-

“Without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans.” – Fed Chair Powell

Remember the Hawk verses Dove view. Powell was pretty hawkish and indicated that inflation is more important than labor.

He denied that the FED would help the Stock market but if things got bad enough, he may change his mind.

In response to Powell’s comments, Trump posted on Truth Social and said, “Powell’s termination cannot come fast enough.”

Housing Starts and Permits – Bottom line – more demand than supply.

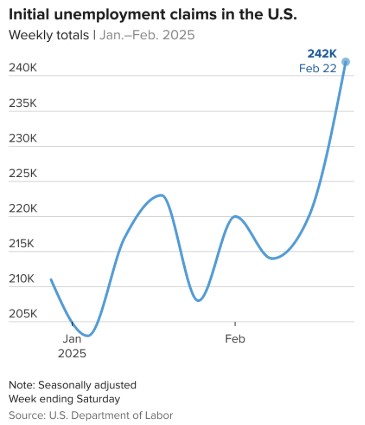

Initial Jobless Claims fell for the first time 9,000 to 215,000

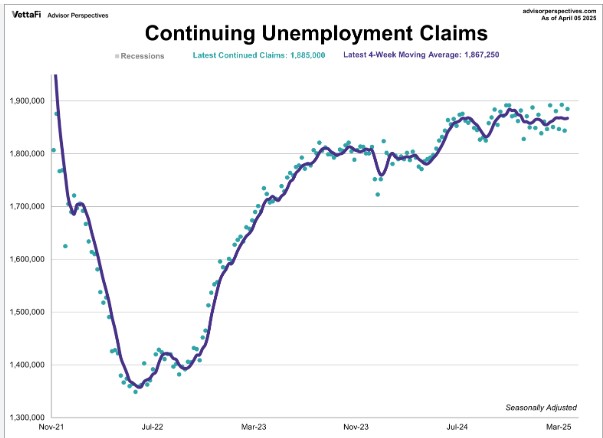

Continuing Claims rose 41,000 to 1.885M

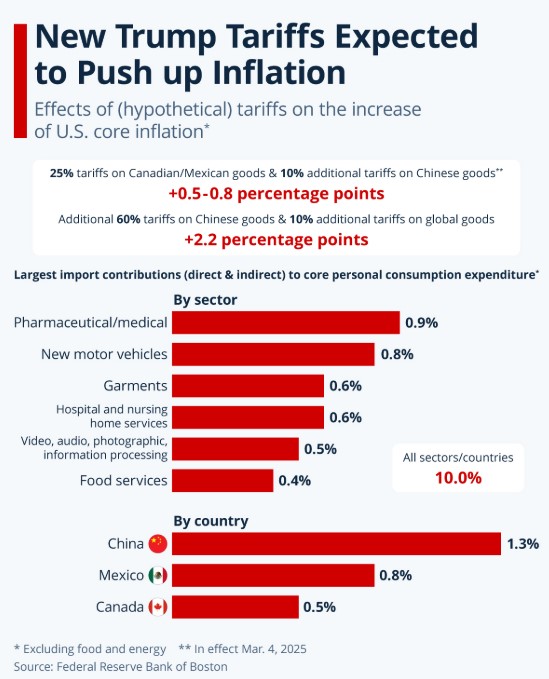

The housing market continues to support home prices into the future. The Tariffs are going to have a significant impact moving forward including inflation, Jobless claims, PCE, CPI and so on.

Stay tuned rates will go down, and up and down….

http://www.YourApplicationOnline.com

-

Flight to Safety, Bond Market improves but why?

The Bank of America Global Fund Manager Survey revealed that nearly half of respondents expect a global recession, while a majority anticipate a mild recession in the U.S.

As a result, a record number of global portfolio managers plan to reduce their exposure to U.S. equities. Historically, this shift tends to redirect capital into the bond market, which can help push yields lower.

We have an interesting week ahead with Powell speaking tomorrow at 1:30pm and the Retail Sales report.

This is a short one today and will be in training tomorrow.

http://www.YourApplicationOnline.com

-

The reports of my death have been greatly exaggerated – Mark Twain.

First I am a bit Graph Happy today but it helps.

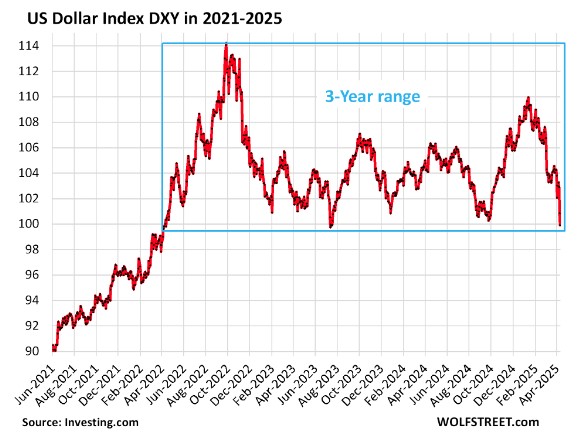

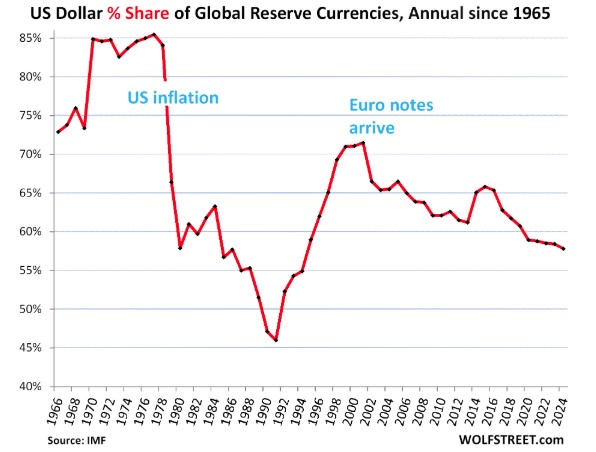

Former Fed Chair and Treasury Secretary, Janet Yellen said the dynamic rise in Treasury yields, simultaneous with the decline in the dollar suggests the investors are beginning to shun dollar based assets.

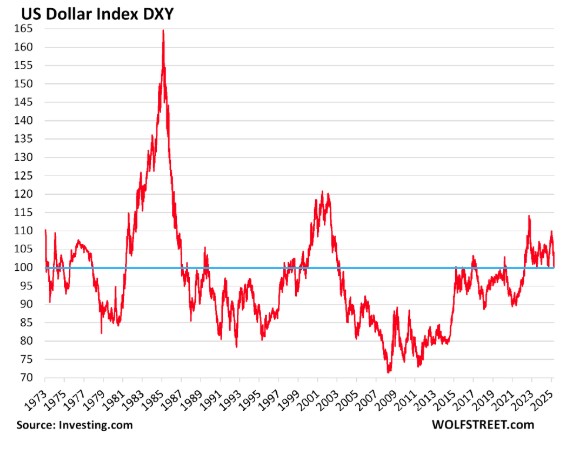

While it is true that the US dollar moved sharply lower last week and is at its lowest level in three years, its not unprecedented, in fact a few months ago late 2024 the complaint was that the dollar was too strong.

Chaos is never good and right now that is what we have. Money Managers hate chaos and uncertainty.

The US dollar is the dominant reserve currency, with 58.7% ahead of the next one in line. The euro share is 20%. see last graph.

http://www.YourApplicationOnline.com

-

Let’s Pull the Band-Aid Off. “We may already be in a recession”. – CEO BlackRock

There are growing fears that we are in a recession already. Larry Fink, the CEO of BlackRock, John Mauldin, and Lacy Hunt all believe we may already be in a recession.

The Federal Reserve may be stepping in sooner than later.

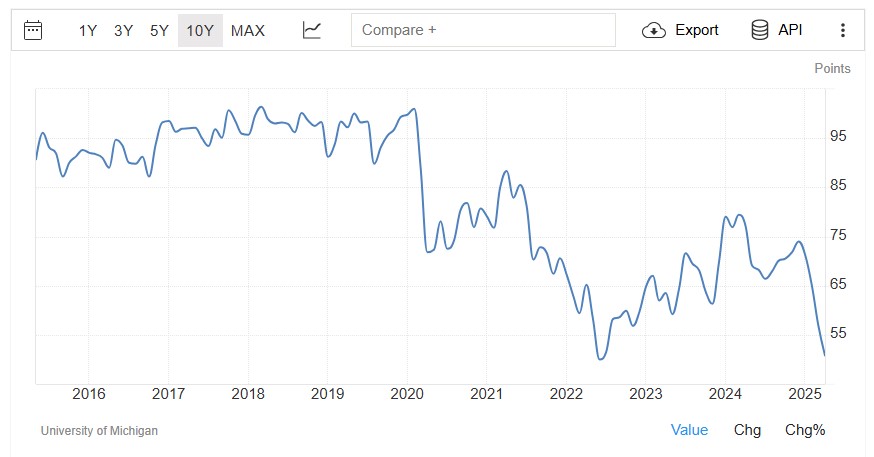

University of Michigan Consumer Sentiment has plunged to 50.8 the lowest level since June 2022 with the index measuring expectations fell to 47.2 the lowest since May 1980.

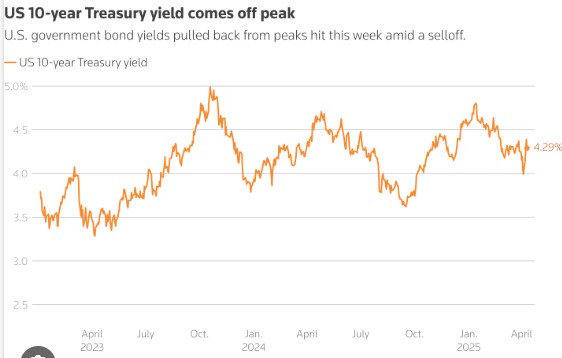

The Bond Market is not happy and has responded accordingly. 10y UST is over 4.51. last week it was closer to 3.80. This rise drives Mortgage rates up.

But still holding onto rates from beginning of the year.

http://www.YourApplicationOnline.com

-

Life often reflects moments, like that game of pool with a friend.

Picture this: he’s lining up a shot and says, ‘Watch this.’ Then, like magic, the cue ball hits four rails, weaves past three other balls, and sinks the 8 ball. Impressive—except he never said what we were supposed to be watching for!

Taking credit after the fact is easy, especially when you fill in the blanks—but if you didn’t call ‘net,’ can you really claim it?

Volatility is never welcome—especially among money managers and business owners. When markets swing unpredictably, it creates hesitation, delays decision-making, and leaves even experienced professionals uncertain about their next move.

Nationally rates are getting hit but are still holding some of the gains from earlier this year. Not pretty but not too ugly.

This may be the exact time to get out their and start looking for a home or selling and buying up/down. When more people are on the sidelines you have less competition.

http://www.YourApplicationOnline.com

-

Investors Sitting on their hands. Stocks, Bonds, and the Dollar all Down at the same time.

Typically, when uncertainty strikes, money flows from stocks into the safety of the bond market. However, that hasn’t been the case recently. Instead, investors appear to be staying on the sidelines, hesitant to commit in either direction. The volatility in the market is not just visible—it’s palpable.

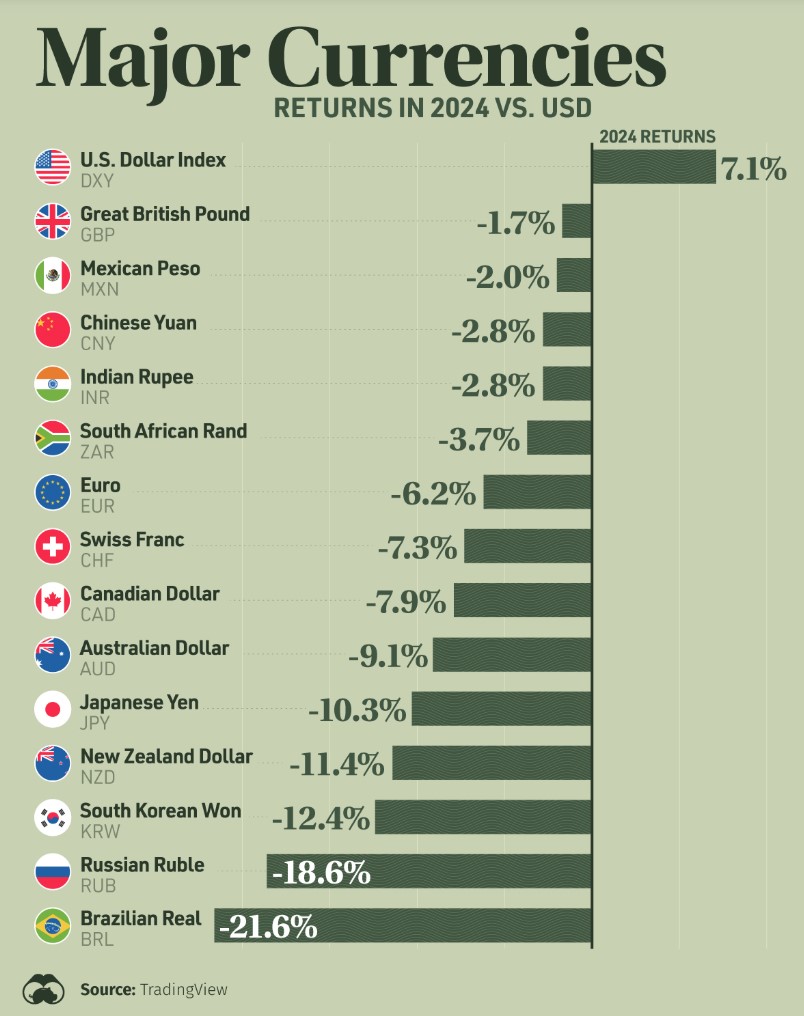

Adding to the complexity is the strength of the U.S. dollar. We’re witnessing a rare and unwelcome trifecta—equity market volatility, bond market instability, and currency pressure—all at once.

There’s also speculation that China, the largest foreign holder of U.S. Treasuries, may be selling off some of its holdings. While this could contribute to rising yields, it’s considered unlikely. The bulk of China’s Treasury purchases were made when interest rates were significantly lower, making any large-scale liquidation costly and impractical.

As for mortgage rates—they remain below the highs we saw earlier this year, but we’ve certainly given up some ground. The Federal Reserve is now facing growing pressure to cut the Fed Funds Rate at its next meeting.

http://www.Your ApplicaitonOnline.com

-

This is interesting “You don’t sell what you want, you sell what you can.” Why Bond market and rates went up.

The last two days in the bond market have been, well… ugly—and pretty confusing. I keep pointing to the typical “flight to safety,” but this time, something different played out.

Around 10am, a rumor started circulating on X that the White House was planning to suspend tariffs on every country except China for 90 days.

The market reacted fast. The S&P 500 surged, gaining nearly $3 trillion in value. But when the White House denied the rumor, nearly $2.5 trillion of that gain was wiped out.

So what’s the big issue? That kind of extreme volatility triggered margin calls across the market. Investors had to come up with cash quickly, which led to selling off assets—primarily Treasuries. And when Treasuries sell off, bond prices drop and yields rise… which means mortgage rates just went up.

Define Margin Call – a demand by a broker that an investor deposit further cash or securities to cover possible losses.

Bond market, down is higher rates.

http://www.YourApplicationOnline.com

-

Up is Down and Down is Up.

Tariffs & the Bond Market: A Love-Hate Story

Ah, tariffs. The economic plot twist no one asked for but everyone feels. Every time a new tariff is slapped on, Wall Street collectively holds its breath while the bond market says, “Well, guess we’re the safe one again.”

When tariffs rattle the economy, investors get nervous—and nervous money doesn’t like risk. So where does it go? Right into the loving, yield-y arms of the bond market. As demand for bonds rises, yields drop… and when yields drop, mortgage rates tend to follow.

So yes, while tariffs might be a gut punch to the stock market (and your retirement account), they often hand out a consolation prize to borrowers: lower mortgage rates. Bitter? A little. Helpful for refinancers and buyers? You bet.

It’s a strange relationship—tariffs stir chaos, bonds catch the fallout, and mortgage rates quietly smile in the corner.

-

Well, if there’s a silver lining, it’s that rates are falling—and not just a little!

The March jobs report came in solid. Meanwhile, mortgage bond yields for both the 2-year and 10-year are down significantly. The U.S. dollar index has dropped 1.8%—a move that would typically take over a year to materialize under normal market conditions.

Do you know someone that needs to refinance or purchase. Soft credit pull.

http://www.YourApplicationOnline.com

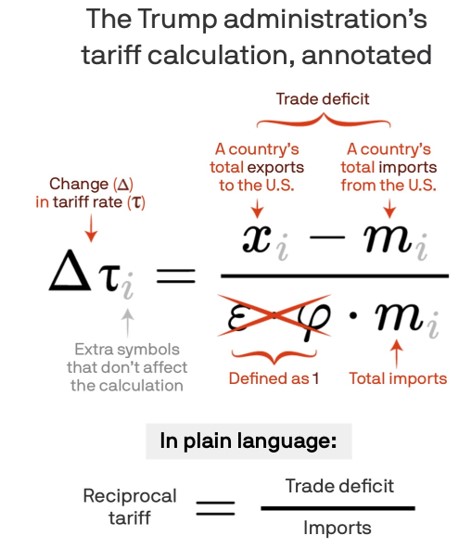

Image thanks to Felix Salmon.

-

Mom always said “Don’t Play Ball in the House”. Where’s the bottle of Super Glue?

Remember yesterday? Ah, the good old days—when things were slightly less chaotic. In my blog, I talked about Risk On and Risk Off. Well, today, it’s looking more like Risk Off the Rails.

Tariffs came in worse than expected, and the stock market just took a 3.4% dive—roughly 1,487 points—as I type. (If you listen closely, you can hear investors screaming in the distance.)

But here’s the silver lining: Risk Off in the stock market means a flight to safety—the Bond Market. And you know what that means? Mortgage rates have improved. Not just a little, but quite a bit. We’re already locking in our slightly risk-averse clients while the opportunity is hot.

Our refinance clients? They’re primed and ready. I do anticipate lower rates ahead, but let’s be real—it’s a bit of a circus right now. We’ll stay on our toes because, at this point, predicting tomorrow is like predicting the weather in April—chaotic at best.

Stay tuned!

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.