-

What the Heck is a Bearish Engulfing Pattern, you may ask your self… Thanks Barry

In trading terms, a Bearish Engulfing Pattern signals the start of a downtrend, which often indicates lower interest rates. To visualize it, think of a “V” shape: you slide down to the bottom, then quickly swing back up.

The image shows it best. We see this all the time but what is different is it comes off the heals of the PPI report yesterday and Japan’s GDP more negative than expected.

The global yields were lower in sympathy. Rates dropped.

Housing Starts and Permits

Housing Permits are forward looking indicator and its been trending lower. permits down 5%. Tariffs create uncertainty and builders are already on edge.

Housing Starts are a better read. They are relatively flat in April an annualized down 2%. Not a big drop.

Have a fantastic weekend and if any questions come up, feel free to reach out.

online mortgage application http://www.YourApplicationOnline.com

-

A Sponge can only hold so much Tariffs… I mean Water.

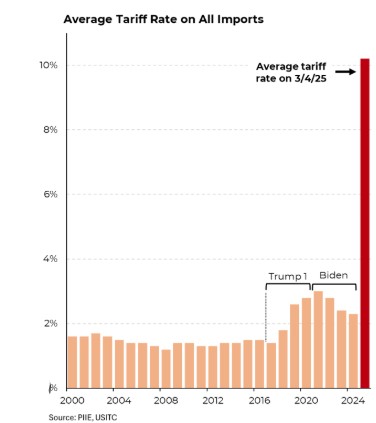

Walmart made a noteworthy observation, and the latest Producer Price Index (PPI) report backs it up.

While prices have remained relatively stable so far, Walmart pointed out that the full impact of the tariffs has yet to be felt at the consumer level.

The PPI data suggests that businesses are currently absorbing much of the cost, resulting in tighter margins. But that can’t last forever—eventually, those costs are likely to be passed on.

So even if inflation appears subdued for now, it’s clear that not all the pieces are in place. We haven’t herded all the cats into the barn just yet.

PPI came in at a negative 0.5% much cooler than the positive 0.2% expected.

Fed Chair Powell’s spoke this morning regarding reviewing their framework. Hum, not exactly sure what that means.

Inflation, Inflation, Inflation. the cure is worse than the disease. Lets drop the rates, restructure debt and let everyone take a deep breath. Just my opinion.

Let’s get you pre-qualified or your clients. http://www.YourApplicationOnline.com

-

Why do we keep pointing to the 10y Treasury Bond when talking rates? Trust me this is interesting.

The 10-year Treasury bond and mortgage rates are closely linked because:

- Both represent long-term borrowing costs.

- Both compete for the same pool of investors.

When the 10-year Treasury yield rises, mortgage rates typically increase as well. This is because:

- Lenders must keep mortgages attractive compared to Treasury notes, which are seen as low-risk investments.

- Higher Treasury yields signal that borrowing is becoming more expensive overall.

In response, lenders raise mortgage rates to:

- Stay competitive with Treasury investments.

- Ensure they offer returns high enough to attract investors.

In a nutshell:

Lenders add a “spread” (a percentage point difference) on top of the yield to account for the higher risk of mortgages compared to Treasuries.

The 10-year Treasury yield acts as a benchmark for mortgage rates.

Online Mortgage application http://www.YourApplicationOnline.com

-

CPI is like stepping on the scale after vacation—you’re hoping for good news, but deep down, you know that extra guac is about to show up in the numbers.

The April Consumer Price Index (CPI) showed overall inflation rising 0.2%, slightly below the expected 0.3%. Year-over-year, inflation edged down from 2.4% to 2.3%.

However, it appears the impact of recent tariffs hasn’t been fully reflected yet. Overall, inflation remains in a relatively flat range.

So what’s a Federal Reserve to do? Well do what they do best. Wait, and wait some more.

Here’s the problem: a huge chunk of homeowners are sitting pretty with sub-3.25% mortgage rates. And really, who wants to trade their cozy low-rate castle for an identical one at double the cost? Not many. Meanwhile, builders are grinning ear to ear—they’ve got brand-new homes with no rate baggage, and they know they’re the only game in town!

Ok, off my soap box and back to work. Lets get you or your clients pre-approved, soft credit pull http://www.YourApplicationOnline.com

-

Elvis was Abducted by Aliens. I found an old article.

This week’s key economic news includes the Consumer Price Index (CPI) and Producer Price Index (PPI), both set to be released Tuesday and Thursday respectively.

Expectations are for moderate readings, with tariff impacts only beginning to appear. A clearer economic picture has yet to emerge.

Stocks are higher with Mortgage Bonds lower after the US and China 90 day agreement.

Rates remain relatively flat, with the mid-6% range likely to be the norm for the foreseeable future. If you’re holding out for a drop in both home prices and interest rates, you may be waiting a long time.

Home prices continue to climb, with the exception of some more volatile markets—particularly in Texas and the Florida condo sector.

We’ll get more insight on Friday when the Housing Starts and Building Permits reports are released.

Online application http://www.YourApplicationOnline.com

-

Stocks and Bonds are like Siblings on a Road Trip

How a Trade War Can Hurt Bonds

A trade war can cause trouble for the bond market, mostly by pushing bond yields up and prices down. Here’s how that happens:

- Prices Go Up: Tariffs make imported goods more expensive, which can lead to higher inflation.

- Interest Rates Rise: To fight inflation, central banks may raise interest rates. Higher rates make borrowing more expensive and can hurt bond values.

- Less Foreign Buying: Trade tensions can scare off foreign investors, leading to lower demand for government bonds and even higher yields.

- Bonds Feel Less Safe: Normally, government bonds are considered safe during uncertain times. But in a trade war, confidence may drop, and investors might sell off bonds.

- Warning Sign of Recession: Trade wars can also lead to an “inverted yield curve,” where short-term bonds pay more than long-term ones—often a red flag for a coming recession.

-

70% of the US GDP is Consumer Spending. Spending is up but Consumers are scared.

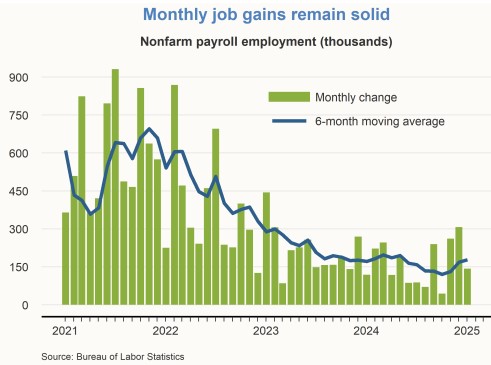

The economy appears to be on stable ground—job growth remains steady, unemployment is near historic lows, and inflation is tracking at 2.4%.

But how is the average American consumer really feeling?

To answer that, we look at both hard data—like unemployment and inflation—and soft data, such as consumer surveys and sentiment polls. One widely used measure is the Consumer Confidence Index, which captures both current conditions and future expectations.

As of the end of April, the Present Situation Index stood at 133, significantly above the historical average of 103, indicating consumers feel confident about the current economy. However, the Expectations Index—which reflects outlook over the next six months—fell to just 54, marking its lowest level since 2011.

This stark contrast suggests that while consumers recognize today’s relative strength, uncertainty about the future is growing.

Mortgage rates holding steady. Lets get you pre-approved, soft credit pull.

http://www.YourApplicationOnline.com

-

What’s a Corporation to Do? Raise Prices Only on Tariffed Goods—or Across the Board?

Corporations typically focus on maintaining profitability, so while they can raise just the prices on tariff-impacted goods, they often take a broader approach. Here’s how it usually breaks down:

- Direct Tariff Pass-Through: Companies may increase prices only on products directly affected by tariffs, especially if those items are clearly traceable to specific materials or imports (e.g., a particular electronics part or imported steel).

- Blended Price Increases: Many businesses choose to spread the cost of tariffs across a broader range of products. This avoids sharp spikes on a few items and softens the blow to consumer demand—basically, hiding the increase across a wider product line.

- Strategic Price Hikes: Some corporations take advantage of tariff news to raise prices on unrelated items under the cover of “inflationary pressures” or “supply chain disruptions.” This can quietly boost margins.

So, while they could limit price increases to just tariffed goods, in practice, companies often raise prices more broadly—especially if the market will bear it.

The Feds meet this afternoon to talk rates. The challenge is uncertainty with regards to inflation.

http://www.YourApplicationOnline.com Soft Credit Pull

-

The Relationship of time Unemployed and the Unemployment Rate.

Unemployment benefits currently extend up to 26 weeks. The share of individuals unemployed for 27 weeks or more has increased from 21.3% to 23.5%—the highest level in three years. This means nearly one in four unemployed workers are no longer eligible for benefits, adding further strain to the economy.

Additionally, the median duration of unemployment rose to 10.4 weeks, up from 9.8 weeks, indicating a broader slowdown in job recovery.

Current Unemployment rate remains at 4.2% but we see a reasonable scenario where the rate rises to 4.4 to 4.5%. The Feds cannot ignore the obvious signs of a slowing economy.

Translation; Mortgage Rates will drop.

Website http://www.YourApplicationOnline.com soft credit pull.

-

It’s like Opening a Can with no Label. You don’t know what you’re going to Find.

Imagine reaching into your pantry and pulling out a food can with no label. No ingredients, no expiry date, no clue what’s inside. It could be soup, peaches, or dog food — you just don’t know until you open it. That’s what tariffs can feel like in the economy.

When tariffs are imposed, especially suddenly or unpredictably, businesses and consumers are left guessing. Will prices go up? Will supply chains break down? What country will retaliate next? It’s like opening that mystery can: you’re not sure what you’re going to get, but you know it might not be good.

Tariffs are meant to protect domestic industries, but they often come with unintended consequences — higher costs, limited choices, and economic uncertainty. For small businesses and everyday families, that uncertainty can make budgeting, planning, and even grocery shopping feel like a gamble.

In the end, whether it’s dinner or a policy decision, people like to know what they’re getting into. With tariffs, as with unlabeled cans, a little transparency could go a long way.

Rates are holding steady. OPEC+ is increasing their production by 411,000 barrels per day roughly 1% of total production. Potentially lowering gas prices and helping inflation.

Lets get you or your clients pre-approved. http://www.YourApplicationOnline.com Soft Credit pull.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.