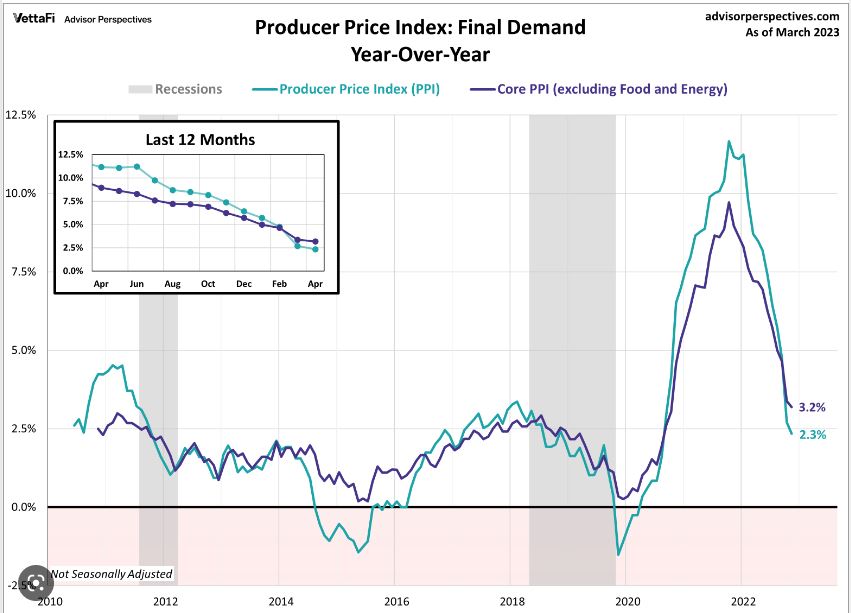

We are in a conundrum. Supply and Demand for Mortgage bonds are the issue. The FDIC who assumed $114B in Treasuries after SVB and Signature bank went under and Banks are selling their Bonds in an attempt to raise capital for depositors. Those depositors are taking their money and investing it in better options.

In 2021 the opposite happened. Inflation was moving higher causing rates to move higher, but rates did not. The reason was the FED was doing the lion share of buying of MBS – Mortgage Backed Securities and Treasuries.

We just need to weather the storm. It’s temporary and all this selling will be exhausted.

Monday morning, Make it a great week.