-

The Wealth Effect Cuts Both Ways: It’s Impact on Today’s Market and what’s up Redfin?

Not one to shy away from a clicky headline myself, but I think Redfin might be playing fast and loose with their math — or borrowing a calculator from a toddler.

They claim there are 1.94 million sellers and 1.45 million buyers… which sounds impressive until you remember that current inventory is 1.45 million, and about 500,000 of those are already under contract. That leaves just 960,000 active listings.

So unless we’ve entered a parallel universe where sellers are cloning homes or buyers are invisible, something doesn’t quite add up.

Front-Running and the GDP

There’s an old adage: “History is written by the winners.” In this case, we saw a spike in inventory driven by front-running — companies buying ahead of the anticipated tariffs.It’s a reminder that information is often presented by those in control, not necessarily those most affected. The GDP data may show a temporary boost, but it’s not always the full story — sometimes it’s just the version told by the ones holding the pen.

My Take

Tariffs impact more than just the cost of goods — they also weigh heavily on consumer confidence. The unpredictable, on-again/off-again nature of tariff policies creates uncertainty, which is never good for anyone — whether you’re a business owner or a consumer. Stability and clarity are key to sustained economic confidence.

http://www.YourApplicationOnline.com Soft Credit pull get qualified.

-

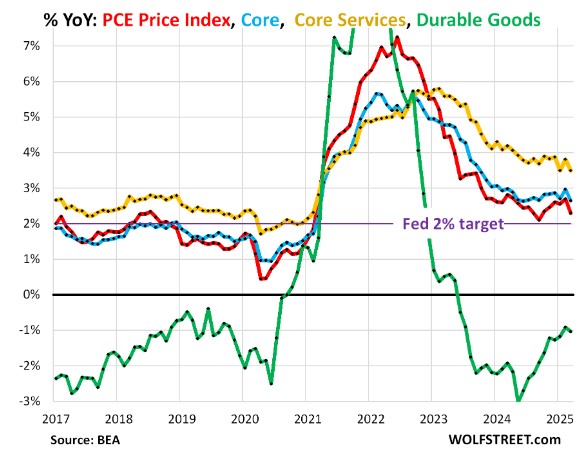

Inflation drops to 2.1%. Powell are you listening or still looking in the rearview mirror? Just asking.

A face-to-face meeting between Fed Chair Powell and the President — described as cordial at best.

We’re all hoping for mortgage rates to come down. Elevated rates are putting pressure on the housing market, keeping millions of homeowners locked into sub-3.25% mortgages and discouraging them from selling. This dynamic contributes to historically low inventory and, in turn, continues to push home prices higher.

At some point the cure is worse than the disease.

Personal Consumption Expenditures (PCE) rose 0.2% as expected

- Personal Consumption Expenditures (PCE) rose 0.2% as expected

- Incomes rose 0.8% expected as 0.3%

- Social Security payments rose 6.9%

- Trend for PCE continues to move down. Good News.

Have a fantastic weekend. we feel the tide shifting in the right direction.

http://www.YourApplicationOnline.com

-

An interesting thing happened on the way to the Forum – grocery store. And Tariff reprieve

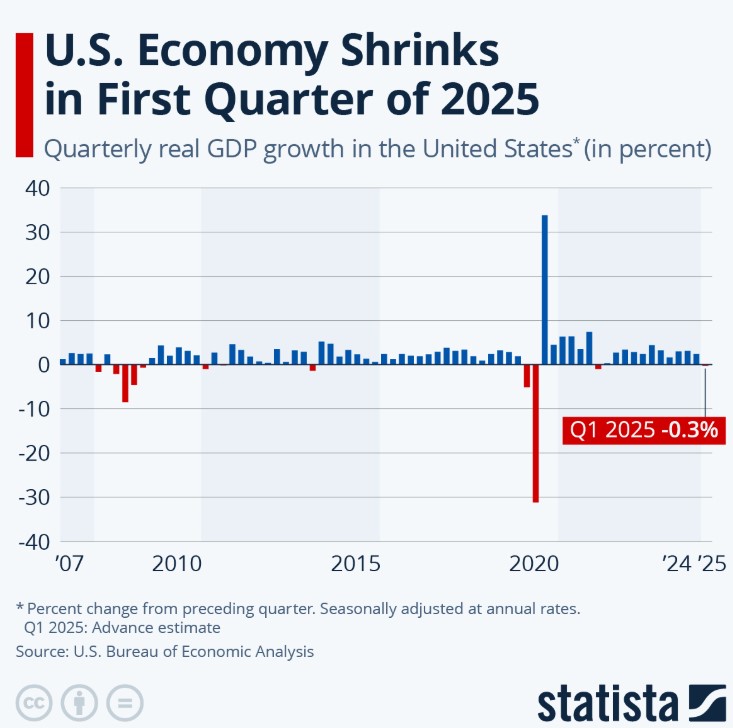

Q1 GDP came in at -0.2%, slightly better than the expected -0.3%, but still reflects a slowdown—particularly in personal spending, which rose just 1.3% compared to the 1.8% estimate.

This points to weaker consumer demand, which in turn eases pricing pressure. With fewer buyers in the market, retailers are often forced to lower prices to attract spending—ultimately helping to bring inflation down.

The power of the consumer at work.

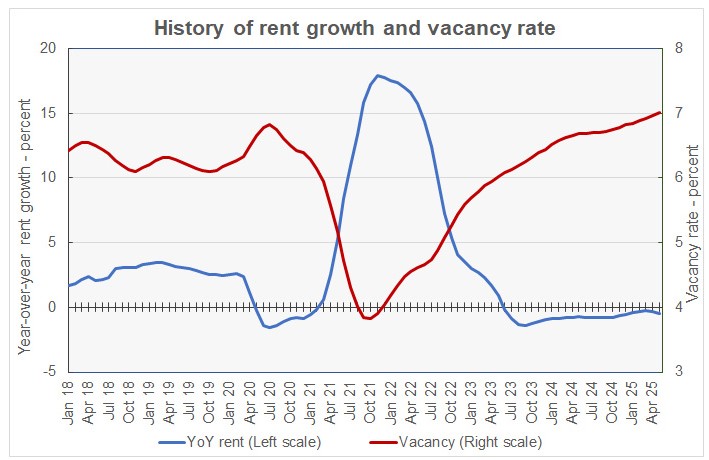

Another sign of slower consumer spending comes from the latest Apartment List Rent Report, which showed new rents rose just 0.4% in May, while rents are actually down 0.5% year-over-year.

This is especially notable because May is typically a peak season for rentals, when demand — and prices — usually trend higher.

Also worth noting: the national vacancy rate is holding at a historically low 7%, a key factor we haven’t touched on before.

The halt on Tariffs has had a positive impact not only to the stock market but the bond market as well.

http://www.YourApplicaitonOnline.com

-

What Happens when Fannie and Freddie go Public? And my take.

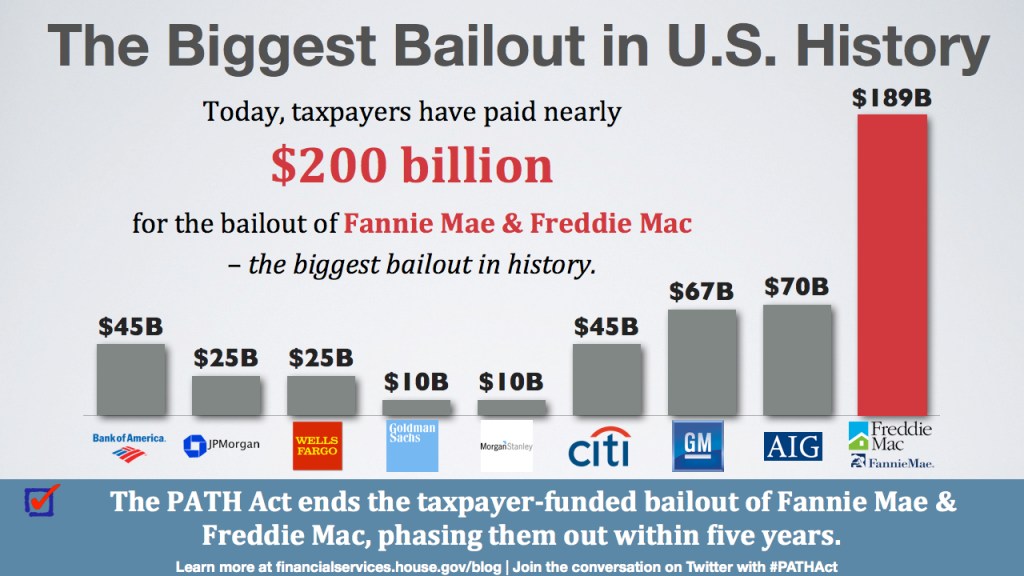

With a new prospect of Fannie Mae and Freddie Mac exiting conservatorship and potentially going public has sparked both fear and excitement.

Lets do a quick breakdown:

Positive Impacts:

- Windfall for U.S. Government – recoup bailout funds from 2008.

- Increased Market Efficiency – market driven decision making, competition and innovation.

- Reduced Government Risk – shifting losses to private investors.

- Capital Market Benefits – raise capital and enhance their financial stability.

Negative Impacts:

- Increase in Mortgage Rates – Privatization to higher returns and higher rates.

- Reduced Access to Credit – impacts to less qualified borrowers with higher credit standards.

- Market Disruption – Government to Private is complex and disruptive.

- Financial Instability – if mismanaged could destabilize housing market.

My Take:

I lived through the 2008 financial crisis and saw firsthand both the positives and the pitfalls when Fannie and Freddie began competing with subprime lenders for market share.

It was a fun ride — until it wasn’t.

Healthy competition is a good thing, and this move has the potential to spark innovation and open up the marketplace. That said, with the government still retaining a degree of control, the guardrails remain in place — and that’s reassuring.

Soft credit pull. YourApplicationOnline.com

-

FNMA ie Fannie Mae rate forecast end of year 2026 5.875%.

Fannie Mae lowered their rate forecast for 2025 to 6.2% to 6.1% and for end of year 2026 from 6% to 5.8%.

There are more than 4M borrowers with rates over 7% right now so this is welcome news. We can get you pre-qualified and ready to go when rates start dropping.

Soft credit pull http://www.YourApplicationOnline.com

Housing report Case-Shiller

Home prices rose 3.4% year over year. What’s interesting is the big cities 10-20 city indices were higher nationwide, showing that big cities are outperforming. the 10-city index is up 4.8% with the 20-city up 4.1%.

Durable Goods Orders

Fell 6.3% in April but less than the -7.8% expected. Tariffs are the Culprit.

With summer just around the corner, I thought I would share a Disneyland pic from last year.

-

Remember the “Flight to Safety” blog I did? lets recap. And to those who Sacrificed and serviced our Nation.

Tariffs, tariffs everywhere — but not a drop to drink.

Tensions escalated with more talk of a potential 50% tariff on the EU, as trade negotiations continue to stall.

The stock market didn’t take it well and responded with a selloff. As usual, when equities take a hit, bonds often benefit. It’s the classic flight to safety.

We’re seeing a bit of rate improvement this morning as a result.

Consumer debt and breakdown:

- Mortgage Debt $13T

- Autos $1.6T

- Student loans $1.6T

- Credit cards $1.2T

- Total Household Debt $18.2T

http://www.YourApplicationOnline.com

-

Just Sold my Homing Pigeon on eBay for the 22nd time. Seriously let’s talk Debt Ceiling.

Let’s jump right in!

Yesterday’s weak 20-year Treasury auction led to a selloff in the bond market, which pushed mortgage rates higher.

We’re also seeing upward pressure on global yields, and Moody’s recent credit rating downgrade for the U.S. certainly isn’t helping the situation.

On top of that, the House just passed a new budget—essentially a tax and spending bill—which is making bond markets nervous. Why? More spending means more debt, and that translates to more Treasury issuance. The market has to absorb all of that.

Looking ahead, August is shaping up to be critical. That’s when we’re projected to hit the X-date—the point at which the Treasury may no longer be able to fund the government or service our debt.

With all of that in play, the ripple effect showed up in April’s Existing Home Sales, which dipped 0.5% — coming in below expectations.

There’s clearly pent-up demand in the market, but with rates moving higher, many buyers are hitting pause and waiting for conditions to improve.

When rates drop, look-out it will get very busy very fast.

http://www.YourApplicationOnline.com

-

Supply and Demand, the Global Bond Market — one big happy family… and a Where’s Waldo picture.

Japan’s weak Treasury bond auction is casting a shadow over upcoming debt sales next week. Lower demand typically means higher yields — and that pushes rates up.

Meanwhile, the UK surprised markets with hotter-than-expected inflation. Investors were expecting a drop, but instead, the 10-year gilt yield moved higher.

Since we’re all part of a globally connected bond market, U.S. yields are rising in sympathy — though the reaction here has been relatively muted.

As for the nine Fed members who spoke yesterday, they focused on rising unemployment, persistent inflation, and ongoing uncertainty around tariffs.

No indication of a Fed rate drop just yet.

http://www.YourApplicationOnline.com soft credit pull

-

Let’s pull the Band-Aid off and pull up our bootstraps.

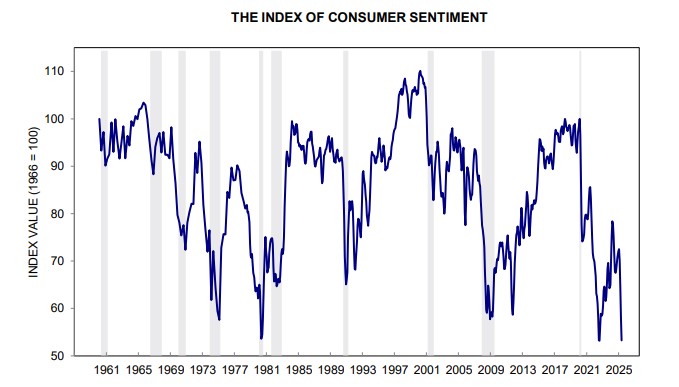

The University of Michigan reported that Consumer Sentiment fell to 50.8% in May, the second lowest reading since 1952 hen the tracking metric started.

Consumers expect inflation to rise to 7.3% over he next year.

Over 60% of respondents are expecting more unemployment over the next year.

To note: the survey was done prior to OK and China trade talks.

There will be 7 Fed speakers throughout the day. lets see what tomorrow brings.

http://www.YourApplicaitonOnline.com

-

Moody’s put me in a bad Mood, but good news it’s Picture day…

Stocks and Bonds are both lower following news that US was downgraded by Moody’s Ratings this weekend due to US debt. The debt is 123% of GDP which is high compared to most other nations.

Rates are slightly higher this morning.

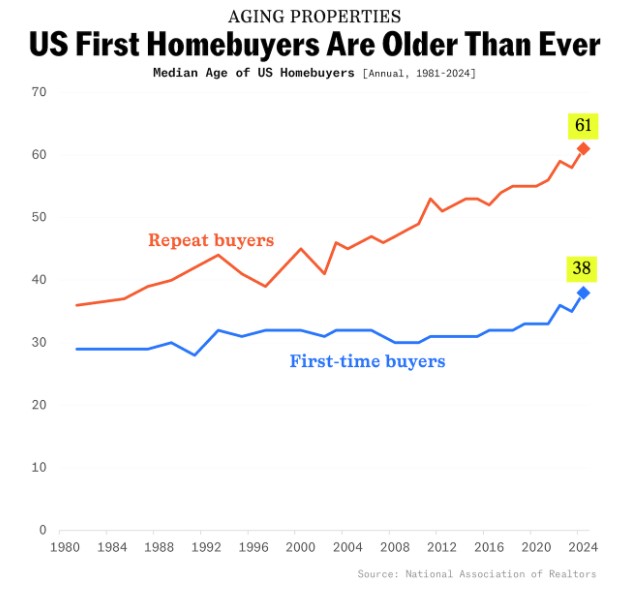

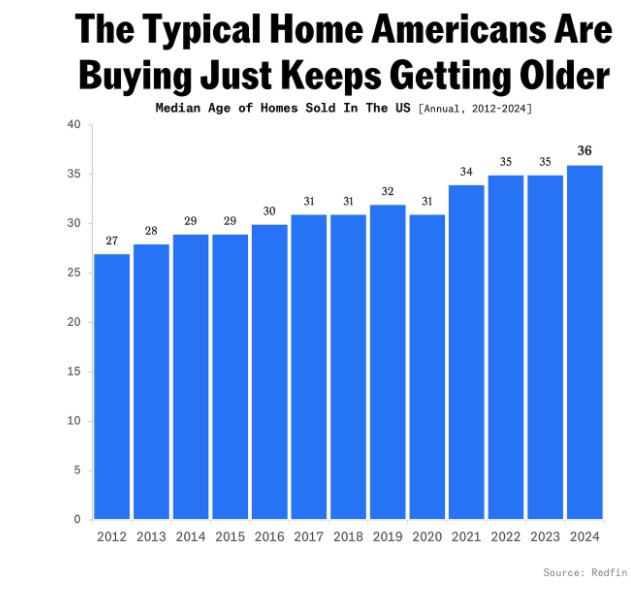

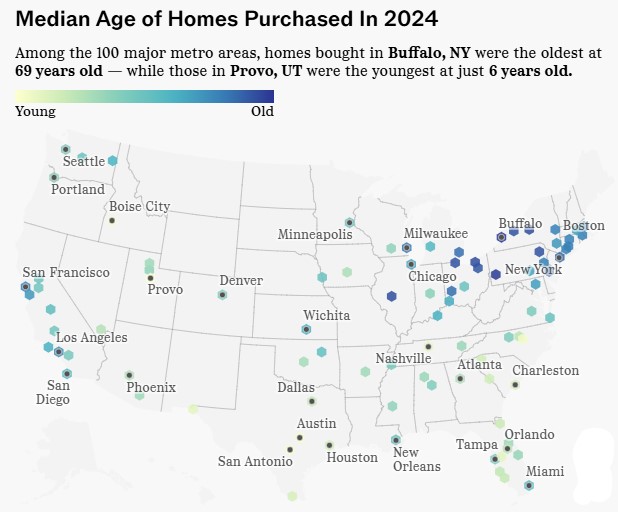

Interesting set of graphs below regarding age of buyers and homes across the US. Have a great week. http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.