-

The Deficit Doesn’t Matter… Until It Does — But Where Will It Show Up First?

Maybe the reaction won’t show up in the Treasury market right away—bonds are pretty subdued today. But it might show up in the price of gold, or in the strength of the dollar. One way or another, it will show up.

The bond market, what drives mortgage rates, isn’t just local, it’s global.

The world buys our bonds, and we issue more bonds to cover growing debt.

More debt = more bonds.

At some point, you have to ask: will global appetite for U.S. debt start to sour?This week will be busy with Trade, Energy, and Earnings reports.

OPEC is increasing August output, housing has cooled a bit, but once the Fed finally cuts rates, we’re likely to see a major boost in activity.Get your financial mortgage house in order and let us pre-qualify for a refinance or purchase. Soft credit pull http://www.YourApplicationOnline.com

-

Why Did ADP show -33,000 jobs but todays BLS Report show +147,000 – Smoke and Mirrors.

I’ve been saying it for years: the BLS report is a masterpiece of BS. Their method for tracking job gains and losses? Brace yourself it’s surveys.

Yes, seriously. Someone picks up a phone, calls 60,000 households and businesses, and asks, “Hey, hiring anyone?” That’s our national employment data, folks. Brought to you by the same process used to figure out who really watches Game of Thrones.

Meanwhile, ADP is over here with actual payroll data, you know, numbers from real paychecks of real employees at real companies. Crazy, right?

So let me ask: whose data would you trust?

The guys with the spreadsheets and timecards… or the ones with a phone and a clipboard?The Bond Market reacted and not in a rate positive way.

Still holding onto gains.

http://www.YourApplicationOnline.com Soft Credit Pull

-

Fed Rate Cut Incoming! Will Mortgage Rates Notice This Time… or Keep Ghosting Us?

Typically, the 10-year Treasury tracks closely with the Fed Funds Rate, but that wasn’t the case last year.

Despite rate cuts in September, November, and December, mortgage rates actually went up.Why? The bond market took a hit from misleadingly strong job creation numbers reported by the Bureau of Labor Statistics, which were later revealed to be way off. On top of that, inflation readings in January and February came in hot, adding more pressure.

This time, things look different.

Job growth is slowing, and inflation is showing signs of stabilizing. The most recent ADP Employment Report showed a loss of 33,000 jobs, far below the expected 95,000. That’s a significant miss, and it supports the Fed’s case for easing.

Bottom line: This could be the window where a Fed rate cut actually leads to lower mortgage rates.

http://www.YourApplicationOnline.com

-

If We are All sure We are right, Who’s wrong. Data Mining and the Dangers of Curated News.

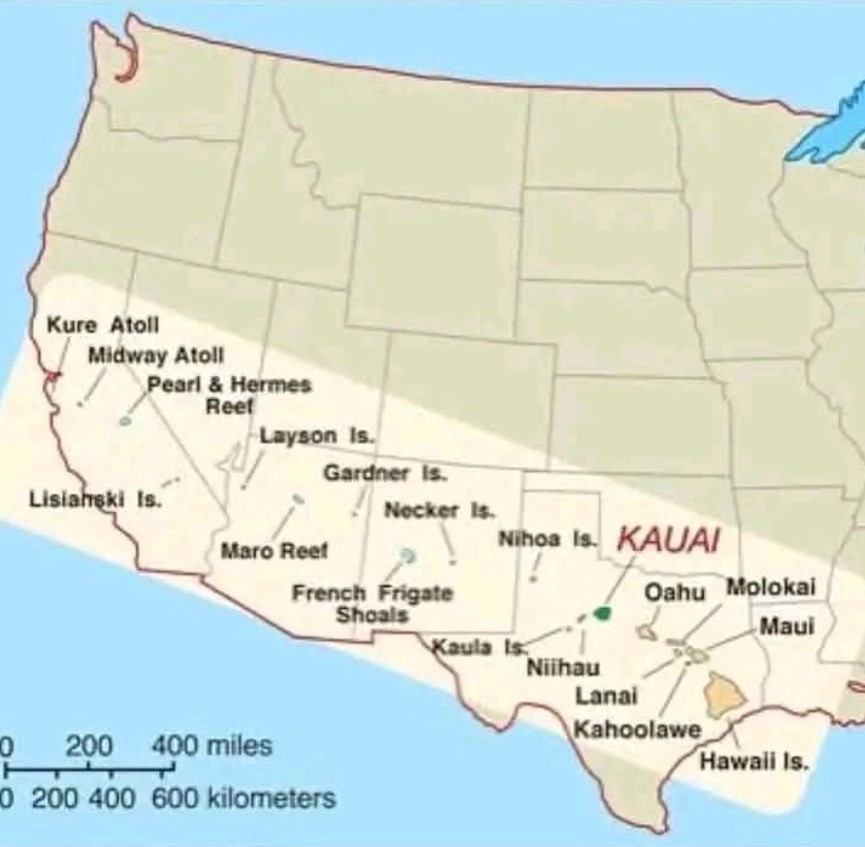

Did you know the Hawaiian Islands are that spread out? It’s like when someone visits the U.S. for a week and thinks they can drive coast to coast and back—nice idea, not realistic.

Today, CNBC real estate contributor Diana Olick sounded the alarm on mortgage delinquencies. But context matters. The increase was barely a blip, rising from 0.95% to 1.01%. Blink and you’d miss it.

There’s a real danger when the news is tailored just for us—not for everyone. It tells us exactly what we want to hear, exactly when we want to hear it. And that’s the problem.

We’re making financial decisions that will shape the rest of our lives—based on what, exactly? Take a moment. Breathe. Mortgage rates are gradually coming down, and real estate has consistently proven to be one of the best long-term investments.

http://www.YourApplicationOnline.com

-

Throwback Thursday. Rollback Capital Requirements could drop Rates a Point this Summer.

Market Update

The Federal Reserve is proposing a reduction in bank capital reserve requirements from 5% to 3.5%. While that may seem like a small shift, it could significantly impact interest rates. Why? Because it would free up billions in capital, giving banks more lending power. If approved, we could see this take effect as early as this summer.

Economic Data Highlights:

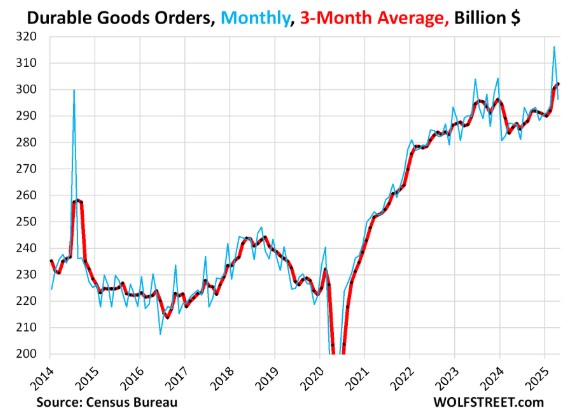

- Durable Goods Orders surged 16.4% last month nearly double the 8.5% forecast. Big-ticket items like appliances are still in demand.

- Jobs Market continues to show stress. Layoffs are rising, and it’s taking longer for people to find new employment. This has been a consistent trend in recent months and may persist.

- Pending Home Sales came in stronger than expected, up 1.8% versus a projected 0.5%.

My Take:

There’s a fundamental shift happening—not just in the economy, but in the bond market itself. This time, it feels real. Palpable.Let’s get you ready. Soft Credit Pull http://www.YourApplicationOnline.com

-

Do I watch Golf for four hours or Powell’s congressional hearing? Its a tossup.

For the second day in a row, Fed Chair Powell is testifying before Congress and yes, I totally geek-ed out. I ended up watching for over 40 minutes… while technically working. Multitasking at its nerdiest.

Powell made a comment I’m paraphrasing.

If we get it wrong our future generations will pay the price.

The thing about waiting on a decision is… well, that is the decision.

A growing group of Fed voters are starting to disagree, I know its shocking. And that ever-elusive 2% inflation target?

Based on data that’s about as precise as weighing an apple by counting every atom. Technically possible, totally impractical. Kind of like expecting perfection in an imperfect world.

New Home Sales came in weaker than expected, but home values continue to climb up 3.7%.

Get outside and enjoy the summer sunshine! Have a great rest of your week. Just two more days until Vegas. I’ll be sure to send pics!

http://www.YourApplicationOnline.com

-

When Doves Cry or Fly… Prince

Rate improvement today isn’t necessarily tied to Powell’s testimony before Congress, but rather to the growing shift among Fed officials. Doves like Fed Governor Bowman and Chicago Fed President Goolsbee are now aligning with Governor Waller in signaling potential rate cuts as early as July.

What’s truly powerful is how much impact a single point drop in the Fed rate can have. It ripples through the economy and directly benefit middle and lower-middle class consumers.

Doves lean towards easing rates, Hawks have their talons poised for a long battle.

Home Values

Year-over-year, home prices rose 2.7%. However, some of the areas in the South and Southeast that saw the sharpest gains are now starting to come back down to earth.

Have a great rest of your week and stay cool. We are headed to Vegas Friday, Temps 104 this weekend.

http://www.YourApplicationOnline.com

-

How Did the Iranian Conflict affect stocks and bonds? Not much.

I was surprised to wake up this morning and see little movement in the stock or bond markets. Sure, bonds improved—but most of that happened last week. And stocks? They’re up, not down.

Oil prices, nope. started out higher but settled back were it was.

So what’s going on?

Iran has responded so maybe that is what the market is waiting for. But still no real change in the stock or bond market this late morning.

How many times have the Strait of Hormuz closed?

Never, even during the Gulf War. It cost more to ship but that was represented in gas prices.

Existing Home Sales rose 0.8% in May to 4.03M. Homes on the market 27 days down from 36 days in April.

http://www.YourApplicationOnline.com

-

Powell Holds the Bat but won’t swing. Who actually gets hurt by high sustained rates?

As the Fed wraps up, even Powell concedes: GDP growth downgraded to 1.4% (from 1.7%) and unemployment ticking up to 4.5%.

Clinging to a 2% inflation target is now hurting everyday Americans and small businesses—while giants like Walmart weather it just fine.

Remember Dune? “He who controls the spice controls the world.” Same game, different players.

My take:

The Fed can’t wait forever—rates must come down. There comes a point when the pursuit of control turns into a stubborn battle of egos, and while power struggles play out at the top, the rest of us bear the cost in silence.

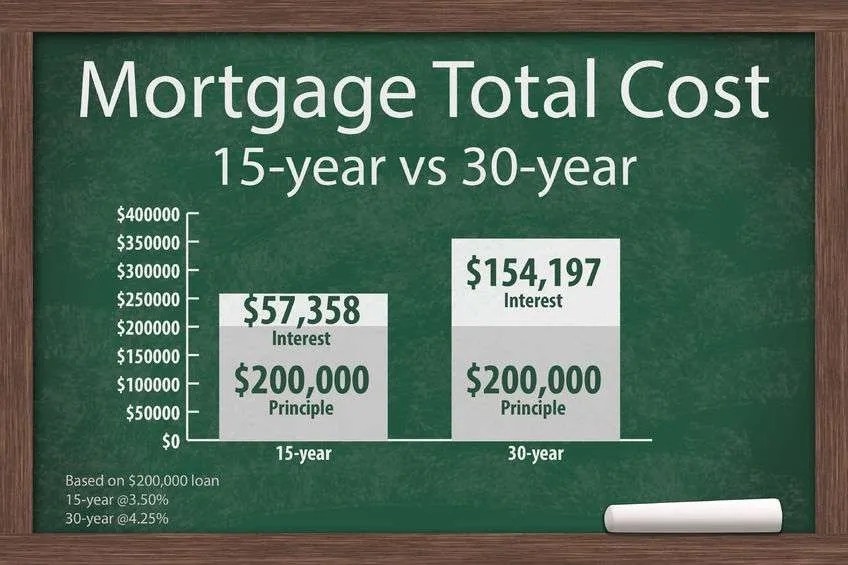

New YouTube Video: 30-Year to 15-Year Refi — Nearly Same Payment, Mortgage Gone 14 Years Sooner!

http://www.YourApplicationOnline.com

-

The Writing is on the Wall. Problem is Powell can’t read.

The Federal Reserve concludes its two-day policy meeting today, with a statement scheduled for release at 2:00 PM ET.

Alongside the announcement, they will also publish the latest Summary of Economic Projections (SEP), which includes updated forecasts for inflation, unemployment, GDP growth, and the federal funds rate.

Recent economic indicators suggest clear signs of a slowdown. Both retail sales and industrial production—highlighted in yesterday’s data—posted declines.

Additionally, manufacturing has been in a prolonged period of weakness, reinforcing the broader narrative of decelerating economic momentum.

My take: I don’t get it. The Fed seems to have strayed beyond its mandate—so afraid of making a misstep, they don’t realize that hesitation is the misstep.

Side note: I just ran numbers for a client who purchased last year with a rate in the mid-7s. We’re now refinancing into a 15-year loan in the high-5s. Their monthly payment is nearly identical—but we’ve eliminated 14 years off their mortgage.

http://www.YourApplicationOnline.com

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.