-

Spring Has Sprung, Sellers are hungry… Ok that did not rhyme

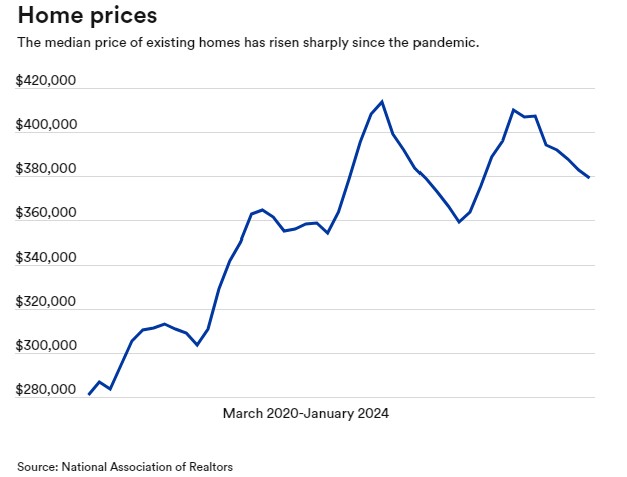

More homeowners are gearing up to sell their homes this spring, and depending on their market, they are pricing their properties more aggressively.

According to Realtor.com, 14.6% of US homes listed for sale had their prices lowered, up from 13.2% last year.

The percentage of homes with lowered list prices has shown a slight increase month by month since 2017.

While the trend is subtle, it serves as motivation for both sellers and buyers to move from the sidelines and actively engage in the market.

-

Algorithmic Amplification

By consistently ranking certain content higher, algorithms can amplify some messages while reducing the visibility of others.

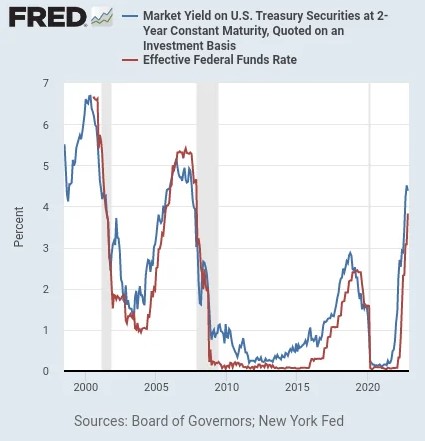

In our industry, we are hyper-focused on rates. Our level of happiness for the day can be dictated by a drop or swift rise.

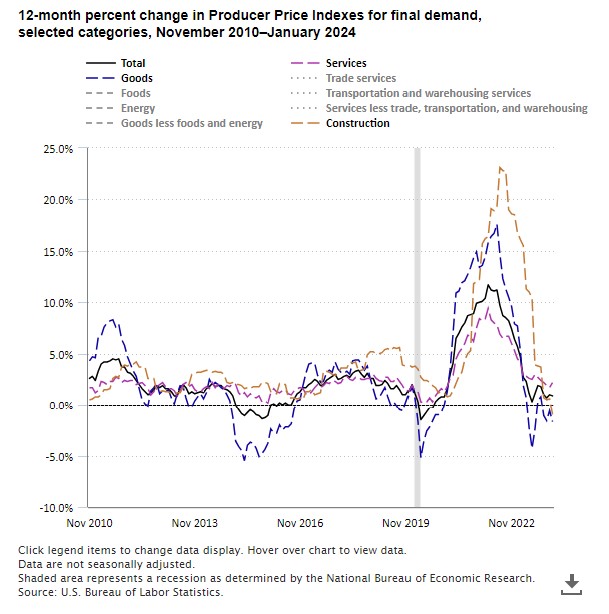

With that said, the Producer Price Index (PPI) report, which measures wholesale, i.e., producer inflation, rose by 0.6% in February. This figure is double the market estimates.

We anticipated the year-over-year numbers to increase from 1.0% to 1.1%, but they rose to 1.6%. While it remains a relatively low figure, it is nonetheless concerning.

Stay steady my friend, there is a light at the end of the tunnel. FEDs may pause a bit longer but yes they will eventually start lowering their rate.

-

Cat hanging on by it’s finger nails

Consumer Price Index (CPI) as we heard yesterday, was slightly higher but overall flat. Tomorrow, the Producer Price Index (PPI) will be released. PPI measures their cost for goods and services.

The expectation is a rise of 0.3% and a year over year reading from 0.9% to 1.1%. Core reading is expected to rise 0.2% with the year over year expected to fall from 2% to 1.9%.

Personal Consumption Expenditures -PCE is out at the end of the month.

What this means: It’s a little good mixed with a little bad. It’s not the nudge we need for the FEDs to step up their rate drop.

Rates are hanging on by their finger nails. Great improvement the last few weeks.

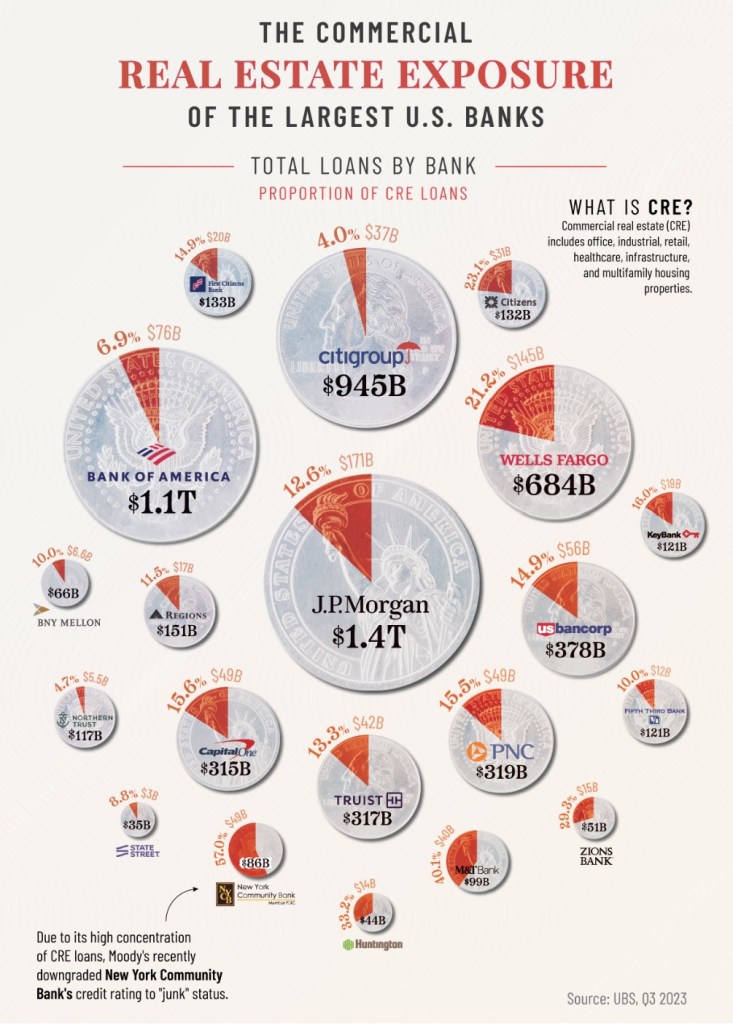

With Commercial Banks in the News, I thought I would share this interesting graph of bank exposure.

-

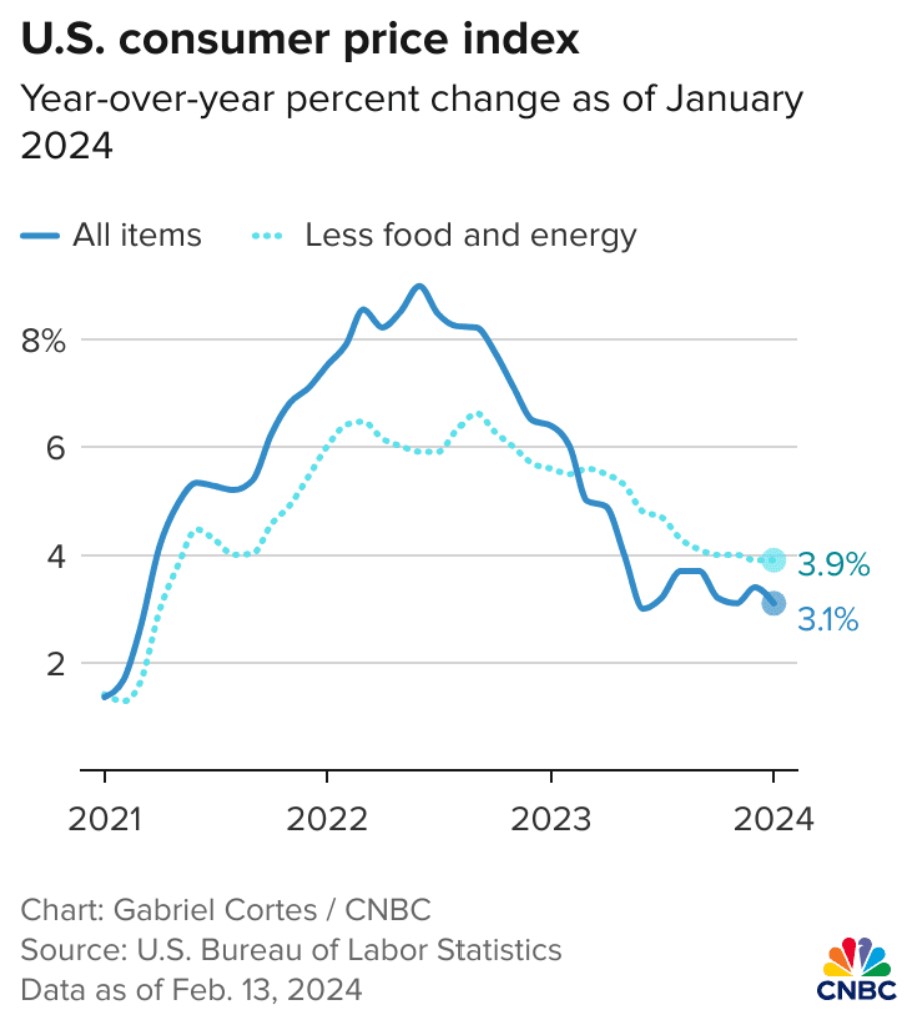

CPI “milquetoast” despite headlines

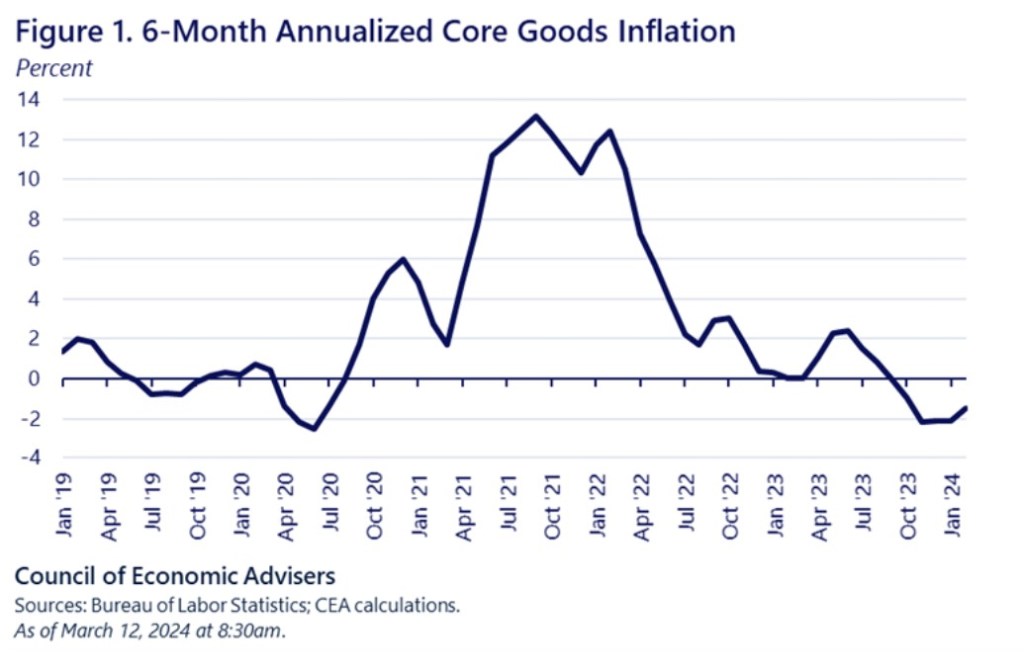

The February Consumer Price Index (CPI) report showed overall inflation rose 0.44% last month, in line with estimates. The Year over Year numbers increased from 3.1% to 3.2%, hotter than expected.

But, the Core rate that strips out food and energy prices, increased by 0.36% hotter than expected, but the Core CPI decreased from 3.8% to 3.7%.

Overall, the inflation rate is just stubborn. Up a bit but core down a bit. This makes the FEDs think twice about June rate cuts.

The Bond Market has basically baked in this news and has a fairly flat response. We are still holding onto the last week’s rate improvement.

-

imputed – /imˈpyo͞odəd/ (of a value) assigned to something by inference

One of the biggest challenges for the Consumer Price Index is how its weighted.

Owner Equivelant Rent is a great example. Owner are asked what they think they could rent their home for.

Its a guess but 1/3 of the Core CPI relies on their response.

Rates continue to improve on gains from last week.

-

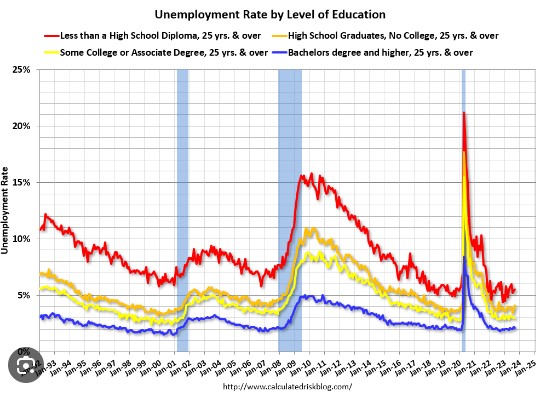

25 Months under 4% Unemployment

The BLS report showed an increase of 275,000 jobs in the month of February. The expectation was 200,000. The Unemployment rate inched up to 3.9% from 3.7%.

Weekly earnings up 0.4% for the month and up 3.7% year over year.

How does this affect the Bond market? See graph below. UP is LOWER rates.

Rate Improvement helps get buyers and sellers off the couch.

-

The only way you can find out if you can’t do something, is to do it.

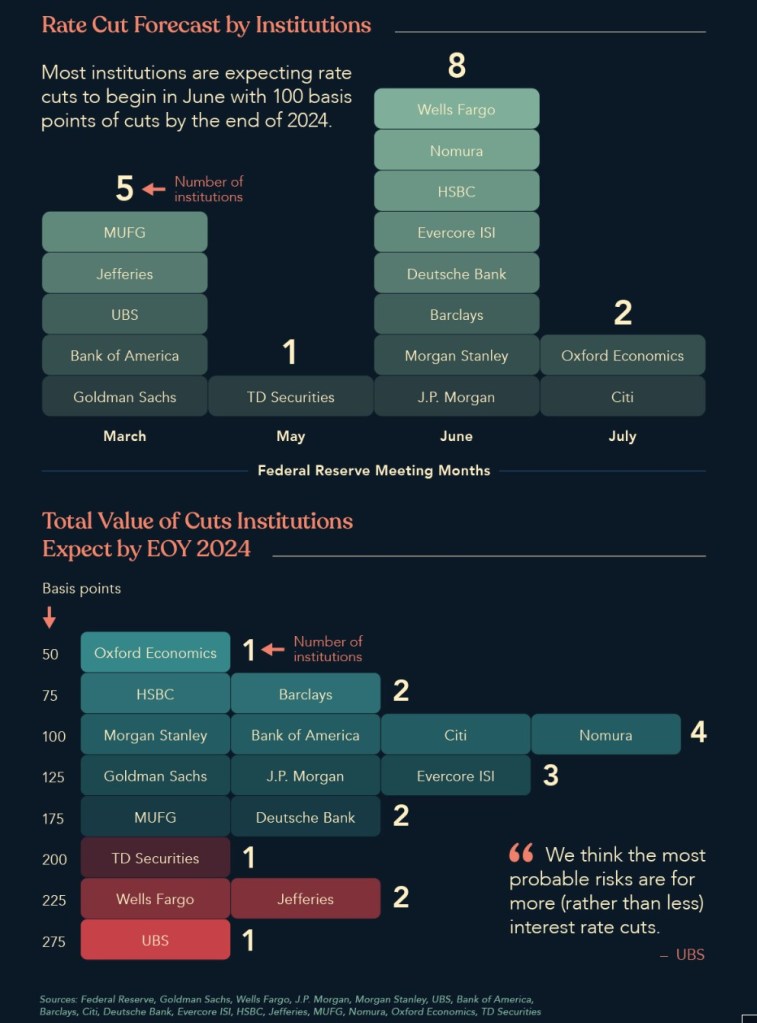

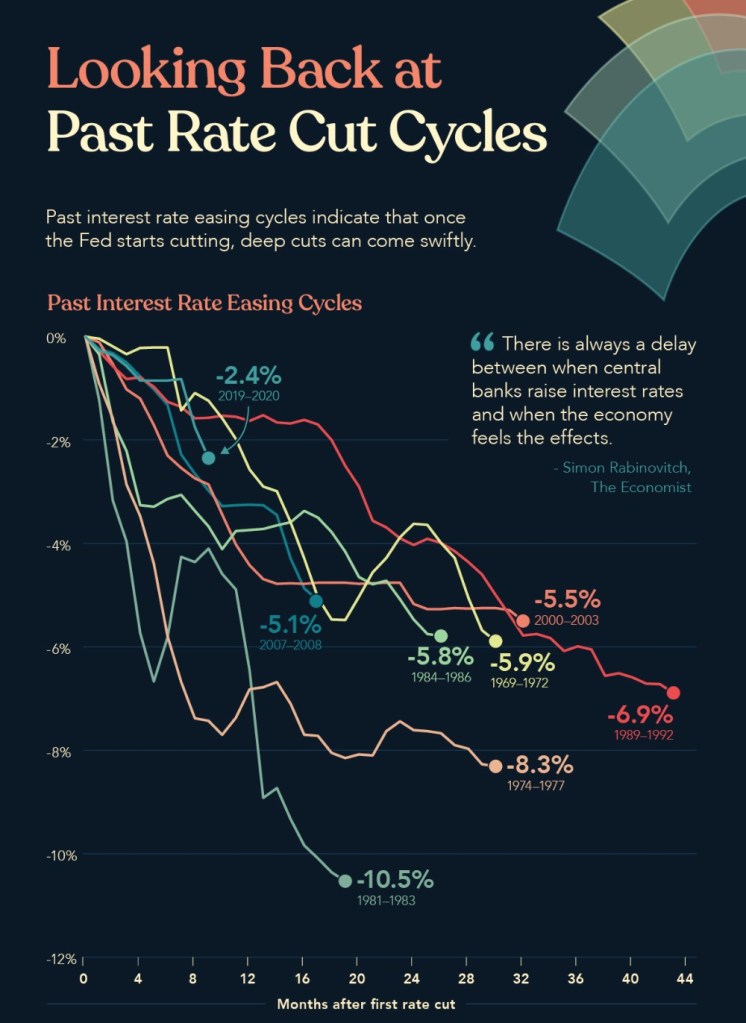

Today is simply a Picture day. First image is the rate cuts estimate by Institutions, the second graph shows the speed of the cuts.

-

140,000 Jobs created but wanted more – ADP

Stock Market is up and ADP Employment Report is in. We are slightly off expectations of 150,000 jobs created in the private sector. January was 111,000.

Mortgage applications are up 9.7% as are refinance applications. Still lower than last year but the trend is there.

Job Stayers pay increased 5.1%, while Job Changers saw an increase of 7.6%. This was the first increase in 19 months.

Powell’s prepared remarks did not shed light on his future actions other than there is not enough confidence that inflation is moving sustainably towards 2%.

So we wait…..

-

It’s beginning to look a lot like…more Housing Inventory?

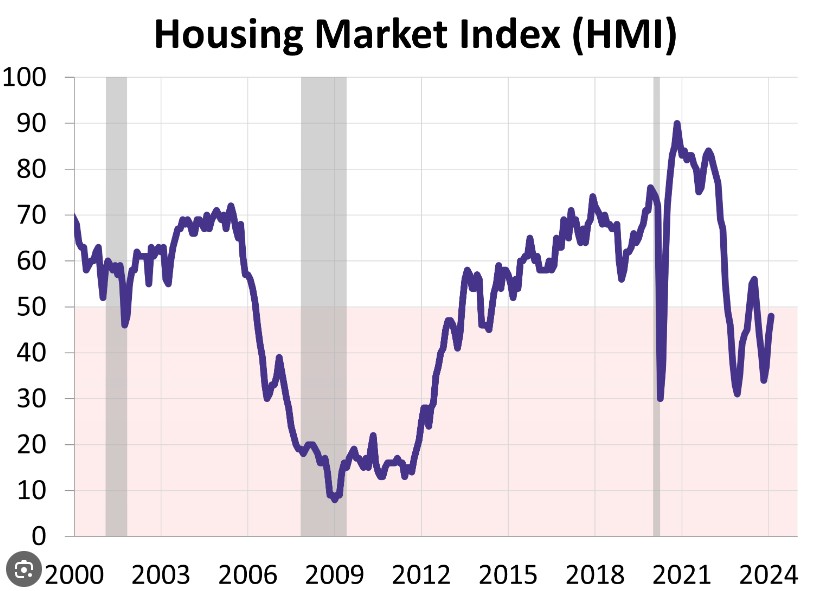

One bright light is the Housing Market Index – HMI report.

Every month, the National Association of Home Builders (NAHB) and Wells Fargo survey NAHB members for their Housing Market Index (HMI) report.

This survey gives a sense of the single-family-home environment and looks at three components. Current home sales, Home sales over the next six months and traffic of prospective buyers. This is measured on a 0-100 scale.

February’s score was 48 up from 44 in January and 42 the year prior. This is the highest rate since August 2023.

Building permits hit a seasonally adjusted annual rate up 8.6% year over year.

With the anticipation of Fed rates dropping this summer, the builders have taken notice and appear to be maintaining their positive outlook.

-

Reaction without Reflection

Acting impulsively without thinking about the consequences. Reflection without reaction is what the FEDs are doing.

As an Engineer for the first part of my life, we called this Analysis Paralyzes. It’s the inability to make a decision out of fear of making the wrong decision.

We can see the data and what the street is telling us. Even if the unemployment rate is historically low, employees have a fear of changing jobs or leaving without a new job. In this case the workforce becomes stagnant.

From my perspective it feels like the world is waiting for the FEDs to start lowering the FEDs Fund Rate before they commit to the future. We are sitting in limbo and that’s not a fun place to be.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.