-

10:00 AM Tomorrow – QCEW Revision to BLS: And It’s a Doozy

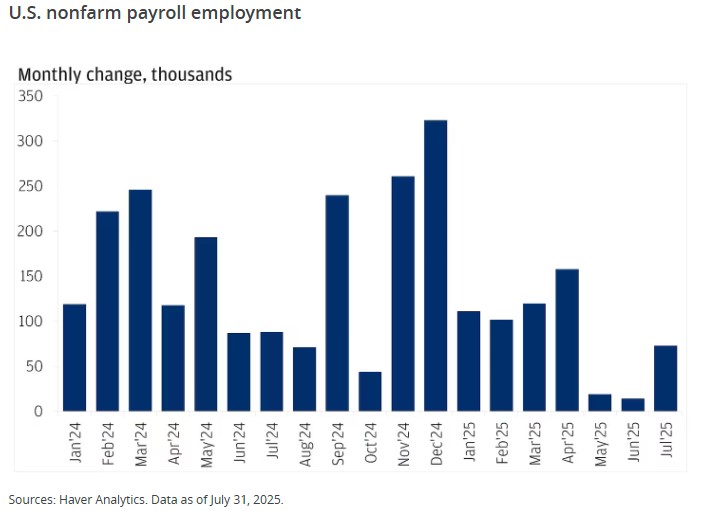

The Quarterly Census of Employment and Wages (QCEW) captures over 95% of U.S. jobs. Tomorrow’s annual revision is expected to show a significant adjustment, potentially 800,000 to 1,000,000 fewer jobs, or about 75,000 per month revised down.

The bond market will react, and the Fed is now almost assured of cutting rates through the remainder of the year, potentially as much as 125bps over the next four months. That means a continued trend toward lower mortgage rates.

If you know friends or family looking to refinance or purchase, send them our way. We’ll take care of them and even start with a soft credit pull, no impact on their score.

http://www.YourApplicationOnline.com

-

Just 22K Jobs: Weak BLS Report Sends Bonds Rallying

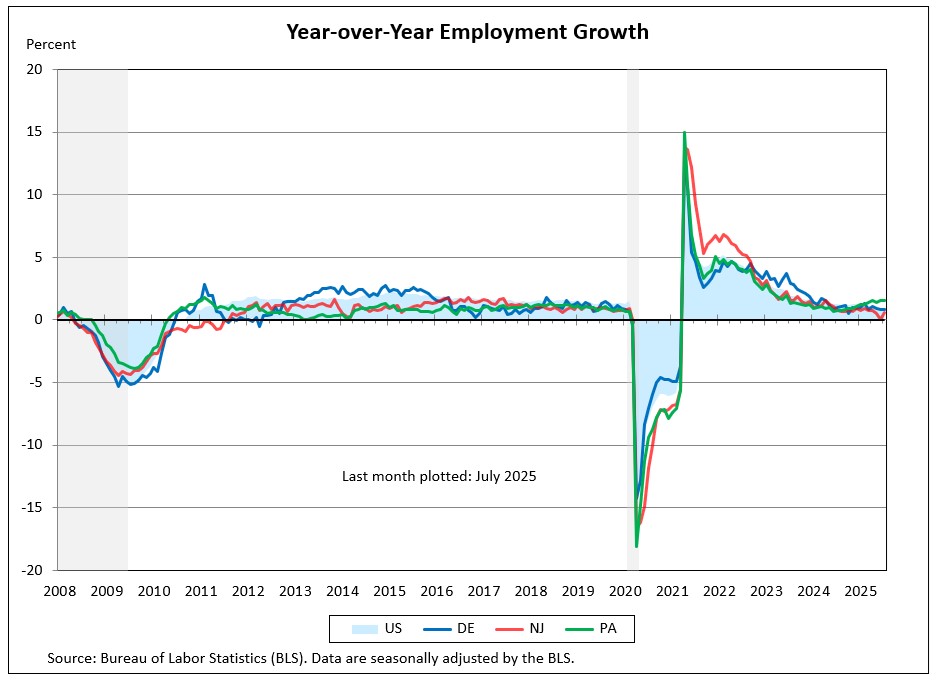

Even with a new head at the Bureau of Labor Statistics (BLS), the jobs report didn’t get a makeover. We still saw a weak headline number and downward revisions to prior months. Ouch.

Because as much as we’d all like a little spin… numbers don’t lie.

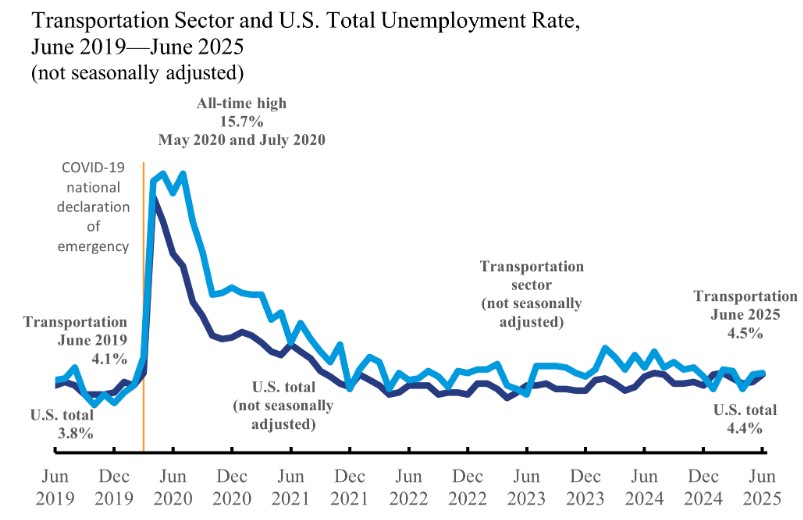

The unemployment rate ticked up from 4.2% to 4.3%. It may not sound like much, but in Fed-speak, that tiny move can feel like a megaphone. Weak jobs plus rising unemployment = a bond market that starts thinking “rate cuts, rate cuts, rate cuts.”

The odds are now 100% for a 25bp rate cut in September, 75% for another in October, and 70% for a December cut.

Once rates move down in a meaningful way, refinance activity will surge. Let’s get you pre-qualified now so you’re ahead of the rush when it hits.

http://www.YourApplicationOnline.com

-

50 Shades of Beige: The Fed’s Latest Page-Turner

It’s basically the Fed’s “boots on the ground” look at the U.S. economy. Instead of just charts and data, it gathers anecdotal information from businesses, community leaders, and economists across all 12 Federal Reserve Districts.

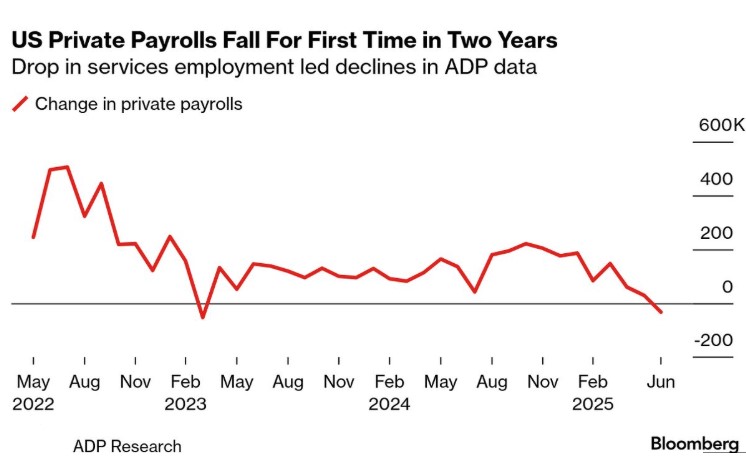

It shows a weakening labor market and with the ADP report confirming, the FEDs have plenty of data to make their move on rates.

We expected 75,000 job gains but only got 54,000 with initial jobless claims rising over 8,000.

Bond Market responded this morning and the mortgage rates dropped.

Remember, the Federal Reserve’s role is to either cool down or stimulate the economy. Raising rates slows things down, while lowering rates helps speed things up. When borrowing costs drop, the cost of doing business becomes cheaper, fueling growth and opportunity.

Lets get you pre-approved today http://www.YourApplicationOnline.com

-

Job Openings JOLTed the Market. And Revisions gone wild.

The July JOLTS Jobs report show job openings fell 176,000 to 7.181M $219,000 less than estimates.

Hiring rate remains low at 3.3%

Quits rate is also low at 2.0%.

FED Gov Christopher Waller said Fed should be cutting next meeting – end of September.

My take:

Labor market is showing its hand and when it does it goes quick. The Feds need to stay ahead of the pain and swallow the rate cut pill now.

apply now http://www.YourApplicationOnline.com

-

Everything and Nothing. How the Tariff ruling affects the Bond Market.

This one caught me by surprise, the lower court’s ruling against using the International Emergency Economic Powers Act (IEEPA) as authority to impose tariffs could have major implications.

Think of it this way: it’s like receiving a generous gift from family, only to spend it on a new car and outfit. Then, two weeks later, they come back and say, “Oops, our mistake. We need that money back.”

The U.S. has collected billions in tariffs, though technically paid by U.S. companies, that may need to be refunded. The big question: where does the government get the money to pay it back? Likely from the bond market.

With that said the Bond market got scared and is trading lower causing rates to move up, slightly.

In other news: Jobs, jobs, jobs! We’ve got JOLTS, ADP, and the always-dramatic BLS report on deck. Could be a real bond mover, in the good way.

Ready to refinance or purchase? http://www.YourApplicationOnline.com

-

Less Demand, Less Supply: Fed Gov Waller Pushes for Half-Point Rate Cut

Waller is looking past the headlines, spotting May–June job revisions (with more likely ahead) and pushing for a 50bp cut in rates. Oh, and by the way… he’s also the frontrunner for the next Fed Chair.

PCE rose 0.2% in July, year-over-year held steady at 2.6%, and Core ticked up to 2.9%, all exactly as expected.

Catch my drift? Everything came in as expected… and the bond market’s reaction was, well, no reaction.

With rates trending lower, I know you have options when it comes to choosing a lender, whether you’re refinancing or purchasing. What sets us apart is not only our expertise in lending, but also our understanding of the market and the timing of when to lock or float a rate.

-

Tomorrow, Tomorrow… Or Not: NVIDIA Beats, PCE Lands, and Markets Hold Steady

The Fed’s favorite bedtime story, Personal Consumption Expenditures (PCE), comes out tomorrow morning. Expectations are for a 0.3% rise, with inflation running at 2.9% annually.

Think of it as the trailer before the big blockbuster: next month’s report will be the real show, for better or worse.

Drama persists at the Fed with Powell pressured to leave and allegations of maleficence. True or not it creates uncertainty which no one likes.

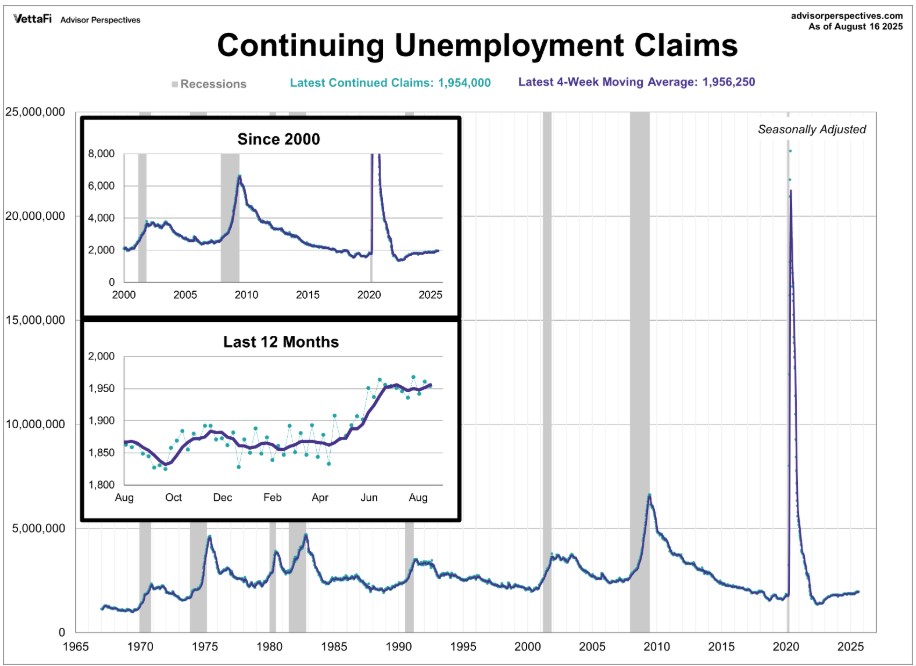

The Initial Jobless Claims report paints the picture of a stable labor market on the surface. But a closer look tells a different story. While about 200,000 people are receiving Continuing Claims, this figure overlooks the 900,000 who fell off the rolls, individuals no longer receiving benefits and still struggling to find employment.

This is a good reminder that headlines and soundbites rarely capture the full picture. To understand the labor market, you have to look beyond the surface.

http://www.YourApplicationOnline.com let’s get you pre-approved.

-

NVIDIA Holds the Market’s Wheel and Mortgage Rates Are Along for the Ride

NVIDIA now represents 7.68% of the S&P 500, the largest single weighting in the index. Expectations for their earnings are set extremely high.

If they deliver a strong beat, equity markets could rally further, with some capital flowing out of the bond market.

Conversely, if NVIDIA falls short of expectations, equities could pull back, prompting investors to rotate into bonds, helping drive interest rates lower.

NY Fed President John Williams says we are too restrictive by 0.875 indicating he is up for 3 rate cuts this year.

Personal Consumption Expenditures – PCE the Feds preferred measure if inflation will be released Friday.

Between NVIDIA’s earnings and the upcoming PCE report, the bond market could move in either direction. If you’re currently floating but like the rate you see, it may be wise to lock now.

Apply today http://www.YourApplicationOnline.com

-

Who takes the first Slice of Cake. The Monster hiding in the math

In every gathering there’s that moment when the cake is cut and everyone glances around. A pause hangs in the air. Do you take the first piece? Do you wait politely?

Eventually someone makes the move, and suddenly it’s no longer awkward, it’s just cake being eaten.

Now think about the Fed and rate cuts. They’re standing over the cake. Everyone sees it, everyone wants a slice, markets, borrowers, politicians. But hesitation is real.

Once you cut that first piece, expectations change. Cut too early, and you look greedy, reckless. Wait too long, and the cake gets cold, or worse, someone else defines the moment for you.

This is the “Monster in the Math”, the uncertainty baked into every economic model. Growth slowing, inflation cooling, jobs weakening… none of it ever adds up neatly. The Fed knows once they take that first slice, it sets the pace for everything that follows.

The Feds are cutting the cake. Get ready for the ride to start.

http://www.YourApplicationOnline.com Soft credit pull.

-

When the Consumer Sneezes, the Economy catches a cold.

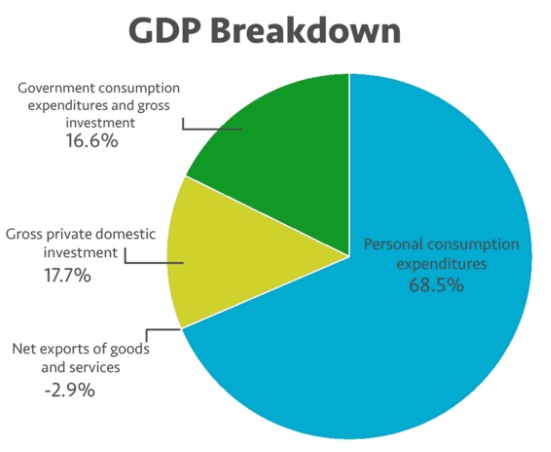

Consumer spending drives 68% of GDP, which means the economy lives and dies by how confident people feel about their wallets. The catch is, it’s not just about the money in their accounts, it’s the sense of wealth.

When people feel richer, they splurge. When they feel squeezed, they cut back fast. That psychology is the Fed’s biggest blind spot: they track the numbers after the fact, while the spending mood can change overnight.

Existing home sales rose 2% in July to a 4.01M unit annualized pace, well above expectations of just 0.5%. Some genuinely good news in housing.

My thoughts:

Powell spoke today, and appeared to give the green light on cuts. He noted the downside risk of employment. We are all collectively crossing our fingers that it will have a positive impact on mortgage rates.

Time to apply for that new home http://www.YourApplicationOnline.com Soft Credit pull.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.