-

Tariffs, Oil Prices, and interest rates Oh My…

OPEC plans to gradually increase production starting in April. Since oil influences nearly every aspect of the Consumer Price Index and other inflation-related metrics, this shift could have widespread economic effects.

In response, the bond market moved in a rate-positive direction.

As for tariffs, while the media often focuses on fear-driven narratives, the reality is more nuanced. Most goods we buy and sell contain components sourced from various parts of the world, which means the actual impact of a 20% or 25% tariff will likely be less severe than the headline figures suggest.

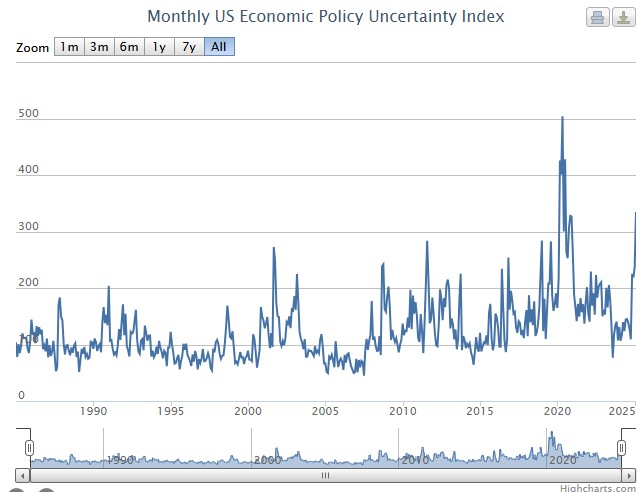

The Uncertainty Index rose significantly the last week including today. This and the new fear of a recession is something the FEDs cant ignore. the Fed rate may be lowered as soon as May.

In my view, things are rarely as bad or as good as they seem, but the uncertainty is undeniable. Ultimately, this trend points toward lower mortgage rates.

-

The Spread is Important. It’s the Differential between the 10y an Rates that’s the tell.

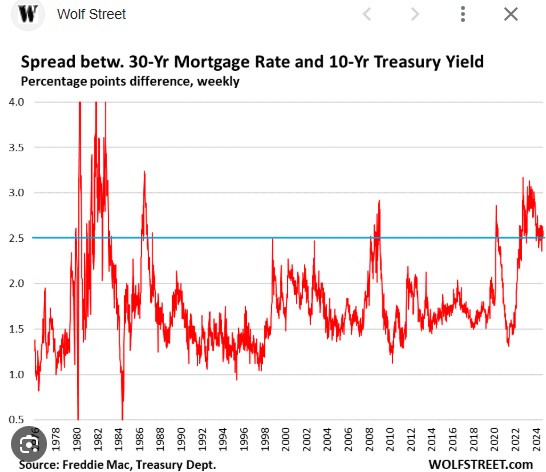

Mortgage rates are influenced not only by the 10-year bond yield but also by the spread between the 10-year yield and the actual mortgage rates offered on the street.

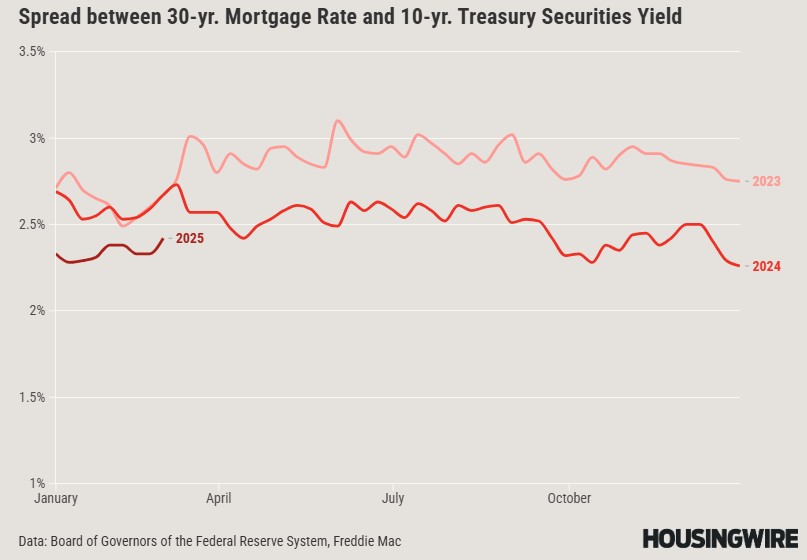

The spread between 30-year mortgage rates and 10-year Treasury yields has remained elevated in recent years, peaking at 2.96% in June 2023.

Now, not only are mortgage rates declining, but the spread between mortgage rates and bond yields is also tightening.

Why does this spread increase? It all comes down to risk. When interest rates rise, the likelihood of future declines grows. If borrowers refinance too quickly, it impacts the long-term return on those mortgages, affecting both lenders and servicers.

To mitigate this risk, mortgage rates are set higher relative to bond yields, creating a buffer against potential refinancing. A higher rate means more interest paid upfront, helping offset future losses.

Rates are dropping as is the differential. Its a positive double whammy.

Lets get you qualified. Soft Credit Pull http://www.YourApplicationOnline.com

-

It’s All that it tells us, and All that it Refuses to tell us. Let’s talk “Risk Off Trade”

Investors are shifting away from riskier assets like stocks and crypto, moving their money into the bond market—a phenomenon known as “Flight to Safety.”

A “risk-off” trade is exactly what it sounds like—when uncertainty rises, investors pull back. While the stock market may be exciting, the bond market offers a sense of security—like a cozy home with warm cookies and milk.

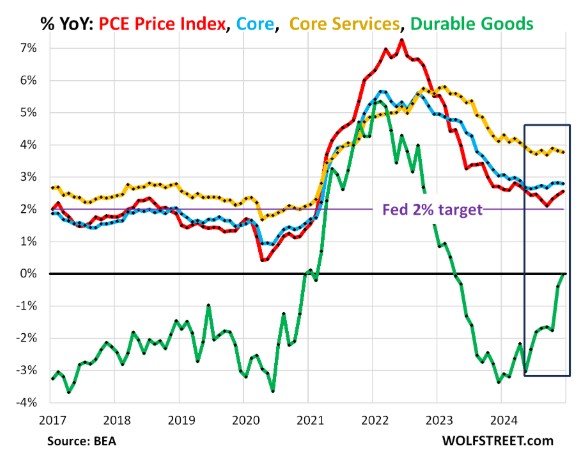

The Personal Consumption Expenditures (PCE) report showed headline inflation rising 0.3% for the month, while year-over-year inflation eased from 2.6% to 2.5%, aligning with expectations.

The core PCE, which excludes food and energy costs, also increased by 0.3% for the month, with annual inflation declining from 2.9% to 2.6%.

As inflation does, so does the interest rates.

-

GDP is like a bathroom scale – it might tell you you’re getting bigger, but it doesn’t tell you if you’re actually getting healthier.

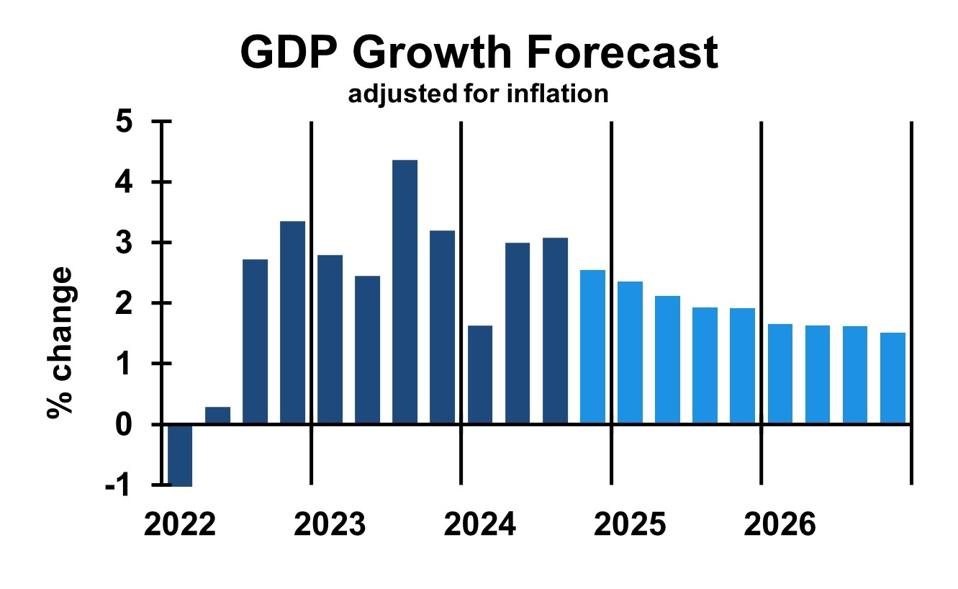

Gross Domestic Product – Q4 2024 was inline with expectations at 2.3%. But may not tell the whole story. Q1 and Q2 should give us insights on Tariffs and the Federal workers being fired or laid off.

Factors affecting GDP

- Consumer spending Increased consumer spending contributed to the increase in GDP in the fourth quarter.

- Government spending Increased government spending contributed to the increase in GDP in the fourth quarter. But will change.

- InvestmentA decrease in investment partly offset the increase in GDP in the fourth quarter.

- Imports Imports decreased, which is a subtraction in the calculation of GDP.

Business investment

Business investment has been relatively strong since the start of 2024. Markets expect the incoming administration to further boost the attractiveness of business investment.

-

New Home Sales are weird. I mean Strange. What’s the actual number?

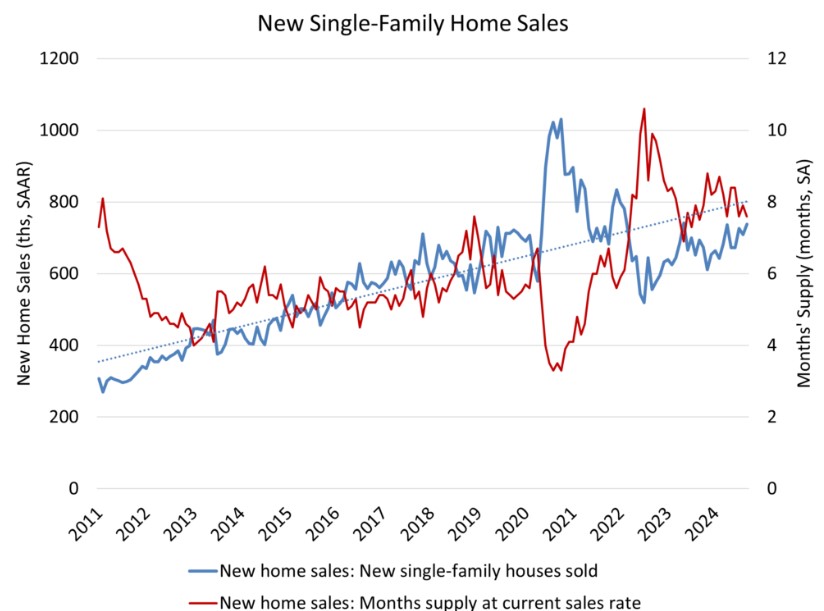

New Home Sales Decline 10.5%, But Supply Tells a Different Story

Recent data shows that new home sales fell by 10.5%, a steeper decline than expected. Meanwhile, the supply of new homes has increased from 8 months to 9 months.

However, out of the 657,000 homes counted in inventory, only 115,000 are completed, while 106,000 haven’t even started construction—and some may never be built.

This means the actual available supply has effectively decreased by 2.1 months, making the housing market even tighter than it appears.

Builders are growing cautious. With rates lingering around 7% and no clear path to lower levels, they are proceeding with caution and hedging their bets.

-

$600k purchase last year, increased value by $24k today.

The Case-Shiller Home Price Index, widely regarded as the gold standard for measuring home appreciation, reported a 0.5% increase in home prices for December, with a 3.9% rise year over year.

Meanwhile, the Federal Housing Finance Agency (FHFA) released its House Price Index, which excludes cash buyers and jumbo loans, focusing instead on single-family homes with conforming loan amounts. According to this report, home prices have increased by 4.7%, reflecting continued market strength. A 4% appreciation is a solid indicator of a healthy housing market.

On the mortgage front, Bond prices have risen significantly over the past week, leading to lower yields and, in turn, lower mortgage rates. We’re hopeful this trend continues, especially with the upcoming PCE report on Friday, which could have a major impact on rate movements.

Lower rates ahead? Let’s stay tuned.

On the Chart, up ie Green is lower rates.

-

But now I am Six. I’m as clever as clever, So I think I’ll be six now for ever and ever. – A. A. Milne

There is a charm and simplicity to this poem. But just as growing up is inevitable, so is the change in the mortgage industry.

Rates fluctuate, regulations evolve, and the market conditions shift.

Professionals and homeowners must embrace change rather than try to “stay six forever”. -Adaptability.

All eyes are on Friday’s release of the Personal Consumption Expenditures (PCE) report, which measures U.S. household spending on goods and services.

Markets anticipate a drop in inflation from 2.6% to 2.5%, a welcome sign for the bond market and interest rates.

-

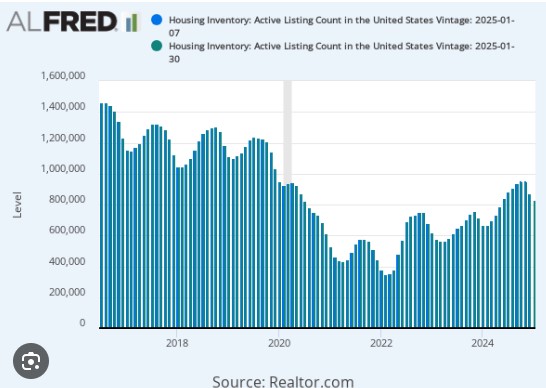

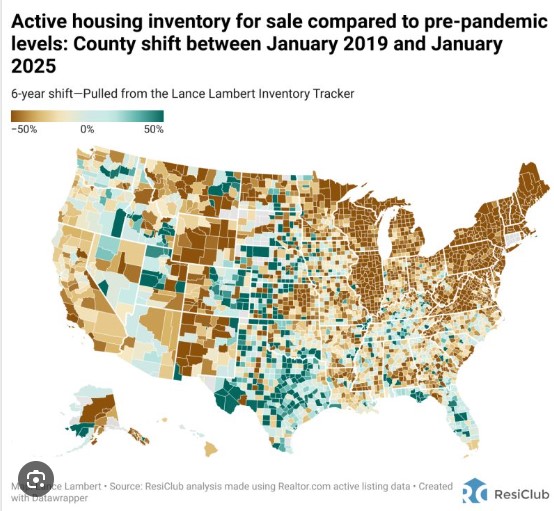

Supply is Not keeping up with Demand. Inventory up 16.8% but not good enough.

Let’s go to our way-back Machine, lets say back to 2022 when the inventory was below 500,000. Pre-Covid numbers averaged closer to 1.4M. currently we are at 1.18M.

We have a 3.5 months’ supply of homes up from 3.2 in December.

Median home price was $396,900 down slightly from December. 28% first time home buyers, 29% cash – down from 32%.

Housing market staying strong as inventory try’s to keep up.

Have a great weekend. ww.YourApplicaitonOnline.com

-

Fed at Net Neutral and QE, QT explained.

I’m sure that got your undivided attention – Not…

But its important and why the rates may actually start dropping.

Quantitative Easing (QE) is when a central bank injects new money into the economy by expanding the money supply. Think back to the 2008 financial crisis and the COVID-19 pandemic—during these periods, the Fed was aggressively pumping money into the system.

Quantitative Tightening (QT), on the other hand, is the process of reducing the money supply. The Fed has been shrinking its balance sheet for years, which has contributed to rising Fed rates and mortgage rates.

Net Neutral is exactly what it sounds like—neither QE nor QT. It’s a steady-state monetary policy where the Fed maintains the status quo without expanding or contracting the money supply.

This is a big deal. Net Neutral is the next step to QE and lower interest rates.

We’re starting to see a shift toward a buyer’s market, as evidenced by the increasing number of listings being pulled. After years of rapid home value appreciation, prices have leveled off and are beginning to normalize. Sellers are catching on, reassessing their pricing strategies, and either adjusting their listings or temporarily stepping back from the market.

http://www.YourApplicationOnline.com

-

FED Speak and they seem to be reading from the same playbook.

Fed Pres Harker, Fed Governor Waller and Fed Pres Bullard all seem to be reading from the same book.

They are all saying, January was not a surprise historically and not overly concerned with potential tariffs.

The NAHB Home Builder Sentiment Index dropped 5 points due to concerns over tariffs, mortgage rates, and rising housing costs—particularly with Canada, which supplies about 30% of our soft lumber.

Housing starts and permits have declined, but only relative to December’s numbers. The key factor in December? Lower mortgage rates. And it wasn’t even a significant drop—just the expectation of lower rates was enough to drive demand.

Now, imagine what will happen when rates actually decline in a more sustained and meaningful way.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.