-

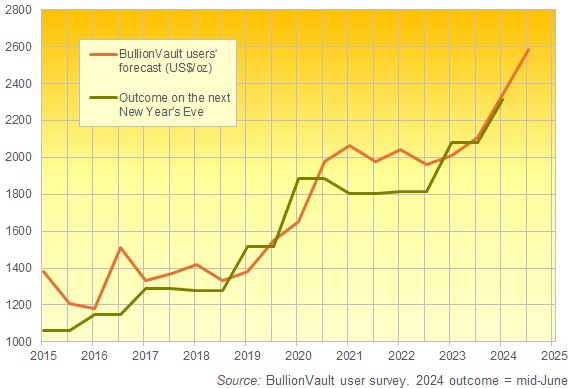

Lets talk Gold. It’s the Cannery in the Coal mine.

Gold has a unique and complex relationship with GDP. Let’s break it down.

The latest Q1 2025 GDP estimate from the Atlanta Fed sits at -2.1%. However, when factoring in gold, the adjusted GDP figure moves closer to zero. Next report scheduled for release Thursday, March 27th.

Here’s why: Strong GDP growth often leads to higher interest rates, which can reduce demand for gold. On the other hand, economic uncertainty or a weakening economy tends to push investors toward gold as a safe-haven asset, influencing the overall economic landscape.

The Feds are paying attention. They are wrapping up their meeting tomorrow afternoon. At that point we will compare their projections on Fed Funds Rate, inflation, unemployment and the DDP from their last meeting.

Why do mortgage rates change? The answer is complex. It’s like looking through a peephole—catching only glimpses of the full picture and making educated guesses as the image gradually comes into focus.

My take on this: Rates are trending downward. As always, be ready—especially if you’re considering refinancing. When the shift happens, things will move quickly, and you’ll want to be prepared.

http://www.YourApplicationOnline.com

-

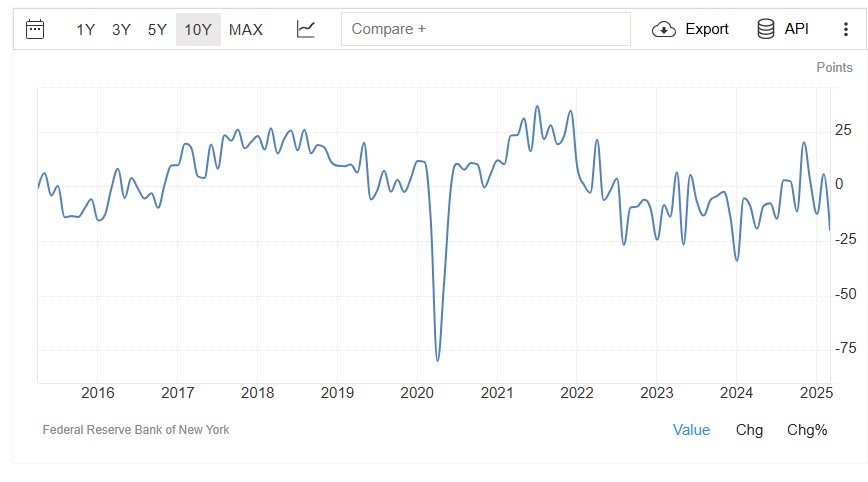

Feds to conclude their Meeting Wednesday. Hold rates? or Drop.

The Empire State Manufacturing Index dropped to -20, significantly weaker than the expected -1. New orders index also dropped 14.9 as well as shipments index to -8.5.

Looking at the long-term trend in the graph, it’s clear that this index has been quite volatile. Let’s take a closer look to determine whether this decline is a serious concern.

Inventory continues to grow. This is concerning. Business optimism continues to decline while prices rose at the fastest pace in two years.

The Fed must consider whether to cut rates sooner rather than later or risk falling into analysis paralysis.

Inflation declines when consumers opt for chicken over beef and brew their own coffee instead of buying Starbucks. Supply and Demand.

The case for lower interest rates is stronger today than it was yesterday. Now is the time to get your mortgage paperwork in order—let’s get you pre-qualified for your purchase or refinance!

http://www.YourApplicationOnline.com

-

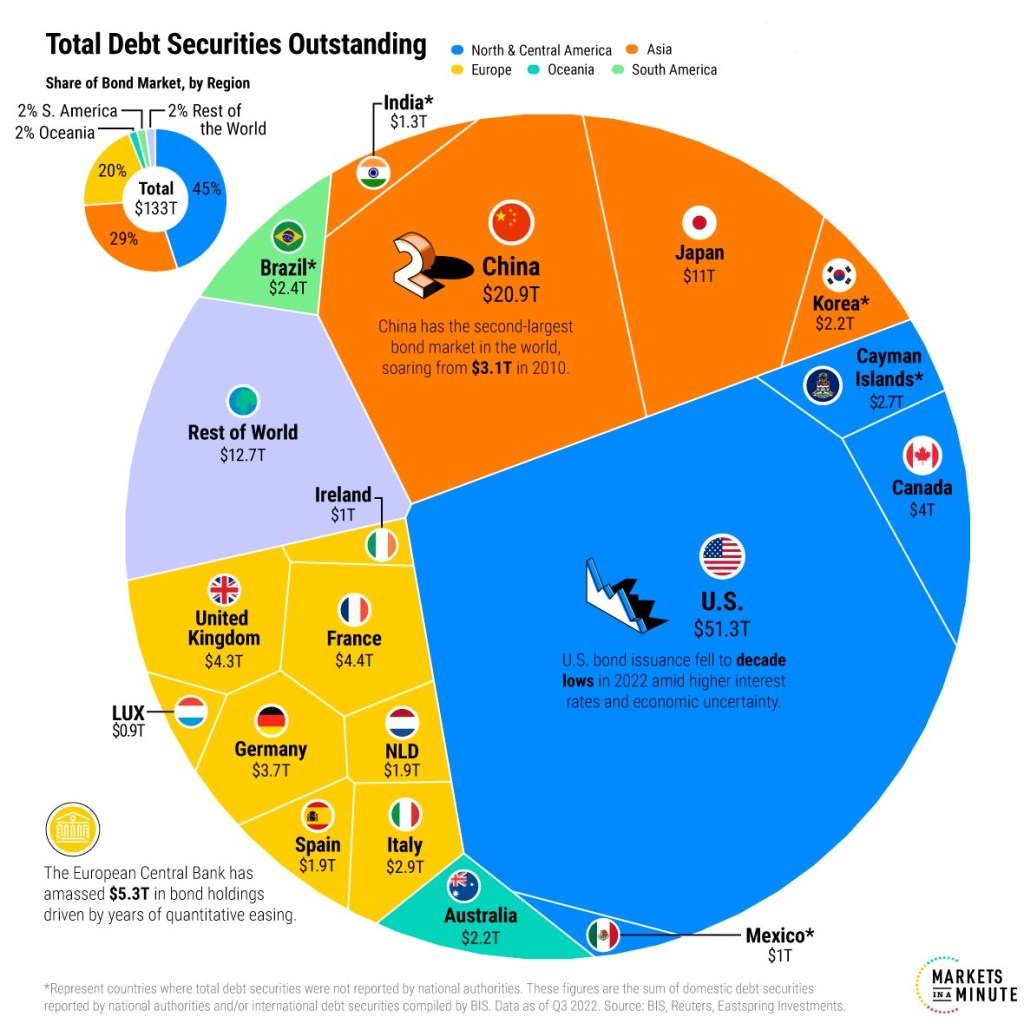

Global Bond Markets are intertwined by ways of competition for yield.

In Global financial markets, there is always competition to attract capital, regardless of the product being offered, and bonds are no exception.

Investors have a wide range of choices, from stocks and real estate to commodities and alternative assets, all vying for their funds. To stand out, bond issuers—whether governments or corporations—must offer competitive yields, favorable terms, and a strong credit profile to attract buyers.

Factors like interest rates, inflation expectations, and economic conditions further influence how bonds compete with other investment options.

In essence, just like any product in a marketplace, bonds must continuously adapt to investor demand to remain an attractive choice.

Mortgage rates have declined since the turbulence of the tariff war but now appear to be stabilizing. The outlook for April 2nd remains uncertain, but we’ll have to wait and see how things unfold.

http://www.YourApplicationOnline.com

-

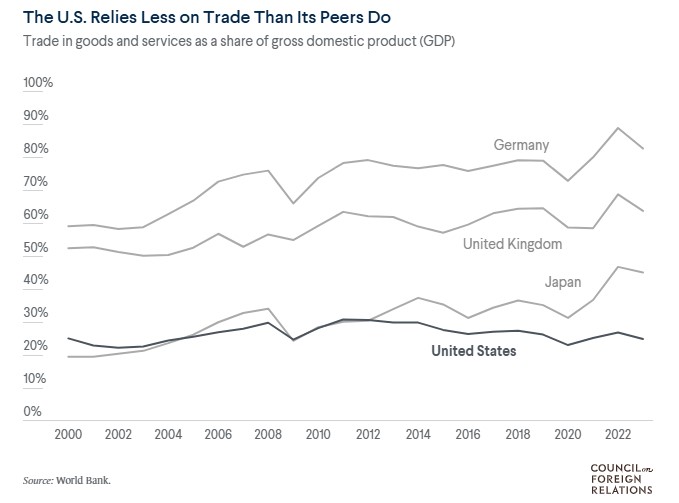

Remember that poster of the kitten hanging by its claws on a tree limb? That’s the bond market right now.

I’m scratching my head. Yesterday, the Consumer Price Index came in cooler than expected, and we saw a strong 10-year auction—yet the bond market barely reacted.

Today, the February Producer Price Index, which measures wholesale inflation, also came in much lower than expected (0.0% vs. 0.3% forecast).

So, what’s going on? The markets are fixated on tariffs and the trade war. This morning, Europe announced tariffs on American whiskey, and in response, Trump threatened a 200% tariff on certain European wines and spirits.

Imagine a group of kids in a sandbox, each claiming their corner as their own. One child takes another’s shovel, so the other retaliates by knocking over their sandcastle. Soon, they’re all piling up sand barriers, blocking each other’s toys, and making it harder for anyone to play.

That’s the trade war—countries imposing tariffs and restrictions, retaliating against one another, and ultimately making it more difficult for everyone to thrive. Just like in the sandbox, the more they fight, the messier it gets, and in the end, no one wins.

The kitten (bonds) keeps defying gravity, but it won’t hold on forever. When yields drop, they’ll drop fast. The flight to safety is real—and it’s happening now.

http://www.YourApplicationOnline.com

-

Bond Friendly CPI Report, but the result were, well, Disappointing.

This morning, I was eager to see the latest Consumer Price Index (CPI) report—yes, I know, I need a more exciting life.

Here are the key takeaways:

- Inflation rose 0.2%, lower than the 0.3% expected.

- Year-over-year inflation slowed from 3.0% to 2.8%.

- Energy and food prices increased, while gas prices declined, but energy services rose.

- Eggs alone accounted for two-thirds of the inflation increase.

- Core inflation dropped from 3.3% to 3.1%, better than expected.

- Airline fares fell 4.0%, driven by lower demand and energy costs.

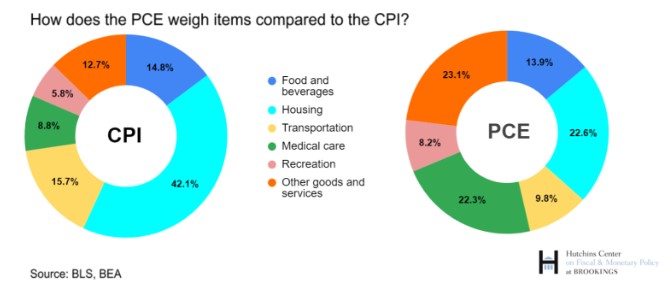

- Shelter, which makes up 44% of the Core Index, rose 0.28%, but came in lower than expected.

There’s a lot to unpack here—lower inflation, tariffs possibly stabilizing (or not), and a stock market that seems to be finding its footing.

I anticipated a rate drop today, but instead, the market remained motionless—like a sleeping dog.

-

Slower Economic Growth and Recession are both Good things for Inflation and Mortgage Rates.

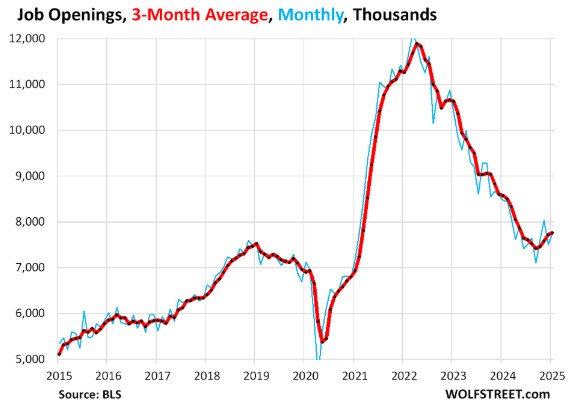

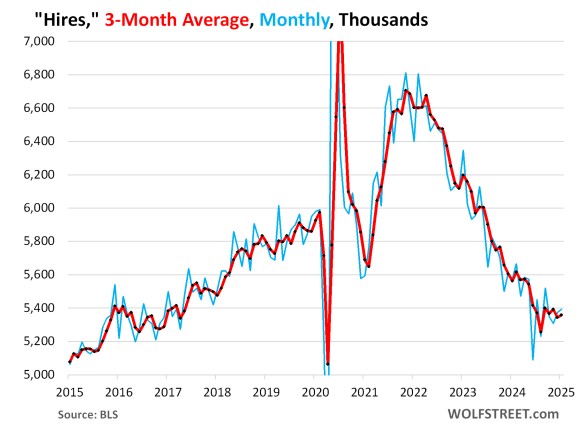

The Job Openings and Labor Turnover Survey (JOLTS) showed a slight increase in job openings, exceeding estimates. However, December’s data was notably weak, and the long-term trend continues to decline.

The BLS Jobs Report saw downward revisions for every month in 2024, totaling a negative adjustment of 263,000 jobs from the original reports.

The Small Business Optimism Index (NFIB) dropped 2 points in February, with the percentage of businesses expecting economic improvement plunging 10 points to 37.

The Atlanta Fed’s Q1 GDP estimate remains negative at -2.4%, with other major forecasters like Morgan Stanley and Goldman Sachs projecting around -1.9% for Q1 GDP.

When thinking about inflation, consider supply and demand. A shift in consumer mindset—such as skipping Starbucks, postponing travel, or choosing chicken over steak—can quickly alter demand and increase supply, impacting overall price levels.

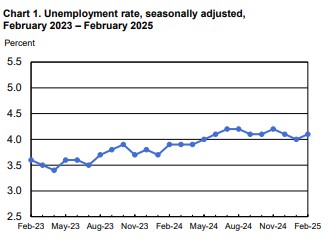

Even if unemployment rises to 5%, that still means 95% of the workforce is employed.

Now is the time to start your home search—get pre-approved and let’s make it happen!

https://YourApplicationOnline.com

-

Mortgage Rates Improving, CPI Wednesday, Inflation numbers.

This week’s inflation data is a mixed bag. Shelter costs, which make up 42% of the CPI report, are expected to continue their gradual decline.

Energy prices dropped 6% in February, accounting for 16% of the CPI report.

Keep in mind that inflation is measured as a percentage change over the past 12 months. February 2024 saw high inflation across the board, so while the current numbers may still seem elevated, they reflect a slight decline compared to last year.

What Does This Mean for You?

Global uncertainty, fueled by an escalating trade war, has led to a flight to safety—Bonds. This surge in bond demand pushes prices up and yields down, which in turn helps bring mortgage rates lower.

On the ground, I’m seeing much more market activity compared to last year. If you’re looking to buy a home, expect more competition. If you’re considering refinancing, now is the time to get your paperwork in order so you’re ready to act when rates take a significant dip.

https://YourApplicationOnline.com

-

BLS, Birth/Death Model and what the Jobs reports really mean.

I’m not here to sugarcoat it, so let’s rip off the Band-Aid.

The Bureau of Labor Statistics (BLS) reported 151,000 jobs created, falling short of the 170,000 estimate. Notably, 136,000 of those jobs came from the Birth/Death model, which estimates employment changes based on business openings and closures—a flawed measure of true job growth.

What does this mean for us? Rates are likely to drop as investors seek safety, driving more money into the bond market.

Let’s break down the job shifts: 1.2 million full-time jobs were lost, while 610,000 part-time jobs were added. Notably, all job gains came from the 16–19 age group, totaling 80,000, while employment for those 20 and older declined by 667,000.

The headlines reflect the reality on the ground. This trend has caught the Fed’s attention, with the market now pricing in three rate cuts this year.

https://YourApplicationOnline.com

-

ECB cut rates 25bp today. What happened and will it continue here.

After inflation concerns fueled by tariffs and tariff threats, the European Central Bank (ECB) cut interest rates by 25 basis points today.

Was this the right decision, or should they have held steady? Any knee-jerk reaction comes with consequences.

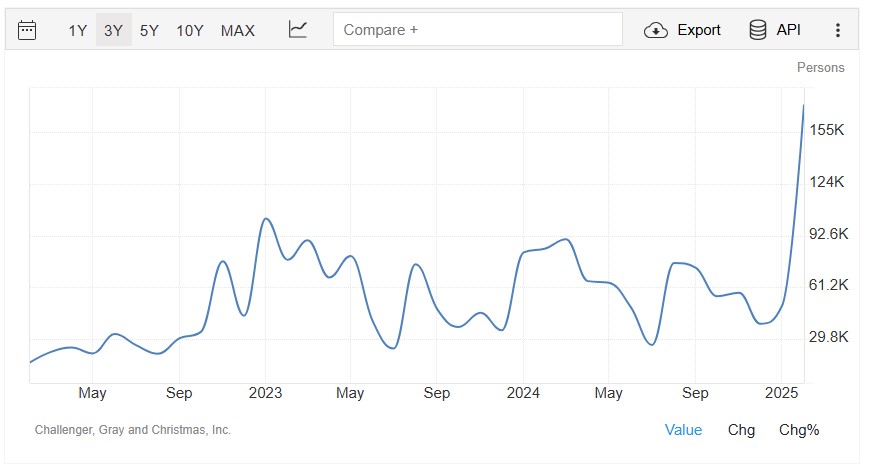

The Challenger Job Cuts Report revealed 172,017 announced job cuts last month—the highest since 2009. Government cuts, particularly in the DOGE sector, contributed to this rise, along with layoffs in retail and technology.

Meanwhile, the leisure and hospitality sector saw job growth, largely due to rebound hiring after weather-related slowdowns in December and January.

Given the historical correlation between the Challenger report and the Bureau of Labor Statistics (BLS) Jobs Report, we anticipate a weaker BLS report tomorrow.

Historically, the Jobs Report has had a direct impact on the bond market—stronger-than-expected numbers push rates higher, while weaker results drive them lower. We expect a softer report and unemployment to hold steady at 4%. This could well translate to lower rates tomorrow.

http://www.YourApplicationOnline.com

-

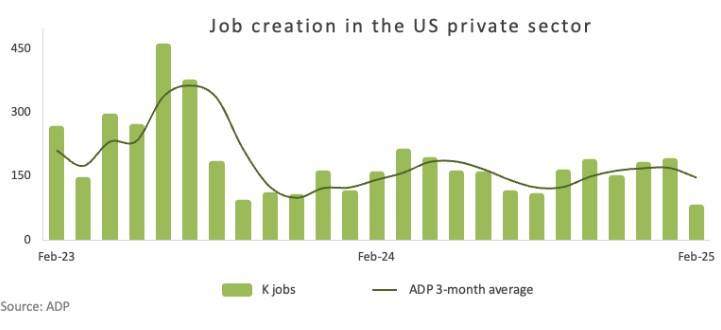

ADP Jobs Report 77,000 jobs Created, expected 140,000.

- Trade/transportation/utilities -33,000

- Information -14,000

- Financial Activities 26,000

- Professional/business services 27,000

- Education/health services -28,000

- Leisure/hospitality 41,000

The ADP report was weaker than expected, helping bonds recover from news out of Germany regarding a proposed rule change that would allow increased defense and investment spending—an inflationary factor.

Mortgage applications are up mainly due to the lower interest rates over the past few weeks.

We can help, soft credit pull no harm to credit. http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.