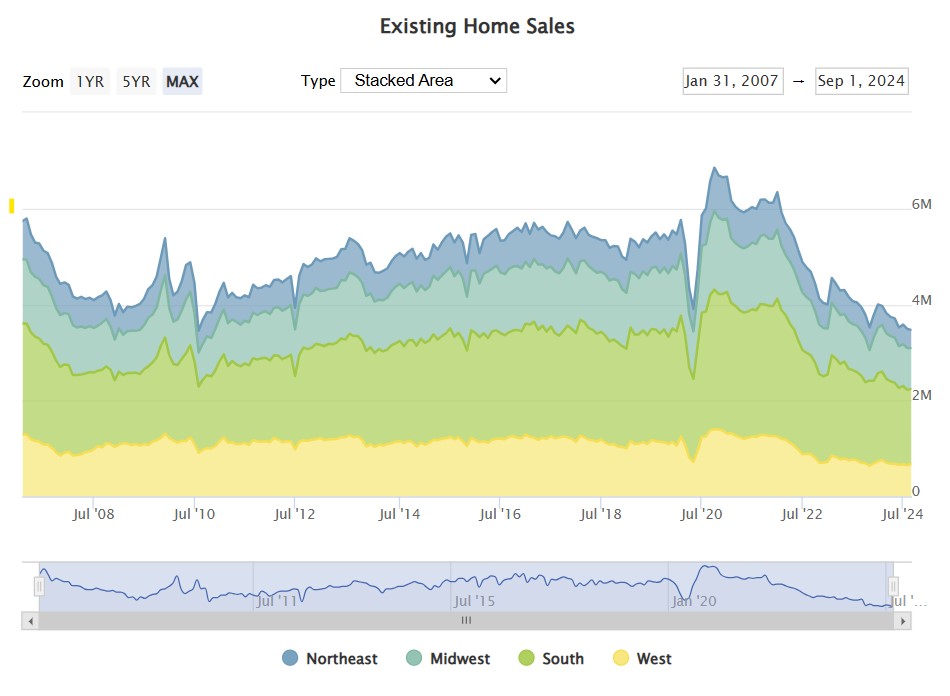

Home Sales. It’s Picture Day! Enjoy.

A picture is worth a thousand words, and today, I’m keeping it simple. Here’s the takeaway: home sales are down, as interest rates stay stubbornly stubborn.

What does this mean for you?

For Sellers: With fewer homes on the market, your property has a better chance to stand out.

For Buyers: There’s less competition, giving you more options and negotiating power.

http://www.YourApplicationOnline.com

-

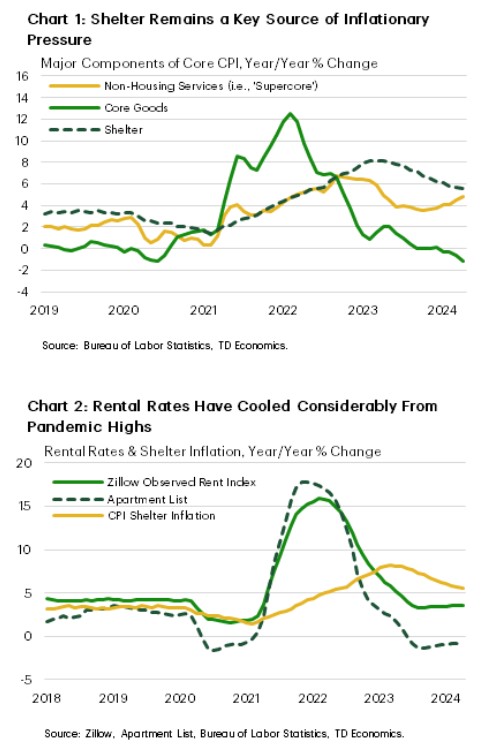

Rents have a huge impact on inflation so why are Real-Time numbers so much lower than CPI’s?

Shelter is the largest single component within the inflation reports. Which makes sense because your house payment or rent payment is the biggest component of your monthly outlay.

Real Time data from Realtor.com and Zillow rental report we have a blended rent rise of 1.25%. CoreLogic’s Blended rate is 1.7%.

The issue is the Government data which affects the Consumer Price Index CPI is 4.6%. The Government is always three months behind the real-time numbers.

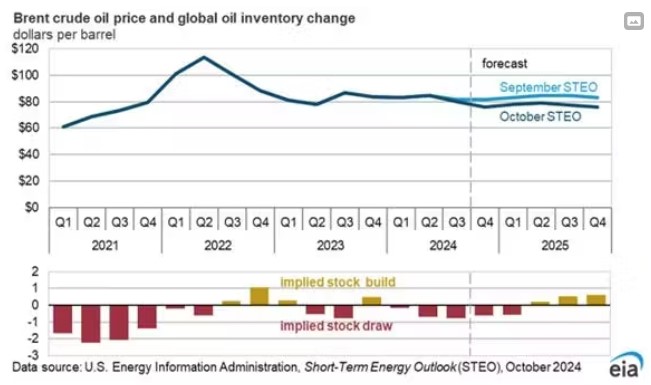

With shelter and potentially oil prices dropping we could see inflation close to 2.0%.

http://www.YourApplicationOnline.com

-

Oil Prices Currently at $75.75 can we hit 58.62 by 2027. Let talk Yesterday, Today.

The new administration plan to increase US supply of Oil are expected to cause oil prices to fall.

A significant driver of inflation is oil prices. Consider this: it impacts transportation—not just fueling your car but also delivering that Amazon package or taking a flight from Chicago to Palm Springs to escape the cold. It also affects the production of goods. In essence, oil influences almost everything. Even the electric vehicle in your garage depends on oil indirectly, as electricity must be generated from some source.

Another whew moment for the bond market was the lack of Tariffs on Canada and Mexico as Tariffs is seen as inflationary.

Bonds are currently trading at roughly 4.5%, give or take. The new administration aims to bring that down to 3.5%. It’s a delicate balancing act of tradeoffs. You can’t have your cake and eat it too, no matter how much you stomp your feet or hold your breath.

Mortgage rates improved today coming off of a nice rally last week. Get out there and start looking at homes and call us if you have any questions or need to get pre-qualified. http://www.YourApplicationOnline.com

-

You Can Use Logic to justify almost anything, that’s it’s power, and its flaw.

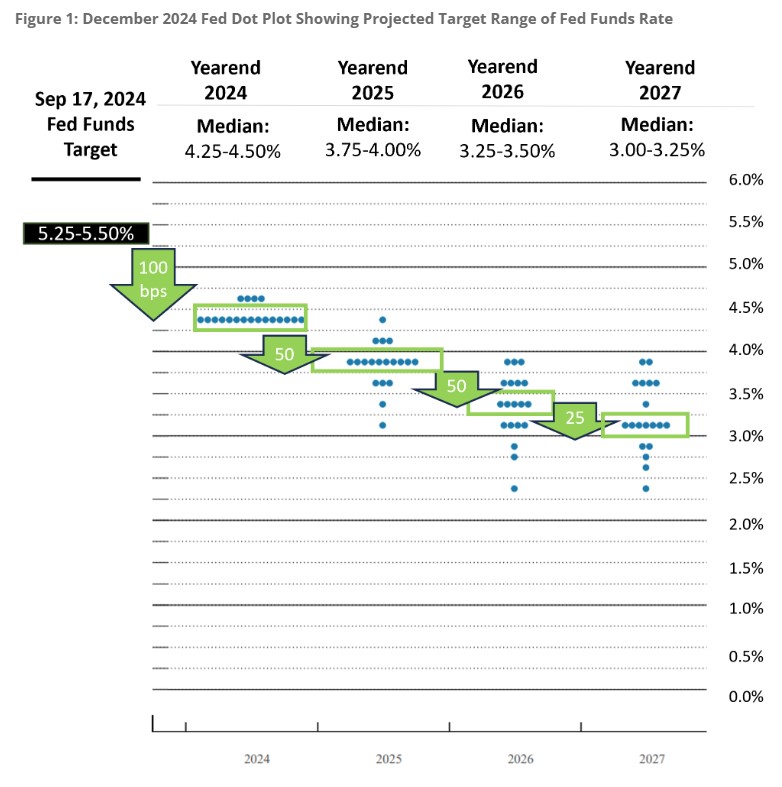

We have contrasting views on inflation from Fed President Beth Hammack and Fed Governor Christopher Waller. Hammack considers inflation an ongoing concern, opposed the December rate cut, and even supports the possibility of a rate hike this year.

In contrast, Waller, who I heard yesterday on CNBC, sounded much more dovish. He expressed openness to rate cuts as early as March.

My concern with high interest rates isn’t that they weren’t necessary at some point, but that the solution is starting to feel worse than the problem. It’s the small business owners, not the big corporations, who are unable to expand due to these high rates.

And it’s everyday people—trying to make ends meet or hoping to buy a home—who are being squeezed out of the market.

Each dot on the graph below (the Fed Dot Plot) represents a Fed President’s forecast for the future Fed Funds Rate. The trend is heading downward—great news!

I’m on a bit of a rant today—got up way too early, a full two hours before sunrise, and have been stewing over this ever since. Thanks for coming to my TED Talk. Wishing you a great weekend!

-

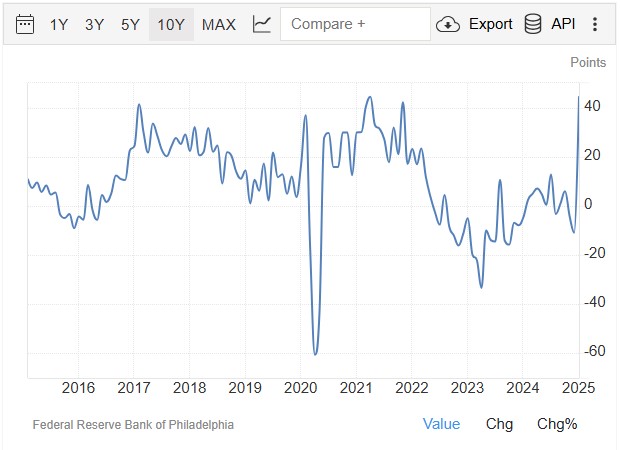

Fed Manufacturing Index Climbed dramatically. Tariffs? or will it continue.

When we look at the Manufacturing Index graph we can almost correlate interest rates inversely against the rise in manufacturing. Which would be good news.

Manufacturers are hedging and producing more than usual to compensate for potential Tariffs.

The challenge is uncertainty. Tariffs will create higher prices translating to higher inflation and higher mortgage rates, or not. That’s the problem.

Uncertainty and global economic and military tensions creates a flight to safety being Bonds.

The higher demand for bonds the higher the value and lower the yield i.e. lower interest rates.

Regardless, get out there and start looking for your first or next home. With less competition and sellers willingness to negotiate especially for closing costs, you might just find the right house at the right price.

-

Inflation increased from 2.7% to 2.9% but the Mortgage Rates Dropped???

The December Consumer Price Index (CPI) showed that overall inflation rose 0.4% for December 0.1% higher than expected.

Energy rose 2.6% which is 40% of the CPI increase. Food also increased by 0.3% higher than expected.

The Core rate, which strips out food and energy prices only increased 0.2%, lower than the 0.4% expected. Lodging is down, Air Fares are up due the above mentioned energy prices.

The Core is what triggered the Bond market to react in a Rate Positive direction. see below.

If you follow my post, this would be counter intuitive. Enjoy the Graph below. Remember, up is lower rates.

-

It’s a Riddle Wrapped in a Mystery inside an Enigma: Winston Churchill radio broadcast, 1 Oct. 1939

Consumers do not feel as good as the Jobs Report illustrates.

The latest BLS Jobs Report showed a strong labor market with allot of job creations. Unemployment rate dropped from 4.2% to 4.1%.

The Consumer Survey out of the University of Michigan tells a different story. The poll when asked about rising unemployment went from 32% to 40% to 50% in January.

The gap between those who thing unemployment is rising vs falling in the year ahead has expanded to 34%. Very similar to 2007 and January 2001.

Why, if the unemployment rate is so low do consumers disagree. Well the consumer may be right. Job numbers are revised constantly. The actual jobs created vs reported could be overstated by as much as 50%.

February QCEW report will help solve this riddle.

-

Business Activity increased, But ISM said due to possible higher Tariffs.

ISM Service report stated the reason for the rise in activity was because of the fears of future inflation caused by Tariffs causing a negative bond market reaction.

The JOLTS -Job Openings and Labor Turnover Survey show job openings rose from 7.839M to 8.098M. Stronger than expected. Hiring rate fell from 3.4% to 3.3%. Lowest since 2013.

Vacancy to Unemployment ratio compares the job openings to number of unemployed. its a different way to see what is going on. It is at 1.1 the biggest decline from the peak of 2%. This shows the labor market is actually cooling.

How does this affect us? Rates are stubborn. we are up one point since the election with no solid signs of dropping anytime soon.

If you are waiting for rates to drop before you buy a home, Don’t. Home values have gone up 3.4% in 2024 and expected to rise 3.8% this year per CoreLogic forecasts.

Sure it will cost you to refinance later but the increase in home value, the tax deductions an buying with less competition far out way the downside of waiting.

To put a fine point on this, historically rates are in the range of 6.5% to 8.5%.

http://www.YourApplicationOnline.com

-

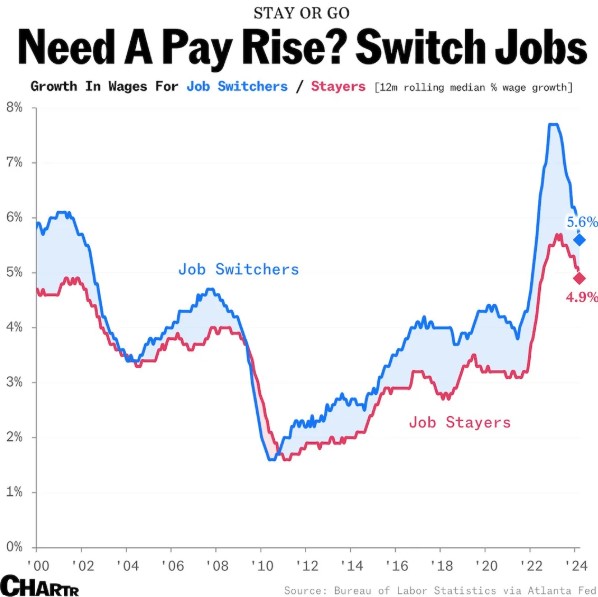

Short Cut is always the longest road.

Hard work truly pays off—if it were easy, everyone would do it.

As we step into the new year, it’s a time to set priorities and define expectations. For some, this might mean pursuing goals like buying a home or switching careers, both of which tie into the challenges of the affordability.

In September, the national average mortgage rate was just above 6%, sparking renewed energy in the housing market. While rates have risen since then, we anticipate a decline as we move into 2025.

Are you a Job Stayer or a Job Changer? On average, people stay in a job for about four years, with 30% of the workforce having been in their current role for less than two years.

According to ADP, job changers saw their incomes grow by 7.2% year-over-year, compared to a 4.8% increase for job stayers.

With inflation stabilizing and wages on the rise, the affordability question is becoming more straightforward.

-

It’s about time! What did you do, Drive here in Reverse?

The Federal Reserve is highly likely to cut interest rates by 25 basis points at 2:00 PM ET today. While this move feels overdue, my concern lies with Fed Chair Powell’s press conference and the release of the Summary of Economic Projections (SEP).

With tariffs back on the policy agenda under the new administration and the labor market continuing to perform better than anticipated, inflation is starting to resurface as a pressing issue.

Back in September, Powell projected a total of 100 basis points in rate cuts for 2025. However, that forecast might now be trimmed to 75 or even 50 basis points.

Sustained high interest rates won’t necessarily help cool the economy. Instead, they could risk pushing it over the edge. Consider the implications for entrepreneurs: starting or expanding a business may become unfeasible under such conditions. Meanwhile, large corporations with greater resources could thrive, amplifying inequality.

It’s reminiscent of It’s a Wonderful Life, where Old Man Potter capitalized on the Great Depression by buying out struggling banks. His ability to play the long game gave him a significant advantage, a scenario eerily similar to what we might face today.

Bottom line, don’t wait to buy if you plan to time the market/rates. Housing is one of the best hedges again inflation and the projections for 2025 are from 3-9% rise.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.