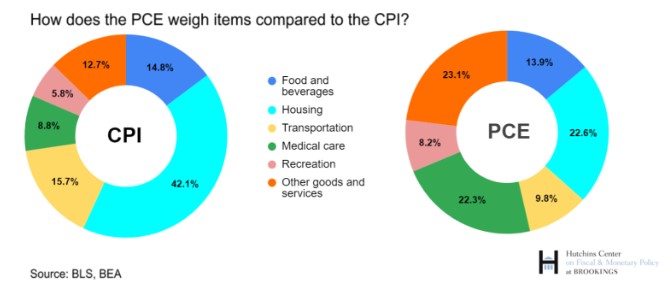

This week’s inflation data is a mixed bag. Shelter costs, which make up 42% of the CPI report, are expected to continue their gradual decline.

Energy prices dropped 6% in February, accounting for 16% of the CPI report.

Keep in mind that inflation is measured as a percentage change over the past 12 months. February 2024 saw high inflation across the board, so while the current numbers may still seem elevated, they reflect a slight decline compared to last year.

What Does This Mean for You?

Global uncertainty, fueled by an escalating trade war, has led to a flight to safety—Bonds. This surge in bond demand pushes prices up and yields down, which in turn helps bring mortgage rates lower.

On the ground, I’m seeing much more market activity compared to last year. If you’re looking to buy a home, expect more competition. If you’re considering refinancing, now is the time to get your paperwork in order so you’re ready to act when rates take a significant dip.

https://YourApplicationOnline.com

One response to “Mortgage Rates Improving, CPI Wednesday, Inflation numbers.”

How will I know when the rates take a significant dip?

LikeLike