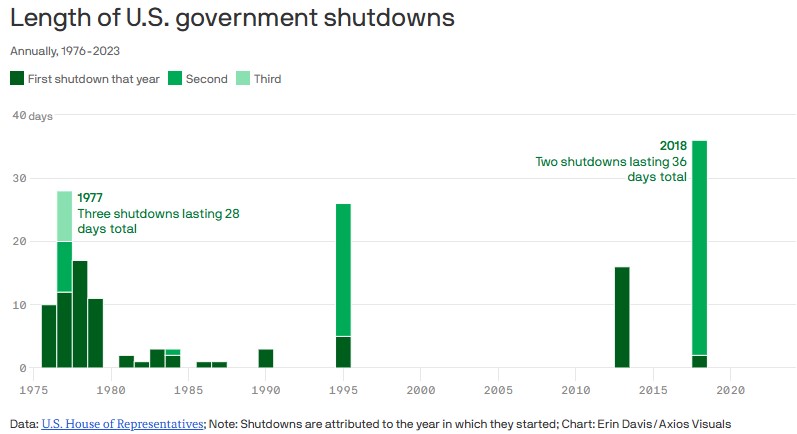

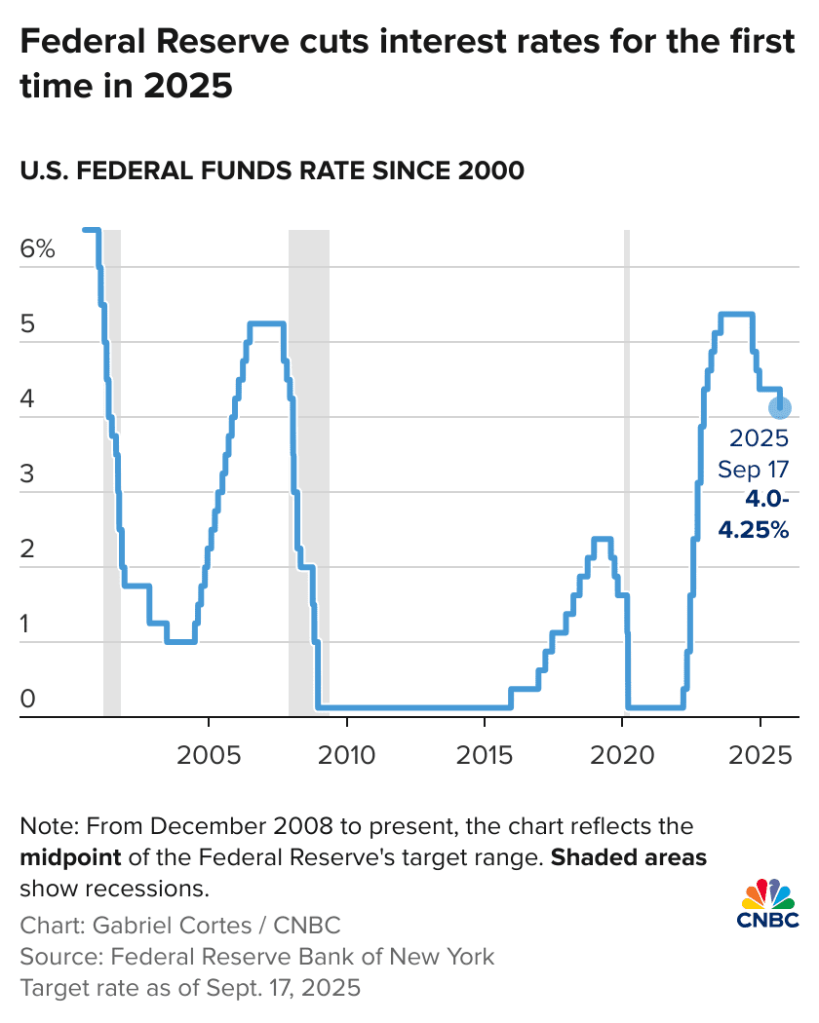

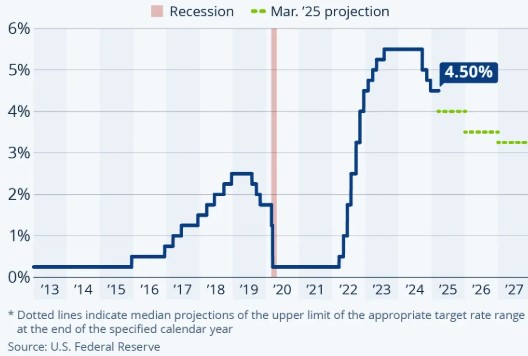

We’ve got a busy week ahead. Bonds are holding their ground for now. Historically, during government shutdowns, bond yields tend to move lower which often translates into lower interest rates.

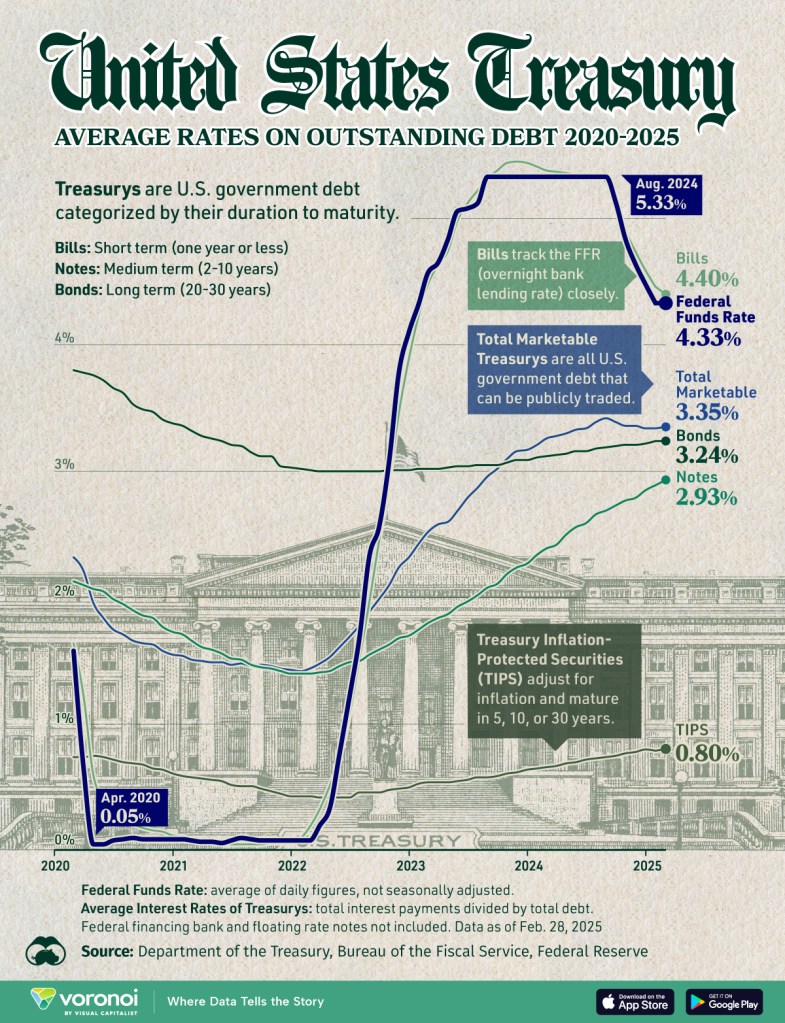

One idea floating is an interesting way to lower rates. It would be for the Federal Government to sell short-term bonds (6-month, 1-year, 2-year) and use those funds to purchase longer-term bonds particularly the 10-year, which mortgage rates are closely tied to.

My take:

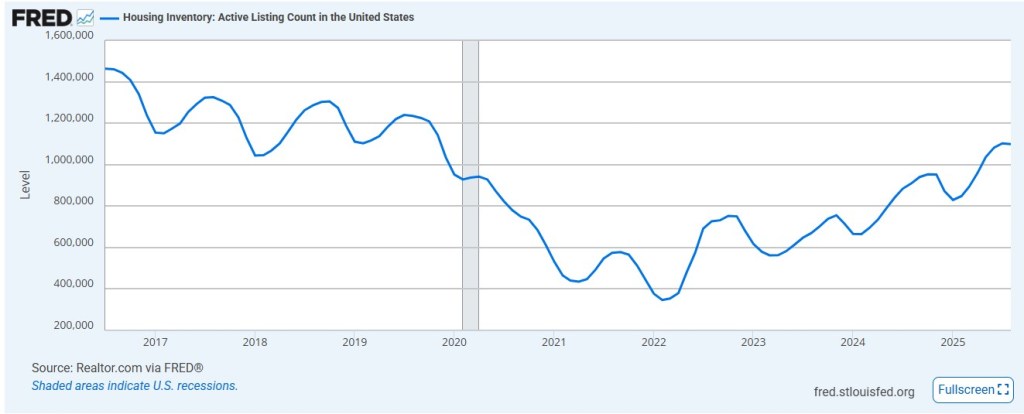

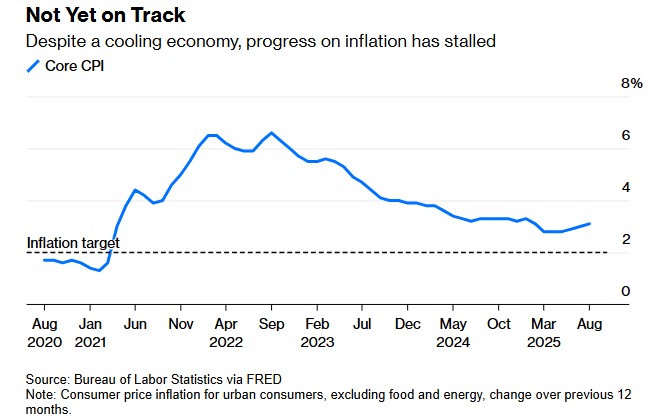

Rates are holding steady for now, while housing inventory continues to rise. Could we see rates in the 5’s by year-end? Possibly. Some clients are already locking into the 5’s with rate buydowns. FHA and VA loans are often at or below 6%, depending on the client’s profile.

Let’s get you pre-approved http://www.YourApplicationOnline.com