What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures changes in the prices paid by typical consumers for a “basket” of goods and services. This basket represents everyday expenses, such as food, housing, and transportation.

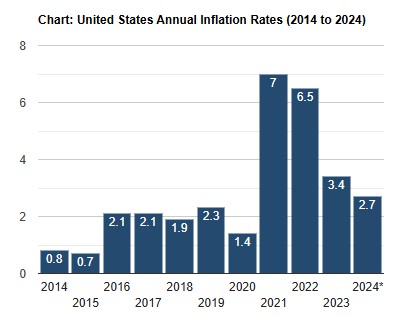

The key figure often discussed—currently 2.7%—represents the year-over-year change in the cost of that same basket of goods and services.

The sharp spike in inflation during 2021 was largely a reaction to the economic disruptions caused by the COVID-19 pandemic. In 2020, spending slowed significantly due to widespread restrictions, closures of restaurants, hotels, airlines, and reduced travel overall. This near-deflationary period was followed by a dramatic rebound when restrictions eased.

Government intervention also played a role. Massive financial stimulus, including programs like PPP (Paycheck Protection Program) and other incentives, pumped billions of dollars into the economy to sustain businesses and households.

This created a “perfect storm.” As people emerged from lockdowns en masse—comparable to being released from a “chicken coop”—the sudden surge in demand for goods and services outpaced supply, driving prices higher.

The Bond Market reacted as expected with the 10-year treasury auction (monthly) at 1pm ET. High demand means lower Mortgage rates.