-

Rate Improvement and some mixed signals on Tariff deadline.

We’re seeing encouraging rate improvements today following comments from Treasury Secretary Bessent, who emphasized that the quality of the proposed tariffs matters more than meeting the August 1st deadline.

This contrasts with Commerce Secretary Lutnick’s firm stance that the deadline is fixed.

On the housing front, completions are down 25% from the August 2024 peak, but construction hiring is on the rise, making up roughly one-sixth of all public sector job gains.

For the week, we’re floating rates for our clients and advising refinance clients to get their documents ready.

If rates drop later this summer as expected, there will be a surge of activity—and being prepared now means you’ll be first in line when the window opens.

http://www.YourApplicationOnline.com Soft Credit Pull.

-

Fed’s Waller Signals July Rate Cut: “Time to Stop Restricting”

Waller is a respected Fed Governor, a current voting member, and even considered a top candidate for the next Fed Chair.

His recent comments point to softening inflation, questionable BLS jobs data, and, echoing my biggest frustration, the need to move away from an overly restrictive policy stance.

He also noted that the Fed is currently 1.25% to 1.5% above the neutral rate signaling that monetary policy remains overly restrictive. A return to neutral would bring the Fed Funds rate down to around 3%, which typically translates to mortgage rates about 1.5% higher.

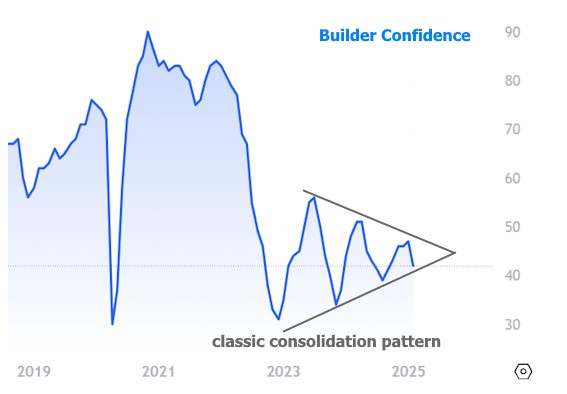

Housing news:

Builder sentiment, while still below average, ticked up to 33 remaining under the neutral level of 50. Housing permits held steady, but overall inventory remains tight, continuing to put pressure on supply.

That’s all for this week. Any open houses or questions, feel free to reach out anytime. 800-424-9293 http://www.YourApplicationOnline.com

-

Home Builders Slashing Prices. At Highest rate in 3 years.

Big News This Morning: Builder Confidence

Builders don’t just think about today, they’re looking 1, 2, even 3 to 10 years ahead. They’re creating homes that must be sold before the paint dries.So when builder confidence ticks up or down, it says a lot about where they believe the market is heading.

This isn’t guesswork, it’s money on the line.

Anecdotally, we’re hearing that buyers are holding out for lower rates, while sellers, though cooperative, are hesitant to drop their prices.

My thoughts:

Watch the dog, not the tail.

Focusing too closely on one data point can give a false read on the bigger picture.Inventory is rising and that trend looks set to continue. Rates, while still higher than we’d like, are starting to ease.

Buyers may be sitting on the sidelines for now, but make no mistake—there are plenty of them, and they’re watching closely.

Apply now http://www.YourApplicationOnline.com

-

Inflation Revisions New Administration same old tricks.

What amazes me isn’t just the sheer number of revisions to the CPI and PPI inflation data… it’s the fact that they’re always worse.

Never, “Oops, we overstated inflation!”

Always, “Actually… it was hotter. Sorry about that.”Remember back in May when we all celebrated those unexpectedly low inflation numbers?

Yeah, turns out that was just a brief episode of data-based optimism.

The numbers were revised higher. Because of course they were.At this point, the CPI release should come with a warning label:

“Preliminary. Subject to disappointment.”Bottom line, inflation has been trending down since 2023 but is stuck or what we call sticky inflation. FEDs want 2% but they are not getting it.

Time for the FEDs to start lowering interest rates. The Bond market will respond with Mortgage rates reciprocating.

http://www.YourApplicationOnline.com

-

Inflation Ticked Up, But No Surprises (Yet) 2.4% to 2.7%

CPI Came In Hot-ish: 2.7%

The Consumer Price Index (CPI) rose 0.3%, bringing the annual rate to 2.7%, exactly what we expected, but still a bit too spicy for the Fed, whose goal remains a cool, calm 2.0%.

So what’s cooking up that extra heat?

Energy.

When energy prices rise, everything feels it—from making stuff to moving stuff.

If it runs on fuel, it’s probably helping drive inflation right now.

In Housing News…

Buyers are pausing. Sellers are dropping prices.

It’s like a big staring contest—everyone waiting for either rates to drop or the next market move.Anecdotally?

There’s a whole crowd of buyers and sellers sitting on the sidelines, just waiting for something—anything—to give.reach us at http://www.YourApplicationOnline.com

-

Tariffs, Tariffs Everywhere. But Is Inflation Still Thirsty? The Parable of the Sword.

The Parable of the Sword

In a quiet village at the edge of a war-torn land, a young man trained for years to master the sword. He dreamed of battle, of glory, of proving his strength. One day, an old warrior arrived—scarred, silent, and respected.

The young man rushed to him, eager to show his skills.

“Watch me,” he said, drawing his sword and slicing the air with precision and speed.

The old warrior simply nodded.“Impressive,” he said. “But can you carry it all day and never draw it?”

The young man frowned. “What’s the point of a sword if not to use it?”

The old warrior replied,

“A sword is not proof of power. It is proof of responsibility. Anyone can swing steel. Few can carry it with restraint.”

And then he walked on, leaving the young man staring at his reflection in the blade—wondering whether he was mastering the sword, or letting it master him.

Just a thought… visit us at http://www.YourApplicationOnline.com

-

An Argument for Rate Cuts and Powell’s exit.

Prolonged High Rates Are Doing More Harm Than Good

At this point, keeping rates elevated is causing more damage than it’s preventing.

Millions of homeowners are effectively shackled to their low-rate mortgages, unable to move, not just because of cost, but because of reality.

Trading a 3% mortgage for a 6.5% one isn’t just tough, it’s financially unrealistic for most. This lock-in effect is freezing the housing market, limiting inventory, and preventing natural mobility for families who need to upsize, downsize, or relocate.

It’s not just slowing the market, it’s stifling opportunity.

Cracks Are Forming at the Fed

The once-solid stance of the Federal Reserve is starting to show stress. Chairman Powell may be on his way out, with Fed Governor Christopher Waller emerging as a potential successor—and a voice of reason.

Waller is signaling what many have been waiting to hear:

Inflation has come down enough to justify a rate cut, possibly as soon as this month.

He’s also dismissing tariff threats as more political noise than economic substance, calling them a “one-off” with limited long-term impact.

The tone is shifting and markets are listening.

Have a fantastic weekend and always feel free to reach out with any questions. http://www.YourApplicationOnline.com

-

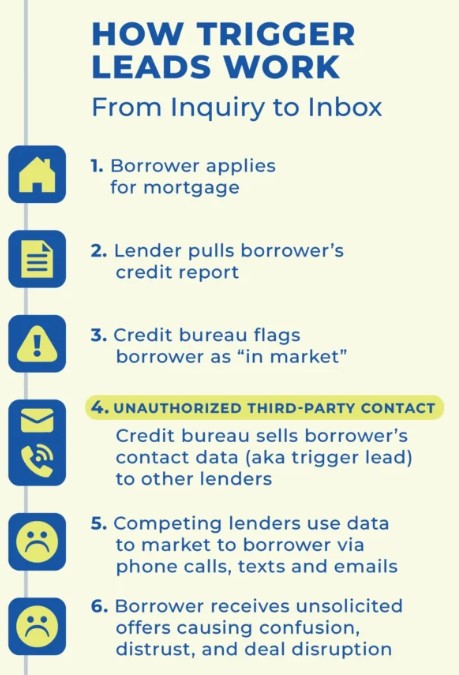

New Push to Ban Trigger Leads Relief Could Be Coming Soon

Have You Been Flooded With Calls After Applying for a Mortgage?

You might be the target of a Trigger Lead.Here’s what’s happening:

When you apply for a mortgage, the three credit bureaus (Experian, Equifax, TransUnion) can sell your basic contact info to other lenders. This happens after a hard credit pull.Some lenders buy these “trigger leads” and immediately flood you with calls, texts, and emails, sometimes within minutes.

A soft credit check helps avoid this, but eventually a hard pull is required to fully process your loan.

Why does this even exist?

It was originally meant to help consumers shop around for better loan options—but like many things, it’s now being misused.Trigger Leads Update: Legislation Is Back on the Table

Last year, Senate Amendment 2358, which aimed to ban the sale of trigger leads, was removed at the last minute from the final legislation.

But now it’s back.

The amendment has resurfaced, and there’s renewed momentum to protect consumer information and stop the flood of unwanted calls and solicitations that happen after a mortgage credit pull.

This could be a big win for borrowers and for lenders focused on doing business the right way.

I’ll keep you posted as this moves forward.

My YouTube video below.

-

Big Credit Score News: 5 Million New Borrowers May Now Qualify

The FHFA just announced a major shift:

Fannie Mae and Freddie Mac will now accept VantageScore 4.0 for mortgage qualifications.Why does this matter?

Because an estimated 5 million new borrowers, many of them younger, new-to-credit, or underrepresented, could now enter the housing market.FICO vs. VantageScore 4.0: What’s the Difference?

The Similarities:

- Both use your credit report to generate a score.

- Both score on a 300–850 range.

- Both consider factors like credit utilization, payment history, and credit length, just with different weightings.

The Key Differences:

- Credit History Requirements:

- VantageScore: Needs just 1 month of history.

- FICO: Requires 6 months of history.

- Score Versions:

- FICO: Has industry-specific scores (Mortgage, Auto, Bankcard).

- VantageScore: Uses one universal score.

- Payment History Weighting:

- VantageScore places more emphasis on your payment history compared to FICO.

Why This Is a Big Deal

This change opens the door for:

- First-time buyers with limited credit history

- Renters with strong recent credit activity

- Borrowers shut out by traditional scoring models

Want to know if VantageScore could help your clients qualify, or re-qualify? I’m happy to run the numbers. Just reach out!

-

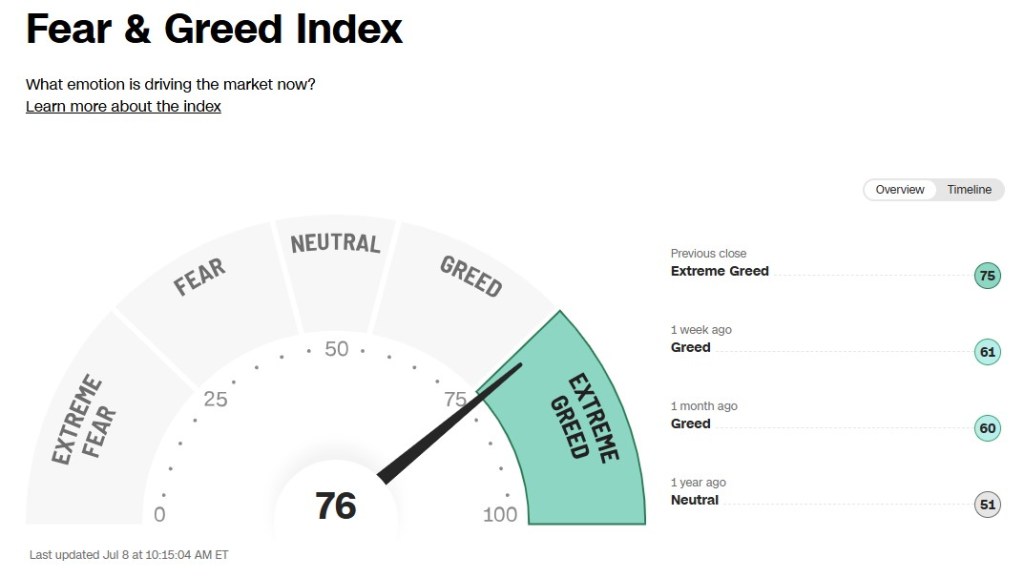

What is the Fear & Greed Index and why is it Extreme Greed.

Puts and Calls options, Selling or Buying. The higher the ratio the higher the Fear and Greed. No one wants to be left with the hot potato.

Quick Market Snapshot:

Inflation? Still calm for now. Stephen Miran, Economic Chair, appeared on CNBC this morning and said inflation and tariffs are “not a thing… yet.” Translation: No immediate threat, but worth watching as policy and election dynamics evolve.

Margin debt which is money borrowed by investors to amplify gains, is now at an all-time high. While this can fuel rallies, it also means any downturn could be sharper and faster as leveraged positions unwind.

The Reserve Bank of Australia surprised markets by pausing a rate cut that had a 95% probability priced in. The signal? Central banks may not be as dovish as expected and the bond market noticed. Global yields moved higher, pressuring borrowing costs.

My Take:

Inflation is still stubborn and hanging on tighter than expected. The Fed needs to stop hesitating and start moving on a rate cut. This constant back-and-forth “we might cut, but only if…” combined with the threat of more tariffs, is creating confusion and volatility.It’s time for consistent policy and less noise. The markets, and the economy need clarity, not more mixed signals.

http://www.YourApplicationOnline.com Soft Credit Pull

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.