-

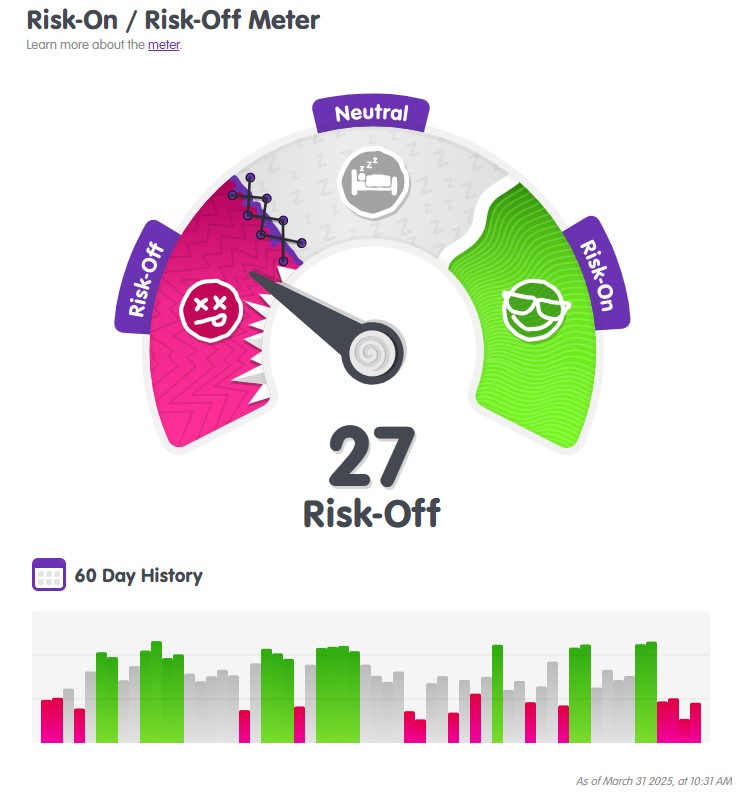

Risk On, Risk Off. If you shoot an arrow into the air, you’d better know where it’s going to land.

How Good or Bad will the reciprocal tariffs be?

Worst than expected – Risk off flight to safety, Bond will benefit, rates improve.

Better than expected – Risk On, back to the stock market at the expense of the Bond market.

Stay tuned 4pm ET.

ADP Jobs report was stronger than expected spread out between all business sizes and sectors.

Job stayers had pay increase of 4.6% annually. seems high but actually the lowest level since June 2021.

Job changers saw an increase of 6.5% down from 6.8% last month.

No one likes the unknown especially business owners who have to plan months to years in advance. Tariffs if you love them or hate them are disruptive especially the way these are being rolled out.

Rates have improved the last few weeks and we hope to continue this trend.

http://www.YourApplicationOnline.com

-

It’s tough to count Nickels when half of them are wood.

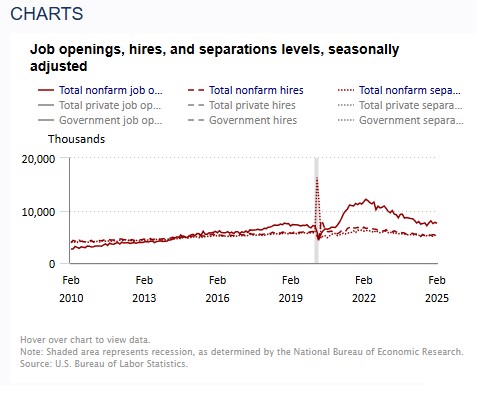

he latest Job Openings and Labor Turnover Survey (JOLTS) data revealed that job openings fell short of expectations. While the downward trend is evident, a bigger concern is that some job postings may be artificially inflated to make businesses appear stronger.

Additionally, the quits rate has dropped to 2%, indicating that fewer people feel confident about finding new job opportunities.

The hiring rate remains at 3.4%, hovering near its lowest level since 2013.

The ISM Manufacturing Index came in lower than expected, with an inflationary impact on new orders, largely driven by tariffs.

As a result, investors are shifting toward safer assets, moving money from the stock market into bonds.

Mortgage bonds are rising as the 10-year Treasury yield declines.

This month, we’re preparing our refinance clients in anticipation of a more significant rate drop by summer. We offer a soft credit pull and can run a “what-if” scenario to explore your refinance options.

http://www.YourApplicationOnline.com

-

Demand Destruction and Slowdown component of Tariffs more than Inflationary impact.

Tariffs are a double-edged sword. On one hand, they can generate revenue to help reduce the U.S. deficit and lower interest rates.

On the other hand, tariffs can significantly weaken consumer demand, increasing the risk of a recession and a deflationary environment.

I’ve previously mentioned Risk-Off Trading, but it’s worth revisiting. Capital primarily moves between two markets: stocks and bonds. The markets are reacting strongly to the effects of tariffs, with money shifting between these assets based on risk and reward dynamics.

In the current high-risk environment, investors are pulling money out of riskier assets and seeking safety in bonds.

This week its all about jobs. JOLTS, ADP, Employment Report, and Fridays BLS Jobs Report.

The expectation is unemployment rate rising from 4.1% to 4.2%. The 10-Year bond should react in a rate positive direction.

http://www.YourApplicationOnline.com

-

12 month 2.8%, 6 month3.0% and 3 month 3.5%. inflation going in the wrong direction.

Here’s the weird part—remember stagflation? That’s when shoppers pump the brakes on spending, forcing businesses to freeze or even drop prices.

As inflation rises, buyers are starting to take control of their wallets.

Personal Consumption Expenditures – PCE only rose 0.4% and a revision downward for February. Spending numbers across several reports show weakness. Consumers have a heavy debt loan with 9.7 million individuals behind on their student loans.

Q1 GDP Estimate has been revised lower from -1.8% to -2.8%.

On one hand, inflation is rising, which usually pushes mortgage rates higher. But on the other, consumers are tightening their wallets, which helps cool inflation down. It’s like the economy is playing tug-of-war with itself!

Rates are down today and expected to continue through the end of Spring. I am headed out to see the sights in Chicago and will see you Monday.

http://www.YourApplicationOnline.com

-

GDP = C+I + (X-M) Consumption + Investment + Government Spending + (Exports-Imports)

I bet you didn’t expect to do math this morning!

Consumer spending, which accounts for 68% of GDP, plays a major role in the economy. Later today, we’ll receive the latest Q1 GDP estimate, with expectations of little to no growth.

In February, Durable Goods orders increased by 0.9%, despite forecasts predicting a 1% decline—largely driven by Defense Spending.

Meanwhile, Core Shipments, along with exports and imports, also rose 0.9%, surpassing expectations. This surge was primarily due to shipments being pushed forward ahead of upcoming tariffs.

What does this all mean to me/you? We don’t exactly know. Uncertainty restricts growth.

Why build a plant if you don’t know if you need it. Tariffs are a double edge sward. If they are put in place will they get yanked a month later. If a business owner is relying on those tariffs they may wait before they spend capital on a new building.

Bottom line is Mortgage rates are headed in the right direction. Home Values are up and unemployment is steady.

http://www.YourApplicationOnline.com

-

Bend the Steel when it’s hot.

Steel bends easily when hot. Likewise, in life and business, acting at the right time brings the best results. Success comes from timing, decisiveness, and action.

Case-Shiller and FHFA Appreciation Reports for January, showed home prices rose 0.6%. Year over Year up 4.1%.

The year over year for the Federal Housing Finance Agency -FHFA are up 4.8% higher by 0.1% than expectations.

Home Prices continue to rise on average 4% year after year.

New home sales are up 5.1%

Mortgage Bonds are struggling a bit with the Tariff uncertainty with rates rising for the first time in two weeks. Not much but still a change in the wrong direction.

I’m headed to the windy City Thursday but will make sure to post a few pics.

http://www.YourApplicationOnline.com

-

You’re the boss when you drive a car—until the carburetor breaks. Then, you’re not the boss anymore.

Tariffs, tariffs everywhere, but not a drop to drink. The erratic, on-again, off-again nature of tariff announcements creates a nightmare for money managers.

Money flows in two directions: the stock market and the bond market. A surge in one pulls from the other, shifting the balance constantly.

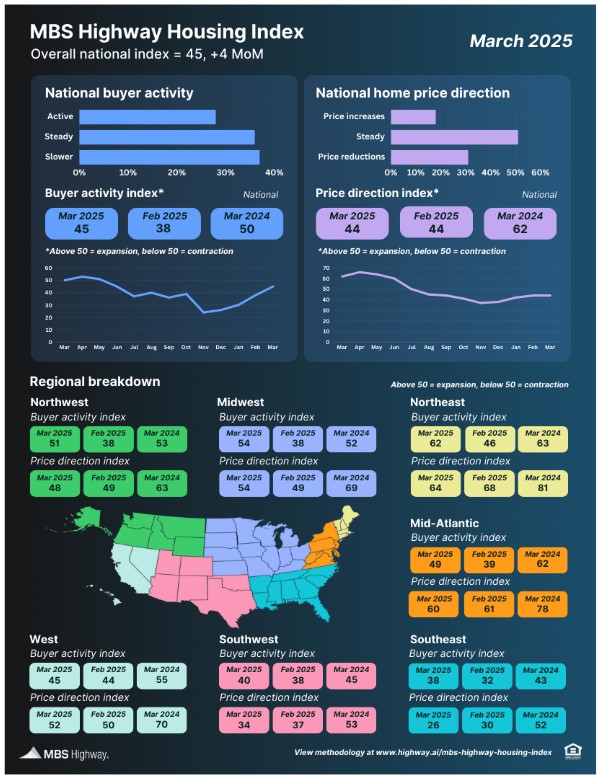

Mortgage rates are directly linked to Mortgage-Backed Securities (MBS) bonds. Homebuilders closely monitor rate trends, as their projects typically take 6 to 18 months from groundbreaking to occupancy.

Buyer activity is directly tied to interest rates—we see it every day. Lower rates drive more applications, more offers, and more contracts, creating a win for everyone. That is, until rates rise again.

The long-term trend points to lower rates. Focus on the bigger picture, not the short-term fluctuations, and we’ll all be fine. Watch the dog not its tail.

http://www.YourApplicationOnline.com

-

“If you’re a dog, it’s either time to walk or sniff.” – Goolsbee, Fed President.

I listened to Austan Goolsbee this morning, and he shared a powerful analogy. He said the Fed is like someone constantly reading data and sniffing everything out, but eventually, you have to start walking—taking action.

He also touched on the concept of transitory – one month of change isn’t the same as four months. He was referring to tariffs and their ongoing impact on inflation, suggesting that short-term shifts don’t always stay temporary.

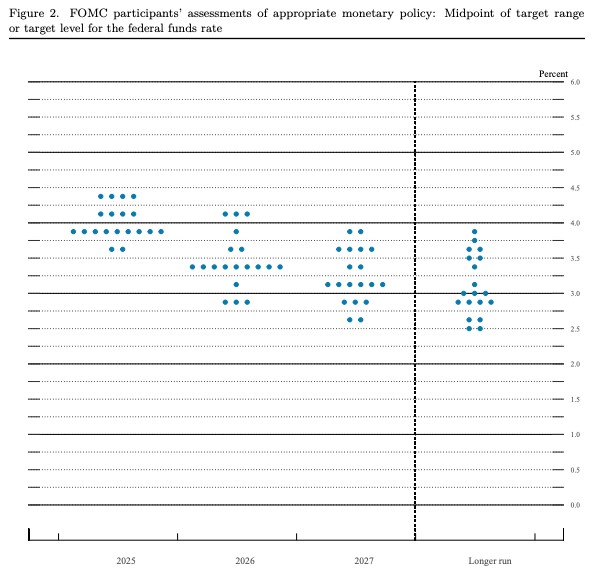

The Dot Plot below represents the The Federal Open Market Committee FOMC 12 members. The trend is lower Fed rates, lower Mortgage rates.

http://www.YourApplicationOnline.com

-

When your Roof is Leaking, you will fix it.

We all have a tendency to delay things that may be critically important. Every now and then, it’s worth looking up to check the ceiling before a leak appears.

From a mortgage standpoint, we encourage our clients to get fully approved through underwriting before purchasing or refinancing. Rates are starting to move in the right direction, and once they shift significantly, the rush will be on. Being prepared now can put you ahead of the curve!

Now lets get to the data:

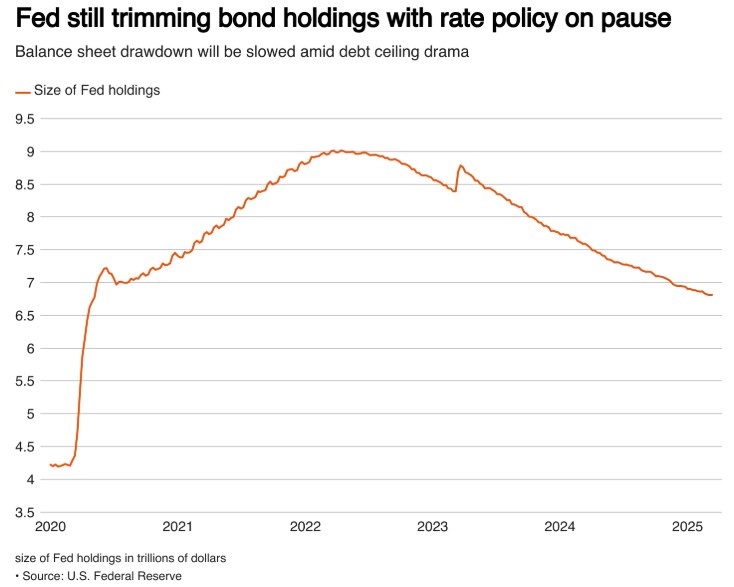

The Fed kept rates unchanged, as expected, and made key adjustments to their balance sheet runoff. Previously, they allowed $25B in bonds to mature and be paid back instead of reinvesting. Now, they’re making changes to this process by re-investing. which could impact the market.

Simply put, Quantitative Tightening (QT) means reducing the Fed’s balance sheet by letting bonds mature without reinvesting. Quantitative Easing (QE) is the opposite—it involves reinvesting those funds to keep money flowing in the economy.

These are all signs of future lower Fed rate and Mortgage rates.

get pre-approved today. http://www.YourApplicationOnline.com

-

At 11AM (PST), the FED releases its SEP…

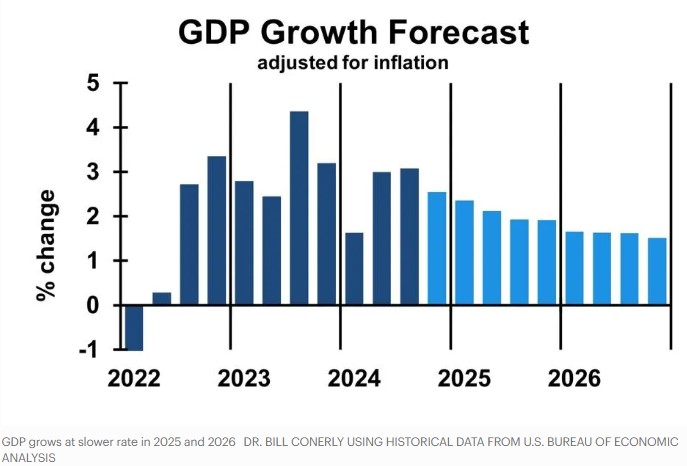

The Summary of Economic Projections (SEP) provides insight into where the 19 Federal Reserve members anticipate key economic indicators, including the unemployment rate, GDP growth, core PCE inflation, and the direction of the Fed Funds Rate.

Let’s take a look back at the last SEP report from December 18th:

- Unemployment Rate: 4.3%

- GDP Growth: 2.1%

- Core PCE Inflation: 2.5%

- Fed Funds Rate Projection: 2 cuts

Current Expectations:

- Unemployment Rate: 4.1%

- GDP Growth: -1.8%

- Core PCE Inflation: Trending lower

- Fed Funds Rate: No clear guidance

Additionally, the Fed may announce an end to its balance sheet runoff, which involves selling bonds. If this happens, there’s a strong possibility they will begin reinvesting approximately $40 billion per month back into Treasuries (Bonds)—a move that could provide positive momentum for mortgage rates.

lets get you qualified http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.