We have quite a week ahead of us. The Federal Reserve will be making their rate hike decision Wednesday and the PCE – Personal Consumption Expenditures report will be released Friday. This will give us more insight into inflation.

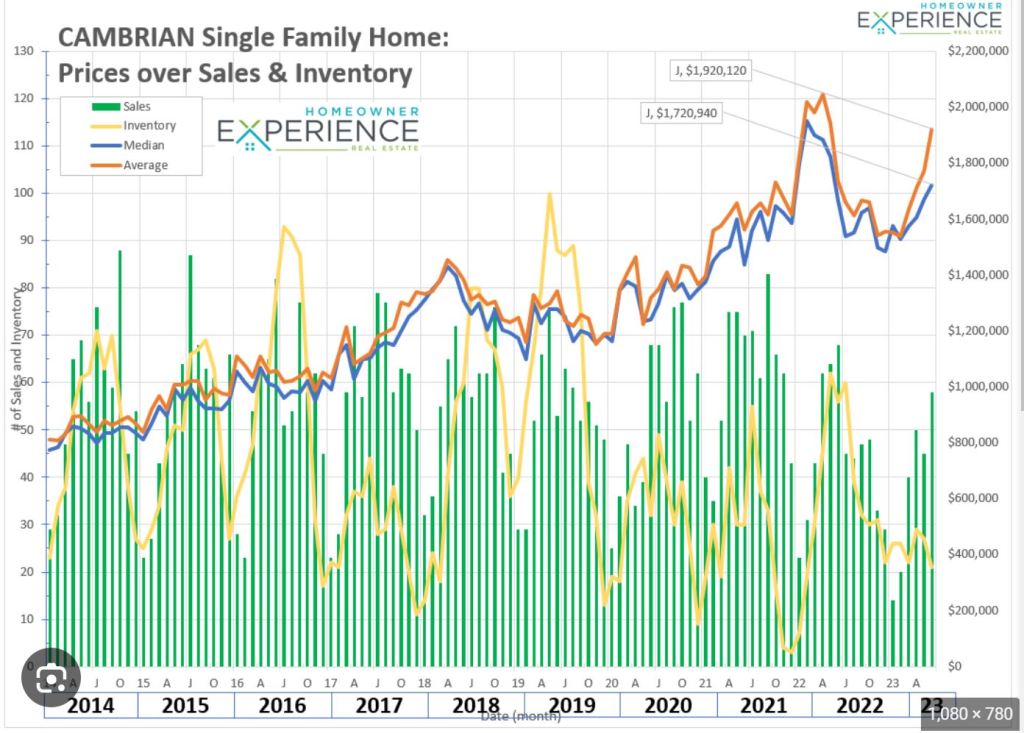

Housing we have Case Shiller, FHFA and New Home Sales and Pending Home Sales reports.

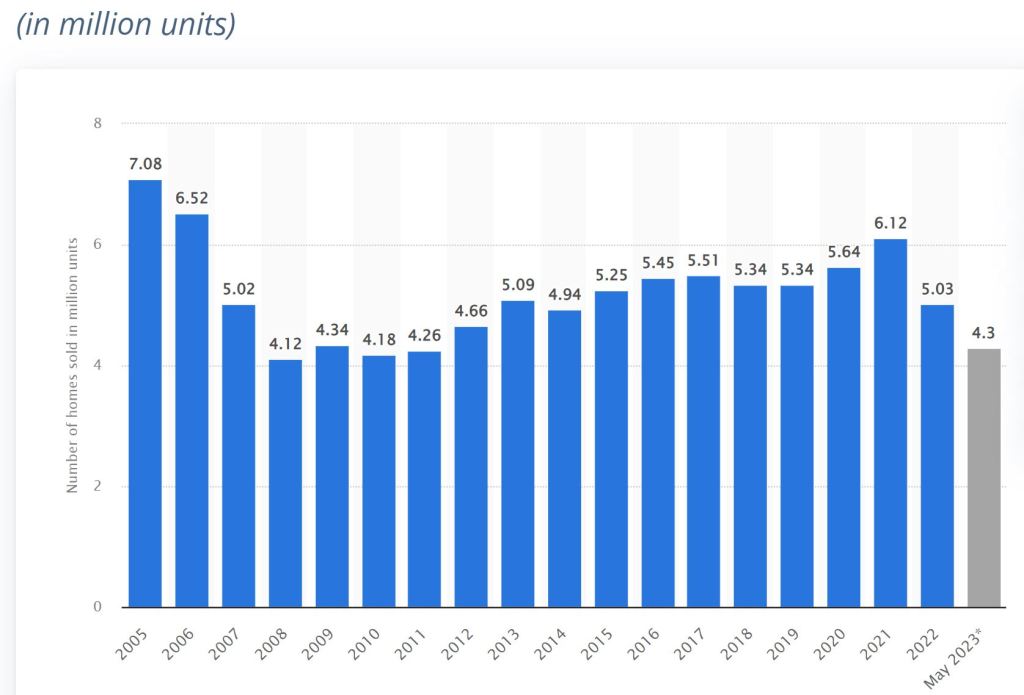

Interesting data from the Realtor Confidence Index Highlights:

- Average bids per home sold 3.5 up from 3.3

- Sold over list price 33% up from 31%

- % of home Sold that were on the market less than a month i.e. 30 days is up to 76% from 74%.

That last bit of information demonstrates the pent up demand. The flood gates are going to open once the rates drop below 5% or maybe sooner.

Get pre qualified. Have us help you get your ducks in a row before you jump into the water.