-

Jackson Hole and the Fed: Bond Auctions, Demand, and Driving by Rear-View Mirror

Today starts the three day Jackson Hole Meeting where central bankers from around the world speak. Powell talks Friday at 10am ET.

Later today, we’ll see a 20-year bond auction, a routine event, but one worth watching. The key factor is demand: strong demand pushes bond yields lower, and mortgage rates typically follow suit.

Q3 GDP outlook is all over the map, with estimates ranging from -0.3% to 2.3%. The wild card? Trade and tariffs, and how they ultimately shake out. A weaker GDP print would put added pressure on the Fed to cut rates.

One of the biggest criticisms of Powell is his obsession with being “data dependent.” The problem is that economic data, by definition, is backward-looking. Relying on it to make forward policy decisions is like trying to drive while staring only through the rear-view mirror, you see where you’ve been, but not where you’re going. By the time the Fed reacts, the road ahead has often already changed.

My take:

The job market right now is essentially treading water, neither adding nor subtracting in any meaningful way. That’s a sharp contrast from just a few years ago, when employers were competing aggressively for new hires. The real concern going forward is whether we start to see the employment pool shrink, which would signal a much deeper shift.

Its time for the FED to turn around and look through the windshield.

-

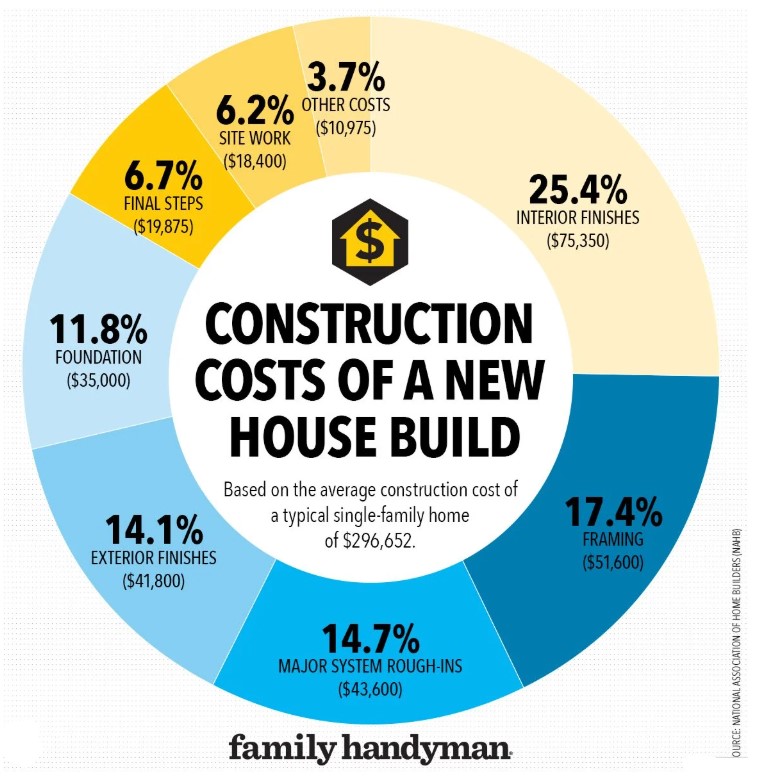

Housing Starts Increase 5%, Permits up on Single Family. Let’s get this party started.

Even though multi-family housing fell 3%, single-family permits were on the rise. Anecdotally, it makes sense, you’ve probably noticed the surge of apartment complexes and other multi-family projects that have gone up over the past five years.

Home completions rose 6%, with most of the gains once again coming from single-family homes.

The market is sitting on enormous pent-up demand, with buyers and sellers alike sidelined by higher interest rates. The dam is going to break and we believe it’s going to be sooner rather than later.

let’s get your house in order and ready to buy or sell.

http://www.YourApplicationOnline.com

-

Walmart, Home Depot, Target and more report e Earning this week. Inflation? we’ll see.

It’s a big earnings week ahead and our first real look at inflation. Up to now, producers and retailers have been quietly swallowing the costs of tariffs, but that’s not a diet they can stay on forever.

The increases we’re seeing are real, though still less dramatic than what the media (and admittedly, myself) have been bracing for.

10y and 30y bonds are holding steady, keeping rates in place for now. However, upcoming earnings reports could inject real volatility into the market. We’re leaning toward a lock position but holding off on pulling the trigger just yet.

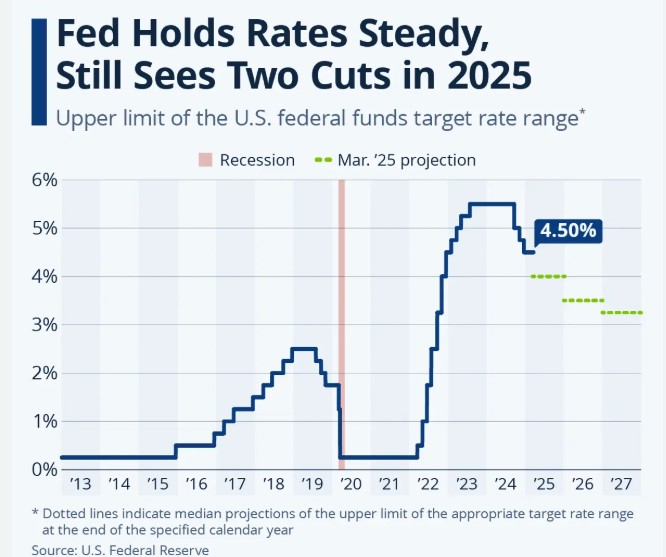

We anticipate a 25bp rate drop from the FEDs in September but will know at Fridays Jackson Hole Symposium with Fed Chair Powell speaking.

Have a fantastic week, lets get you pre-approved and ready to role.

-

Here we go again. Analysis Paralysis. Goolsbee wants more Data. Soap Box Rant ahead.

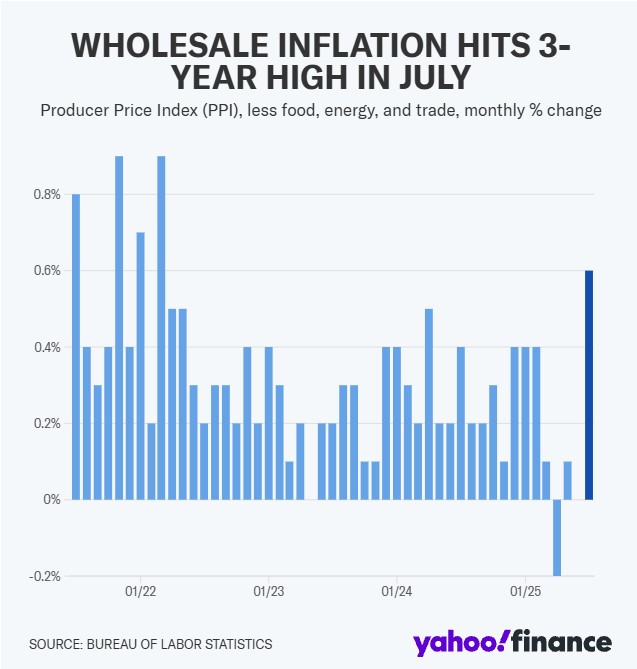

Chicago Fed President and voting member says we shouldn’t overreact to yesterday’s PPI inflation numbers, better to “wait for more data” to see a trend.

Sound familiar? It should. Powell’s been singing that same “wait for the data” tune for four years now. At some point, this isn’t patience, it’s Analysis Paralysis. And the enemy isn’t the inflation trend, it’s the endless waiting.

Same chorus from St. Louis Fed’s Musalem, Richmond Fed’s Barken, and the rest of the Fed echo chamber, don’t overreact, just “wait for more data.”

The clock is ticking on the Fed’s Achilles’ heel: stagflation, persistent high inflation with slowing employment. It’s the no-win scenario they hope you don’t talk about, because there’s no playbook that ends well.

More homes on the market but with rates still elevated, they are not moving as quickly as we thought.

Sorry for the Friday rant. Have a fantastic rest of your day and weekend.

-

Producer Inflation Jumps 0.9% — Big Number, No Surprise seriously.

CNBC and FOX Business are buzzing about a “whopping” PPI jump but let’s unpack where that number actually came from, and why it’s showing up here before it hits the Consumer Price Index.

The last four months have been very tame for PPI and CPI even in the flood of Tariff and Tariff threats. But why? Well the ships from other countries take weeks to travel, those are not subject to new Tariffs as well as the influx of orders back in March and April to counter Tariffs.

The chickens have come home to roost — tariffs are making their way through the system exactly as expected. The Producer Price Index (PPI) measures costs at the production level, not for consumers. As these higher producer costs filter through, we can expect CPI inflation to rise in the next month or two.

How does this affect rates?

We lost some ground on interest rates today but not too much. The stock market also responded but all in all a bit muted.

Lets get you pre-qualified http://www.YourApplicationOnline.com

-

Rumors Swirl: Could the Fed Deliver a 50bp Cut in September, With More to Follow?

Treasury Secretary Scott Bessent suggested yesterday that the Fed should consider a 50bp “catch-up” cut, a move that would be welcome news for interest rates.

Currently, there are 11 candidates in the running for Fed Chair, with Fed Governor Chris Waller leading the pack. Waller is notably bullish on rate cuts, and we’re optimistic about what that could mean for the market.

I hopped off a webinar yesterday about the new Trigger Lead bill that just passed, set to take effect in six months. This is a big win for consumers, finally putting a stop to the barrage of unwanted calls after applying for a loan.

But what really caught my attention was the shift in energy in our industry. With rates dropping and the possibility of even deeper cuts ahead this year, there’s a new momentum building, and it’s exciting to watch.

If you haven’t already, now’s the perfect time to get financially tuned up and ready, whether you’re buying, selling, or refinancing. The shift is coming, and we want to make sure you’re ahead of the game.

http://www.YourApplicationOnline.com

-

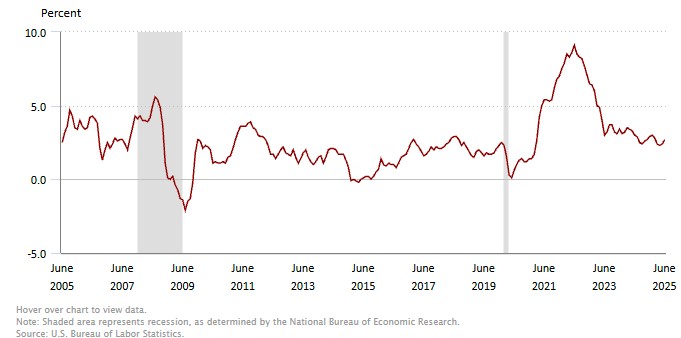

Inflation Meets Expectations, Bonds Shrug, Oil Slips

The Consumer Price Index (CPI) showed overall inflation rose 0.2% in July, while the year-over-year rate held steady at 2.7%. Both came in right on target with expectations, giving the Fed more reason to consider cutting rates in the near future.

Home Price Index showing a slight increase in value of 0.06%. Less appreciation but is regionally impacted.

Rates holding their ground. We expected a more rate positive response to the inflation numbers.

Big changes are coming to the “trigger lead” practice that’s been plaguing borrowers—from auto loans to mortgage applications. A trigger lead happens when the three credit bureaus sell a borrower’s basic data to the open market, leading to a flood of unwanted calls and texts.

A new bill slated to pass will prohibit this practice. A huge win for everyone.

http://www.YourApplicationOnline.com lets get you pre-qualified

-

Fed Gov Bowman wants THREE rate cuts this year. Finally

Her point: with employment growth averaging just 35,000 over the past three months and unemployment at 4.3%, there’s already more than enough reason to start cutting rates now.

It’s like a rock rolling down a hill, much easier to stop early than to wait until it’s gained momentum and rolls right over you.

We expect inflation to rise, but not for the reason you might think.

Remember, inflation is measured against the previous 12 months. This month’s reading will likely be a modest 0.16%–0.20%, replacing an already low 0.19% from last year.

It’s a busy reporting week ahead. CPI as mentioned above, PPI, initial Jobless Claims, Retail Sales and more.

We’re continuing to float our clients as current technical indicators show no signs of imminent risk.

Shout out to the open house agents working hard this Sunday, always great to hear your perspective from the field.

Apply now http://www.MortgageNews.Blog soft credit pull.

12-month percentage change, Consumer Price Index.

-

Sub-6% Rates Are Coming. Let Me Show You How

The spread between the 30-year fixed mortgage rate and the 10-year Treasury yield has narrowed to 2.36%, and that matters.

When mortgage rates were in the 7’s, investors were worried about clients refinancing out of their high rates, so investors demanded a large spread to compensate for the risk.

Now, as rates begin to come down and those fears ease, the spread is shrinking, a sign that the market sees less risk of early refis.

Banks are getting a deregulation boost, and Fed rate cuts are looming.

If the 10-year Treasury yield drops to 3.90% (currently at 4.288%) and the spread narrows to 2.25% (currently 2.36%), we could see mortgage rates fall to 6.125%.

And this is just the beginning.

As the Fed continues to cut and the spread keeps tightening, rates will drop well below 6% by years end.

Online Application http://www.YourApplicationOnline.com

-

More Global Rate Cuts: The Writing’s Not Just on the Wall — It’s in Bold Ink

The Bank of England just announced a 25 bps rate cut, bringing the benchmark rate to 4.00%.

Notably, one dissenter pushed for a more aggressive 50 bps cut, signaling growing concern about economic momentum.As for the image above, it’s interesting, but it doesn’t accurately reflect global GDP contributions, where the U.S. and other Countries still accounts for the lion’s share.

Jobless Claims rose 7,000 to a still low 226,000. Continuing claims are still elevated and hit the highest levels since 2021. Rose 38,000 to 1.974M.

My take: we know the economy is slowing, other countries have lower and far lower Central Bank Rates. The pressure for not just September but more cuts through the end of the year which should drive interest rates down.

Lets get you pre-approved and ready to move on your new house.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.