-

Capacity Utilization. What we can do and what we are capable of doing. What’s Up FEDs.

There’s a distinction between overall capacity and capacity utilization. The chart is particularly insightful, with the gray vertical bars indicating periods of recession.

In May, we saw a slight pullback in capacity utilization—a development that isn’t surprising, considering the impact of tariffs and the surge in purchasing activity during March and April in anticipation of those changes.

Retail Sales in May were -0.9% expected -0.7%. It was a weak report showing consumers spending less.

It was the big ticket items like Autos and building materials showing the largest declines.

Feds meet this week with a zero chance of rate cuts.

http://www.YourApplicationOnline.com

-

Market Reaction and how it affects Rates short and long term.

In most global conflicts, stocks drop and investors rush to the safety of bonds. This time, the stock selloff happened — but the bond rally didn’t show up like it usually does.

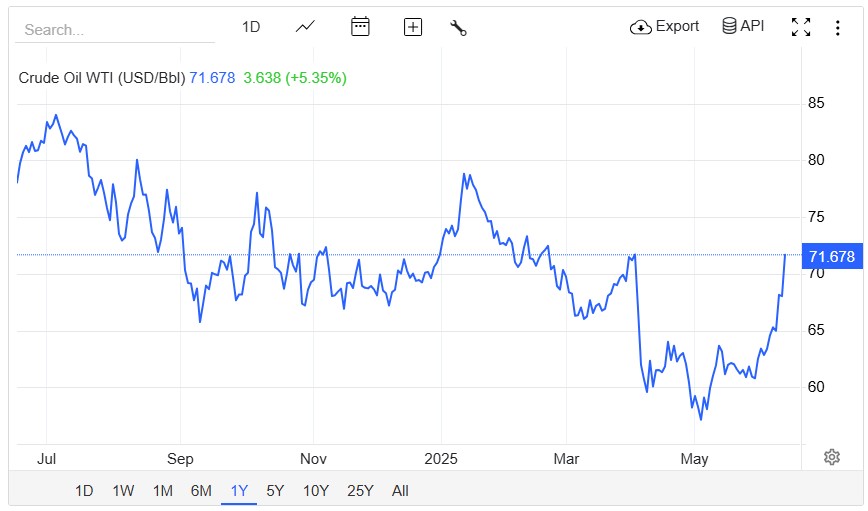

Oil prices surged 8% overnight and are up 16% over the past week.

Since oil is a major input in both the Consumer Price Index (CPI) and the Producer Price Index (PPI), this sharp increase has put inflation fears back in the spotlight.Rising energy costs can ripple through the economy — from transportation to goods and services — making inflation harder to contain.

We saw a 30-year Treasury bond auction yesterday, following a strong 10-year auction earlier in the week. Both were met with solid demand, particularly from foreign investors — a sharp contrast to recent media narratives suggesting a global move away from the U.S. dollar and Treasuries.

The takeaway? Stocks took a hit, but the bond market didn’t respond the way we’d expect.

Rates are flat today, though we’re expecting a more favorable shift as early as next week.http://www.YourApplicationOnline.com Soft Credit Pull.

-

What happens if the Fed just drops rates by 2 points. Slower Labor Market impact on rates.

Recession concerns haven’t gone away — they’re just not showing up in May’s PPI report… yet. For now, we’re all in wait-and-see mode, watching to see how inflation really shakes out in the coming months.

What if the Feds dropped rates before inflation goes down?

If the Fed drops rates before inflation comes down, it’s a bit like trying to cool down soup while turning up the stove — here’s what could happen:

Inflation could heat up again

Lower interest rates make borrowing cheaper — whether it’s mortgages, car loans, or credit cards. That encourages people to spend more, which can drive prices up and make inflation worse, not better.It’s classic supply and demand: more buyers chasing the same goods = higher prices.

And just like the scorpion and the frog — it’s in our nature to spend. So when borrowing gets easier, wallets open up, demand rises, and so do prices.

The Fed risks losing credibility

The Fed’s main job is price stability. If they cut rates too soon, markets might think they’re caving to political or market pressure, not economic fundamentals. That can shake investor confidence.Short-term gains, long-term pain?

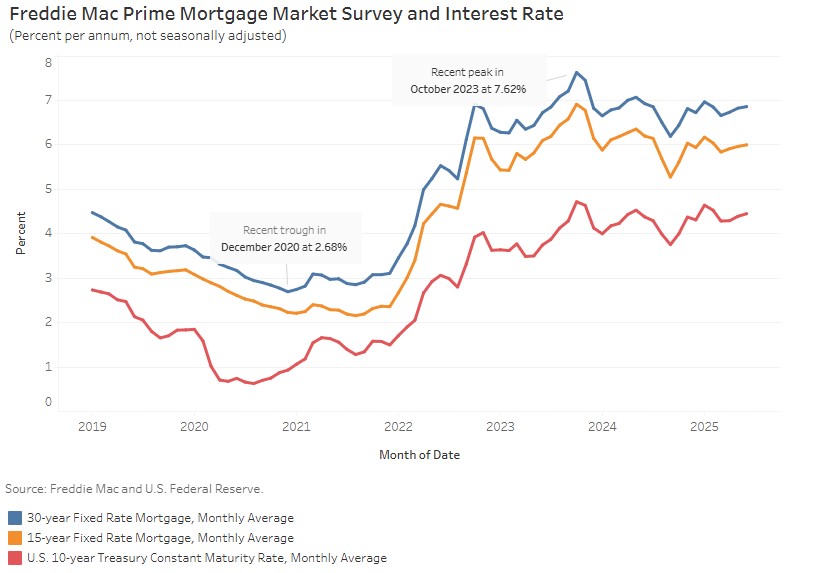

Yes, rate cuts could give a short-term boost to housing and stocks, but if inflation spikes again, the Fed may have to reverse course and hike rates even more aggressively later — which hurts consumers and markets.Real Estate Angle:

If you’re in real estate or mortgage, a premature rate cut could briefly fuel demand, but if inflation rebounds, rates may spike again — and with it, uncertainty in the market. Timing becomes everything.http://www.YourApplicationOnline.com Soft credit pull.

-

Trade deal behind us, Inflation Down, Powell are you awake or still sleeping?

It’s still unclear whether the full effect of the tariffs has hit the market yet.

Tomorrows Producer Price Index will probably tell us more in the next round of data since it tracks what businesses are paying for goods — which often shows inflation trends before they hit consumers.

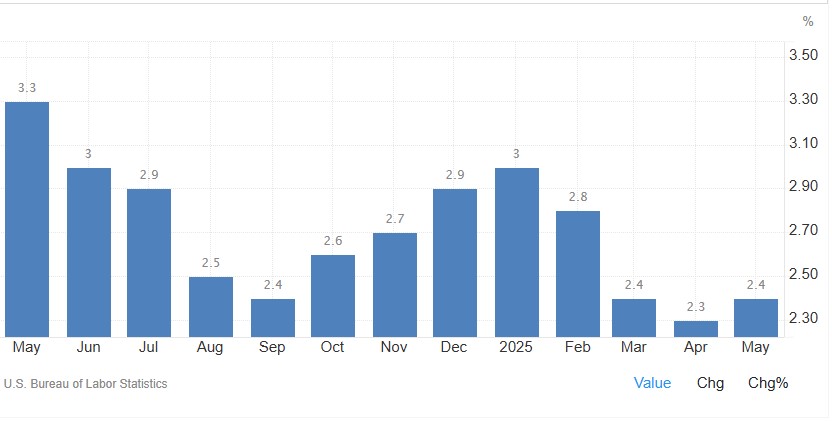

The Consumer Price Index (CPI) came in at just 0.1% — well below expectations. However, on a year-over-year basis, inflation still edged up slightly from 2.3% to 2.4%, just under the street’s forecast of 2.5%.

The World Bank lowered its global growth outlook from 2.7% to 2.3%, and cut U.S. growth projections from 2.3% to 1.4% — yet another sign of economic retraction.

Taken together with the softer-than-expected inflation numbers, this could give the Fed additional incentive to move toward rate cuts sooner rather than later.

Let’s get you financially tuned up and ready to buy, sell or refinance. http://www.YourApplicationOnline.com

-

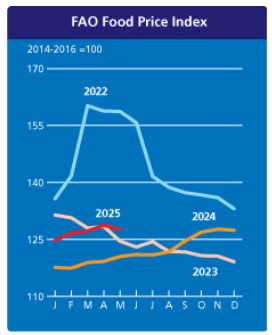

Tomorrow’s CPI inflation Report. Food Price Index from a different perspective. (Graphs, Yay graphs)

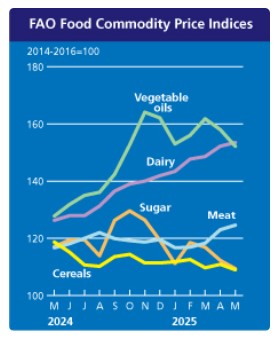

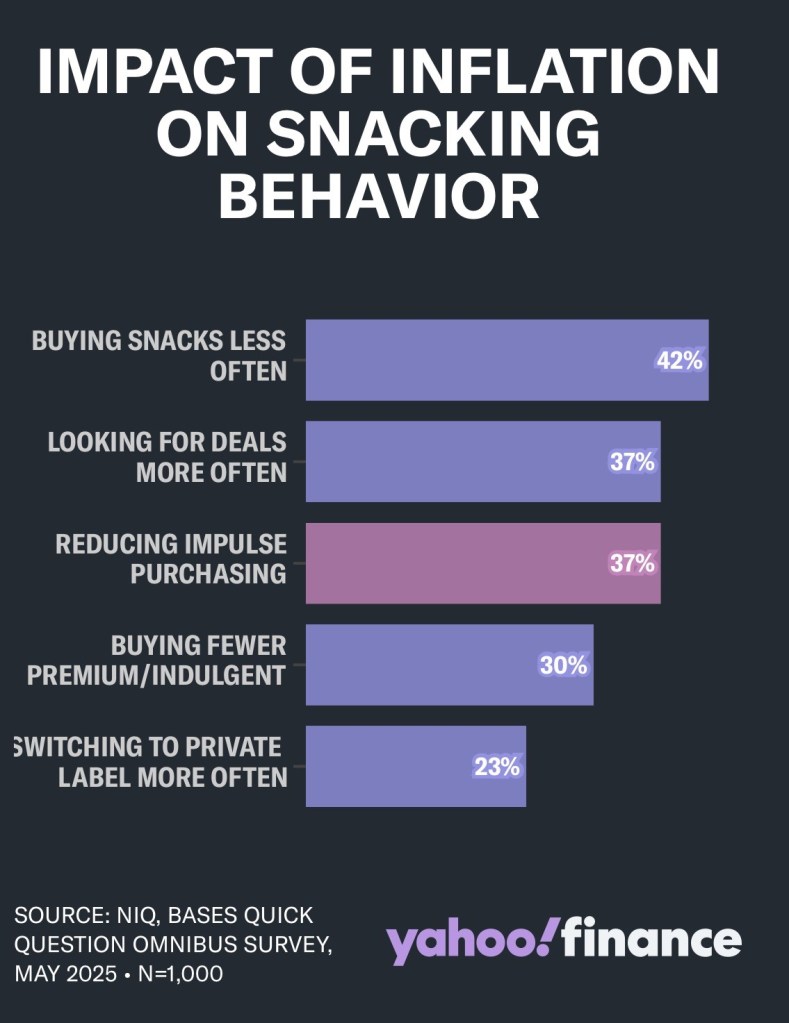

These two graphs highlight the commodity price of goods. An interesting data point.

Bonds remain on edge as trade negotiations between the US and China continue. Positive developments have sparked a rally in stocks, which is coming at the expense of bonds.

The CPI report is scheduled for release tomorrow. This marks the first month potentially affected by tariffs, though the market expects only a minimal impact.

A key point in the deregulation debate centers on the required capital ratios banks need to uphold. Treasuries are not expected to affect these ratios. Market consensus anticipates a potential drop in rates of 50 to 70 basis points—roughly equivalent to a 3/8 to 1/2 percent decline.

Almost Wednesday… YourApplicationOnline.com soft credit pull.

-

Why Inflation Numbers are so Impactful to Bonds and Mortgage Rates.

The Consumer Price Index (CPI) report is set to be released this Wednesday. This release is especially important because it will be the first month reflecting the early impact of the new tariffs.

Let’s talk impact of Inflation bonds and mortgage rates.

Inflation reduces the purchasing power of money over time — meaning a dollar today buys less in the future.

How this affects the bond market:

- Bond yields rise with inflation:

Investors want to be compensated for the loss of purchasing power. If inflation is rising, they’ll demand higher yields (interest rates) on bonds to make up for it. - Bond prices fall:

When yields go up, existing bond prices drop. This is because older bonds with lower fixed rates become less attractive compared to newer ones offering higher returns. - Longer-term bonds are hit harder:

The further out the maturity, the more inflation can eat away at returns. So long-term bonds typically drop more in price when inflation expectations rise.

In short:

Inflation = higher yields = lower bond prices.

And since mortgage rates are closely tied to the bond market (especially the 10-year Treasury), inflation often means higher mortgage rates too.http://www.YourApplicationOnline.com

- Bond yields rise with inflation:

-

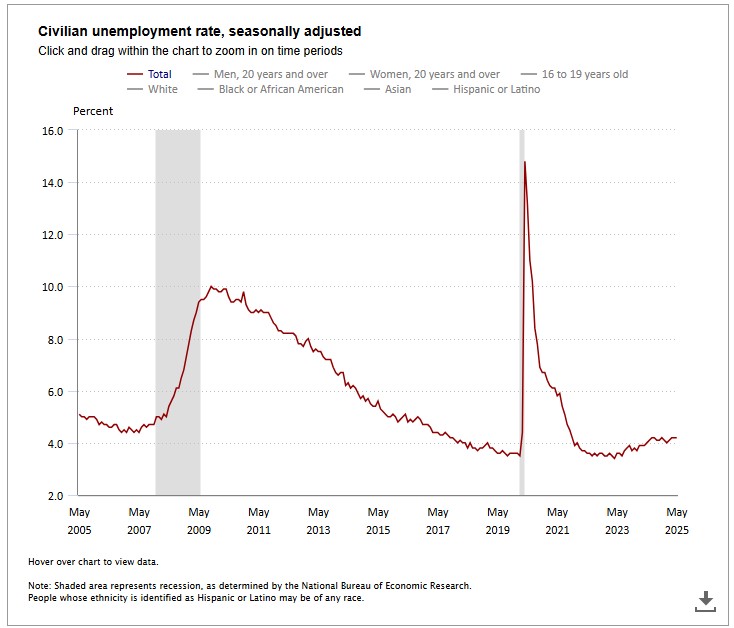

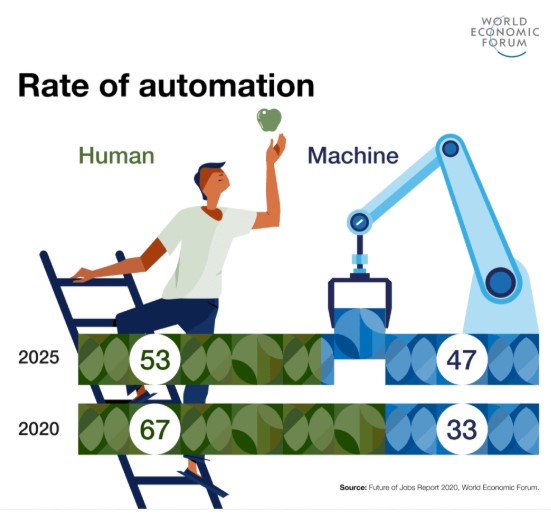

The Bureau of Labor Statistics (BLS) reported that 139,000 jobs were created in May, above the 125,000 expected.

However, the challenge with these reports is that they are consistently revised downward after the initial release.

- March was revised down by 65,000, bringing the total to 120,000.

- April was revised down by 30,000 to 147,000.

Despite the pattern, the initial headlines do the damage, while the quieter revisions often go unnoticed — or perhaps bond traders just have short memories.

Let’s dig into the details for a moment.

The Quarterly Census of Employment and Wages (QCEW) for Q1 revealed that the Bureau of Labor Statistics (BLS) overstated job growth by 500,000 jobs.

Yes — half a million jobs. Let that sink in.

This raises real questions about the accuracy of headline employment numbers and their impact on markets.

Bond market did not like this report but rates are holding onto gains this last week. http://www.YourApplicationOnline.com

The top photo captures my wife’s shoes catching the morning sun — a quiet, golden moment.

Have a fantastic weekend!

-

Is BLS BS? Garbage in Garbage out.

Speaking from my Engineering days, If the data collected is inaccurate, incomplete, or low quality (“garbage in”), any analysis, insights, or decisions made using that data will also be flawed or misleading (“garbage out”).

The Wall Street Journal article spoke to the staffing shortages at the Bureau of Labor and Statistics -BLS a U.S. Government agency hit by staffing cuts.

The BLS Report is utilized to calculate the inflation rate. These are actual people or statisticians going out and physically checking prices on groceries and other commodities. With less staff they have to guess or substitute.

Other Headlines:

- Challenger Job Cuts: Announced layoffs are up 80% compared to this time last year.

- Beige Book: Reports declining economic activity across several regions.

- Initial Jobless Claims: Increased by 8,000 to a total of 247,000.

My Take:

While these headlines may seem negative at first glance, they actually signal positive movement for interest rates. Slower job growth and economic softening tend to ease inflation concerns — a key focus for rate policy.With the BLS report due tomorrow, expectations are for a cooling labor market, marked by slower hiring and a potential uptick in unemployment.

If that plays out, we could see rates begin to trend downward — possibly meaningfully — as we move into summer.

http://www.YourApplicationOnline.com soft credit pull.

-

What does Deflation look like in real time. And Only 37,000 jobs created.

Those of us who’ve been around the block a few times — say, 12 years ago — remember what deflation looked like.

It was a magical time when:

- Steak night turned into “Hey, chicken’s great too!”

- That snack your kids love? Suddenly it was, “Let’s try something similar… and half the price.”

- Craving a soda? Congratulations! You’ve discovered the kitchen faucet — nature’s original soft drink, now with 100% fewer bubbles and all the hydration.

Deflation wasn’t just economic — it was a lifestyle.

The May ADP Jobs Report came in well below expectations, with just 37,000 jobs created versus the 115,000 forecasted. The sharpest weakness was seen among small businesses (1–49 employees).

In a notable detail, goods-producing businesses lost 2,000 jobs — a potential canary in the coal mine for broader economic trends.

My take:

If job growth continues to decline, we’re likely to see bond yields fall, which in turn puts downward pressure on interest rates. A softer labor market typically supports rate relief.Have a fantastic rest of your week and always feel free to reach out to our team. http://www.YourApplicationOnline.com.

-

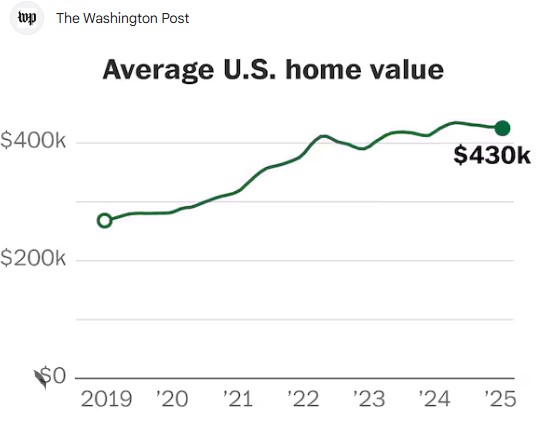

Just one year of 4% appreciation turns a $500,000 home into a $520,000 asset.

Your home (or future home) is a solid, appreciating asset.

- Home prices rose 0.6% in March.

- April data projects a 5.3% growth in home values over the next 12 months.

Job market highlights:

The Leisure and Hospitality sector saw a decline for the third consecutive month, removing 92,000 job openings in April alone.

Job openings increased by 191,000, reaching 7.39 million — well above estimates.

The quits rate fell to 2%, a historic low — indicating fewer people are confident enough to leave their current jobs.

Most new job openings came from the Professional and Business Services sector.

While the bond market moved in a rate-friendly direction, it’s clearly staying measured and reserved.

http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.